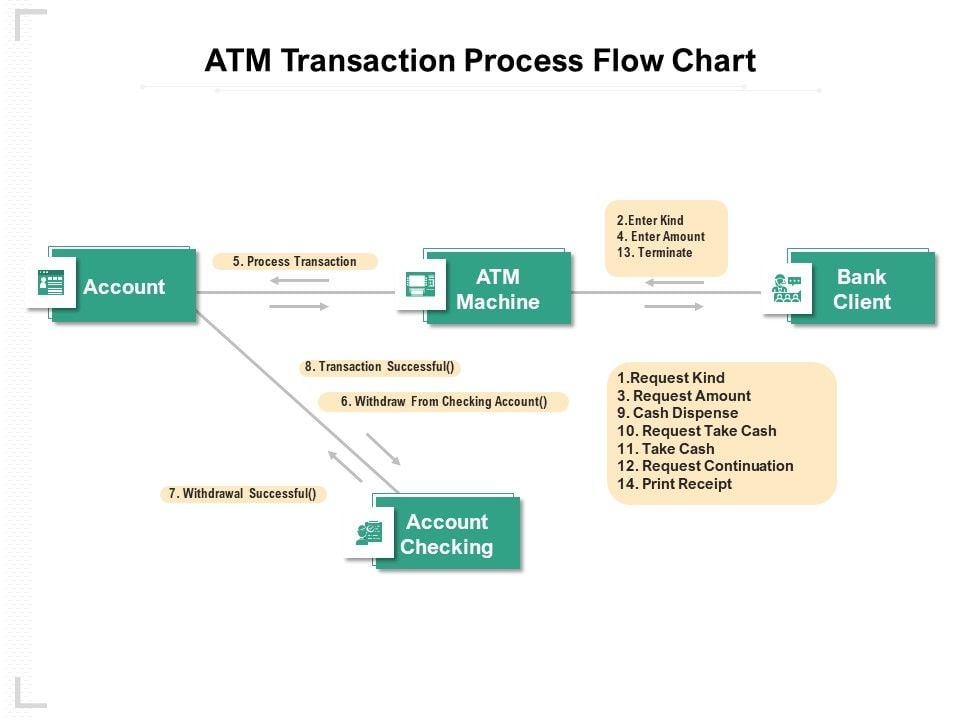

EBT Glitch: It’s happened to the best of us—standing at the ATM, card in hand, punching in your pin, and then… nothing. The machine took your money, but it didn’t spit out a single dollar. It’s a frustrating, nerve-wracking moment, and if you’ve ever found yourself in this situation, you’re probably wondering what to do next. Don’t worry—this article will guide you through the steps you need to take to handle this issue effectively. Whether you’re using an EBT card, a debit card, or even a credit card at the ATM, we’ve got you covered. This comprehensive guide will explain what you need to know about ATM glitches, how to get your money back, and how to avoid similar problems in the future. So, let’s dive into what to do if an ATM took your money but didn’t give you anything!

EBT Glitch

If an ATM takes your money but doesn’t give you anything, it’s a frustrating experience, but it doesn’t have to be the end of the world. Act quickly, document everything, and follow the proper channels for filing a claim. By understanding the process, you can get your money back and avoid future issues. Remember, patience is key in these situations. Whether you’re dealing with a bank or a third-party ATM provider, the resolution process can take a few days, but your money is protected by federal regulations. Stay calm, stay informed, and you’ll be on your way to resolving any ATM-related problems that come your way.

| Key Topic | Key Data & Stats | Helpful Resource |

|---|---|---|

| What to do when an ATM takes your money | 10–45 days for investigation, 60-day reporting window | U.S. Federal Reserve on ATM Regulations |

| Customer service response times | 10 business days for resolution | Consumer Financial Protection Bureau |

| Misdispense claim | File a claim with the ATM provider or bank | FNS EBT FAQ |

| Escalating your claim | Contact the bank’s dispute department | CFPB Complaints Portal |

Step 1: Stay Calm and Document the Incident

First things first: don’t panic. While it’s understandably frustrating to watch the machine take your money and give you nothing in return, it’s important to stay calm and act quickly.

The very first thing you should do is document the incident. This includes writing down the date and time, taking a screenshot or photo of the ATM receipt (if one is available), and noting the exact location of the ATM. Most machines will have a unique ATM ID number displayed on the screen or somewhere nearby—write it down. This information is crucial for tracking the issue and will be required when you file a claim.

