Fed’s Goolsbee Says Confidence Must Rebuild Before Outlook Feels Stable Againb: In July 2025, Austan Goolsbee, President of the Federal Reserve Bank of Chicago, made a pointed and timely statement: “We’ve got to see the confidence return—before the outlook feels stable again.” That’s not just Fed-speak. It’s a signal that public perception, business sentiment, and market behavior now weigh heavily in the Federal Reserve’s decision-making process—right alongside inflation, GDP, and jobs data. Even with promising economic indicators, Goolsbee’s message is clear: unless anxiety among businesses and consumers subsides, the central bank may pause or delay expected interest rate cuts. For businesses, investors, and households, this uncertainty has real-world consequences.

Fed’s Goolsbee Says Confidence Must Rebuild Before Outlook Feels Stable Again

Austan Goolsbee’s remarks are more than just cautious musings—they’re a signal that perception is becoming policy. The Fed’s actions will now depend not only on what the numbers show, but also on how people feel about the future. And right now? People are uneasy. Businesses are hesitant. Until that changes, interest rate cuts remain on hold, and the path to a full economic recovery stays bumpy. So whether you’re budgeting, investing, or hiring, the best move in 2025 might be the simplest: stay ready, stay informed, and keep your expectations flexible.

| Topic | Details |

|---|---|

| Who Said It? | Austan Goolsbee, President of the Federal Reserve Bank of Chicago |

| When? | July 11, 2025 |

| Main Message | Economic outlook won’t stabilize until business and consumer confidence rebounds |

| Trigger for Concern | Rising anxiety caused by new tariffs and market uncertainty |

| Current Fed Funds Rate | 5.25% (as of July 2025) |

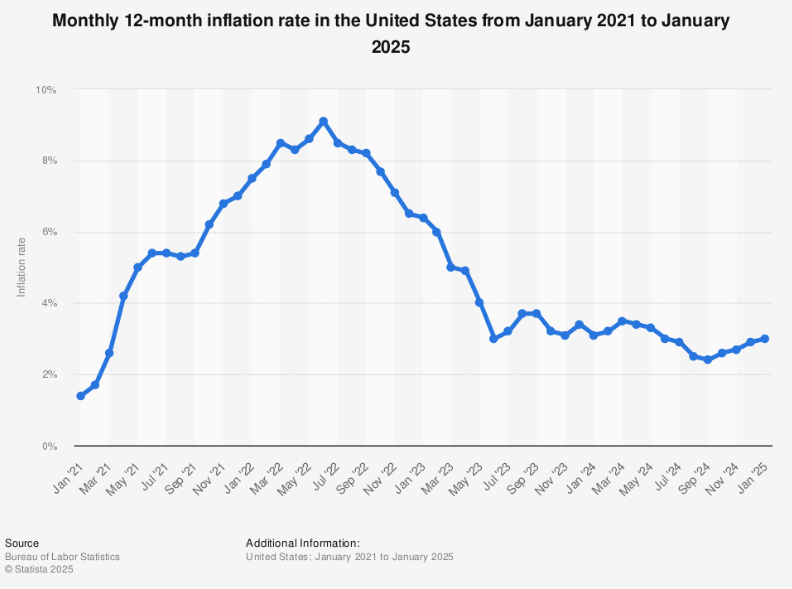

| Inflation Trend | Dropped from 9.1% in 2022 to approx. 2.8% in mid-2025 |

| Potential Outcome | Delay in rate cuts and cautious policy from the Fed |

| Source | FederalReserve.gov |

What Goolsbee Really Means: Breaking Down the Message

Goolsbee’s recent comments, made in a podcast published on July 11, 2025, were part of a broader discussion on economic expectations, trust in the data, and the Fed’s readiness to act. He acknowledged that while inflation has been trending downward, businesses aren’t acting like it’s over. Why? Because of what he calls “noise” in the system.

That noise includes:

- The Trump administration’s renewed tariffs on Chinese imports, steel, and electronics

- Global uncertainty linked to ongoing trade disputes

- Supply chain hiccups related to climate disruptions and geopolitical tension

- Concern over whether inflation might reignite unexpectedly

The result? Companies are holding off on long-term decisions—like expanding operations, hiring aggressively, or locking in new supplier contracts. They’re essentially waiting for the fog to clear.

Confidence Versus Numbers: A Simple Example

Let’s say your boss tells you the company is doing great—but at the same time, rumors start flying that layoffs are coming. Even if the books are balanced, you’re likely going to hold off on buying that new car. That’s where we are with the economy: good stats, bad vibes.

Goolsbee is saying that until businesses feel safe, they’re not going to act like they’re in a strong economy. This mismatch between data and behavior is what’s keeping the Fed cautious.

The Fed’s Soft Landing Goal

The phrase “soft landing” has become something of a buzzword lately. But what does it really mean?

A soft landing is when the Fed raises interest rates just enough to slow inflation—without crashing the economy into recession. It’s a delicate balance.

In 2022 and 2023, the Fed raised interest rates from near-zero to over 5% in just 18 months. That aggressive tightening was necessary to tame runaway inflation after the pandemic. And it’s worked: inflation has dropped from 9.1% in June 2022 to about 2.8% today.

But here’s the catch: now that inflation is cooling, many expect rate cuts. The Fed, however, is signaling “not so fast.” If the economy still feels unstable—even if it isn’t technically unstable—cutting rates too early could reignite inflation.

The Tariff Effect: Fuel on the Fire?

One of the biggest concerns voiced by Goolsbee is the resurgence of tariffs on imported goods—a policy reintroduced by the Trump administration.

Tariffs act like a tax on goods coming into the country. That tax gets passed on to businesses and consumers in the form of higher prices. And if consumers and businesses expect prices to rise? They start changing behavior:

- Companies raise prices now to avoid getting caught off guard later.

