Frugal People Instantly Judge These 11 Things in a Rich Person’s Home: Frugal people instantly judge these 11 things in a rich person’s home, and that judgment isn’t always about jealousy—it’s about mindset. It’s about living intentionally, valuing practicality, and questioning excess. This article goes deep into the psychology behind frugal living, expanding the original 11 things to 14 and showing how these judgments offer practical life lessons for anyone seeking financial freedom. We’re breaking it down in a professional, friendly, and approachable tone that blends financial expertise with real-world examples—something even a 10-year-old could understand but a professional would respect.

Frugal People Instantly Judge These 11 Things in a Rich Person’s Home

Frugal people instantly judge these 11 things in a rich person’s home because they’re trained to see value gaps. Their mindset is rooted in experience, respect for money, and a deep desire to align spending with purpose. Whether you’re living frugally or flush with cash, these insights offer a way to spend smarter, live cleaner, and feel more content with what you already have. Because at the end of the day, true wealth isn’t about how much you spend—it’s how well your spending serves you.

| Point | Details |

|---|---|

| Main Keyword | Frugal people instantly judge these 11 things in a rich person’s home |

| Expanded List | 14 judged items instead of 11 |

| Avg. Cost Impact | Cars lose 30% of value in year one; utilities spike 25–30% with poor insulation |

| Waste Statistics | 63% of Americans regret at least one major purchase (CNBC) |

| Frugal Focus | Value, efficiency, low-waste lifestyle |

| Sources | EPA, DOE, Consumer Reports, FinanceBuzz, Edmunds |

| Tools for Savings | Rocket Money, Wirecutter, Truebill, secondhand apps |

| Official Link | Energy.gov |

Why Frugal People Judge What They See?

Let’s start with a little context: frugal people aren’t just looking to save a buck. They’re grounded in the idea of value over appearance, usefulness over flash, and longevity over trends. Many have experienced financial hardship, grown up in modest homes, or have spent years educating themselves on what money can really do.

So when they walk into a high-end house with luxury draped from wall to wall, they don’t just admire—they evaluate. It’s not petty judgment; it’s curiosity fueled by experience and economics.

Frugality is often mistaken for cheapness, but it’s more about conscious spending. It’s a discipline, and like any other lifestyle, it comes with its own compass for what feels right—and what feels like throwing money down the drain.

Frugal People Instantly Judge These 11 Things in a Rich Person’s Home

Let’s dive into the specific household features that catch the critical eye of frugal-minded folks.

1. Single-Use Products

From disposable cutlery to endless paper towel rolls, these items scream “temporary convenience” but drain the wallet fast. Frugal people prefer reusable items like microfiber cloths, stainless steel straws, or silicone baking sheets.

Why? Because long-term cost adds up. According to the EPA, packaging and single-use items account for over 30% of household waste.

2. Expensive but Uncomfortable Furniture

If you’ve ever sat on a $6,000 leather couch that feels like concrete, you’ve felt the disconnect. Frugal people think furniture should first and foremost serve the people who live there—not just impress visitors.

Pro tip: Comfort trumps aesthetics in daily use. You want your home to serve you, not the other way around.

3. Name-Brand Everything

It’s one thing to splurge on a premium blender if you use it every day. But frugal minds question whether a $500 appliance is better than a $60 one if both do the job well.

Resources like Consumer Reports and Wirecutter regularly show that generic or mid-range options often compete neck-and-neck with high-end ones.

4. Decorative-Only Towels

Towels that are hung up just to “look pretty” but are off-limits for drying hands are an automatic red flag. If you bought it, why not use it?

Frugal rule: Use what you own. Money that sits idle isn’t serving its purpose.

