Delaying Social Security Can Pay Off: When it comes to retirement, the question of when to claim Social Security can be as critical as how much you’ve saved. Many folks jump on benefits as soon as they turn 62, thinking it’s a now-or-never deal. But the truth is, delaying Social Security until age 70 can substantially boost your income and give you financial breathing room for decades.

This is where a smart tactic called the Bridge Strategy comes in. Instead of drawing benefits early, you “bridge” the gap using your retirement savings until Social Security pays out the max at 70. In this article, you’ll learn exactly how it works, why it matters, and how to apply it to your own retirement plan. Whether you’re a teacher, welder, nurse, or corporate VP, this strategy is for anyone who wants to maximize their lifetime income, minimize financial stress, and create a more stable retirement plan.

Delaying Social Security Can Pay Off

The Social Security Bridge Strategy is a practical, data-driven way to maximize your lifetime retirement income — especially if you’re in good health and have some retirement savings to work with. Instead of settling for a smaller check at 62, this approach helps you tap into your own resources now and secure larger, inflation-adjusted income for life. It’s not just smart — it’s strategic, safe, and effective.If you’re serious about building a strong financial foundation for retirement, don’t just think short-term. Build your bridge, and walk into retirement with confidence.

| Topic | Details |

|---|---|

| What is it? | A method of delaying Social Security benefits to age 70 by using retirement savings as temporary income. |

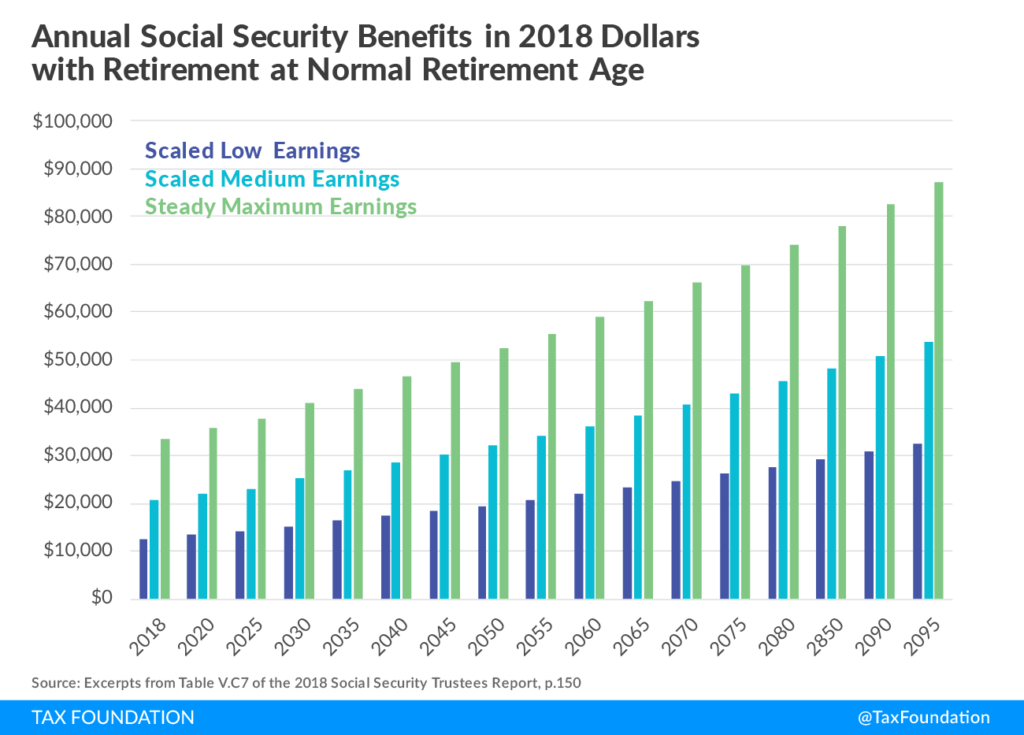

| Why delay? | Benefits increase by 8% per year after Full Retirement Age (FRA), plus inflation adjustments. |

| Who benefits most? | Retirees with decent savings, good health, and a long life expectancy. |

| Potential gain | Up to 76% higher monthly benefit than claiming at 62. |

| Timeframe | Bridge typically covers retirement years from age 62 to 70. |

| Official tool | Social Security Administration Estimator |

What Is the Social Security Bridge Strategy?

The Bridge Strategy is a retirement income technique. Instead of claiming Social Security right at 62, you use your own savings (like from a 401(k), IRA, or savings account) to cover your living expenses for a few years. Then, once you hit age 70, you start drawing Social Security — now with a much bigger check.

