Earning This Much Could Trigger CRA Scrutiny of Your CPP Payments: When it comes to Canada Pension Plan (CPP) payments, many people don’t realize that their income levels can trigger the Canada Revenue Agency (CRA) to take a closer look at their contributions and eligibility for benefits. In fact, earning above certain thresholds can raise red flags and lead to increased scrutiny. So, if you’re collecting CPP benefits while working or have multiple income streams, it’s essential to understand how your earnings might affect your CPP payments and the likelihood of CRA intervention. This article will walk you through everything you need to know about triggering CRA scrutiny of your CPP payments.

Earning This Much Could Trigger CRA Scrutiny of Your CPP Payments

In summary, earning above certain thresholds can trigger CRA scrutiny of your CPP contributions. By understanding the key thresholds—the YMPE and YAMPE—and staying on top of your earnings and contributions, you can avoid potential issues with the CRA. Whether you’re working multiple jobs, are self-employed, or have other income sources, it’s important to report all of your earnings accurately and consult with a professional if you’re unsure. Keeping good records and ensuring that your contributions are correct will help you avoid unnecessary scrutiny and ensure that your CPP benefits are calculated properly.

| Topic | Key Takeaways |

|---|---|

| CPP Contribution Thresholds | Earnings above $71,300 (YMPE) trigger the base CPP contribution. |

| Additional Contributions | Earnings between YMPE and $81,200 are subject to extra contributions for employees and self-employed individuals. |

| CRA Scrutiny Triggers | High earnings, multiple employers, or inconsistencies in reporting may lead to CRA investigations. |

| Common Mistakes to Avoid | Misreporting income or failing to track contributions accurately. |

| Tips to Stay Safe | Keep detailed records and report all income sources accurately. Seek professional advice when necessary. |

What is the Canada Pension Plan (CPP)?

The Canada Pension Plan (CPP) is a government program that provides financial support to Canadians when they retire or if they become disabled. Contributions to the CPP are mandatory for most workers in Canada, with payments being calculated based on the amount you earn and contribute. Workers who have paid into the CPP throughout their careers are eligible to receive monthly payments when they reach retirement age, or they may receive disability benefits if they are unable to work.

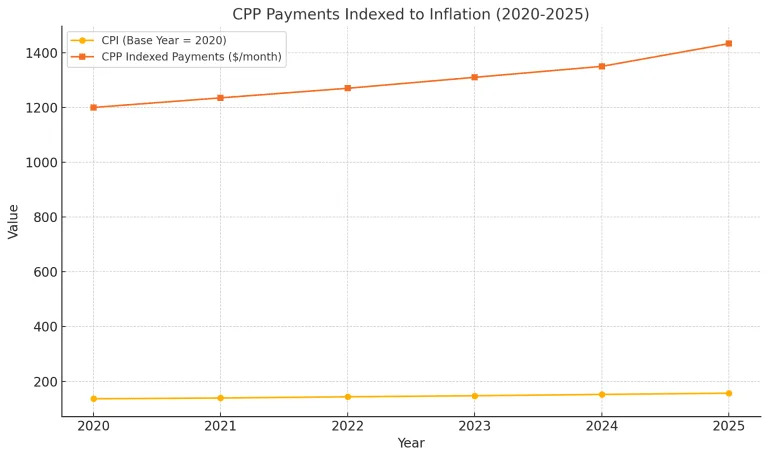

But what many people don’t realize is that your income level directly impacts the contributions you make to the CPP—and those contributions, in turn, influence how much you receive from the plan. If you earn a certain amount of money, or if you have multiple sources of income, the Canada Revenue Agency (CRA) may start looking at your contributions more closely.

How Earning This Much Could Trigger CRA Scrutiny of Your CPP Payments?

