Federal Student Loans: When it comes to paying for college, many students and their families look to federal student loans as a way to finance their education. If you’re considering using federal student loans to fund your degree, it’s essential to understand the maximum amounts you can borrow, as well as the eligibility requirements to secure this financial aid. In this article, we’ll break down the details of federal student loans, explain how you can apply, and provide practical tips to make sure you’re ready for the financial journey ahead.

Federal Student Loans

Federal student loans offer a valuable way to finance your college education. Understanding how much you can borrow, the eligibility requirements, and the application process is essential to making the most of these financial tools. Whether you’re a high school graduate about to enter college, a graduate student, or a parent of a student, navigating the world of student loans can seem overwhelming. But with the right information and planning, you can make informed decisions and set yourself up for success.

| Topic | Key Details |

|---|---|

| Max Loan Limits | Federal student loan limits vary based on student status, program level, and dependency status. |

| Undergraduate Students | Dependent students can borrow up to $31,000; independent students up to $57,500. |

| Graduate and Professional Students | Graduate students can borrow up to $20,500; professional students up to $50,000 annually. |

| Eligibility Criteria | Applicants must be U.S. citizens, enrolled in an eligible program, and maintain satisfactory academic progress. |

| Application Process | Complete the FAFSA® to apply for federal loans and determine eligibility. |

| Current Legislative Changes | The “One Big Beautiful Bill” changed some federal student loan rules, affecting borrowing limits for grads. |

What Are Federal Student Loans?

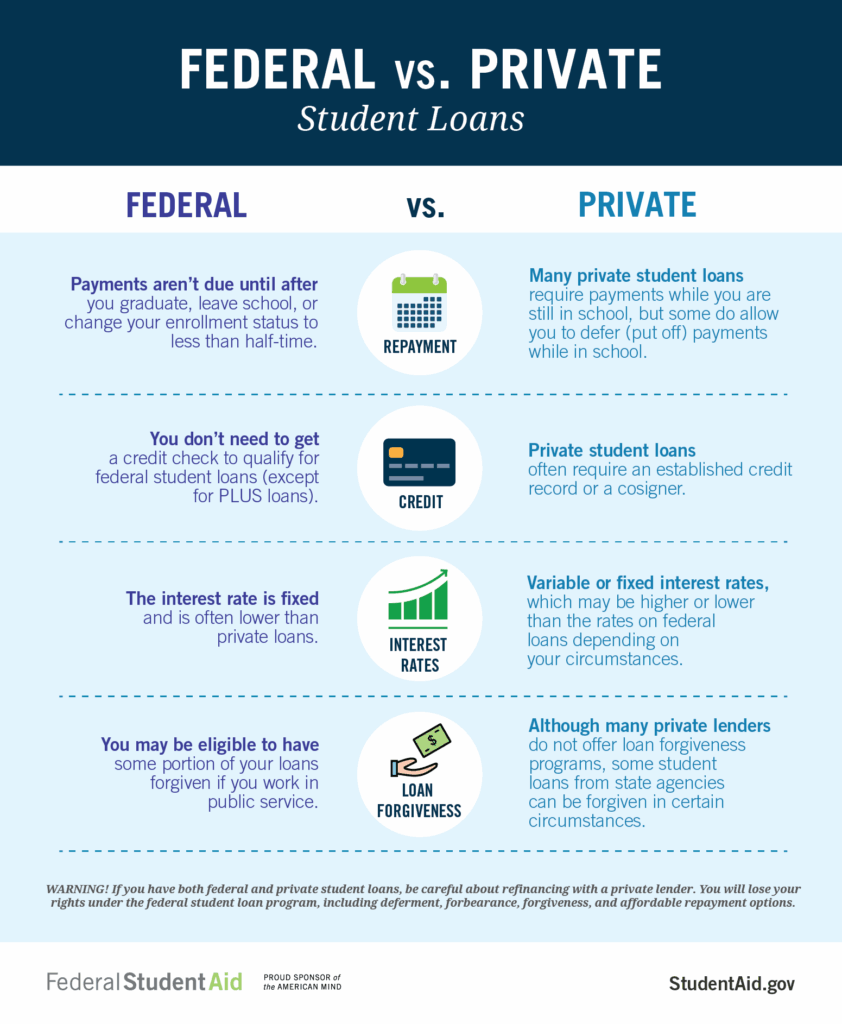

Federal student loans are loans provided by the U.S. Department of Education to help students pay for their college education. Unlike private loans, federal student loans come with benefits such as fixed interest rates, more flexible repayment options, and, in some cases, the opportunity for loan forgiveness.

