Surprise Extra Payment for All State Pensioners: In a move that’s bringing some unexpected relief to millions of pensioners across the UK, the Department for Work and Pensions (DWP) has confirmed that all state pensioners will receive an extra payment this year. This “13th payment” is set to boost the finances of state pensioners, ensuring they get an additional financial lift when it’s most needed. Whether you’re a pensioner or just someone interested in how this will impact your loved ones, this article breaks down everything you need to know about this surprise extra payment.

Surprise Extra Payment for All State Pensioners

| Topic | Details |

|---|---|

| Extra Payment | State pensioners will receive an additional, automatic 13th payment this year. |

| Eligibility | All state pension recipients will receive the 13th payment, whether on the new or basic state pension. |

| Payment Amount | The full New State Pension stands at £230.25 per week, while the Basic State Pension is £176.45 per week. |

| Payment Cycle | The 13th payment aligns with the pensioner’s usual payment cycle, paid automatically into their account. |

| Additional Benefits | Pensioners may be eligible for Pension Credit, Winter Fuel Payment, and Cost of Living Payments. |

| When It Will Arrive | The 13th payment will be paid automatically, with no need for application. Exact timing depends on the payment cycle. |

If you’re wondering what exactly this “13th payment” means for you, don’t worry – we’ve got all the details you need. Let’s take a closer look at how this unexpected bonus is going to work, why it’s so important, and what other financial support might be available for pensioners.

What Is the “13th Payment”?

The 13th payment isn’t a new form of government aid or a bonus in the traditional sense, but rather a “quirk” in the way state pension payments are structured. Usually, pension payments are made every four weeks instead of monthly, which means there are 13 payments in a year rather than just 12. This extra payment is automatic, so pensioners don’t need to apply for it – it’ll simply show up in their bank accounts like any other payment.

The reason this is a big deal is that pensioners often rely on these payments to cover their living expenses. The idea of an additional payment can be a big help, particularly for older adults living on a fixed income.

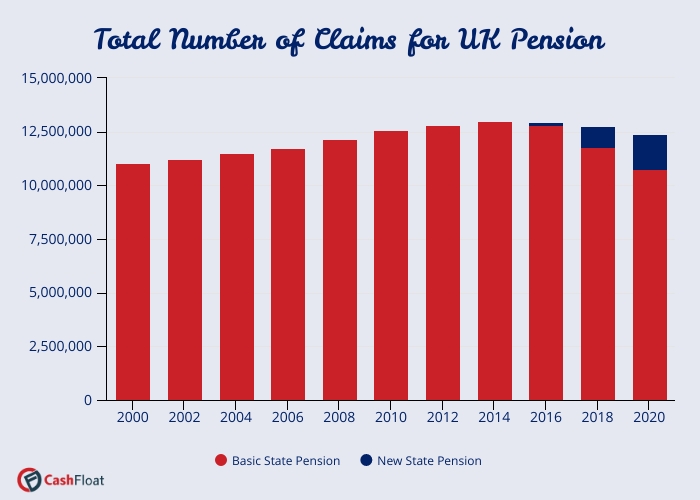

History of the State Pension and 13th Payment

The state pension system in the UK dates back to 1908 when the government introduced it to ensure that people over a certain age had a guaranteed income. Over the years, the pension system has evolved, and in recent years, the triple lock system was introduced to guarantee that pensions would increase in line with inflation or earnings growth.

The 13th payment has been part of the system for many years now, though it’s not always clearly understood. While it’s not a new benefit, the confusion often arises from the fact that the payment is tied to a four-week cycle rather than a monthly one. It’s essentially a bonus payment resulting from the structure of the state pension payments.