Also, make sure to write down the transaction amount, and whether you received any error message. The more details you can gather, the faster you’ll be able to resolve the issue.

Step 2: Contact Your ATM Provider or Bank

After documenting the incident, the next step is to get in touch with your ATM provider or bank. The number for your bank’s customer service is usually printed on the back of your debit card or available on their website. You should call as soon as possible to report the problem. Make sure you have all the information you gathered in Step 1 ready to share.

When you call, you’ll likely be asked to provide:

- Your ATM receipt number (if you received one)

- The location of the ATM and the ATM ID number

- The time and date of the transaction

- The exact amount of money that was withdrawn or “taken”

Example:

Let’s say you’re using your EBT card at an ATM in a grocery store. You check the receipt and realize you were charged $100, but no cash came out. You call the number on your EBT card, give them all the details, and file a claim. Keep in mind that banks are required to respond to disputes within a certain period, usually within 10 business days (for a quick resolution) or up to 45 days if an investigation is needed .

Step 3: Understand the Claims Process and Timeline

You’ll need to be patient after reporting the issue, as it can take some time to resolve. But rest assured, under federal regulations, you are entitled to have the money reimbursed if the issue is confirmed to be an ATM malfunction. Here’s how the timeline usually works:

- 10 business days: The bank has this amount of time to investigate the transaction and resolve the issue if possible.

- 45 days: If further investigation is needed, the bank may have up to 45 days to finalize the claim and issue a refund.

If you don’t see any updates or reimbursement after 10 business days, you should follow up and check on the status of your claim.

Step 4: Check with the Bank’s Local Branch

If the ATM is located at a bank branch, it’s a good idea to speak directly with a bank representative. Sometimes, resolving the issue in person can speed up the process. The bank staff may have direct access to more information about the machine and can file a report more quickly.

If the ATM is third-party operated, you may need to contact the ATM provider directly. In some cases, third-party ATMs (like those at convenience stores or gas stations) have different processes for resolving issues.

Step 5: Escalating the Claim

If your claim hasn’t been resolved within the appropriate timeline or you feel the bank isn’t handling it properly, you may need to escalate the issue. Here are some options:

- File a formal complaint: If you’re not getting anywhere with customer service, you can escalate the issue by filing a formal complaint with your bank’s dispute department or with the Consumer Financial Protection Bureau.

- Contact your state’s attorney general’s office: In some cases, contacting your state’s attorney general’s office or consumer protection agency can help move the process along.

- Police report: If the ATM appears to have been tampered with or there’s suspicion of fraud, it might be necessary to file a police report. This step is usually needed only for severe cases.

Step 6: Avoiding Future EBT Glitch

Now that you know what to do when an ATM takes your money and doesn’t give you anything, let’s talk about how to avoid this problem in the future:

1. Inspect the ATM Before Use

Before using any ATM, check the machine for signs of tampering or unusual behavior. Cover the keypad when entering your PIN, and make sure the machine looks properly maintained.

2. Use Bank-Owned ATMs When Possible

If you have a choice, try to use ATMs owned by your bank. They’re less likely to have maintenance issues or malfunctions. Many banks also offer fee-free ATMs in their networks.

3. Keep Track of Your ATM Transactions

Track your transactions regularly through online banking or your bank’s mobile app. This will help you spot any discrepancies quickly. In case something goes wrong, you’ll be ready to act fast.

Step 7: Know Your Rights as an ATM User

As an ATM user, it’s essential to understand your rights. The Electronic Fund Transfer Act (EFTA) and its related regulations ensure that you are protected when using ATMs, including if there is a malfunction that causes you to lose money.

- Refunds: Under the Regulation E rules, banks are required to credit your account for disputed ATM transactions that are found to be incorrect.

- Timeframes: As mentioned earlier, your bank is required to investigate within 10 business days and resolve the issue within 45 days.

- Lost or Stolen Cards: If your card is lost or stolen, notify your bank immediately to limit liability. Under the EFTA, your liability is capped at $50 if you report the loss or theft within two business days.

Understanding your rights empowers you to handle any situation confidently and effectively.

Goodbye Fossil Fuels: California Revives 19th-Century Biofuel to Battle Climate Change

The Earth is No Longer Blue: NASA Reveals Shocking Climate Change Impact as Planet Turns Green

Biggest Piece of Mars Ever Found on Earth Just Sold for $5.3M — Guess Who Bought It