DWP Mistakes Could Mean You’re Owed Thousands: The UK’s benefits system is a lifeline for millions — but what happens when the Department for Work and Pensions (DWP) makes a mistake? You might be surprised to learn that thousands of claimants across the UK have been underpaid or wrongly billed due to official DWP errors. And many of them don’t even know it. This article breaks down everything you need to know about potential DWP benefit errors, including how to check if you’re owed money, how to challenge incorrect overpayments, and how to reclaim thousands in back payments. Whether you’re a carer, a parent, a disabled individual, or simply someone who’s ever dealt with the DWP, this is your go-to guide for finding out if you’re due a refund.

DWP Mistakes Could Mean You’re Owed Thousands

Errors by the DWP have affected thousands of claimants, costing some families life-changing sums. But you don’t have to accept it. With the right steps — and a little persistence — you can claim back the money you’re owed and ensure you’re receiving the correct benefits moving forward. Check your benefit records, ask the right questions, and don’t hesitate to challenge official errors. After all, it’s not just paperwork — it’s your income, your security, and your rights.

| Issue | Who’s Affected | Possible Amount Owed | Action Required | More Info |

|---|---|---|---|---|

| PIP Underpayments | People with disabilities needing support | £5,000–£12,000 | Request reassessment | Gov.uk – PIP |

| State Pension Errors | Parents (mainly women) with kids pre-2010 | Average £5,000 | Claim HRP credits before 2027 | DWP Pension Credit |

| Universal Credit Overpayments | UC recipients with DWP admin errors | £1,000s | Request waiver or appeal | Universal Credit |

| Carer’s Allowance Overpayments | Carers with earnings breaches | £300–£20,000 | Dispute repayment | Carer’s Allowance |

What’s Behind the DWP Mistakes?

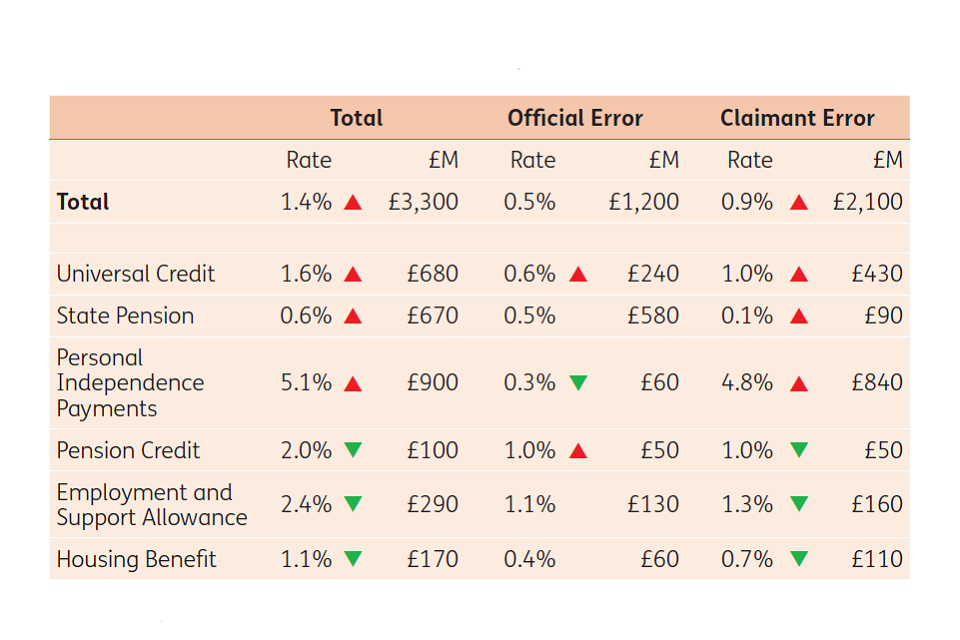

With over 20 million people receiving benefits annually, the DWP operates one of the most complex welfare systems in the world. But complexity breeds confusion — and official errors. According to reports from the National Audit Office and The Guardian, DWP has acknowledged underpayments and overpayments that have affected hundreds of thousands of claimants, often due to miscalculations, outdated processes, or policy misinterpretation.

Most troubling? In many cases, DWP didn’t notify those impacted. That means you have to take the initiative to investigate and claim what you’re owed.

