From Super to Solar: July 1, 2025, wasn’t just the start of a new financial year in Australia—it marked a sweeping transformation in government payments, retirement savings, energy rebates, and tax rules. From boosted Centrelink payments to superannuation contributions, solar energy incentives, and Medicare threshold changes, these reforms affect millions of Australians across various walks of life.

Whether you’re a full-time worker, parent-to-be, small business owner, or a retiree managing household expenses, these changes could put money back in your pocket—or change how you plan your future. Let’s unpack the biggest changes in a clear, easy-to-understand guide that blends practical advice with professional insights.

From Super to Solar

These changes represent a strategic shift toward helping Australians combat inflation, save for the future, and transition to cleaner energy. While not every reform will affect you directly, many provide immediate savings or long-term value. Take advantage of these reforms early. Review your finances, update your payroll, and explore all available rebates. A small step today could lead to big financial wins tomorrow.

| Change Area | Key Update | What It Means | Learn More |

|---|---|---|---|

| Centrelink Payments | 2.4% increase | Up to $48 extra per fortnight for eligible recipients | Services Australia |

| Superannuation | SG rate up to 12% | Employers contribute more to your retirement fund | ATO Super Info |

| Paid Parental Leave | Extended to 24 weeks + 12% super | More leave, plus retirement savings for parents | |

| Electricity Rebate | $150 per household | Automatically credited to power bills | |

| Battery Rebate | Up to 30% off solar battery installations | Potential savings up to $4,000 | |

| Minimum Wage | Increased to $24.95/hour | ~$948 per week full-time | |

| Medicare Levy | Threshold raised to $101,000 (singles) | Fewer Australians paying levy |

Centrelink Payments: Modest Increase, Broad Impact

Centrelink payments were indexed by 2.4%, a routine adjustment to reflect rising living costs. This move benefits more than 2.4 million Australians who rely on support programs like JobSeeker, Parenting Payment, Youth Allowance, and the Age Pension.

Examples:

- A single person on JobSeeker will receive around $20.30 more per fortnight.

- Youth Allowance recipients gain about $22.40 per fortnight.

- Family Tax Benefit Part A and B increases mean additional support for parents.

In addition, asset and income test thresholds for the Age Pension and Disability Support Pension have been adjusted upward, allowing more people to qualify or to receive higher amounts.

Superannuation: Reaching the Final Step at 12%

One of the biggest structural changes this year is the rise of the Superannuation Guarantee (SG) rate from 11.5% to 12%, marking the final stage of a multi-year plan to boost Australia’s retirement savings system.

What this means:

- If you’re earning $70,000 annually, your super contributions go from $8,050 to $8,400—a $350 annual increase.

- Over a 30-year career, this increase can result in thousands of dollars more at retirement.

Also new: Super contributions will now be made on Paid Parental Leave—a historic first in Australia, giving new parents a fairer path to long-term financial security.

Additional change:

- The Transfer Balance Cap (the maximum amount you can move into the retirement phase of super, where earnings are tax-free) rose to $2 million.

Although the much-discussed 15% earnings tax on super balances above $3 million has not yet been legislated, many financial advisors are already preparing clients for its possible introduction in 2026.

Tip: Log into your super fund account to ensure your employer is paying the correct new rate. If not, contact the ATO or your payroll department immediately.

Paid Parental Leave: More Time, More Security

The Paid Parental Leave (PPL) scheme now gives eligible families 24 weeks of paid leave, up from 20 weeks in previous years. By July 2026, this will further expand to 26 weeks.

Key features:

- Leave can be shared between parents, offering flexible arrangements for different household needs.

- For the first time, PPL includes 12% superannuation contributions, helping parents—especially mothers—reduce the retirement gap caused by time out of the workforce.