The most common types of federal student loans are Direct Subsidized Loans and Direct Unsubsidized Loans. Subsidized loans are awarded based on financial need, and the government pays the interest while you’re in school. Unsubsidized loans are available to all eligible students but accrue interest while you’re still in school.

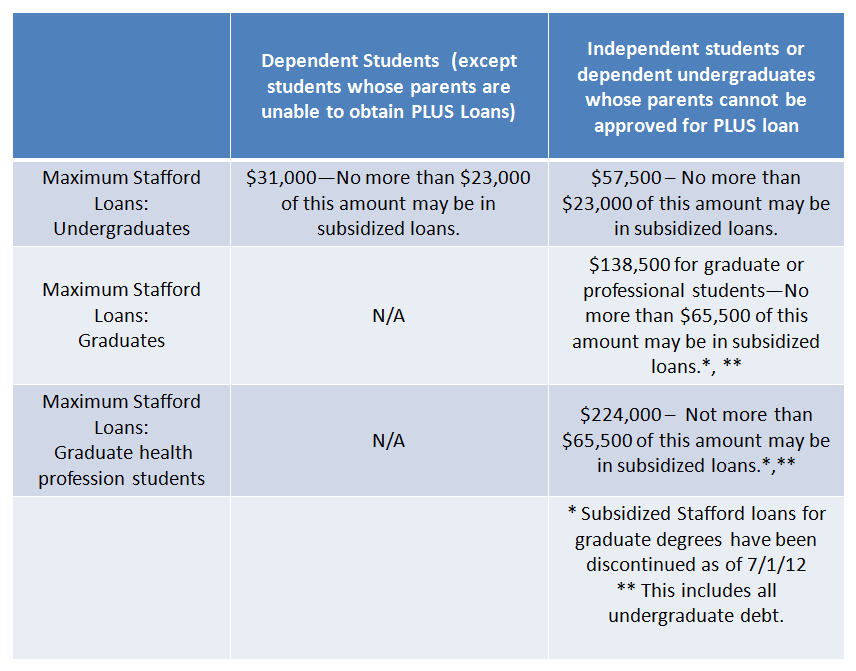

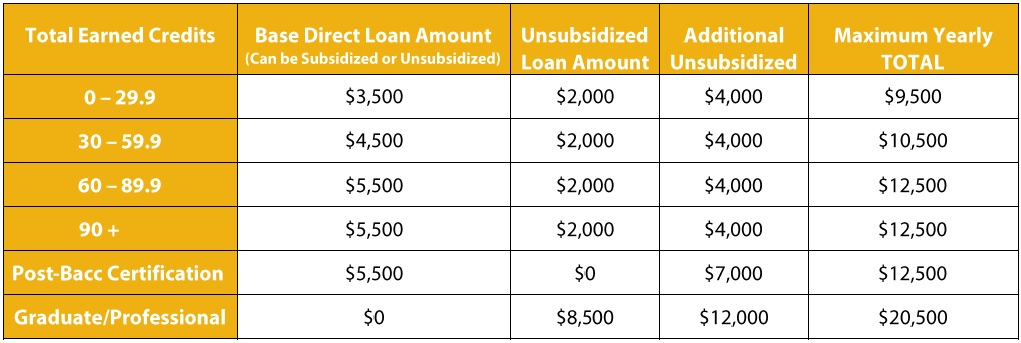

Loan Limits for Undergraduates

Let’s start with the basics. If you’re an undergraduate student, how much can you borrow?

- Dependent students: You can borrow a maximum of $31,000 in federal student loans throughout your college education. However, no more than $23,000 of this amount can be in subsidized loans, which are better because they don’t accrue interest while you’re in school.

- Independent students: These students have a higher borrowing limit. You can borrow up to $57,500 in total, with the same restriction of $23,000 in subsidized loans. Independent students are those who are financially independent from their parents, typically because they are over 24 years old, married, or have dependents of their own.

The above limits apply to undergraduate students enrolled in a four-year degree program, and the amounts can vary slightly depending on your school’s program structure.