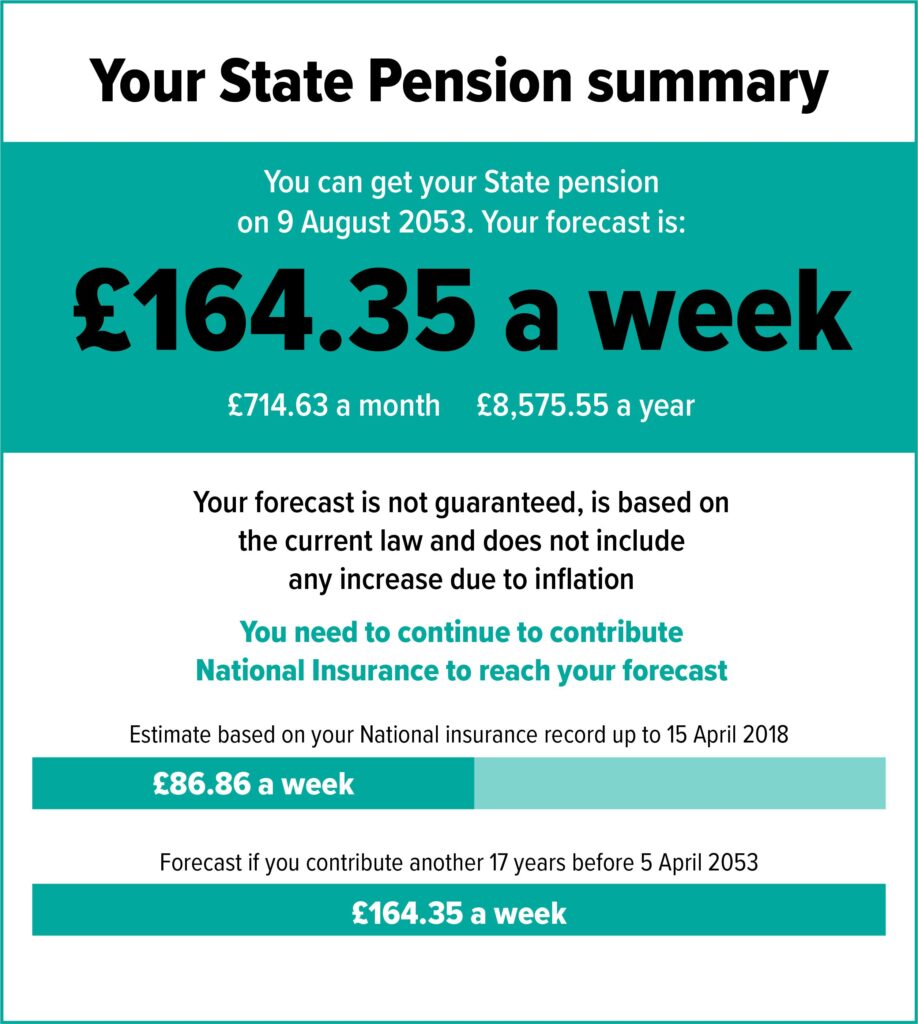

How Much Is the Extra Payment?

The amount of the 13th payment is equivalent to one full week of your regular pension. Here’s a breakdown of the current state pension figures for 2025/26:

- New State Pension: £230.25 per week

- Basic State Pension: £176.45 per week

These figures are already up 4.1% from the previous year, as part of the government’s “triple lock” policy, which ensures the state pension increases each year by the higher of inflation, average earnings growth, or 2.5%. So, in 2025, pensioners will already be seeing a bump in their state pension – and the extra 13th payment will provide even more of a boost. For pensioners, this extra payment could mean an extra week’s worth of groceries, bills, or a treat!

How Will Surprise Extra Payment for All State Pensioners Affect Your Pension Payment?

If you’re a pensioner, this will impact your regular payment schedule. Normally, state pensions are paid every four weeks, but with the 13th payment, you’ll receive an additional week’s worth of funds during the year. So, rather than just 12 payments, you’ll now receive 13 over the course of the year.

Example:

- If your weekly state pension is £200, you’ll normally receive £200 every four weeks.

- With the 13th payment, you’ll receive one additional £200 payment throughout the year.