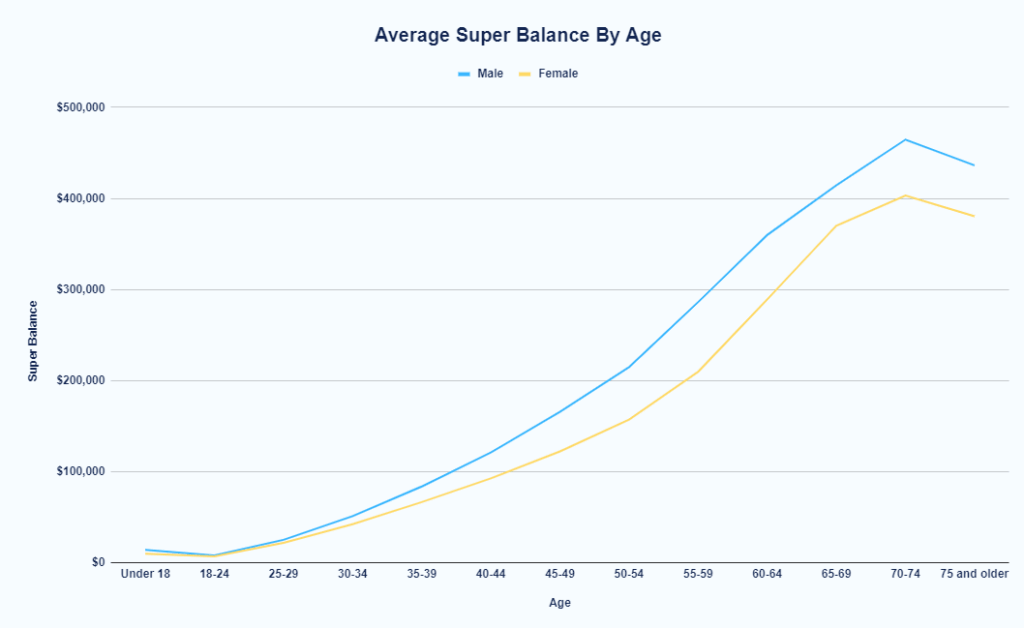

This policy was implemented in response to data showing women retire with 23% less super than men. By paying super on parental leave, the government is taking an important step toward equity.

Electricity Rebates and Solar Battery Incentives

The federal government introduced a $150 electricity rebate, automatically credited to every household’s power bill in quarterly instalments. You don’t need to apply—it’s applied directly by energy providers.

Additionally, a new Home Battery Rebate Program offers up to 30% off the cost of a solar battery installation. Depending on your state and system specs, this can result in savings of $3,600–$4,000 per household.

Why it matters:

- A solar battery can significantly reduce your energy bills by storing excess energy for use at night.

- Over 3 million Australian homes now use solar, and these incentives aim to make battery storage more accessible.

Minimum Wage: A Pay Raise for Millions

The national minimum wage has increased by 3.5%, bringing the base hourly rate to $24.95 or $948.90 per week for full-time workers.

Industries most impacted:

- Hospitality

- Retail

- Cleaning services

- Healthcare and aged care

This increase benefits over 2.6 million Australian workers, many of whom were disproportionately affected by inflation and cost-of-living hikes.

Employers should ensure payroll systems reflect the new rates immediately to avoid penalties under Fair Work Australia regulations.

Medicare Levy Surcharge: Relief for Middle-Income Earners

The Medicare Levy Surcharge (MLS) is an additional tax on individuals without private hospital insurance who earn over a certain threshold. As of July 1:

- Singles: Threshold increased from $93,000 to $101,000

- Families: Increased from $186,000 to $202,000

These changes mean fewer Australians will be required to pay the MLS, saving up to $1,500 annually, depending on their tax bracket.

This is especially beneficial for young professionals, freelancers, or contract workers who are managing rising rent and education costs.

State-Specific From Super to Solar Reforms: Fines and Road Rules

Each state rolled out updates to road safety regulations, including AI-powered speed and mobile phone cameras and harsher fines.

New South Wales:

- Expanded use of average-speed cameras

- Seatbelt and phone use fines increased

Queensland:

- Select suburban roads now have reduced speed limits

- All traffic fines indexed by 3.5%

Western Australia:

- $700 fines for phone usage while driving

- $1,600+ fines for extreme speeding

Victoria and South Australia:

- Mandatory 40 km/h speed limits when passing emergency or roadside assistance vehicles

Motorists should check their state transport authority website for full details.

Career & Professional Implications

These July 1 changes affect more than households—they also impact key industries:

- Financial advisors and accountants: Need to guide clients through new super caps, parental leave calculations, and Medicare levy changes.

- HR professionals: Must adjust payroll systems for minimum wage and super increases.

- Clean energy providers: Can capitalize on increased interest in battery storage due to new rebates.

- Social workers and case managers: Should inform clients about updated Centrelink eligibility and supports.

Real-Life Scenarios

Case 1: Anna, 32, earns $75,000 and is expecting her first child. Thanks to PPL changes, she gets 24 weeks off with 12% super on top, helping her maintain her retirement trajectory.

Case 2: Tom and Sara, retirees in Adelaide, install a battery storage unit for $11,000. They receive a 30% rebate (~$3,300) and cut their power bill by 60% annually.

Case 3: Jacob, 24, working in hospitality, now earns $948 a week full-time, up from $917, and benefits from higher super contributions.

Action Steps: What to Do Next

- Review your Centrelink payments via MyGov

- Check your payslip to confirm 12% super is being deposited

- Apply for PPL early if you’re expecting a child

- Explore battery rebates on your state’s energy website

- Ensure payroll updates for minimum wage compliance

- Adjust client strategies if you’re in finance or consulting

Centrelink Rules for Caravan and Boat Dwellers in Australia—What You Must Know in 2025

Centrelink and ATO Send Urgent July 1 Warning to Tax Return Filers—How to Avoid Costly Mistakes