DWP May Reduce Benefit Payments by 15%: The UK Department for Work and Pensions (DWP) has recently announced significant changes to its benefit payment system, with a focus on reducing certain payments by up to 15%. This move aims to address issues such as debt repayments, fraud penalties, and overpayments. However, the changes have raised many questions about how they will impact claimants and their finances. In this article, we’ll explore why these changes are happening, what they mean for you, and what steps you can take to minimize the effects of these reductions. Whether you’re a claimant receiving Universal Credit, a tax professional advising clients, or someone just curious about the changes, we’ve got you covered.

DWP May Reduce Benefit Payments by 15%

The DWP’s decision to reduce benefit payments by 15% is an important change that will affect many claimants in the UK. While this reduction offers some relief for those struggling with debt repayments, it also means that those with large debts may find it takes longer to pay them off. If you’re facing deductions, make sure to review your payments and request mandatory reconsideration if needed. The financial landscape for benefit recipients can be tricky, but by staying informed and taking proactive steps, you can ensure that you’re getting the support you need.

| Topic | Details |

|---|---|

| What’s Happening | DWP may reduce benefit payments by up to 15% due to debt repayments, overpayments, and fraud penalties. |

| Affected Groups | Universal Credit recipients, benefit claimants, and tenants with rent arrears. |

| New Deductions Limit | The 15% cap applies to certain benefit reductions, allowing claimants to keep more of their payments. |

| Potential Impact | While it may reduce debt repayments, it could result in slower recovery periods for debts. |

| Resources | Gov.uk, Citizens Advice, Shelter |

| Actions to Take | Claimants can request reconsideration if they disagree with deductions or face financial hardship. |

Background on DWP and the Benefit System

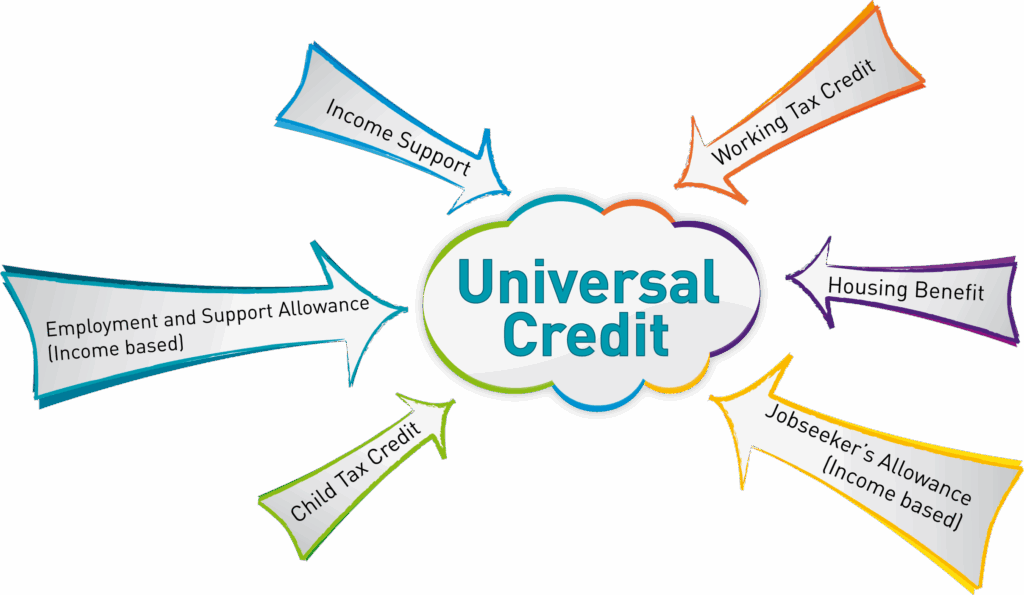

The DWP is responsible for administering welfare benefits in the UK, including Universal Credit (UC), which provides financial support to people who are on a low income or unemployed. UC payments can be subject to deductions for various reasons, including debt recovery, fraud penalties, and overpayments.

Historically, the DWP had a maximum deduction rate of 25%, which means that 25% of a claimant’s standard allowance could be taken out each month to repay debts or penalties. But now, in a significant policy change, the cap will be reduced to 15% starting in 2025. This adjustment comes as part of the UK government’s wider welfare reform program, designed to streamline benefit systems and provide more support to those facing financial hardship.

Why Are These Changes Being Made?

The 15% cap is being introduced in an effort to ensure that claimants receive more money each month, particularly those who are struggling with debt repayment. By reducing the percentage of deductions, the government is aiming to offer financial relief to individuals and families who may already be struggling with low income.

The main reasons for the changes are:

- To help claimants retain a larger portion of their Universal Credit payments each month.

- To support individuals facing ongoing financial hardship, including those who have fallen behind on rent payments, utility bills, or other debts.

- To create a more sustainable and balanced repayment plan that doesn’t take too much of a claimant’s income.

While this may seem like a relief for many claimants, it also comes with certain trade-offs, including the risk of slower debt recovery.

What Types of Deductions Will Be Affected?

The 15% cap will apply to several types of deductions from UC, including:

- Repayments for overpaid benefits

- Housing Benefit debts

- Budgeting loans or advances

- Hardship payments (where financial support is granted in exceptional circumstances)

However, some deductions will not be subject to this cap. These include:

- Fraud penalties: If you’re penalized for fraud, you may have up to 100% of your UC payments deducted.

- Sanctions: UC claimants who fail to meet certain work-related requirements may face sanctions, and these can result in up to 100% of payments being deducted.

