DWP May Cut Benefit Payments by 15% in Some Cases: The Department for Work and Pensions (DWP) is rolling out a significant change that could put more money in some claimants’ pockets—but might also quietly shrink support for others. Starting April 2025, deductions from Universal Credit (UC) for things like debt repayment or advance loans will be capped at 15% of the standard allowance—down from the current 25% limit.

Sounds like good news? It is—for those who owe money to DWP. But there’s more to the story. Behind this debt-relief change are new, tougher rules targeting people with disabilities, mental health challenges, and long-term health conditions, set to begin from 2026. Whether you’re a benefits recipient, a carer, a caseworker, or just trying to plan ahead, this article breaks it all down for you—in plain English, from a real-world perspective.

DWP May Cut Benefit Payments by 15% in Some Cases

While the 15% deduction cap is a welcomed relief for many, the broader changes to health and disability benefits are raising alarms across the UK. These reforms don’t just affect those newly applying—they reshape what it means to be “disabled enough” for support. Whether you’re a working parent, long-term carer, new UC claimant, or someone living with fluctuating conditions, the next few years will be critical in shaping your financial well-being. Now is the time to plan, get advice, and speak out if needed.

| Topic | What’s Changing | Who’s Affected | More Info |

|---|---|---|---|

| UC Deduction Cap | Reduced from 25% → 15% | 1.2M households | gov.uk |

| Repayment Savings | Up to £420/year | Anyone repaying advances, loans, or arrears | citizensadvice.org.uk |

| New UC Health Element | Frozen at £416/month (starting 2026) | New health-based UC claimants | parliament.uk |

| PIP Eligibility Tightens | Minimum 4 points in Daily Living activity | 800,000 PIP claimants, 150,000 carers | scope.org.uk |

| Fluctuating Conditions | May no longer qualify for support | People with MS, bipolar, long COVID, etc. | mssociety.org.uk |

Why Is the DWP Cutting Deduction Rates?

For years, debt deductions have been a huge burden for people on Universal Credit. In many cases, the DWP was taking up to a quarter of someone’s monthly benefit to repay budgeting loans, overpayments, or rent arrears—leaving people without enough money for essentials like food, heating, and school supplies.

This new 15% cap, which starts in April 2025, is meant to address that.

A Real Example

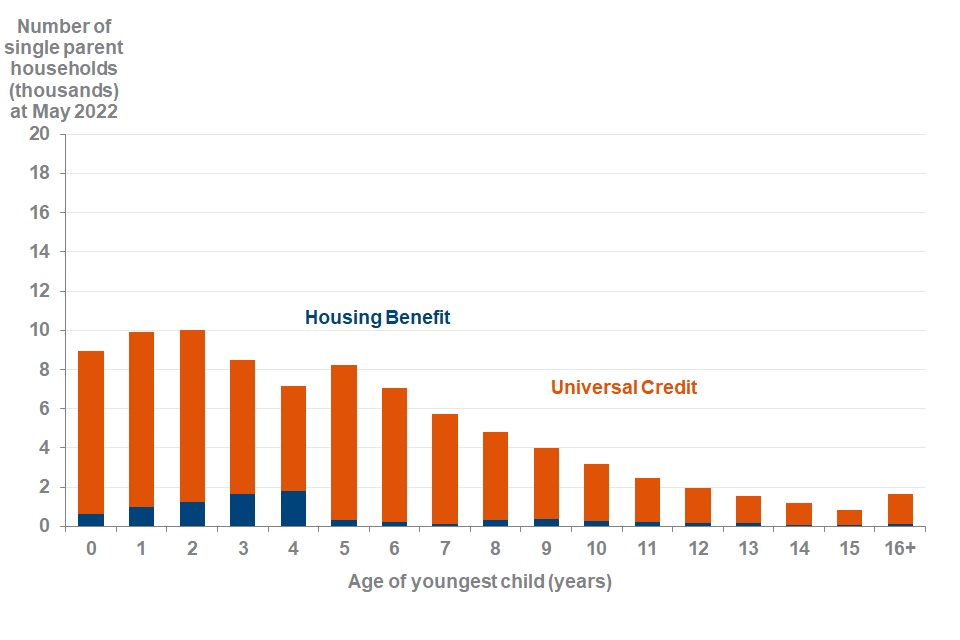

Take Sarah, a single mom of two in Manchester. She borrowed a £400 advance to cover her rent while waiting for her first UC payment. Under the old system, she was paying back £92/month—25% of her UC standard allowance. Under the new cap, that drops to just £55/month—a £37 monthly relief, or £444 per year. That’s a full week of groceries or school uniforms for her kids.

But Not All Cuts Are Good News

While the deduction cap is helpful, other upcoming policy changes are raising serious concerns.

Starting in April 2026, people making new claims for UC due to incapacity or long-term illness will face a reduced health element—frozen at £416 per month, regardless of inflation or need. For many, this will be significantly lower than the current Limited Capability for Work and Work-Related Activity (LCWRA) top-up, which can reach over £760 per month.

What This Means in Real Terms

People who become too ill to work after April 2026 may receive £3,000 to £4,000 less per year than someone with the same condition who started UC in 2025. That’s a massive inequality based on nothing more than timing.