1. Earnings Above the Threshold: The YMPE and YAMPE

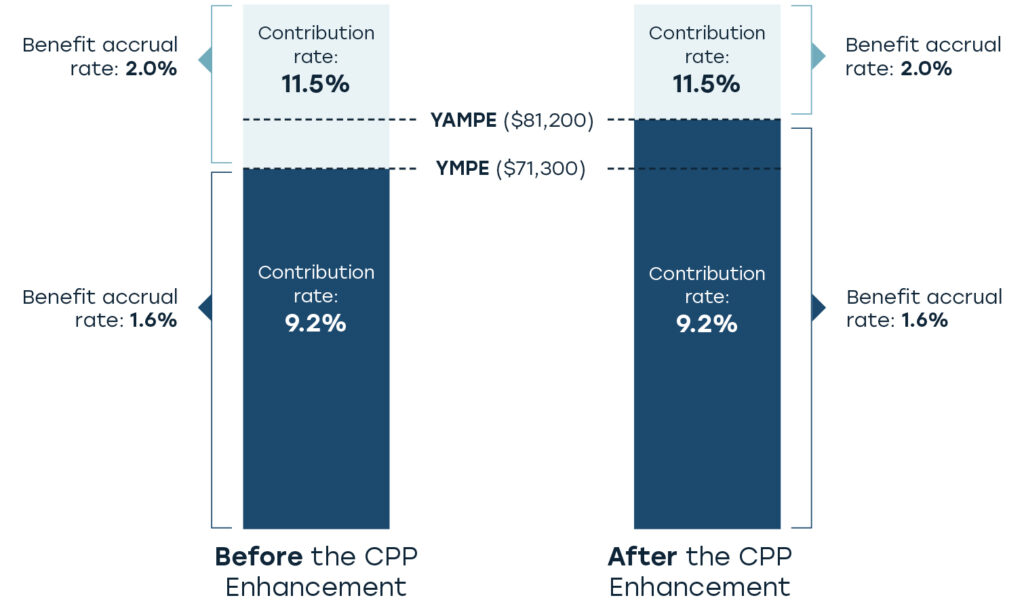

For the CRA to determine if you’re contributing correctly to the CPP, it compares your income to two key thresholds:

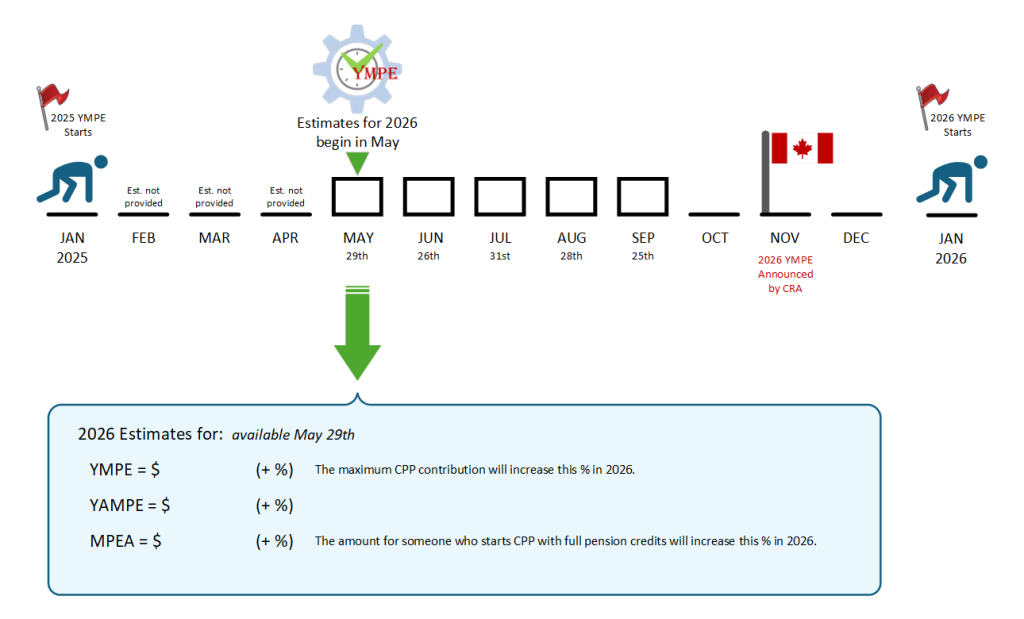

- YMPE (Year’s Maximum Pensionable Earnings): This is the maximum amount of income on which you are required to contribute to the CPP in a given year. In 2025, the YMPE is $71,300.

