DWP Lowers Estimated Reimbursements for Unpaid UK State Pensions: If you’re one of the many people wondering whether you might be owed money due to unpaid UK state pension benefits, the latest news from the UK Department for Work and Pensions (DWP) could affect your claim. Recently, the DWP revised its estimates regarding reimbursements for unpaid state pensions, and the new forecast is not promising for those expecting large payouts.

Historically, millions of people in the UK were underpaid on their state pensions, especially individuals who were supposed to receive compensation due to certain errors in the system. The DWP initially projected it would be able to pay back large sums, but a new update has scaled those numbers down dramatically. This has left many individuals with a smaller-than-expected compensation. But what does this mean for you if you’ve been affected by these pension issues? Let’s break it down in easy-to-understand terms, giving you the context, the facts, and the practical advice you need to understand the situation better and determine if you are owed money.

DWP Lowers Estimated Reimbursements for Unpaid UK State Pensions

The recent update from the DWP on state pension underpayments is a disappointing one, especially for those who were expecting large reimbursements. While the compensation fund has significantly decreased, it’s important for anyone affected to stay proactive in checking their records and responding to official communications. Although the path to compensation may be more complicated than anticipated, there are still opportunities for you to claim what you’re owed if you act quickly. By understanding the changes and following the necessary steps, you can increase your chances of receiving the compensation you deserve.

| Topic | Details |

|---|---|

| DWP’s revised estimate | The DWP has lowered its projected reimbursements for unpaid state pensions. |

| Impact | This affects tens of thousands of people, particularly stay-at-home parents. |

| Total compensation so far | About £104 million has been paid out of a previously estimated £1 billion fund. |

| Key affected groups | Primarily stay-at-home mothers and other carers who did not receive HRP (Home Responsibilities Protection). |

| Cause of underpayment | Errors with National Insurance credits for those who were claiming child benefit between 1978 and 2010. |

| DWP’s current strategy | A new method for communicating with people affected, though still limited in its effectiveness. |

| Useful links | For more information, visit gov.uk and thetimes.co.uk. |

What’s Going On with the UK State Pension?

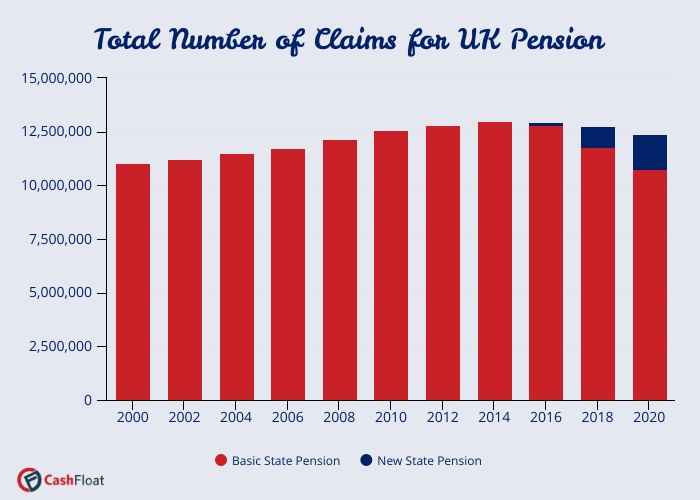

To fully grasp the magnitude of this issue, let’s take a step back and understand the basic facts of the state pension system. In the UK, individuals who have worked and paid National Insurance contributions (NICs) are entitled to a state pension, which is a source of income for retirees. But, there’s been a massive oversight that affected the payments many people were supposed to receive.

