Gen Z Is Saving for Retirement Early: Forget what you thought about Gen Z and their relationship with money. While older generations may see them as glued to screens, spending on short-lived trends, or bouncing between jobs, the truth is Gen Z is saving for retirement earlier—and smarter—than anyone expected.

Many of today’s young workers are opening Roth IRAs before they turn 21, contributing to employer-sponsored 401(k) plans at record rates, and talking about financial independence like it’s second nature. Yet the systems meant to support their goals—particularly employer retirement benefits—are still catching up to a generation that demands digital-first, flexible, and values-driven solutions. This article breaks down the trends, challenges, and most importantly, practical strategies for both Gen Z and employers to bridge the gap and build a stronger, more modern path to retirement security.

Gen Z Is Saving for Retirement Early

Gen Z has redefined what it means to plan for retirement. They’re early, eager, and incredibly resourceful. But the retirement system—especially employer benefits—must evolve to meet their needs. With more portable plans, smarter automation, and education that meets them where they are, employers can turn Gen Z’s motivation into lifelong security. The time to modernize retirement is now—because this generation isn’t waiting.

| Topic | Details |

|---|---|

| Median age Gen Z starts saving | 20 years old |

| Average Gen Z 401(k) balance (2024) | $78,300 (Empower) |

| % contributing enough to earn full match | ~62% (T. Rowe Price) |

| Top challenges | Job-hopping, debt, lack of education |

| Best employer actions | Auto-enroll, Roth plans, student loan match |

| Resources | U.S. Dept. of Labor – Retirement Topics |

Gen Z: The Financially Woke Generation

They’ve Seen What Can Go Wrong

Gen Z—those born roughly between 1997 and 2012—grew up watching the 2008 financial crisis, sky-high student loan burdens, pandemic layoffs, and an affordability crisis in housing. They’ve witnessed firsthand the instability that poor financial planning can cause.

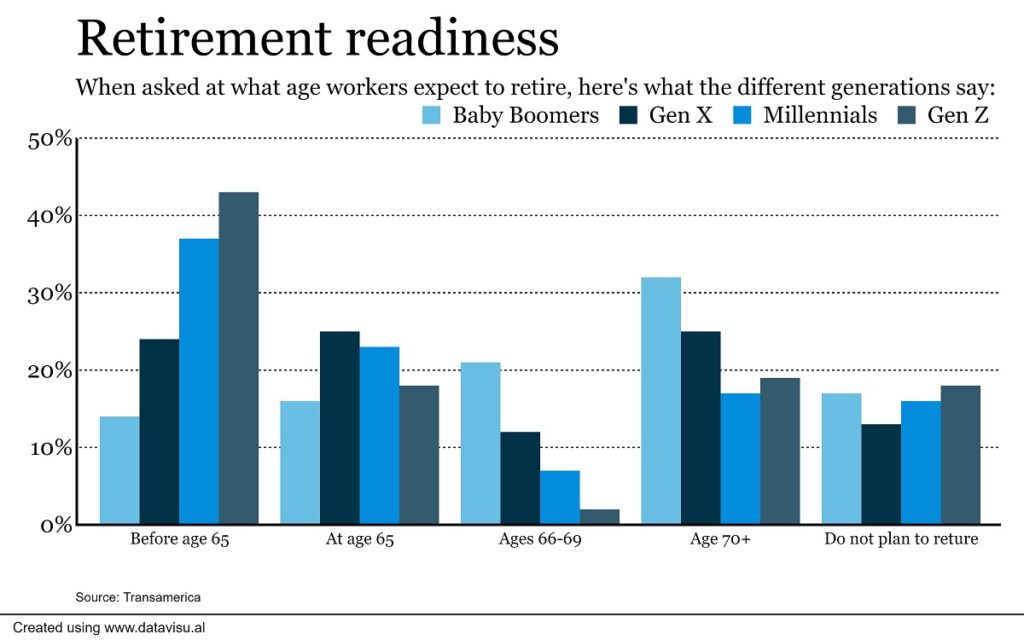

Rather than running from the problem, they’ve chosen to prepare early. Pew Research and T. Rowe Price studies show that Gen Z starts saving for retirement at a median age of 20—far earlier than Boomers (35+) or even Millennials (27).

Tech Tools Are Their Financial Sidekicks

Unlike past generations who had to meet a financial advisor in person or read through confusing pamphlets, Gen Z has grown up with apps like:

- Acorns: Invests your spare change

- Fidelity Spire: Goal-oriented investing and saving

- SoFi: Offers student loan refinancing, investing, and retirement planning

- Mint: Tracks expenses and savings goals

These tools are making investing as simple as scrolling through Instagram.

Retirement Means Freedom, Not Old Age

Gen Z isn’t necessarily obsessed with retirement in the traditional sense—they’re interested in financial independence. That might mean retiring early, starting their own business, or just having the freedom to say “no” to a toxic job.

As a result, many contribute more than 15–20% of their income to retirement accounts—some even maxing out their 401(k) or Roth IRA limits in their 20s.