This means, by the end of the year, you’ll have received £2,400 in total from the 13 payments (instead of the usual £2,400 from just 12 payments).

When Will You Receive the 13th Payment?

The timing of your 13th payment depends on when your pension payment cycle lands. There’s no set date for when the 13th payment will appear in your account because it’s tied to your regular payment schedule. However, the DWP has assured pensioners that the payment will be automatically paid into their usual bank accounts.

You won’t have to do anything – just keep an eye on your bank balance to see the extra deposit.

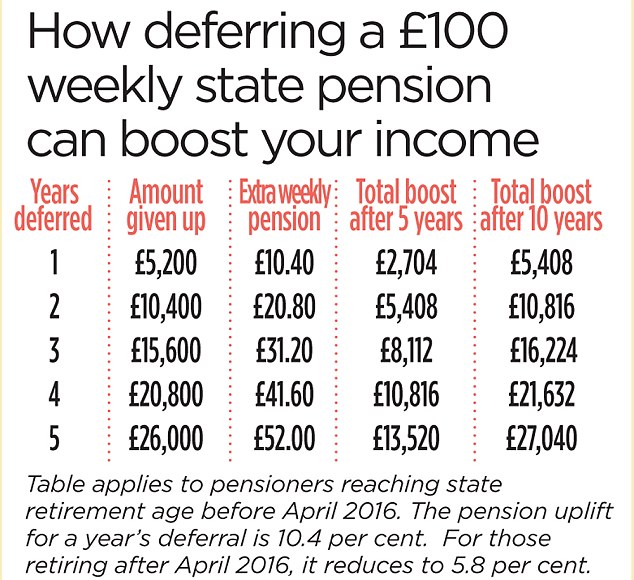

How to Maximize Your Pension Payments?

While the 13th payment can be a nice surprise, managing your pension efficiently is key to making the most of your income. Here are a few tips for maximizing your state pension payments:

- Budgeting: Create a budget that accounts for all essential expenses like housing, utilities, and food. This way, you can plan for both regular payments and the 13th payment.

- Save for Emergencies: Having an emergency fund can help cover unexpected costs. If you get the 13th payment, you could consider saving it for emergencies or larger expenses.

- Use Government Benefits: Explore additional benefits you might be eligible for, like Pension Credit or Cost of Living Payments, to increase your total income.

- Invest Wisely: If you can, try to invest any savings in low-risk accounts to grow your funds over time.

Impact of Inflation on State Pensions

The cost of living can be tough on pensioners, especially when inflation rises faster than the pension amount. That’s why the triple lock system is so important—it ensures pensions grow in line with inflation, earnings growth, or 2.5%. This helps to protect pensioners from losing out as the cost of goods and services increases.

For example, if inflation is at 4.1%, your pension will increase by this amount, ensuring you don’t lose purchasing power. The triple lock helps keep pensions in line with rising costs, which can make a world of difference over time.

Comparison with Other Countries’ Pension Systems

While the UK’s state pension system is quite robust, it’s interesting to compare it with other countries’ systems. For example, in the United States, Social Security provides benefits based on a worker’s earnings history, and there is no equivalent to the UK’s automatic 13th payment. Similarly, in Germany, pensioners receive monthly payments, but these are subject to inflation adjustments based on the country’s economic conditions.

Testimonials/Personal Stories

Many pensioners have shared that the extra 13th payment can be a lifesaver. One pensioner, Margaret, from Manchester, said, “That extra payment really helped me get through the winter. I used it to cover my heating bills, which had gone up because of the cold weather. Without it, I’m not sure how I would have managed.”

Stories like Margaret’s highlight how crucial these payments can be for those living on a fixed income.

State Pension Payment Increase for Those Receiving Disability Benefits- Check Details!

DWP Confirms Payment Date Changes for PIP, State Pension, Universal Credit and More

UK Set to Raise State Pension Age Beyond 67 as Life Expectancy Grows