1. Personal Independence Payment (PIP) Underpayments

Personal Independence Payment (PIP) is designed to help people with disabilities cover extra living costs. However, a 2019 court ruling — known as the MM judgment — revealed that DWP misinterpreted what counted as “social support” for people with mental health conditions. The result? Over 600,000 claimants were potentially underpaid.

According to The Sun, the DWP has reviewed more than 520,000 PIP claims. So far, over £250 million has been repaid, with average back payments of £5,285.

How to Check if You’re Affected

- Did you receive PIP between 2016 and 2019?

- Were you denied support for social interaction or daily decision-making?

- Do you live with mental health conditions like anxiety, PTSD, or autism?

If so, you may be owed money.

Next steps:

- Call PIP enquiry line: 0800 121 4433

- Request a reassessment under the MM judgment

- Ask for a Mandatory Reconsideration if initially refused

- Appeal to the Social Security and Child Support Tribunal if necessary

2. State Pension Underpayments – Especially for Parents

A major DWP error has left tens of thousands of mostly women pensioners underpaid due to missing Home Responsibilities Protection (HRP) credits. These credits should have been applied to parents — especially mothers — who claimed Child Benefit between 1978 and 2000 but may not have been recorded correctly.

According to The Guardian, an estimated 210,000 people are affected, with an average payout of £5,000.

Who’s Affected?

