Devastating Financial Impact of Supporting Adult Children on U.S. Families: In recent years, a troubling financial trend has been emerging in U.S. households: parents providing ongoing financial support to their adult children. While it’s not uncommon for parents to help their kids get on their feet when they first move out or while they’re pursuing higher education, many families are now experiencing a different kind of financial strain. With rising living costs, burdensome student loans, and limited job opportunities, the financial dependency of adult children has become a long-term issue, leaving parents scrambling to balance their own financial goals and future security.

This situation is affecting millions of families across the United States, with many working parents struggling to save for retirement while simultaneously helping their adult children with everything from rent and utilities to groceries and car payments. Whether they’re paying for medical bills, covering housing costs, or funding education, these ongoing expenses are impacting both the parents’ immediate financial health and their future plans. This article will dive into the devastating financial impact that supporting adult children has on U.S. families, breaking down the reasons behind the trend, providing actionable advice for managing these costs, and offering a clear guide for parents who may be facing these challenges.

Devastating Financial Impact of Supporting Adult Children on U.S. Families

Providing financial support to adult children has become a significant financial strain for many U.S. families. While it’s understandable that parents want to help their kids, it’s important to balance this support with securing their own future. Setting boundaries, teaching financial responsibility, and seeking professional advice can help parents navigate this challenge and ensure that their financial security isn’t jeopardized.

| Key Data/Fact | Details |

|---|---|

| Percentage of Parents Supporting Adult Children | Around 50% of U.S. parents provide financial assistance to their adult children. |

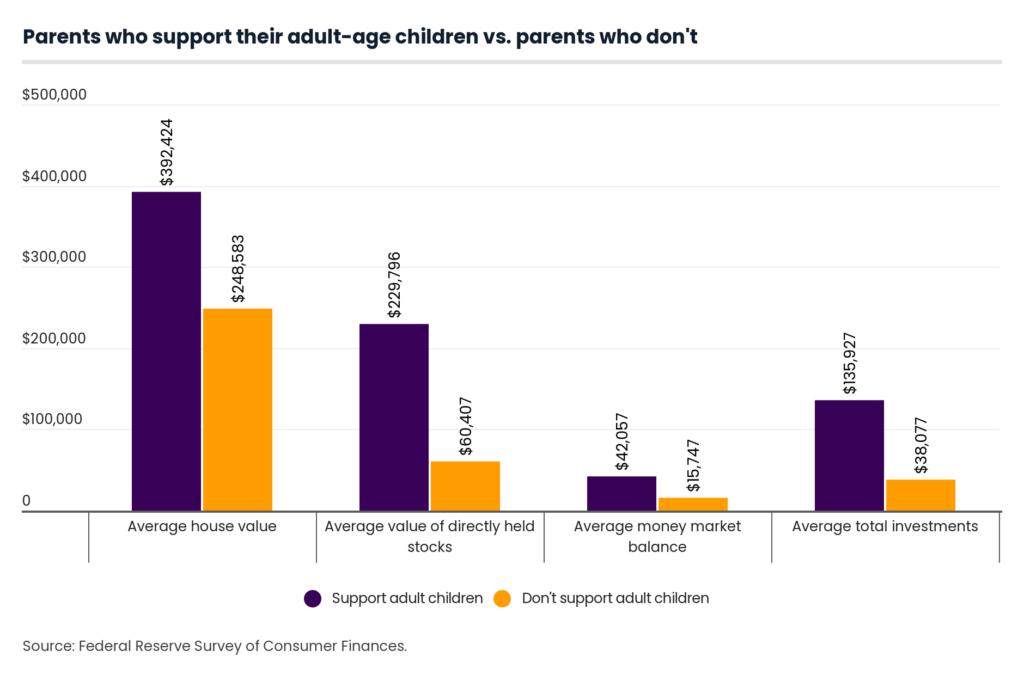

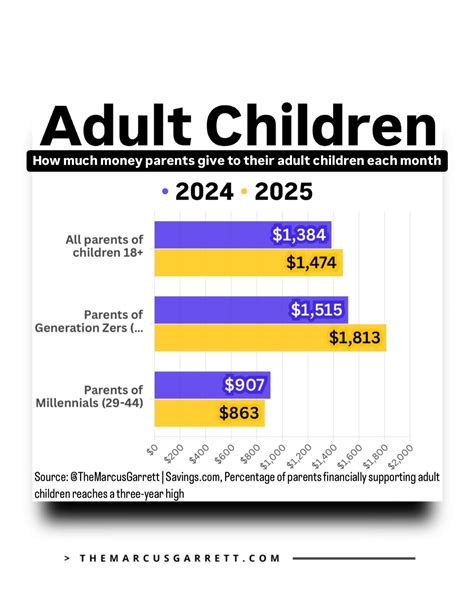

| Average Monthly Financial Support | Parents contribute an average of $1,474 per month to their adult children. |

| Financial Impact on Retirement Savings | Parents are contributing 2.4 times more to their children’s expenses than to their own retirement savings each month. |

| Financial Support for Gen Z | Gen Z adults (ages 18–27) receive about $1,800 monthly from their parents. (Source: NYPost) |

| Impact on Future Financial Security | Many parents are delaying retirement or withdrawing from savings to continue supporting their children. (Source: The Guardian) |

The Growing Trend of Financially Supporting Adult Children

As inflation, housing costs, and student debt continue to rise, more and more adult children are finding themselves unable to fully support themselves, often requiring their parents’ help to make ends meet. This growing trend isn’t limited to a particular generation of parents—Boomers, Gen X, and even Millennials are all grappling with the impact of financially supporting their children well into adulthood.