Loan Limits for Graduate and Professional Students

If you’re pursuing a graduate or professional degree, your loan limits increase. But there are key things to know before taking out loans.

- Graduate students can borrow up to $20,500 annually in Direct Unsubsidized Loans. These are loans where the government doesn’t pay the interest while you’re in school. This amount can be higher if you’re pursuing a professional degree (think: law, medical, or business school). Professional students can borrow up to $50,000 per year.

- Aggregate loan limits: For graduate and professional students, the total borrowing limit can be quite large. You can borrow up to $100,000 if you’re pursuing a graduate degree. But if you’re attending a professional program, such as law or medicine, your aggregate borrowing limit can rise to $200,000.

Remember, these figures represent the maximum amount you can borrow, but they include both federal student loans and any other federal aid you receive, like grants or work-study funds.

Parent PLUS Loans: What Are They?

Another option for helping pay for your child’s education is the Parent PLUS Loan. This is a loan that parents can take out to help pay for their dependent undergraduate child’s education. Unlike other federal loans, Parent PLUS Loans are not based on financial need. However, they do require a credit check.

- Loan limits for Parent PLUS: Parents can borrow up to the full cost of attendance at their child’s school, minus any other financial aid the student receives. This means that if your child’s education costs $50,000 a year and they already have $20,000 in other financial aid, you could potentially borrow the remaining $30,000.

Eligibility Criteria: Am I Eligible for a Federal Student Loan?

Before you dive into applying for federal student loans, it’s important to know the eligibility criteria. You must meet the following requirements:

- U.S. Citizenship: You must be a U.S. citizen, national, or an eligible noncitizen.

- Enrollment Status: You must be enrolled or accepted into a degree or certificate program at an eligible institution.

- Half-Time Enrollment: Generally, you must be enrolled at least half-time to qualify for federal loans.

- Financial Need: Some loans, like Direct Subsidized Loans, are based on financial need.

- Academic Progress: You must maintain satisfactory academic progress to continue receiving federal aid. This often means keeping a certain GPA.

- Default Status: You can’t be in default on a previous federal loan or owe a refund on a federal grant.

To apply for federal student loans, you must submit the Free Application for Federal Student Aid (FAFSA®), which determines your eligibility and the amount of aid you qualify for.

How to Apply for Federal Student Loans?

The application process for federal student loans is pretty straightforward. Here’s a step-by-step guide:

- Complete the FAFSA®: This is your first step. You can fill out the FAFSA® online at FAFSA.gov. It will ask for information about your family’s finances, so have your tax returns and financial documents ready.

- Review Your Student Aid Report (SAR): After you submit your FAFSA®, you’ll receive a Student Aid Report (SAR) summarizing your financial situation. This report will show your Expected Family Contribution (EFC), which helps determine how much financial aid you’ll get.

- Accept Your Loan Offer: Once your school processes your FAFSA®, they’ll send you an offer detailing the types and amounts of loans you’re eligible for. If you want to borrow the loans offered, you must accept them and sign a Master Promissory Note (MPN).

- Loan Counseling: If you’re a first-time borrower, you’ll need to complete loan counseling. This ensures you understand your rights and responsibilities as a borrower.

What About Interest Rates and Repayment?

Interest Rates

Federal student loans come with fixed interest rates, which can be more favorable than private loans. The interest rates are set by Congress each year and apply to loans disbursed for the upcoming academic year. For the 2025-2026 school year, the rates for federal student loans were:

- Direct Subsidized Loans (Undergraduate): 5.50%

- Direct Unsubsidized Loans (Undergraduate): 5.50%

- Direct Unsubsidized Loans (Graduate): 6.28%

- PLUS Loans: 7.08%

Repayment Options

One of the benefits of federal student loans is the variety of repayment plans available. Some of the most popular plans include:

- Standard Repayment Plan: Fixed payments over 10 years.

- Income-Driven Repayment Plans: Payments based on your income, with the possibility of loan forgiveness after 20 or 25 years.

- Graduated Repayment Plan: Payments start low and gradually increase over time.

If you have federal loans, it’s important to explore all your repayment options and choose one that fits your financial situation.

US Government Suspends Student Loan Forgiveness Under IBR—Here’s What It Means for Borrowers