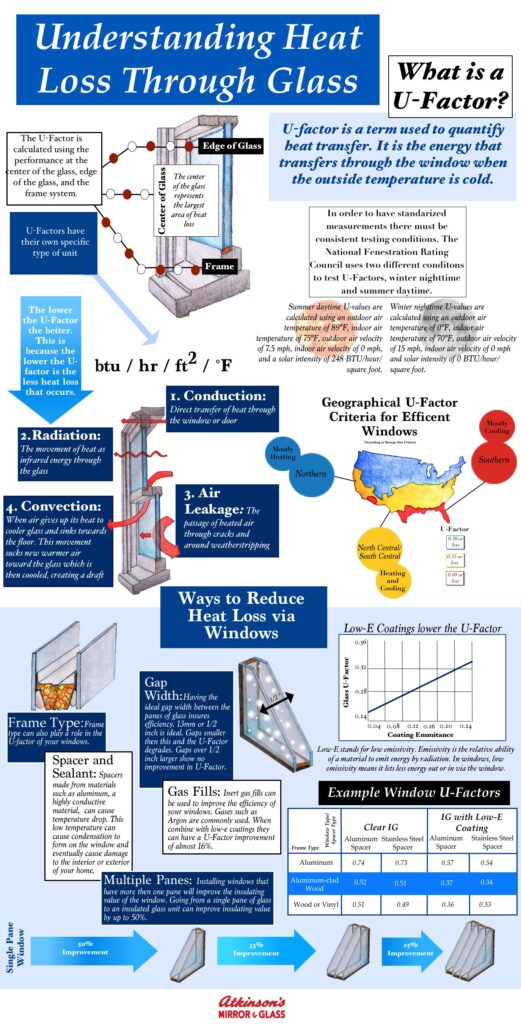

5. Lack of Window Coverings

Huge windows without curtains may look nice, but they allow energy to escape like an open door. The U.S. Department of Energy estimates that poorly insulated windows cause 25–30% of heating and cooling losses.

Frugal suggestion: Use blackout or thermal curtains. They save energy and add privacy.

6. Gourmet or Specialty Groceries

When the fridge is stocked with $15 cheeses, $12 waters, and imported berries, frugal folks notice. It’s not that good food isn’t worth paying for—it’s about the frequency of indulgence.

Better approach: Shop at Trader Joe’s or ALDI. Healthy, affordable, and less excessive.

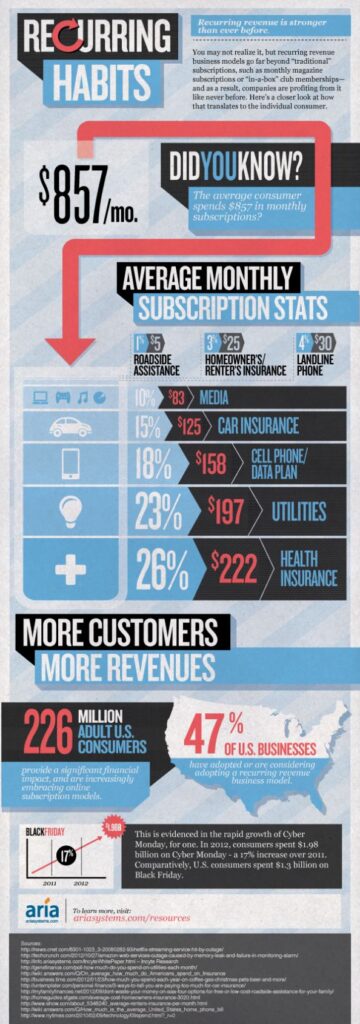

7. Too Many Subscriptions

The average American now has 12 paid subscriptions across entertainment, fitness, food delivery, and apps. According to FinanceBuzz, most spend about $219/month on digital services alone.

Frugal rule: If you forgot you were subscribed, you probably don’t need it.

8. Tech Overload

Smart lights, smart fridges, smart mirrors… tech can be helpful, but frugal minds ask, “Is it essential or just a novelty?” If it doesn’t save time or significantly improve quality of life, it may be wasteful.

Also, more gadgets mean more maintenance, higher electricity use, and a faster obsolescence cycle.