In fact, data from Savings.com shows that 50% of U.S. parents are financially helping their adult children in some capacity. The most significant portion of this support goes toward housing costs (rent, mortgage, utilities), but it also covers a wide range of other expenses, including groceries, healthcare, and transportation.

One reason for this financial dependence is the lack of affordable housing. Many young adults are struggling to enter the housing market due to soaring rental prices and mortgage rates. As a result, they’re forced to live with their parents longer or rent in less-than-ideal circumstances. Some are even opting to live at home to save money, hoping to build up enough capital for a future home purchase, but this comes at the cost of their financial independence and, ultimately, their parents’ savings.

Additionally, student loans are a heavy burden for many young adults, preventing them from achieving financial independence. With a high percentage of recent graduates buried under substantial debt, it can be hard to find the financial footing needed to secure stable employment or afford rent.

The Real Cost to Parents

While helping your kids is a noble and generous gesture, many parents are realizing just how much financial strain it is putting on their own long-term financial security. A study from The Guardian found that working parents are spending 2.4 times more on their adult children’s expenses than they are putting away for their own retirement each month. This imbalance is starting to become a major cause for concern, as it’s not only affecting their current finances but could also significantly delay their retirement plans.

Parents who are contributing a significant portion of their income toward helping their children are sometimes left with little choice but to delay retirement or scale back their retirement savings plans to cover the costs. In some extreme cases, parents have been forced to dip into their savings accounts or 401(k) funds, jeopardizing their long-term financial stability.

Moreover, supporting adult children can also impact parents’ emotional wellbeing. Financial stress can lead to anxiety and burnout, which can affect not only their work life but also their personal relationships. As the strain grows, it becomes harder to maintain a healthy work-life balance and plan for the future.

Devastating Financial Impact of Supporting Adult Children on U.S. Families: Why Are Parents Still Helping?

There are several factors contributing to why parents continue to financially support their adult children. Here are the most common reasons:

Economic Challenges for Young Adults

Young adults today face a tough economic environment that is vastly different from what previous generations experienced. Many of them are struggling with stagnant wages and rising living costs, making it nearly impossible to become fully independent. While their parents may have been able to secure a stable job and purchase a home at a young age, the economic realities for Millennials and Gen Z are far more challenging.

High Student Loan Debt

Many adult children are burdened with student loan debt, which can sometimes total tens of thousands of dollars. Repaying these loans while trying to live independently often seems impossible, especially when combined with other rising costs of living. As a result, many young adults turn to their parents for financial help while they try to get a foothold in their careers and pay down their debts.

Housing Affordability Issues

Housing costs have skyrocketed in recent years, and for many Gen Zers (ages 18-27), it’s almost impossible to rent or buy a home without help. Rents are higher than ever, and mortgage rates are also soaring, leaving young adults in a precarious financial situation. As a result, many are forced to either live at home with their parents or take on significant financial burdens that their parents feel compelled to help with.

Parents’ Generosity and Sense of Responsibility

Many parents genuinely feel responsible for providing for their children, even as adults. The love and sense of duty to care for their children don’t simply end when they reach the age of 18 or finish college. As a result, many parents continue to help financially, despite the impact it may have on their own financial future. This generosity often stems from a belief that it’s the parent’s duty to ensure their children are secure and successful in life.

The Emotional Toll on Parents

Supporting adult children financially doesn’t just affect parents financially—it can also take a significant emotional toll. Parents are not just managing money, but also expectations and stress that come with constantly worrying about their children’s future. The emotional strain of supporting adult children who may not show immediate signs of independence can create resentment, burnout, or feelings of inadequacy.

A Harvard study highlighted that parents often feel torn between doing what’s best for their children and maintaining a healthy, fulfilling life for themselves. Some parents even experience guilt if they set boundaries with their children, fearing that they might appear unsupportive. This can create internal conflict, making it harder to make decisions that prioritize their own long-term well-being.

How Can Parents Manage the Financial Burden?

If you find yourself in a situation where you’re financially supporting your adult children, there are a few steps you can take to manage the burden without sacrificing your own financial security:

1. Set Clear Boundaries and Expectations

One of the most important steps you can take is to have an open conversation with your children about the nature of the financial support. Establish clear boundaries and set expectations around how long you plan to help and what specific expenses you’ll cover. It’s also important to discuss financial independence goals and work together to create a plan for them to become self-sufficient.

2. Create a Budget

Managing both your own finances and your adult children’s expenses requires careful planning. Track your spending and create a detailed budget to ensure that you’re not overspending on things that aren’t essential. Prioritize saving for your retirement and make sure your own financial goals aren’t being neglected.

3. Encourage Financial Responsibility in Your Children

While it’s admirable to want to help your kids, it’s also important to teach them financial responsibility. Encourage them to budget their own finances, look for ways to reduce costs (like finding a cheaper living situation), and actively work toward financial independence.

4. Consider Financial Counseling

If you’re feeling overwhelmed by the financial strain, it might be helpful to consult with a financial planner or advisor. A professional can help you navigate this complex situation and ensure that you’re on the best path for both your own future and your children’s.

5. Gradually Scale Back Support

If you’ve been supporting your adult children for some time, it’s a good idea to gradually scale back the financial support you’re providing. Slowly reduce the amount of assistance, helping them learn how to become more self-sufficient over time, without cutting them off abruptly.

4 Financial Mistakes Americans Keep Making That Wreck Their Budgets

Millions of Americans Could See Their Social Security Checks Cut by 50 Percent

Millennial Who Achieved Early Retirement Reveals Harsh Truth About FIRE Lifestyle