Good News for U.S. Retirees: If you’re one of the millions of retirees in the United States, there’s some exciting news to help you plan your finances for July. Retirees born between the 11th and 20th of the month will receive their maximum Social Security payment on July 17, 2025. This marks an important date for many retirees who depend on their Social Security payments for their monthly living expenses.

This year, Social Security recipients are seeing significant increases, with some retirees now eligible for the maximum benefit amount. Understanding how this process works and when to expect payments is essential for retirees who rely on these funds. In this article, we’ll dive into how Social Security payments are distributed, who qualifies for the maximum payment, and what this means for your financial planning. We’ll also provide a detailed breakdown of Social Security’s 2025 payment schedule, along with practical advice on how you can best prepare for your payments. So, if you’re waiting for that Social Security check, keep reading, because there’s a lot to unpack!

Good News for U.S. Retirees

Social Security payments are a lifeline for millions of retirees across the United States. If you were born between the 11th and 20th of the month, your payment is scheduled for July 17th. The maximum benefit of $5,108 is a possibility for those who’ve earned the highest taxable income over 35 years, while most retirees receive an average payment of $1,907. Now is also a great time to switch to electronic payments if you haven’t already, as paper checks will be phased out by September 2025. Make sure you stay on top of your payment schedule and take steps to secure your payments through direct deposit. By taking proactive steps, you can ensure your retirement is as financially stable as possible.

| Key Info | Details |

|---|---|

| Social Security Payment Date | July 17, 2025 (for retirees born between 11th and 20th) |

| Maximum Monthly Benefit | $5,108 (for individuals who claim at 70 with max earnings) |

| Average Monthly Benefit | Approximately $1,907 (as of July 2025) |

| Payment Schedule Overview | Payments are made on specific dates based on birth month. |

| Official Source | Social Security Administration |

| Transition to Electronic Payments | Starting in September 2025, paper checks will be eliminated. |

Understanding the Social Security System

What is Social Security?

Social Security is a government program that provides financial assistance to individuals who are retired, disabled, or survivors of deceased workers. It’s designed to help seniors maintain a standard of living once they’ve stopped working. For many retirees, Social Security is a vital source of income.

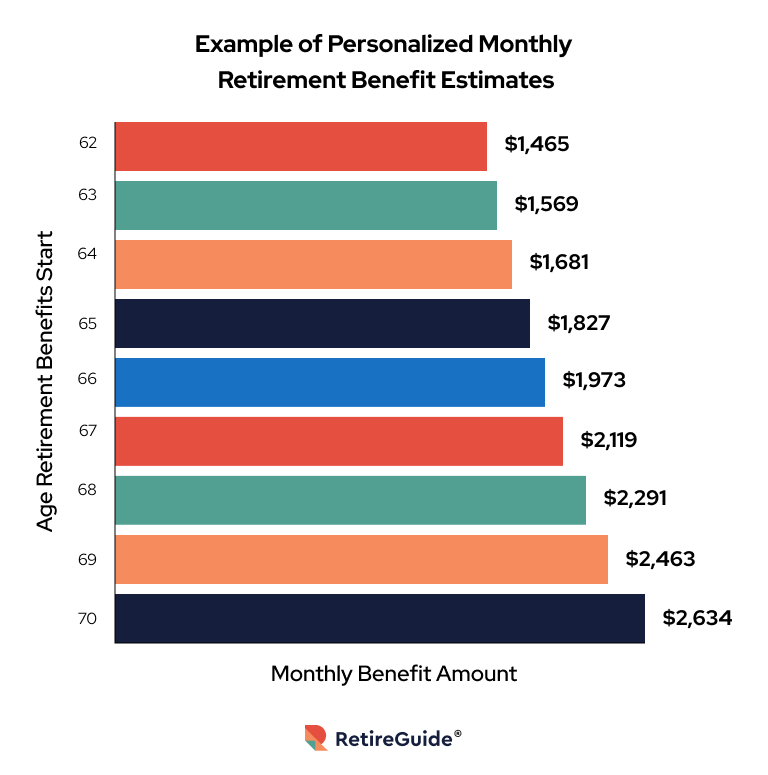

The amount you receive each month depends on how much you paid into the system during your working years. This is based on your lifetime earnings and when you choose to start claiming benefits. For the most part, the earlier you start receiving benefits, the smaller the monthly payment.

Social Security is part of the Federal Insurance Contributions Act (FICA), which requires workers to pay taxes to support the program. If you’ve worked and paid into the system for at least 10 years, you are eligible to receive Social Security benefits when you reach the required age.

How Much Could You Receive?

