Experts Predict Major COLA Increase in 2026: When it comes to Social Security benefits, a major part of the financial picture for retirees, the Cost-of-Living Adjustment (COLA) is crucial. It helps people keep up with rising costs—something that’s especially important for seniors. As we look toward 2026, experts are predicting a significant COLA increase. This article will break down exactly what that means for you, why it matters, and how it’s determined, making it easier to understand for both everyday readers and professionals.

Experts Predict Major COLA Increase in 2026

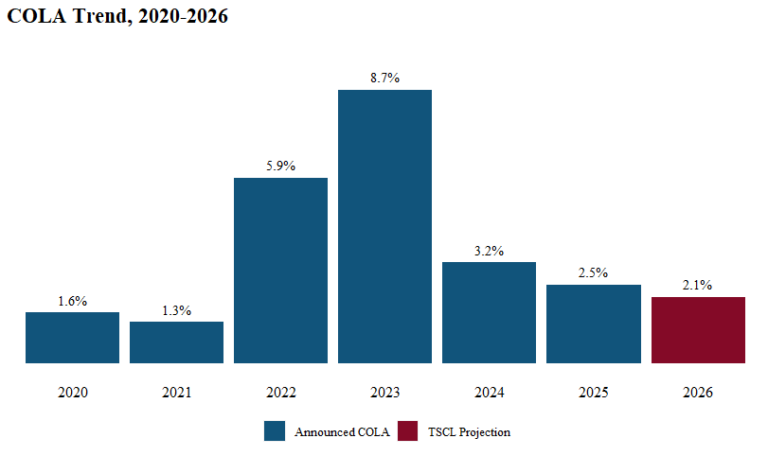

Looking ahead to 2026, Social Security recipients can expect a 2.5% COLA increase, which will help them keep up with rising inflation. While this increase is good news, it’s important to understand that inflation in certain areas, such as healthcare, may still outpace the adjustment for many seniors. The official COLA figure will be confirmed in October 2025, but for now, understanding how COLA works can help Social Security beneficiaries plan their finances and better prepare for the future.

| Key Insight | Details |

|---|---|

| Projected COLA Increase for 2026 | 2.5% |

| Reason for the Increase | Based on rising inflation and other economic factors, experts expect this boost. |

| How the COLA is Calculated | Based on changes in the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). |

| Impacts of the COLA | Helps Social Security beneficiaries keep up with rising costs, especially in areas like healthcare, housing, and food. |

| Official Announcement Date | October 2025, when the official COLA figure is finalized by the Social Security Administration (SSA). |

| Concerns About the CPI-W | The CPI-W may not fully reflect the inflation seniors experience, particularly when it comes to healthcare and other senior expenses. |

What Is COLA and Why Does It Matter?

To put it simply, COLA is the annual adjustment made to Social Security benefits to help recipients keep up with inflation. Inflation is the rate at which the general price of goods and services rises, leading to a decrease in purchasing power. For example, if inflation is 2% per year, something that costs $100 today would cost $102 next year. Social Security benefits are adjusted to reflect these changes in the economy, ensuring that those who rely on them aren’t left behind as the cost of living increases.

In 2026, experts are predicting a 2.5% COLA increase. This is particularly relevant to seniors, who often face higher costs for things like healthcare, housing, and food. In fact, the COLA increase directly impacts millions of Americans, including retirees, disabled individuals, and others who rely on Social Security.

Why Should You Care About COLA?

If you’re receiving Social Security benefits or planning for retirement, COLA is a significant factor in financial planning. A bump in your monthly benefits might seem small, but when you’re on a fixed income, even small increases can add up over time. A 2.5% increase might not fully cover all rising costs, especially for seniors with health issues, but it’s still better than no increase at all. Understanding how COLA works helps you better plan your finances for the future, whether you’re already retired or preparing to retire.

How Experts Predict Major COLA Increase in 2026?