- YAMPE (Year’s Additional Maximum Pensionable Earnings): This is an additional threshold that applies to higher earners. In 2025, this amount is $81,200.

If your annual income exceeds the YMPE, you must contribute to the base CPP. If your earnings exceed the YMPE but stay under the YAMPE, you’ll make additional contributions to the enhanced portion of the CPP. Contributions to this enhanced portion are higher for both employees and the self-employed.

Once your earnings exceed $81,200, no further CPP contributions are required for that year. This is why it’s important to track your income carefully to ensure that you are contributing the correct amount.

2. Multiple Employers or Self-Employment

Another common trigger for CRA scrutiny is having multiple sources of income. If you work for more than one employer, both employers may deduct CPP contributions based on the wages they pay you, without realizing that you’ve already hit the YMPE with your first job. This could lead to over-contribution, and you may end up paying more than you are supposed to. The CRA can review these contributions and determine whether they were properly calculated, which can lead to further inquiries.

For self-employed individuals, the risk of over-contribution is also present. Self-employed individuals are responsible for both the employer and employee portions of CPP contributions, meaning they pay 8% on their income, which is double the rate paid by employees. If your business income exceeds the YMPE, the CRA will expect you to make the corresponding contributions, and failure to do so could prompt an audit.

3. Inconsistent Reporting or Errors

If there are discrepancies between the income you report to the CRA and the amount of income you actually earn, this can trigger an audit. For example, if you report a lower income than what you actually earn, you may not contribute the correct amount to the CPP. The CRA uses various methods to track and cross-reference reported income, so any discrepancies can raise flags and lead to scrutiny.

How to Avoid CRA Scrutiny and Protect Your CPP Payments?

1. Track Your Earnings and Contributions

The first step to avoiding CRA scrutiny is to keep careful track of your income and contributions. Ensure that all your employers are aware of the CPP contributions made by other employers if you work multiple jobs. If you’re self-employed, make sure you’re calculating your contributions accurately, including both the employer and employee portions.

2. Report All Income Sources Accurately

If you have income from other sources—such as rental income, investment returns, or freelance work—ensure these are reported on your tax returns. Missing or underreporting income could lead to audits and an investigation into your CPP contributions.

3. Seek Professional Advice

If you’re unsure about your contributions or how your income will affect your CPP payments, it’s always a good idea to consult a tax professional. They can help you ensure that your contributions are accurate and compliant with CRA guidelines, potentially saving you from unnecessary scrutiny.

4. Keep Detailed Records

Maintaining detailed records of your income and CPP contributions is vital to avoiding audits. Make sure you have a clear record of how much you’ve earned and how much has been contributed to the CPP, especially if you have multiple income sources.

Why Does the CRA Scrutinize CPP Payments?

The main goal of the CRA’s scrutiny is to ensure the system works fairly and that people are contributing the correct amounts to the CPP. By reviewing CPP contributions, the CRA helps ensure that:

- People who are entitled to benefits are receiving them

- Those who earn above the contribution limits are not underpaying

- Contributions are made in accordance with Canadian tax laws

In addition, the CRA works to prevent fraud and errors in the system by reviewing contributions and payments to ensure compliance with the law.

What Happens If the CRA Finds Discrepancies?

If the CRA finds discrepancies in your CPP contributions, they may require you to pay the difference. For example, if you’ve underpaid due to incorrect calculations, the CRA may issue a notice of assessment and request that you make up the shortfall.

If you’ve overpaid, the CRA will generally issue a refund for the excess contribution after their review is completed. However, it’s always better to avoid overpaying in the first place, as that can lead to delays and additional paperwork.

GST/HST Payments in Canada Start This Week—Check If You Qualify for the July 2025 Deposit

Boosted CRA Benefit in Quebec Could Bring Over $1,200 This Week for Eligible Residents