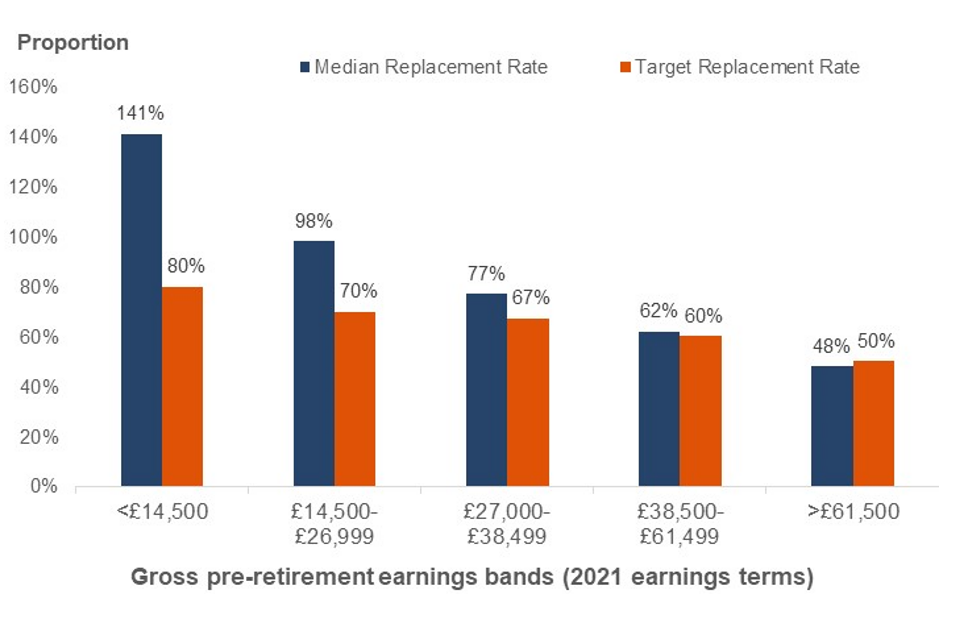

The government had previously identified that a large number of people—mostly mothers, carers, and some low-income workers—had been underpaid state pensions. This happened because they missed out on National Insurance credits, a system called Home Responsibilities Protection (HRP), which ensures that individuals with caring responsibilities (like parents of young children) get the equivalent of National Insurance contributions. These credits help secure their future pension rights, even if they weren’t working and paying NICs at the time. The Department for Work and Pensions (DWP) launched a corrective scheme to make things right, but it seems their efforts weren’t as effective as anticipated.

Why Were the State Pensions Underpaid?

The primary issue stems from a failure in tracking and crediting individuals who were claiming child benefit between 1978 and 2010. Parents who stayed home to care for their children were entitled to HRP, but the DWP made mistakes in processing these credits, leaving many individuals with significantly lower state pensions than they should have received.

This underpayment mainly impacted stay-at-home mothers, but other carers and individuals in similar circumstances were also affected. The mistake wasn’t something that was easy for people to detect on their own, as it wasn’t always clear whether the right credits had been applied.

The DWP’s Revised Forecast

In the past, the DWP estimated that it could rectify pension records for a significant portion of those affected. They initially forecasted that they could reimburse up to 90% of the individuals impacted by these errors. However, in the most recent update, they revealed that their ability to fix these errors is much lower—now estimated at just 8%. This reduction in the number of corrections means that fewer people will receive the compensation they were expecting.

In terms of the money, this is a huge disappointment. Initially, the government had expected to pay out a £1 billion compensation fund. But, the most recent figures suggest that only about £104 million has been distributed, and the payout will likely not reach anywhere near the previously estimated figure.

What Does DWP Lowers Estimated Reimbursements for Unpaid UK State Pensions Mean for You?

If you’re someone who believes they may be affected by these state pension underpayments, you might be wondering, “Am I going to get my money?” Unfortunately, the revised estimates don’t look promising. The number of people receiving compensation is expected to be significantly lower than originally thought, but that doesn’t mean you should give up on trying to get what you’re owed.

Here’s what you need to know:

- Check Your Records: Make sure that your pension records are accurate and up-to-date. If you’ve been out of work or were claiming child benefits during the time in question, ensure that your HRP credits have been applied properly.

- Respond to Correspondence: If you receive any communication from HM Revenue & Customs (HMRC) or the DWP, don’t ignore it. The government is trying to contact people who are owed money, but they’ve faced difficulties in reaching everyone. Ignoring these letters could mean missing out on compensation.

- Stay Informed: Keep an eye on government announcements or news outlets regarding the progress of these corrections. It’s possible that there will be more updates on the issue, and being in the loop will help you understand when and how you might receive a payment.

- Seek Expert Advice: If you’re unsure about your eligibility or what steps to take, consider consulting with a professional—whether it’s a financial advisor or a pension expert—who can guide you through the process of checking your records and making a claim.

How Did This All Go Wrong?

So why is this happening in the first place? Why weren’t these errors caught sooner? There are a few key factors at play here:

- Poor Communication: The DWP’s communication strategy has been widely criticized. People affected by the underpayments often didn’t know they were entitled to HRP, and even if they did, the communication channels were not effective in getting the word out.

- Systemic Failures: There were issues in the way that the DWP processed information related to child benefit claims. Some individuals, particularly those who made claims before 2000, were missed when the DWP attempted to apply the HRP credits to their accounts.

- Public Confusion: Many people who were affected by these underpayments were unsure how to confirm whether they were being paid correctly. The DWP and HMRC’s letters were often confusing and didn’t provide clear instructions on how to respond.

Why Some State Pensioners Receive Lower Payments, DWP Explains

Universal Credit Payments Being Issued to Eligible Individuals, Says DWP

DWP Confirms Payment Update for 24 July— Check Who Could Be Affected