- You claimed Child Benefit before 2000

- You weren’t paying full National Insurance at the time

- You’re now drawing a reduced State Pension

How to Check

- Use Check Your State Pension

- Review gaps in your NI contribution record

- Contact the Pension Service: 0800 731 0469

- Apply for a correction before the March 2027 deadline

3. Universal Credit Overpayments Due to DWP Error

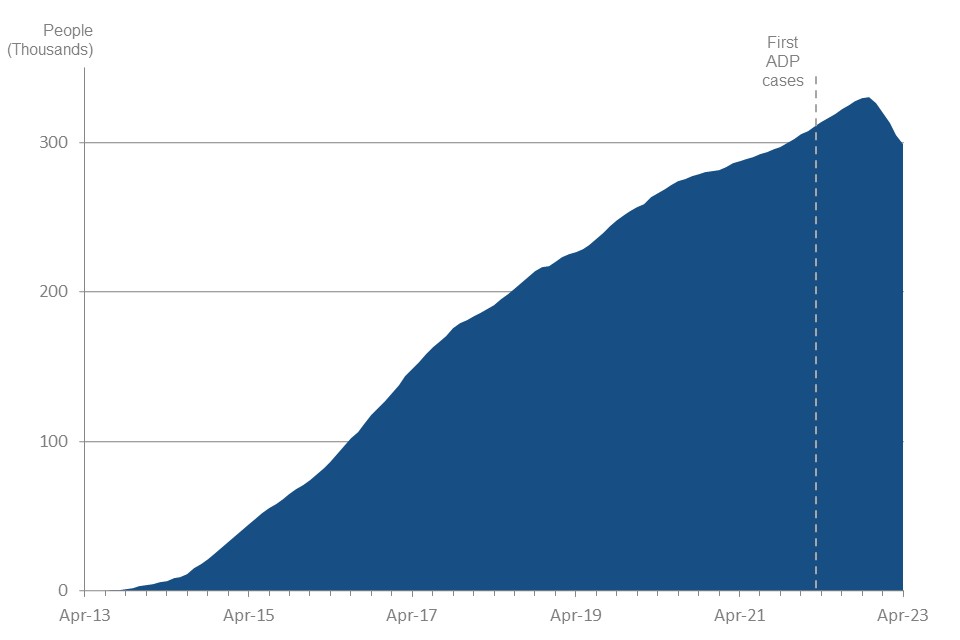

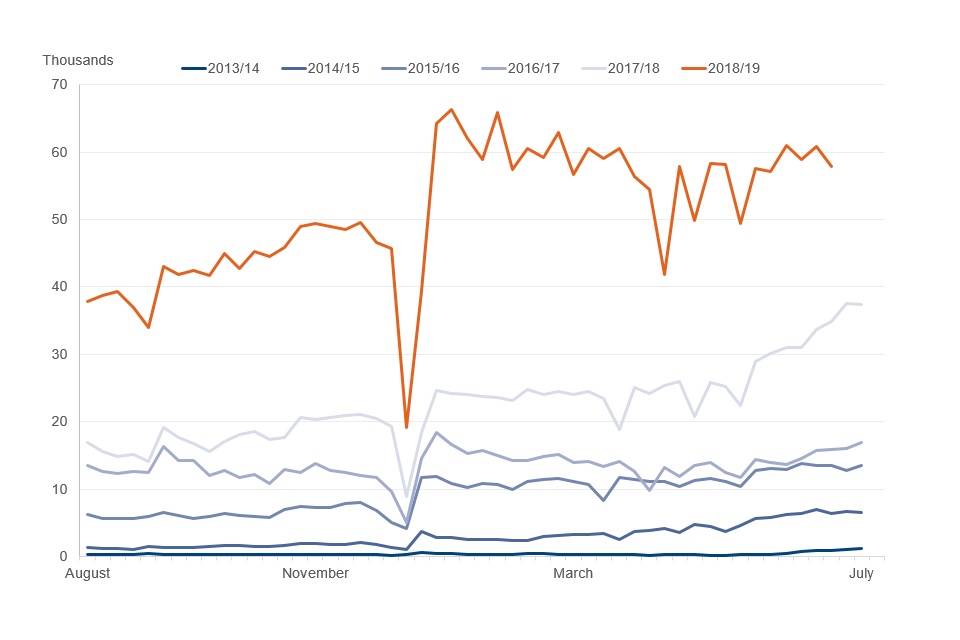

Universal Credit (UC) simplifies multiple benefits into a single monthly payment. But simplicity doesn’t mean accuracy. In 2023–24 alone, the DWP created over 686,000 overpayment debts — many of them caused by its own administrative errors.

Despite being at fault, DWP still recovers the overpayments, often by deducting from future UC payments. This practice has been widely criticized by charities and MPs.

Real-Life Case Example

A single father from Manchester discovered he was being charged £85 a month for an overpayment he didn’t cause. The DWP had mistakenly duplicated his income entry — costing him nearly £2,000 in repayments over two years.

What You Can Do?

- Log into your Universal Credit online journal

- Check for overpayment notices or deductions

- If an error occurred, request a Discretionary Waiver or appeal

- Reference that it was caused by official error (DWP’s responsibility)

4. Carer’s Allowance Errors — Big Repayments for Small Mistakes

Carer’s Allowance supports those who care for someone 35+ hours a week. But there’s a strict weekly earnings limit — £151/week after tax — and going even £1 over can lead to thousands in overpayments.

Unfortunately, the DWP doesn’t warn carers if they exceed the limit. Many carers continued receiving payments for years before being suddenly hit with bills of £10,000+, sometimes facing prosecution.

Who’s Most at Risk?

- Informal carers balancing part-time jobs

- People unaware of the earnings threshold

- Anyone not receiving alerts from DWP when income rises

How to Respond?

- Contact Carers UK

- Review your payment history

- Challenge the repayment if DWP failed to provide notice

- Request a waiver based on administrative failure

Remember: You have the right to appeal. Overpayments caused by DWP inaction or system flaws are not your fault.

DWP Mistakes Could Mean You’re Owed Thousands: What the Law Says

If DWP makes a mistake, you are entitled to:

- A correction of your benefit record

- Back payments of money owed

- The ability to challenge and appeal overpayments

- Legal support from welfare advisors or organizations like Public Law Project

Appeals can go through:

- Mandatory Reconsideration

- First-tier Tribunal (Social Security)

- Upper Tribunal, if legal errors occurred

Time limits apply in some cases — usually one month from the decision notice — so act fast.

Are Back Payments Taxable?

Here’s the good news:

- PIP and Carer’s Allowance: Not taxable

- Universal Credit: Refunds are not taxed

- State Pension back payments: May be taxable if they push your total income above your annual tax allowance

£150 DWP Payment Extended — See If Your Household Now Qualifies

Universal Credit Claimants With Savings Get New Warning From DWP

DWP Issues Alert for Universal Credit Claimants Holding Rainy Day Savings