The PIP Shakeup: What’s Changing in 2026?

Things get more serious in November 2026, when the DWP plans to tighten eligibility for Personal Independence Payment (PIP)—a benefit that helps with extra costs of daily living or mobility for disabled individuals.

To qualify for the Daily Living component, claimants must:

- Score at least 4 points in a Daily Living activity (e.g., preparing food, managing medication)

- Score at least 8 points overall across all relevant criteria

Right now, someone with a mild cognitive condition or variable disability might qualify on 6 total points. Under the new rules, that person would no longer be eligible.

Potential Impact

An estimated 800,000 people could lose PIP altogether, and around 150,000 unpaid carers may also lose Carer’s Allowance or UC-related carer premiums.

Who Else Might Be Affected?

People with Fluctuating or Invisible Conditions

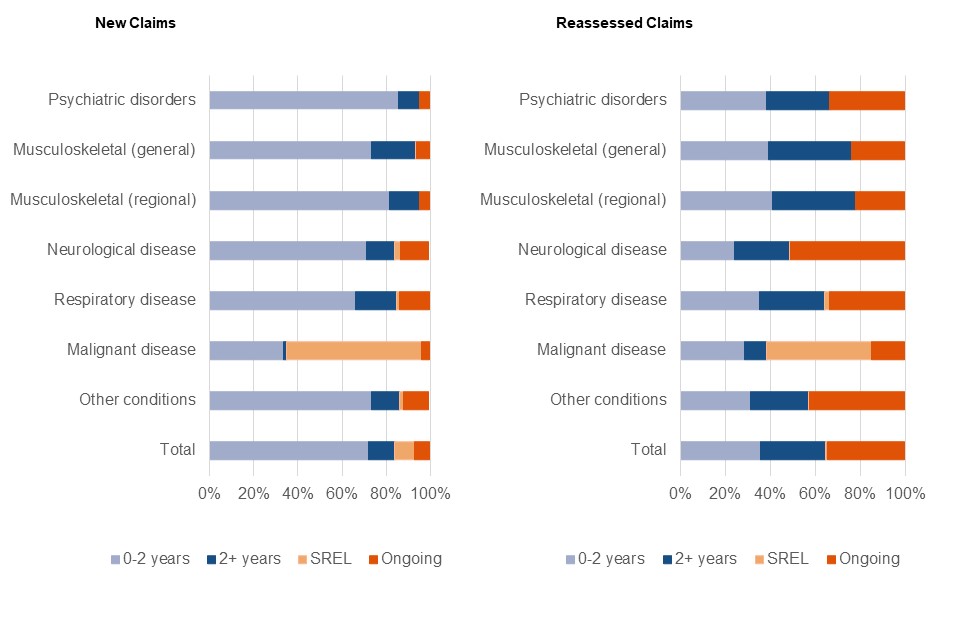

The DWP is also planning to strengthen the Severe Conditions Criteria—the rules that allow some long-term disabled individuals to skip reassessments.

The issue? Not all disabilities are consistent. People with:

- Multiple sclerosis (MS)

- Bipolar disorder

- Autism spectrum disorders

- Long COVID

- Epilepsy

…might not meet the “predictable and unchanging” test—even if their disability is severe and lifelong.

This could result in people losing out on £3,000 or more per year, according to disability rights advocates like Scope, MIND, and the MS Society.

Why DWP May Cut Benefit Payments by 15% in Some Cases Matters for the Future?

Many of these changes—particularly to health-related benefits—are part of the government’s broader strategy to reduce the welfare bill and encourage more people back to work.

But critics argue this strategy:

- Punishes the newly disabled or chronically ill

- Creates a two-tier system based on when you got sick

- Ignores the lived realities of fluctuating conditions

Experts like Sir Stephen Timms, Chair of the Work and Pensions Committee, have called on the government to delay or reverse these plans until more evidence is available.

Step-by-Step Guide: What You Should Do

Step 1: Check Your UC Deductions

- Log into your Universal Credit account

- Click on “Payments”

- Look for deductions listed as “Advance repayment,” “Rent arrears,” or “Overpayment”

If your total deductions exceed 15% of your standard allowance starting April 2025, they should automatically be lowered.

Step 2: Apply for Hardship Reduction

If you still can’t afford essentials:

- Contact your work coach

- Request a financial hardship decision

- Provide evidence of your bills, rent, food, or family needs

DWP can sometimes pause or reduce deductions further in severe cases.

Step 3: Prepare for PIP Reassessment

Even if you already receive PIP:

- You may be reassessed under the new rules after 2026

- Keep updated medical reports, symptom logs, and letters from specialists

- Contact your local welfare rights adviser or citizen’s advice bureau for support

Step 4: Get Support from Disability Charities

Organizations like:

- Scope

- MS Society

- Turn2Us

- Citizens Advice

…can help you navigate these changes and even provide legal aid or appeal representation.

Why Some State Pensioners Receive Lower Payments, DWP Explains

Universal Credit Payments Being Issued to Eligible Individuals, Says DWP

DWP Confirms Payment Update for 24 July— Check Who Could Be Affected