Exploring the Growth of Devanahalli: Exploring the Growth of Devanahalli isn’t just another catchy real estate headline—it’s the unfolding story of a quiet Bengaluru suburb transforming into one of South India’s hottest property destinations. Whether you’re a young family looking to buy your first home, a seasoned investor eyeing returns, or someone planning retirement in a quieter pocket of the city, this is the place to watch.

Situated just about 35 kilometers from the city center of Bengaluru, Devanahalli is now a strategic goldmine. It’s a town growing at warp speed due to the international airport, booming infrastructure, upcoming tech hubs, and investor-friendly policies. And trust me—it’s not hype. The numbers and facts speak louder than speculation. Let’s walk through everything you need to know—from land prices and infrastructure to real-life examples and professional insights. We’ll break it all down so it makes sense whether you’re 10 or 60.

Exploring the Growth of Devanahalli

Devanahalli is no longer the “sleepy cousin” of Bengaluru—it’s stepping into its own identity as a well-connected, commercially rich, and infrastructure-backed region. With a solid mix of affordability, capital appreciation, and rental returns, it checks every box that a smart investor could ask for. If you’re looking for the next big thing, where your money works hard, grows smart, and offers real utility—it’s here. Devanahalli isn’t just land. It’s land with a plan.

| Feature | Insight / Data | Reference |

|---|---|---|

| Land Price Growth | CAGR of 12–15% since 2012 | Knight Frank, CBRE, OneCityProperty |

| Year-on-Year Price Surge | 15–20% average hike in last 2 years | Hindustan Times, TimesProperty |

| Price Range (2025) | ₹4,200–15,600 per sq ft; average ₹10,577/sq ft | Purva Aerocity, Godrej MSR City |

| Rental Yield | 5–7% annually | CrazyAssets, Housing.com |

| Passenger Growth at Airport | 41.9 million passengers (2024–25), up 11.6% YoY | Airports Authority of India |

| Infrastructure Projects | Metro extension, suburban rail, STRR, circular rail, mega terminal | TOI, Wikipedia, Karnataka Budget 2025 |

| Connectivity | NH‑44, STRR, Namma Metro Phase 2B, Devanahalli rail terminal | Indian Railways, K-RIDE |

| Corporate Presence | Boeing, Foxconn, Amazon, WTC, IT Parks, Aerospace SEZ | Wikipedia, Brigade Orchards, Government Sources |

Why Devanahalli Is Becoming a Real Estate Powerhouse?

1. International Airport Changed Everything

Kempegowda International Airport (KIA) wasn’t just an upgrade to air travel in Bengaluru—it rewrote the region’s real estate story. With 41.9 million annual passengers and continuous expansion including Terminal 2, Devanahalli is now seen as the “Airport City” of India, much like how Atlanta or Dallas suburbs boomed around their major airports in the U.S.

An airport that size creates a ripple effect. Hotels, logistics parks, retail centers, and—of course—homes all grow around it. And we’re just getting started.

2. Major Corporates and Tech Hubs Are Moving In

Big names have already landed. Boeing’s largest campus outside the U.S. is being built here. Foxconn and Amazon have acquired land and committed to large manufacturing and fulfillment centers. Add to that the Karnataka government’s Aerospace SEZ and Hardware Park, which span over 5,000 acres, and it’s clear that jobs—and income—are coming.

Not to mention, the 74-acre World Trade Center project promises a futuristic business ecosystem. Much like what happened in Whitefield or Electronic City in the early 2000s, Devanahalli is now catching the same wind—only with better planning and smarter zoning.

3. Multi-Crore Infrastructure is Rolling In

When you invest in a place, it’s not just about where it is today—it’s where it’s going tomorrow. Devanahalli is getting plugged into a network of next-gen transport and civic upgrades that will make commuting, connectivity, and quality of life drastically better by 2030.

Here’s a breakdown:

- Suburban Rail Projects: Sampige Line connecting to the city center by 2029; Mallige and Kanaka lines by 2026. These are game-changers for middle-class commuters.

