First Group to Receive Up to $1,751 This July: This July, millions of Americans are set to receive some much-needed relief, with the U.S. government issuing direct deposit payments of up to $1,751. If you’re one of the eligible recipients, you might be wondering when you’ll get the payment and what the eligibility criteria are. In this guide, we’ll walk you through all the details, including the payment schedule, eligibility requirements, and how to check if you qualify. Whether you’re a single filer, married, or head of household, you’ll find the answers you need right here.

First Group to Receive Up to $1,751 This July

The $1,751 payment this July is an important financial relief measure aimed at helping millions of Americans navigate ongoing economic challenges. Understanding the eligibility requirements, payment schedule, and how to track your payment is crucial to ensuring you don’t miss out on this opportunity. Whether you’re a single filer, married, or head of household, this guide has given you all the information you need to take full advantage of this assistance.

| Key Information | Details |

|---|---|

| Amount of Payment | Up to $1,751 |

| Eligibility Criteria | Must meet income requirements, be a U.S. citizen or lawful permanent resident. |

| Payment Date Range | Payments will be issued between July 22–31, depending on the filing status and eligibility. |

| Maximum Income for Full Payment | $75,000 for single filers, $150,000 for married couples. |

| Official Reference | IRS Payment Info |

What is the First Group to Receive Up to $1,751 This July?

In response to the ongoing economic challenges faced by millions of Americans, the U.S. government has confirmed that up to $1,751 will be distributed to eligible individuals this July. This payment is part of a series of financial relief measures designed to help families recover and thrive amid rising costs of living, inflation, and economic uncertainty.

While these payments have been designed to provide assistance, it’s essential to understand the eligibility requirements and when to expect your payment. This article will break down everything you need to know about these relief checks — from who qualifies to how and when the payments will arrive.

Who is Eligible for the $1,751 Payment?

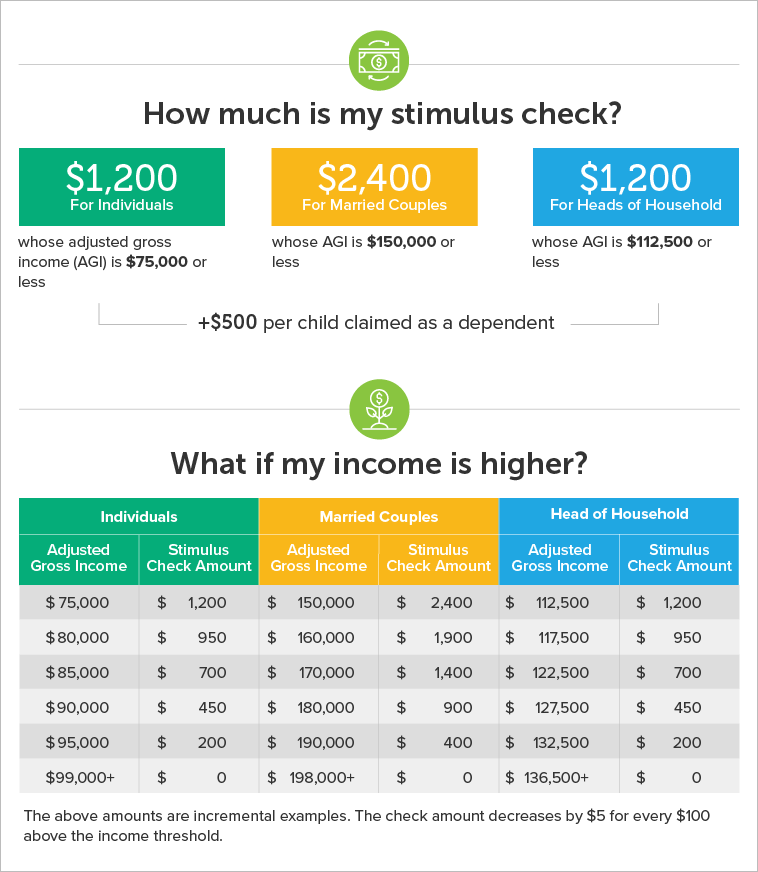

To be eligible for this $1,751 payment, certain criteria must be met. The amount you’re eligible to receive depends on your income, filing status, and other factors. Here’s a breakdown of the eligibility requirements:

- Income Limits:

- Single Filers: You must have an adjusted gross income (AGI) of $75,000 or less to qualify for the full payment. If your income exceeds this threshold but is under $100,000, you may receive a partial payment.

- Married Filing Jointly: For married couples, the combined AGI must be $150,000 or less to qualify for the full amount. Partial payments are available for incomes up to $200,000.

- Heads of Household: If you’re the head of a household, your AGI must be under $112,500 to qualify for the full payment.