- Shoppers stockpile goods, creating artificial scarcity.

- Investors flee to safer assets, stalling market growth.

Goolsbee warned that even though inflation hasn’t reacted yet, the fear of inflation might be enough to cause inflation. That’s why he’s not ready to celebrate the end of inflation just yet.

How Fed’s Goolsbee Says Confidence Must Rebuild Before Outlook Feels Stable Again Affects You: Real-World Implications?

Whether you’re a college student, a startup founder, or a homeowner watching your mortgage rate, Goolsbee’s comments signal that uncertainty is still the name of the game.

Here’s what this means across different areas of life and work:

For Investors

- Expect continued volatility in the stock market. As long as the Fed holds back on rate cuts, growth stocks may underperform.

- Keep an eye on safe-haven assets like Treasury bonds or dividend-paying equities.

- Monitor sectors sensitive to tariffs—especially manufacturing, retail, and tech.

For Business Owners

- Hold off on large capital investments unless you’re sure about supply chain stability.

- Monitor supplier contracts and import costs, especially if you rely on foreign goods.

- Consider building in some price flexibility for customers in case input costs spike.

For Job Seekers

- Hiring may stay soft in sectors like logistics, retail, and real estate.

- Upskill in industries that are more resilient to trade policy—like cybersecurity, health tech, and AI.

- Be cautious about making big job moves unless the opportunity offers long-term security.

For Homeowners and Renters

- Mortgage rates remain around 6.8%, and are unlikely to fall until the Fed signals confidence in the economy.

- Refinance opportunities may emerge in late 2025 or early 2026.

- If buying, focus on homes you can afford at current interest levels—not future ones.

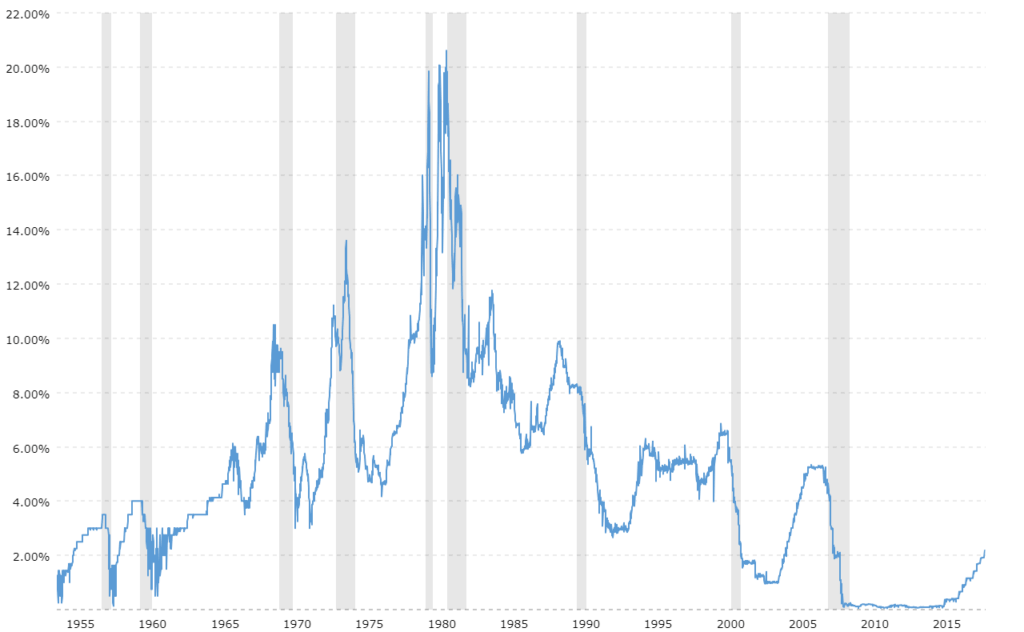

Historical Lessons: What Past Fed Moves Teach Us

Understanding Fed behavior also means looking backward. The last time the Fed attempted a clean soft landing was in the mid-1990s. Here’s how that turned out compared to other key moments:

- 1994–95: The Fed raised rates rapidly, paused, and inflation eased without a recession.

- 2000–2001: Rate hikes triggered a tech bubble burst and recession.

- 2008: The Fed cut rates quickly, but it wasn’t enough to prevent the financial crisis.

- 2022–2025: So far, inflation is cooling, but business confidence hasn’t caught up.

Goolsbee’s caution is rooted in this history. Getting it wrong could either send the economy into a recession or reignite inflation.

The Psychological Factor: Economics Isn’t Just Math

One often overlooked fact is that economics is as much about psychology as it is about statistics. When consumers or CEOs believe something bad is going to happen, they act accordingly.

- Consumers might pull back on spending.

- Banks might tighten lending.

- Investors might flee to cash.

These behaviors—driven by expectation, not reality—can bring about the very downturn people feared.

Goolsbee’s comments remind us that the Fed’s job isn’t just to read the data; it’s to manage the mood of the economy.

What to Watch in the Coming Months?

If you’re planning your finances, career, or business strategy around Fed decisions, keep an eye on the following:

- Inflation Reports from the Bureau of Labor Statistics (monthly)

- Consumer Sentiment Indexes from the University of Michigan

- ISM Manufacturing and Services Data

- Comments from other Fed officials, especially Chair Jerome Powell

If inflation stays below 3% for several months and tariffs don’t ignite cost spikes, we could see the first rate cut in early 2026. But that hinges on one big question: Will confidence return?

Trump’s ‘Big Beautiful Bill’ Sparks Debate Over Social Security and Benefits

Trump’s Claim That His Bill Ends Social Security Taxes Debunked by Experts