9. Outsourcing Every Chore

Frugal folks often raise eyebrows when they see hired help for tasks that seem manageable: basic cleaning, meal prep, or gardening. For them, doing things yourself is a badge of honor and a way to save thousands yearly.

That said, time is money. If outsourcing frees you up to make more money or take care of your mental health, they respect that—as long as it’s intentional.

10. Overflowing Closets

Closets packed with clothing still sporting price tags are a classic sign of impulse shopping. Frugal people tend to own fewer, high-quality pieces they wear often.

Try the 30-wear rule: If you won’t wear it 30 times, don’t buy it.

11. Unused Vehicles

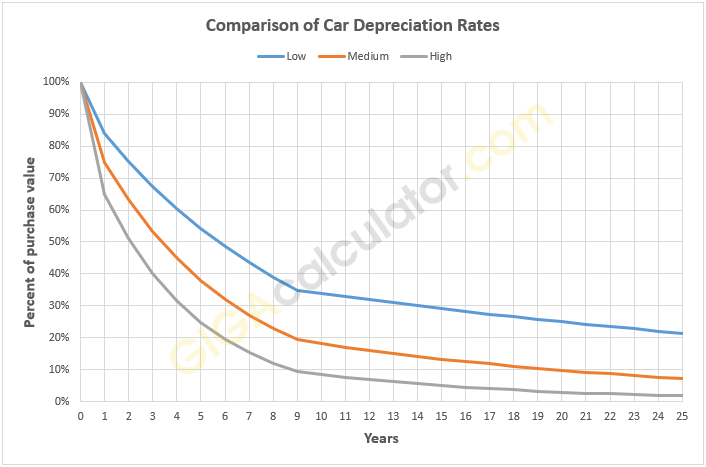

If you have more cars than drivers—or luxury vehicles that are rarely driven—expect some raised eyebrows. Vehicles lose value fast. According to Edmunds, a new car depreciates by nearly 30% in the first year.

Solution: Consider sharing cars in the household or investing in practical, fuel-efficient vehicles.

12. Clutter or “Passive Investments”

Homes full of unused gym gear, holiday-themed kitchen gadgets, or overly niche tools (like a cotton candy machine) seem wasteful. If you use something once a year, is it worth owning?

Frugal thinkers often prefer multi-purpose tools or renting when needed.

13. High Utility Use

Air conditioning set to 60°F in summer? Heating at 75°F in winter with windows open? That’s a frugal person’s nightmare.

Frugal fix: Set a programmable thermostat, seal drafts, and insulate well. The DOE recommends 68–72°F for comfort and savings.

14. Underused Amenities

Think home theaters that sit dark, indoor gyms that gather dust, or wine cellars that are more for show than use.

Frugal people calculate return on investment in terms of joy and function. If it’s not being used often, it’s just expensive clutter.

Actionable Guide to Adopt Frugal Thinking

Step 1: Perform a Room-by-Room Audit

Grab a notebook and walk through each room. List items you haven’t used in the last 3–6 months. Donate, sell, or repurpose.

Step 2: Cancel Unused Subscriptions

Use an app like Rocket Money to scan your accounts. Cancel anything you haven’t used in 30 days.

Step 3: Identify “One-Time Wonders”

Ask: “Have I used this more than once?” If not, rent or borrow next time.

Step 4: Prioritize Utility Over Prestige

Whether you’re shopping for clothes, furniture, or tech, ask: “Is this solving a real problem?”

Step 5: Track Emotional Spending

Next time you feel tempted to buy something expensive, pause. Ask if it’s meeting a need or soothing a mood.

The Benefits of Green Living: How Eco-Conscious Homes are Changing the Market

Goodbye Fossil Fuels: California Revives 19th-Century Biofuel to Battle Climate Change

The Earth is No Longer Blue: NASA Reveals Shocking Climate Change Impact as Planet Turns Green