Does Requesting a Tax Extension Delay Your Payment: Tax season can feel like a juggling act. You’ve got the forms, the deadlines, and, of course, the nagging worry about whether you’re going to owe the IRS money. Now, imagine you’re trying to get a little more breathing room, so you request a tax extension. But here’s the million-dollar question: Does requesting a tax extension delay your payment? Let’s unpack that.

If you’ve been wondering if filing for an extension means you can hold off on paying your taxes until later, the short answer is: no, it doesn’t. But don’t worry, you’re not alone in that confusion. Plenty of taxpayers misunderstand the relationship between filing extensions and payment deadlines. The truth is, while an extension can give you more time to file your tax return, it does not give you more time to pay any taxes you owe. In this guide, we’ll explore everything you need to know about tax extensions, including why this is the case, the penalties involved if you don’t pay on time, and the options available to those who can’t pay in full. By the end of this article, you’ll be an expert in the dos and don’ts of tax extensions—and you’ll understand why timing is so important when it comes to paying the IRS.

Does Requesting a Tax Extension Delay Your Payment?

Filing for a tax extension is a smart move if you need more time to prepare your return, but don’t let the extension fool you into thinking you have more time to pay. The original payment deadline is still in effect, and failing to pay on time can lead to costly penalties and interest. By understanding the rules around extensions and taxes, you can make sure you’re not caught off guard. If you owe taxes and need help, there are options like installment plans and offers in compromise to ease the burden. Remember: when it comes to taxes, timing is everything. Don’t let a little extra time to file lead to big problems down the road.

| Topic | Key Information |

|---|---|

| Tax Extensions and Payment | A filing extension doesn’t extend the payment deadline. Payments are due by the original filing deadline (e.g., April 15). |

| Extension Length | You can get up to 6 more months to file your return, but not to pay. The new deadline for filing your taxes will be October 15. |

| Penalties for Late Payment | Interest and penalties accrue on unpaid taxes from the original deadline (e.g., April 15). You may face up to 25% in penalties for late payments. |

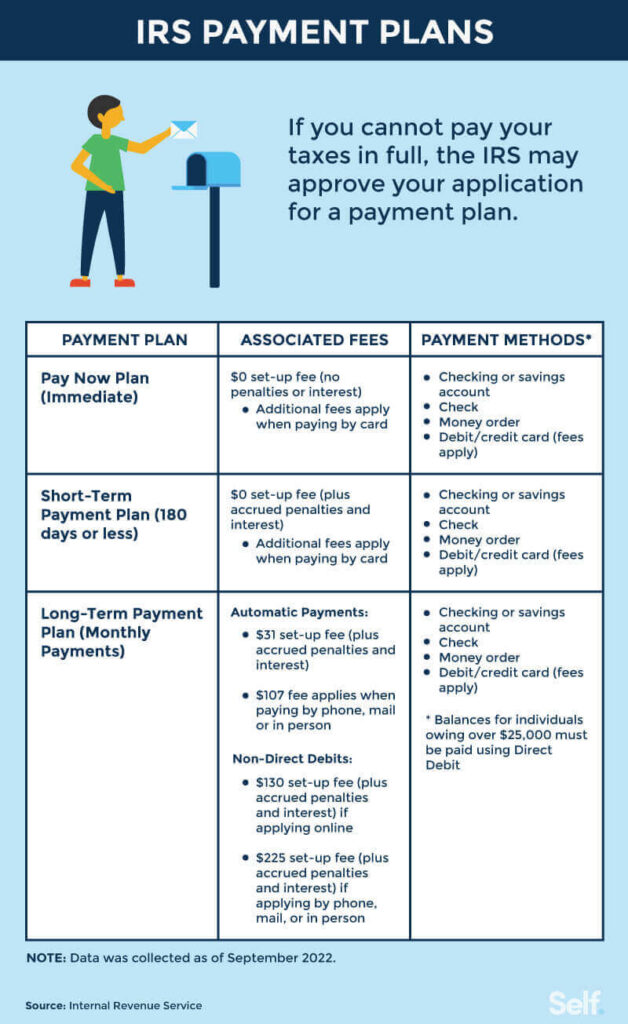

| Options for Those Who Can’t Pay | The IRS offers payment plans and installment agreements for taxpayers who are unable to pay the full amount. |

| Official Resources | IRS Tax Extension Page and IRS Payment Options. |

What is a Tax Extension?

A tax extension gives you more time to file your taxes. Instead of submitting your tax return by the usual April 15 deadline, you can request an extension to file until October 15. However, let’s be clear: it’s just an extension to file, not to pay. If you owe the IRS money, your payment is still due on the original deadline.

Why is this important? If you don’t pay on time, you might face penalties. The IRS imposes penalties for both failure to file and failure to pay. While the failure-to-file penalty can add up quickly, the failure-to-pay penalty is a bit more forgiving. Either way, it’s better to avoid both.

Understanding Payment Deadlines: The Big Difference

It’s easy to get confused about what an extension covers. So, let’s break it down:

- Extension to File: You can delay submitting your paperwork and supporting documents for up to six months. You’re still legally responsible for filing your return by the new deadline (October 15).

- No Extension to Pay: If you owe money, the IRS expects you to pay by the original filing deadline (usually April 15, but it varies depending on the tax year). This means if you don’t pay in time, you could end up paying interest and penalties.

The penalties for late payments are not trivial. The IRS charges interest on unpaid taxes, and that interest can add up fast. In addition, the penalty for not paying on time is usually 0.5% per month, capping at 25% of the amount owed. This means that the longer you wait, the more you’ll pay—on top of what you already owe.

Does Requesting a Tax Extension Delay Your Payment Explained: How Much Can You Be Fined?

