DWP Issues Alert for Universal Credit Claimants Holding Rainy Day Savings: If you’re receiving Universal Credit (UC) and have a bit of money saved up — whether for emergencies, future plans, or just peace of mind — the Department for Work and Pensions (DWP) wants you to know that those savings could directly affect how much benefit you get, or whether you get anything at all. In this article, we break down the rules, thresholds, consequences, and smart ways to manage your money while staying compliant with DWP policies. Whether you’re navigating benefits for the first time, or you’re a financial advisor helping a client, this guide covers everything you need to know in simple, practical language.

DWP Issues Alert for Universal Credit Claimants Holding Rainy Day Savings

If you’re claiming Universal Credit and holding savings — whether as emergency funds, inheritance, or an investment — it’s essential to understand how these affect your entitlement. Anything over £6,000 starts reducing your monthly payment, and savings of £16,000 or more disqualify you entirely. But more than that, failing to report these savings can lead to overpayment recovery, fines, and even criminal charges.

| Topic | Details |

|---|---|

| Savings Thresholds | Savings over £6,000 begin reducing your Universal Credit payments |

| Upper Limit | If you have £16,000 or more in savings, you’re not eligible for Universal Credit |

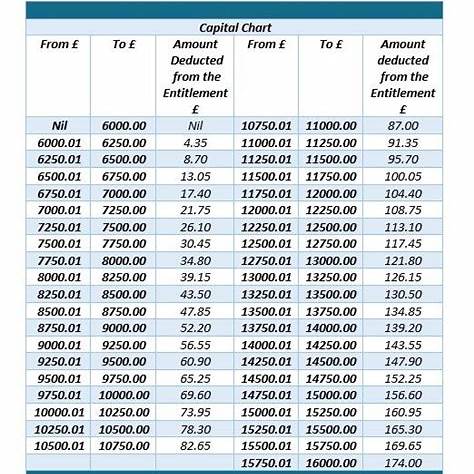

| Impact Calculation | For every £250 over £6,000, your UC is reduced by £4.35 per month |

| Applicable Assets | Bank accounts, ISAs, stocks, crypto, lump sum payments, property (excluding your home) |

| Excluded Assets | Your primary residence, personal belongings, most pensions (under pension age) |

| Reporting Requirement | Any change in savings must be reported via your Universal Credit online account |

| Consequences of Non-Reporting | Overpayments, repayment demands, fines, and potential legal action |

| More Info | GOV.UK – Universal Credit Savings Policy |

Universal Credit and Savings: What’s the Deal?

Universal Credit is the main income-based benefit in the UK for people who are out of work or on a low income. It replaces several legacy benefits and aims to simplify the support system. However, not everyone realizes that having too much saved up can limit or disqualify you from UC.

The DWP uses what it calls the “capital rules” to determine how much savings you’re allowed to have before it affects your claim.

Here’s how it works:

- £0 to £6,000 in savings: No impact on your Universal Credit.

- £6,000 to £16,000: Your monthly payment is gradually reduced.

- Over £16,000: You’re not eligible for Universal Credit at all, regardless of your income or circumstances.

This includes not just cash in a current or savings account, but also stocks, bonds, property (except your main home), and even cryptocurrency.

How Is the Reduction Calculated?

When your savings exceed £6,000, the DWP assumes you’re earning “notional income” from it — even if you’re not earning interest at all. Here’s the formula:

For every £250 (or part of) over £6,000, your UC payment is reduced by £4.35 per month.

Example:

You have £9,500 in savings.

- That’s £3,500 over the £6,000 threshold.

- £3,500 ÷ £250 = 14

- 14 × £4.35 = £60.90

Your UC is reduced by £60.90 every month.

If your savings increase to over £16,000 — even by £1 — your entire UC payment is stopped.

What Counts as Savings or Capital?

Understanding what is counted as capital is essential. The DWP includes a wide variety of assets in their assessment, including some that might surprise you.

Counted as Capital:

- Cash savings

- Bank and building society accounts

- Premium Bonds

- Stocks and shares

- ISAs (cash or stocks)

- Cryptocurrencies (Bitcoin, Ethereum, etc.)

- Second homes or buy-to-let properties

- Inheritances (even if not yet accessed)

- Lump sum insurance payouts or compensation

- Redundancy payments

- Refunds or backdated benefits from other claims

Not Counted as Capital:

- Your main home

- Personal belongings (clothing, furniture, car)

- Pension funds (if under the pension age)

- Some business assets (if you’re self-employed and actively trading)

Note: Joint accounts are generally split 50/50 unless you can prove the money belongs to someone else.

Real-Life Scenarios

Let’s bring this home with a couple of real-world examples:

Case 1: Sarah’s Inheritance

Sarah, 34, was claiming UC while looking for work. When her grandmother passed away, she inherited £12,000. She reported the inheritance within 7 days. Her UC dropped by £104.40/month, but she remained eligible. Had she not reported it, she would have faced a penalty and possible fraud investigation.

Case 2: Mike’s Crypto Wallet

Mike had £5,000 in a savings account and another £3,000 in cryptocurrency. Thinking the crypto didn’t count, he didn’t report it. The DWP discovered the crypto through a financial check, and Mike had to repay nearly £900 in overpayments and received a civil penalty.

What Happens If You Don’t Report?

Failure to report capital changes can lead to:

- Overpayments: You may be asked to pay back benefits you weren’t entitled to.

- Civil Penalties: Fines of up to £300.

- Benefit Suspension: You may lose eligibility temporarily while your case is reviewed.

- Fraud Investigation: In serious cases, non-disclosure could lead to criminal prosecution.

Additionally, giving away money or spending it quickly to stay under the threshold is called deprivation of capital. If the DWP believes you did this to avoid benefit reduction, they will treat you as still owning the money.

How to Report Capital to DWP?

It’s straightforward to report savings and capital:

- Sign in to your Universal Credit online account.

- Navigate to “Report a Change”.

- Select “Savings and Capital”.

- Enter the new amount, source of funds, and date of change.

- Submit and save the confirmation.

Changes must be reported within one month, but the sooner the better.

Strategies for Managing Savings on UC As DWP Issues Alert for Universal Credit Claimants Holding Rainy Day Savings

Having savings isn’t a bad thing — but you need to be smart about it.

1. Use Savings for Essentials

If your savings exceed £6,000, consider using them for essential expenses: paying off high-interest debt, rent arrears, or urgent home repairs.

2. Document Every Transaction

Keep bank statements, invoices, and receipts in case you’re asked to prove what you spent money on. This helps demonstrate you didn’t waste capital deliberately.

3. Speak to a Financial Advisor

Some people set up Discretionary Trusts for inheritance or settlements. This might shield money from UC assessments if set up correctly — but it must be done with legal guidance.

4. Separate Business from Personal Savings

Self-employed? Keep your business savings in a separate account and document their use clearly. Some business assets may not count toward the savings limit.

Tax Implications to Consider

Some lump sum payments — like redundancy pay or investment withdrawals — may also carry tax consequences. While Universal Credit is not directly affected by tax, your post-tax income or capital might still be counted.

It’s wise to check with:

- A financial advisor

- HMRC (www.gov.uk/contact-hmrc)

- Turn2us Tax Credit Advice

Why Some State Pensioners Receive Lower Payments, DWP Explains

Thousands Missing Out on Extra DWP Support Without Knowing—Are You One of Them?

DWP Winter Fuel Payment Dates Announced for 2025—Here’s When You’ll Get Paid