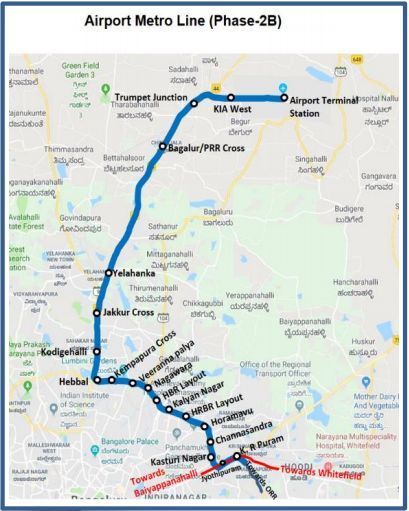

- Metro Line Extension (Phase 2B): Approved in Karnataka’s 2025 budget, it links Devanahalli and KIA to the city’s Namma Metro grid.

- Satellite Town Ring Road (STRR): A 280-kilometer mega highway under construction, connecting Devanahalli to towns like Doddaballapura, Ramanagara, and Hoskote.

- Circular Rail Project: ₹81,000 crore rail loop connecting all Bengaluru suburbs—including Devanahalli.

- Mega Rail Terminal: Survey sanctioned in March 2024 for Devanahalli’s own full-scale railway terminal.

These developments won’t just improve access—they’ll make Devanahalli a self-contained city with near-zero dependence on Bengaluru traffic.

How Real Estate Prices Are Behaving?

Devanahalli’s price appreciation is no longer a fluke. Here’s what the numbers say:

- Land Prices: From ₹2,000 per sq ft in 2015 to over ₹10,000 today in some gated plot communities. That’s a 5x increase in under a decade.

- Apartments: Entry-level 2BHKs start at ₹70–80 lakhs. Premium ones go up to ₹1.2 crores depending on the builder and amenities.

- Rental Yield: Ranges from 5–7% annually for apartments close to the airport and tech parks.

Those investing ₹1.5 crores in 2016 are now sitting on assets worth ₹2.5–3 crores in resale value. Meanwhile, rent flows in steadily from corporate tenants, especially aviation and IT professionals.

Step-by-Step Guide to Investing in Devanahalli

Step 1 – Choose the Right Type of Property

- Plots: Flexible, customizable. Ideal if you want to build your own home or hold for capital appreciation.

- Apartments: Ready-to-move and easy to rent out. Best for passive income seekers.

- Villas: Mid to luxury segment. Gated, secure, and usually near top schools and hospitals.

- Commercial Spaces: For shops, clinics, or co-working spaces—good ROI but requires more active management.

Step 2 – Map Your Investment Horizon

Short-term flippers might find Devanahalli a bit slow. This is a 5–10 year game. The biggest infrastructure changes are coming between 2026 and 2030. Enter now, and you’ll ride the upside.

Step 3 – Stick with RERA-Certified Builders

Names like Tata Housing, Godrej, Prestige, Brigade, Embassy, Salarpuria Sattva, and Purva Projects dominate the area. These players offer transparent documentation, timely delivery, and quality finishes.

Step 4 – Secure Financing and Legal Checks

- Always verify land titles.

- Go with RERA-registered projects.

- Confirm all government approvals (zoning, water supply, road connectivity).

- Use home loans from nationalized banks or HFCs like HDFC, LIC Housing, or SBI for best rates.

Practical Examples from the Ground

Case 1: The Plot Investor

In 2017, a family from Texas bought a 1,200 sq ft plot in a gated community near the airport for ₹35 lakhs. By 2024, similar plots were going for ₹80–90 lakhs. That’s an absolute return of over 130%, not including any rental or development income.

Case 2: The Apartment Landlord

A tech couple bought a 2BHK apartment near the SEZ belt in 2019 for ₹75 lakhs. With the SEZ expanding, they now earn ₹40,000 per month in rent—plus the flat is valued at ₹1.1 crores today.

Case 3: Commercial Office Buyer

An investor bought two 400 sq ft office units in 2020 for ₹90 lakhs total. By leasing to startup consultancies, they’ve recovered 60% of their investment in four years via rentals alone.

Tips to Maximize Your Investment in Exploring the Growth of Devanahalli

- Buy near existing infrastructure or confirmed project corridors (like Metro or STRR).

- Go for early-stage projects with big builder names.

- Avoid agricultural or “green belt” plots unless you’re 100% sure about land use conversion.

- If unsure, hire a local legal expert to vet everything before you pay.

Exploring the World-Class Amenities at Birla Trimaya: A Luxury Living Experience

A Guide to the Best Schools and Colleges Near Birla Trimaya for Your Children’s Education

How Birla Trimaya’s Strategic Location Near Bangalore Airport Offers Unmatched Connectivity