- U.S. Citizenship or Legal Residency:

You must be a U.S. citizen or a lawful permanent resident to receive the payment. Unfortunately, individuals with temporary visas or other immigration statuses may not qualify. - Tax Filing Requirements:

You must have filed a 2024 tax return in order to qualify for this payment. Even if you don’t typically owe taxes, filing a return is essential to receive these benefits. - Federal Benefit Recipients:

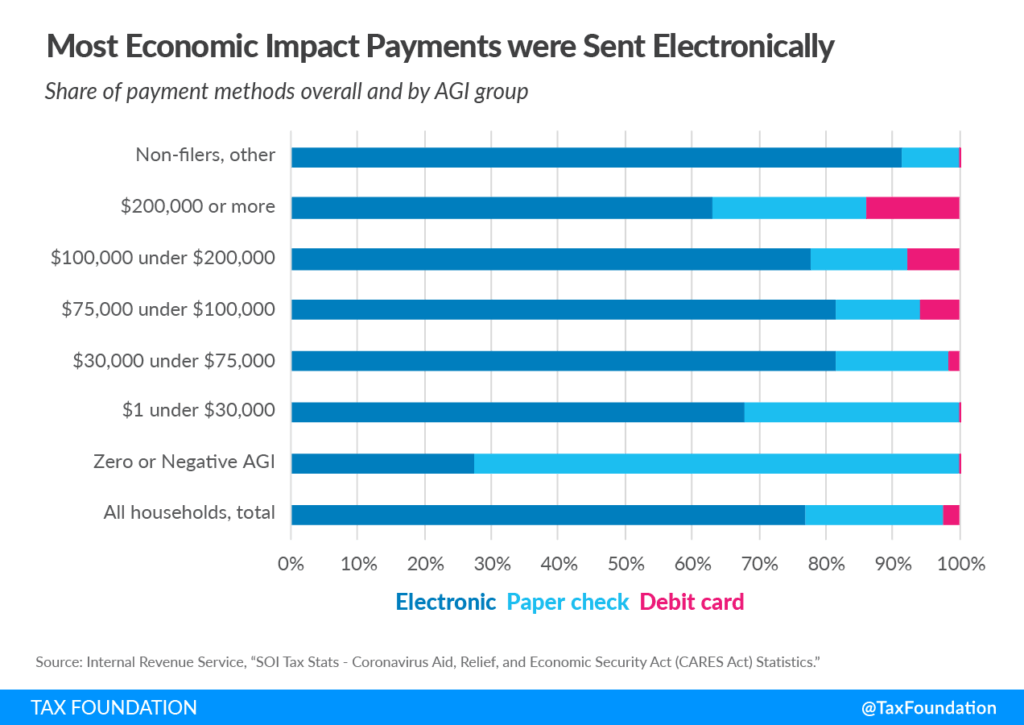

Individuals who receive federal benefits such as Social Security, SSDI, SSI, or Veterans Affairs (VA) payments are automatically eligible for this relief. - Payment Delivery Method:

Payments will be sent via direct deposit if you have banking information on file from your 2024 tax return. If no banking information is available, the payment will be issued as a paper check or prepaid debit card.

Payment Schedule and When to Expect It

If you’re eligible for the $1,751 payment, here’s the schedule for when to expect your relief check:

- July 22–26: Direct deposits will be issued for individuals who filed their 2024 taxes early or have a direct deposit setup with the IRS.

- July 27–31: If you haven’t received your payment by the 26th, be on the lookout for a paper check or prepaid debit card in the mail.

- August 1–5: A second round of direct deposits will be issued for late filers. This is for people who filed their taxes after the initial direct deposit period.

How Can You Track Your Payment?

The IRS provides tools to help you track your payment. You can visit the official IRS website to check the status of your payment. You’ll need to enter basic information like your Social Security number, filing status, and mailing address to get an update.

In addition, the IRS2Go app is available for download on smartphones and can help you track the status of your payment. This app also allows you to check your refund status, make payments, and get other useful information related to your taxes.

Why Are These Payments Important?

The direct deposit payment of up to $1,751 is more than just a check in the mail. It is part of the federal government’s larger effort to ease the financial strain many Americans face, especially with the current economic challenges. These payments are designed to assist with various costs, from rising energy prices to the costs associated with raising a family.

This relief package acknowledges the financial struggles of the middle and lower-income households that make up a significant portion of the population. It’s designed to help people get back on their feet after months, if not years, of economic difficulties.

What If You Don’t Qualify?

If you find that you’re not eligible for this payment, don’t worry. There are other forms of financial relief available. For example, you may qualify for tax credits like the Earned Income Tax Credit (EITC) or Child Tax Credit (CTC). Additionally, there are other local, state, and federal programs available to assist with housing, utilities, and food.

How to Maximize Your Payment So First Group to Receive Up to $1,751 This July?

Here are a few tips to help you make the most out of your relief check:

- Budget Wisely: If you’re using the payment to cover essential expenses, prioritize things like rent or mortgage, utilities, and food.

- Save for Emergencies: If you’re able to, consider saving a portion of the relief payment for unexpected costs that may arise.

- Consider Paying Down Debt: Use some of the payment to reduce high-interest debt. This can provide long-term financial relief.

- Invest in Education or Career Development: If you’re financially stable, consider using the funds to invest in a course or training that can boost your career.

Tips for 2025 Tax Filing

Though you may receive this relief payment in 2025, it’s important to plan for your tax return in 2025. The government has indicated that the $1,751 payment is non-taxable, so you won’t need to pay it back, and it won’t affect your refund. However, any changes in your income in 2024 may impact future payments, so be sure to file your taxes on time to stay up to date with potential future relief programs.

IRS Reveals the Truth: Does Requesting a Tax Extension Delay Your Payment?

80% VA Disability Pay for Veterans with Children: Here’s How Much You Could Receive

Millions of Americans Could See Their Social Security Checks Cut by 50 Percent