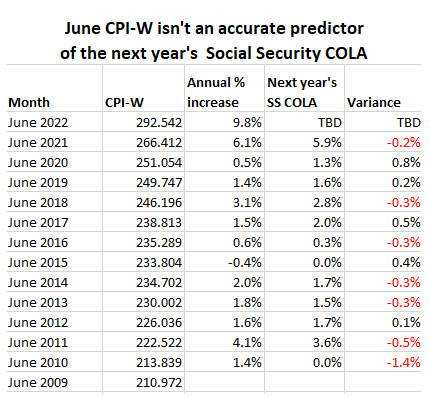

The Cost-of-Living Adjustment is based on changes in the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). The CPI-W tracks the prices of a basket of goods and services typically purchased by urban workers. These include items like groceries, utilities, and gasoline. When these prices go up, the COLA increases to keep Social Security benefits in line with the higher cost of living.

However, there are some challenges with this calculation. Advocates for seniors argue that the CPI-W doesn’t fully reflect the way older Americans spend their money. For example, seniors tend to spend a larger portion of their income on healthcare, which has seen much higher inflation rates than the general economy. For them, a 2.5% COLA might not be enough to cover the rising costs of prescription drugs, medical treatments, and long-term care.

Key Factors Impacting the COLA Calculation

Several factors can influence the final COLA figure:

- Energy Prices: Rising fuel prices can push up the overall cost of goods and services, influencing inflation.

- Housing Market: Increased rent prices and housing costs can significantly affect the CPI-W.

- Healthcare: As previously mentioned, healthcare inflation is much higher than general inflation, which is a significant burden on seniors.

Potential Adjustments to the COLA Formula

Some advocacy groups suggest adjusting the COLA formula to better account for the unique expenses of older Americans. A proposal often discussed is the CPI-E, a version of the CPI that focuses on elderly spending patterns.

Why Do Experts Predict a 2.5% Increase in 2026?

Experts predict that the 2026 COLA will increase by 2.5%, driven by ongoing inflationary pressures. The forecasted number is based on data collected through May 2025, showing a steady rise in the cost of goods and services. While this prediction is subject to change as the economy fluctuates, it is a positive outlook compared to some of the more modest COLA increases in previous years.

A 2.5% increase would provide much-needed relief for many Social Security beneficiaries, especially after several years of lower or even minimal increases. As of now, this number is not final and will be confirmed in October 2025, when the Social Security Administration (SSA) announces the official figure.

Inflation Trends and Its Impact on Seniors

Seniors often face inflation rates that are higher than the general population, particularly in categories like healthcare and long-term care. According to the Senior Citizens League (TSCL), healthcare inflation has been growing at a faster rate than general inflation, creating additional challenges for older Americans.

Practical Impact: What Does This Mean for You?

Example 1: The Retiree on Social Security

Let’s say you’re a retiree receiving $1,500 a month in Social Security benefits. If the 2.5% COLA prediction holds true for 2026, your monthly check would increase by about $37.50—bringing your total monthly benefit to $1,537.50. While this is a welcome bump, it may not be enough to cover all the rising costs seniors face, particularly in healthcare.

Example 2: The Disabled Veteran

Consider a disabled veteran who is receiving a monthly benefit of $2,000. A 2.5% COLA would mean an additional $50 per month, bringing the total to $2,050. Again, while this increase is helpful, it’s important to note that inflation in areas such as healthcare could eat up that extra money quickly.

Example 3: The Working American Close to Retirement

If you’re still working but getting close to retirement age, a 2.5% COLA increase may not have a direct impact yet. However, it does provide an early indication of what to expect when you start receiving Social Security benefits. Planning ahead for retirement and understanding how COLA works can help you manage your finances more effectively during retirement.

Challenges and Concerns About the COLA Increase

The Problem with CPI-W Data

One of the primary concerns surrounding the COLA calculation is that the CPI-W may not fully capture the reality of inflation for seniors. While the CPI-W includes categories like food, gas, and housing, it doesn’t necessarily reflect the disproportionate rise in healthcare costs, which are a significant burden for many older Americans. In fact, healthcare inflation has been running at a higher rate than other types of inflation.

Other Factors That Could Affect the COLA

Inflation is a tricky thing. Even though experts are predicting a 2.5% increase, it’s important to remember that inflation can vary from month to month. Other factors, such as changes in energy prices, economic downturns, or even international events like wars or pandemics, can affect the final COLA adjustment.

2026 COLA Estimate Is In—Here’s How Much Social Security Could Increase

Up to $5000 in Social Security Payments Scheduled for This Date- Are You Eligible to Get it?

Social Security Retirement Age Adjusted to 67 Under New Guidelines- Check Official Details!