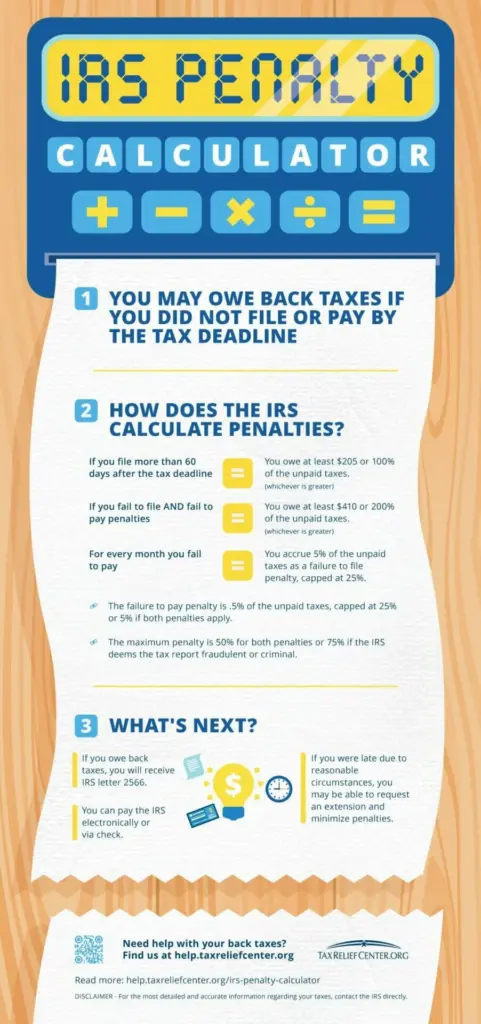

It’s essential to understand the penalties involved in late payments and filings. If you miss the tax deadline entirely, you could face two types of penalties:

- Failure to File Penalty: This penalty is applied if you do not file your taxes on time. The fine can be up to 5% of the amount you owe per month your taxes are late, with a maximum of 25%. So, if you’re several months late, this penalty can be severe.

- Failure to Pay Penalty: This penalty is lower but still important. If you don’t pay your taxes by the due date, you will face a penalty of 0.5% of your unpaid taxes per month. This continues to accrue until you pay in full. Even after the penalties, there’s also interest that adds up. The IRS interest rate changes quarterly and is based on federal short-term interest rates.

Example: If you owe $1,000 in taxes and are 3 months late, you could face a failure to pay penalty of 1.5% ($15), plus interest.

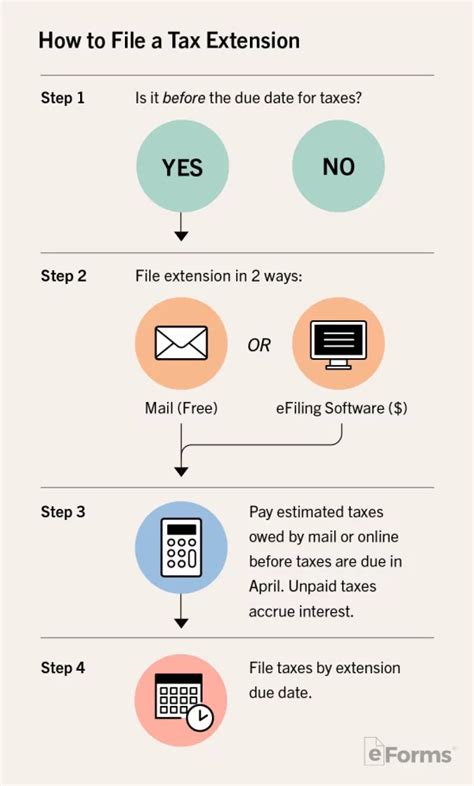

How to Request a Tax Extension

Requesting an extension is pretty straightforward—and it’s something most taxpayers can do without much hassle. You can request an extension using IRS Form 4868. Here’s how:

- Online Filing: One of the easiest ways to file for an extension is through the IRS Free File program or e-filing services. If you’re paying your estimated tax, you can do that at the same time.

- Paying with an Extension: You can also file for an extension by paying a portion of your taxes owed. If you pay at least $1, the IRS will automatically approve your extension.

- Mailing Form 4868: If you prefer the old-school method, you can submit a paper version of Form 4868 by the original tax deadline.

How to Estimate Your Taxes Before the Deadline?

If you’re worried about how much you’ll owe, estimating your taxes before the deadline is a good idea. You don’t want to be caught off guard and face penalties for late payment. Here are some ways to estimate what you owe:

- Use IRS Withholding Calculator: If you’re unsure about how much taxes you owe, the IRS provides a withholding calculator that can help you estimate your payments for the year. This tool is especially helpful for individuals who have side gigs or self-employed income.

- Check Last Year’s Return: If your financial situation hasn’t changed much, you can base your estimate on what you owed last year.

- Seek Help from a Tax Professional: If you’re self-employed or have complicated tax situations, a tax professional can help ensure you get your calculations right.

The Importance of Filing Even If You Can’t Pay

Even if you can’t pay your taxes, you should still file on time. It may seem tempting to ignore the deadline if you don’t have the money to pay, but doing so will trigger the failure-to-file penalty, which is much steeper than the failure-to-pay penalty.

Here’s the kicker: The IRS will not waive the failure-to-file penalty unless you can show a legitimate reason (like a medical emergency). On the other hand, the failure-to-pay penalty is easier to manage and can even be reduced or waived in some cases if you arrange a payment plan.

Trump’s New Tax Bill Could Reshape How Social Security Benefits Are Taxed

Social Security Sends Out Urgent Email Over Trump Tax Bill Confusion – Check Details!

How Social Security Taxes Could Be Impacting Your Retirement Income Today? Check Details!