A Look Back: How Does Gen Z Compare to Other Generations?

| Generation | Avg Start Age (Saving) | Avg 401(k) Balance (Age 25–34) |

|---|---|---|

| Baby Boomers | 35+ | $240,000 (age 55–64) |

| Gen X | 30 | $110,900 |

| Millennials | 27 | $89,800 |

| Gen Z | 20 | $78,300 (age 18–25) |

Clearly, Gen Z is off to a stronger financial start than their predecessors, at least in terms of timing and participation.

The Catch: Employers Are Falling Behind

Despite Gen Z’s efforts, many employer-sponsored retirement plans haven’t evolved to meet their expectations or work habits. Here’s where things break down.

1. Poor Plan Portability

Job-hopping is a norm for Gen Z—most change jobs every 1–2 years. But many retirement plans still penalize mobility:

- 401(k) plans are often hard to roll over

- Vesting schedules (when you “own” your employer’s match) can take up to 5 years

- Outdated tech can cause workers to lose track of accounts

Russell Investments estimates that plan fragmentation could cost workers $300,000+ over a lifetime in lost growth and unclaimed matches.

2. Weak Auto-Enrollment Policies

Only about 60% of employers use automatic enrollment for 401(k)s—and many set it at a low 3% default, which isn’t enough to build lasting wealth. Auto-escalation (automatically raising contribution levels each year) is even rarer.

Yet studies show that raising the default to 6% or 8% doesn’t significantly reduce participation—and boosts long-term outcomes.

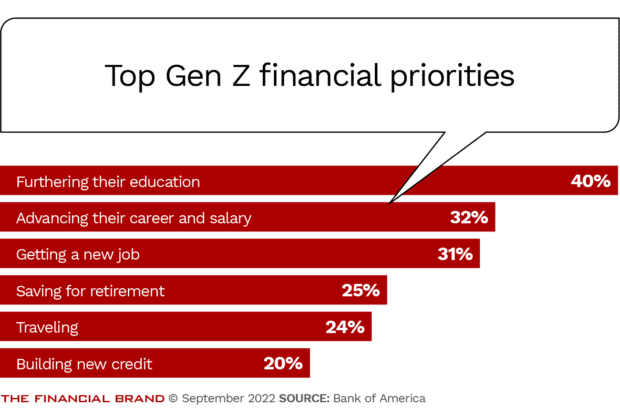

3. Financial Literacy is Still Low

Even the savviest Gen Z workers often don’t understand their retirement options:

- Only 24–26% feel educated about workplace benefits

- Many confuse Roth IRAs with traditional IRAs or don’t understand investment allocations

- Some don’t know how to claim their full employer match, leaving free money untouched

The solution? Better onboarding, modern learning tools, and relatable education strategies—not 50-page PDFs.

How Employers Can Bridge the Gap?

Here’s a straightforward roadmap for HR leaders, benefit managers, and company decision-makers who want to support Gen Z—and boost long-term employee satisfaction.

Implement Better Plan Features

- Auto-enroll at 6% or higher, not 3%

- Offer auto-escalation, nudging workers toward 10–15% over time

- Provide Roth 401(k) options for tax-free growth

- Build emergency savings tools alongside retirement plans

- Consider student loan matching under IRS Notice 2023-43

Invest in Portability

- Choose platforms like Alight, Fidelity, or Empower that simplify rollovers

- Provide 1:1 financial counseling when employees leave

- Integrate a lifetime plan employees can carry throughout their career

Educate Creatively

- Host live webinars with Gen Z financial coaches

- Offer short-form videos, gamified learning, and office hours

- Use Slack, TikTok-style content, or mobile apps to keep Gen Z engaged

These aren’t just “nice to have” features—they’re becoming must-haves if employers want to retain top talent.

Gen Z Is Saving for Retirement Early: How to Build Your Retirement Like a Pro

If you’re part of Gen Z and ready to secure your future, here’s a proven step-by-step method to stay ahead:

Step 1: Prioritize Your Employer Match

If your employer matches 4% of your salary, contribute at least 4%. That’s a 100% return on investment, no questions asked.

Step 2: Use a Roth IRA or Roth 401(k)

You pay taxes now and enjoy tax-free growth later. It’s ideal when you’re in a lower income tax bracket.

Step 3: Automate Your Savings

Use tools like Fidelity Spire, Wealthfront, or Betterment to automate contributions. Consistency builds momentum.

Step 4: Review Your Investments Annually

Don’t let your 401(k) sit in a money market fund. Allocate to low-cost index funds or target-date funds based on your retirement year.

Step 5: Learn Monthly

Watch YouTube videos from Graham Stephan, follow @herfirst100k, or read Investopedia’s Retirement section. Treat financial literacy like brushing your teeth—it’s basic maintenance.

$2,000 Social Security Payments Arriving in 4 Days—Check If You Qualify Now

Millions of Americans Could See Their Social Security Checks Cut by 50 Percent

Trump’s New Tax Bill Could Reshape How Social Security Benefits Are Taxed