For many, understanding how much they could receive is crucial. In 2025, the maximum monthly benefit for someone who claims at age 70 is $5,108. However, this is only achievable if you’ve worked for 35 years or more at the maximum taxable income—which in 2025 is about $160,200 per year.

This is an important milestone for those working toward maximizing their benefits and for those who are already retired and curious about their potential payment.

The average monthly benefit for retirees is much lower, sitting around $1,907 as of July 2025. This is a much more common figure for most people, so don’t expect $5,108 unless you’ve really maximized your earnings over the years.

Key Dates for 2025 Social Security Payments

Payment Distribution: When Can You Expect Your Check?

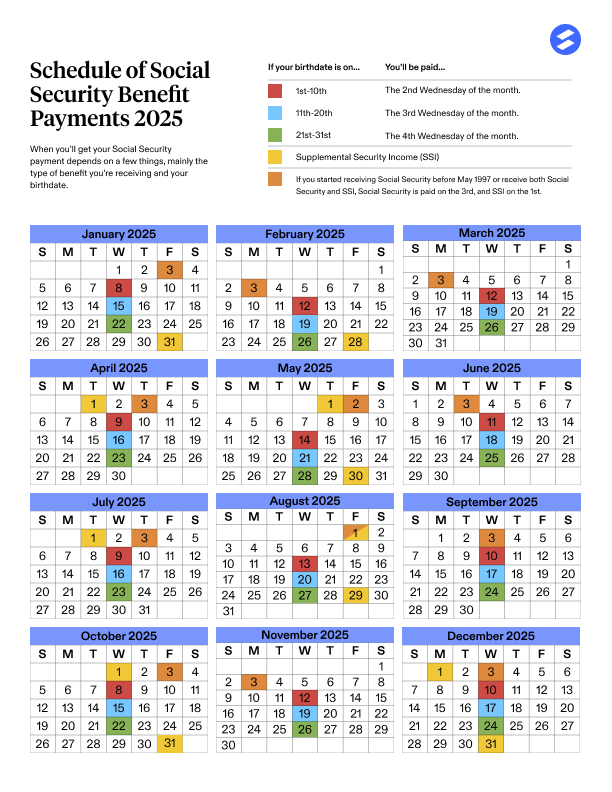

The Social Security Administration (SSA) distributes payments in a staggered manner, depending on the date of birth. For 2025, here’s how it works:

- July 1: Supplemental Security Income (SSI) recipients

- July 3: Beneficiaries receiving both Social Security and SSI

- July 9: Birthdays on the 1st–10th

- July 16: Birthdays on the 11th–20th

- July 23: Birthdays on the 21st–31st

If your birthday falls between the 11th and 20th of the month, your payment is scheduled for July 17th. This date is crucial because it ensures you receive the necessary funds to cover your expenses.

The Transition to Electronic Payments: What You Need to Know

Goodbye to Paper Checks: Setting Up Electronic Payments

Starting in September 2025, the SSA will no longer issue paper checks. This is part of an ongoing shift toward electronic payments. If you’re still receiving paper checks, this is a great time to make the switch.

The SSA encourages recipients to use direct deposit or a Direct Express debit card to receive payments. This ensures faster, more secure, and reliable access to your funds.

Setting up direct deposit is easy:

- Log in to your My Social Security account.

- Follow the prompts to link your bank account.

- Confirm the information, and you’re set!

Switching to direct deposit helps you avoid any delays caused by postal issues and ensures that your funds are available on time.

Good News for U.S. Retirees: What to Do If Your Payment Doesn’t Arrive On Time

It’s natural to worry if your payment is late, but don’t panic! If your payment hasn’t arrived by the expected date, give it at least three business days before contacting the SSA. Often, delays are caused by weekends or holidays, and payments can arrive later than expected.

If your payment is still missing after the waiting period, you can:

- Check your payment status through your My Social Security account.

- Call the SSA’s toll-free number at 1-800-772-1213 for assistance.

Be sure to keep your payment schedule handy so you know exactly when to expect your check. It’s also a good idea to keep track of any direct deposit confirmations or transaction records for peace of mind.

How to Maximize Your Social Security Benefits?

If you’re planning for retirement, it’s crucial to maximize your Social Security benefits. To do this, consider waiting until age 70 to begin claiming your benefits, as this will result in the highest possible monthly payment. Additionally, earning the maximum taxable income for 35 years significantly boosts your monthly benefit amount. Even if you’re not at the maximum threshold, it’s still important to stay informed about how your work history impacts your benefits. You can check your earnings record through your My Social Security account to ensure that everything is up to date.

Trump’s ‘Big Beautiful Bill’ Sparks Debate Over Social Security and Benefits

Social Security Projected to Cut Benefits by 2033, Affecting Retired Workers