- Child maintenance payments: Deductions for child maintenance won’t be capped.

- Third-party deductions: This includes deductions for rent arrears, utility bills, or council tax payments.

How Deductions Are Calculated

Deductions from Universal Credit payments can be a source of significant stress for many claimants, particularly those already facing financial difficulties. Understanding how these deductions are calculated is crucial for managing your finances.

The DWP will calculate deductions based on several factors, including:

- The total amount of the debt: Whether it’s due to an overpayment, rent arrears, or another cause, the larger the debt, the larger the deductions may be.

- The claimant’s standard allowance: Deductions are taken as a percentage of the claimant’s monthly Universal Credit payment. Under the new 15% cap, this means that no more than 15% of a claimant’s standard allowance can be deducted in a month.

For example, if a claimant’s standard monthly UC payment is £800, the maximum that can be deducted under the new rules is £120 per month (15% of £800). This is a significant decrease from the previous 25% deduction rate, which would have been £200.

Understanding these calculations can help you anticipate your UC payments and adjust your budget accordingly.

The Impact on Claimants

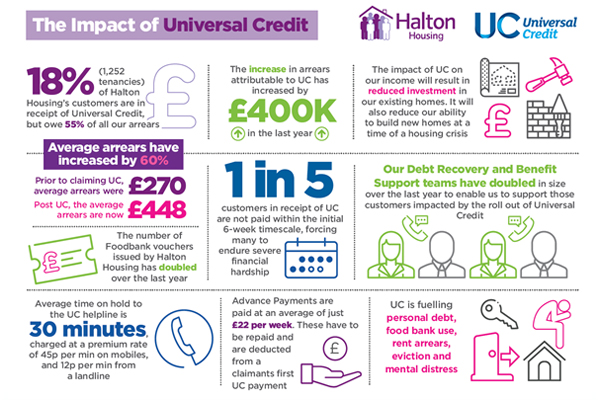

The changes to the deduction limits will have a significant impact on claimants who are already struggling with debt repayment.

- Positive Impact: Claimants will have more money left in their pocket each month as fewer deductions are made from their UC payments. This could help them manage essential costs such as groceries, transport, and utility bills.

- Negative Impact: For those who owe substantial debts, reducing the deduction rate could mean slower repayment of those debts. This could lead to extended payment periods for rent arrears or overdue bills, which could be problematic for claimants facing potential eviction or utility disconnections.

For example, if you’re in a situation where you’re repaying rent arrears through UC deductions, reducing the deduction percentage could make it more difficult to catch up on those payments. While you might have more disposable income each month, the arrears will take longer to pay off, which could create long-term financial strain.

Practical Steps to Manage Payment As DWP May Reduce Benefit Payments by 15%

If you’re affected by these changes, here are some steps you can take to minimize the impact:

1. Review Your Deductions

- Check the details: If you’re receiving Universal Credit, review your monthly statement to see exactly how much is being deducted.

- Understand the deductions: Familiarize yourself with the reasons for each deduction (e.g., overpayment, sanctions, fraud penalties, etc.). If the deductions seem unclear, ask the DWP for clarification.

2. Request a Mandatory Reconsideration

- If you disagree with any deductions or think they’re too high, you have the right to request a mandatory reconsideration. This is a review process where you can ask the DWP to reassess the decision. If the reconsideration process doesn’t result in a favorable outcome, you can appeal the decision.

3. Seek Financial Hardship Consideration

- If the deductions are leaving you with little to no income, you can request financial hardship consideration. This could result in a reduction of the amount deducted from your payments, giving you a little more breathing room. It’s important to demonstrate your financial need clearly when requesting hardship consideration.

4. Consult with an Advisor

- If you’re unsure how the changes will affect you or if you’re struggling to manage your deductions, it’s a good idea to consult with an advisor at Citizens Advice or Shelter. These organizations offer free guidance and can help you navigate the changes. They can also assist with appealing deductions or securing financial support.

5. Consider Creating a Budget

- Budgeting is essential in times of financial uncertainty. Consider setting aside a small amount each month to save, which can be used to cover upcoming deductions or other financial responsibilities. There are many budgeting tools available online, as well as apps that can help you track your expenses and savings goals.

Example Scenario: How the 15% Cap Impacts Claimants

Let’s say you receive £500 per month in Universal Credit. Previously, your deductions for overpayments and rent arrears were 25%, or £125 each month. Now, under the new 15% cap, your deductions would be reduced to £75, giving you an additional £50 each month.

This extra £50 might not seem like much, but for someone on a tight budget, it could make a difference, helping them to cover other essential costs like groceries, utilities, or transport.

On the other hand, if you owe significant rent arrears, the reduction in deductions means it may take longer to clear your debts, as repayments will be spread over a longer period. This can be particularly difficult for tenants who are at risk of eviction or facing financial strain.

Additional Considerations for Vulnerable Claimants

While these changes will benefit many claimants, vulnerable groups such as individuals with disabilities, single parents, and those with fluctuating incomes might still face challenges. Some vulnerable claimants may struggle with the lengthy recovery periods for debts due to the reduced deductions.

For example, a disabled claimant who relies on Universal Credit to meet their living expenses may have to wait longer to pay off a budgeting loan, which could cause additional stress. In such cases, it’s even more crucial to explore options like additional financial support, disability benefits, and budgeting tips.

Why Some State Pensioners Receive Lower Payments, DWP Explains

Universal Credit Payments Being Issued to Eligible Individuals, Says DWP

Integrated Pension Rules May Reduce State Pension for Some, Confirms DWP