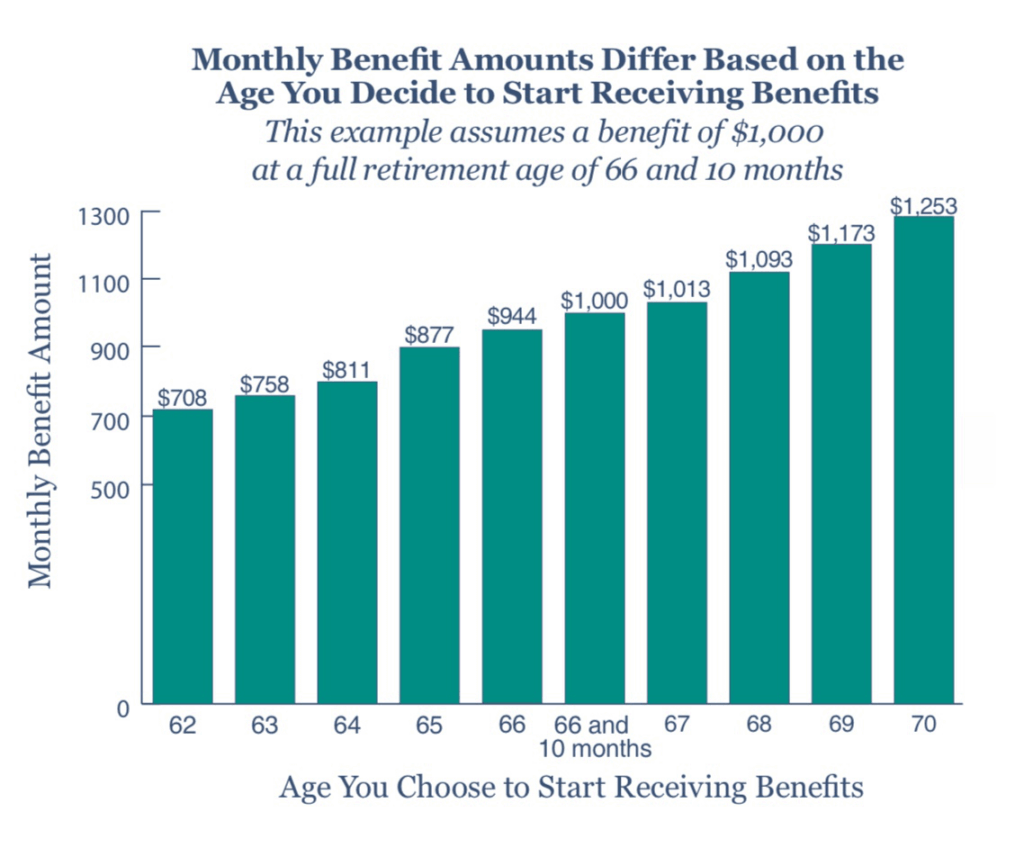

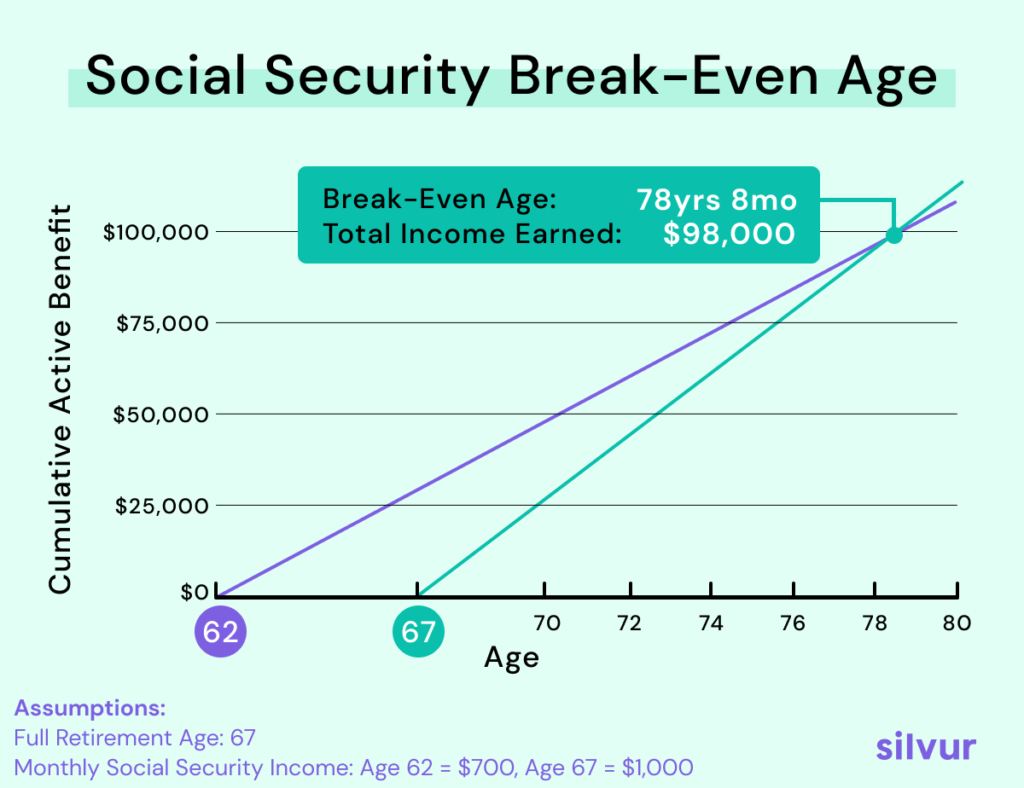

Here’s the deal: your Social Security benefit grows by about 8% per year for every year you wait beyond your Full Retirement Age (typically 66 or 67 depending on your birth year), up until age 70. On top of that, you get annual cost-of-living adjustments (COLAs) based on inflation.

This growth is locked in for life. That means by delaying, you’re essentially purchasing a larger government-backed, inflation-adjusted income stream for yourself — for as long as you live.

Why Delaying Social Security Can Pay Off Big Time

Every year you wait equals more income — for the rest of your life. This is especially valuable if you live into your 80s or 90s, which many Americans do. According to the Social Security Administration:

- A 65-year-old today has a 50% chance of living past 85

- One in three 65-year-olds will live past 90

- One in seven will live past 95

If you live a long life, delaying Social Security can lead to hundreds of thousands of dollars in extra lifetime income.

Let’s compare:

| Age You Start | Monthly Benefit | Total Lifetime Benefits (If you live to 90) |

|---|---|---|

| 62 | $2,000 | ~$672,000 |

| 67 (FRA) | $2,667 | ~$800,100 |

| 70 | $3,520 | ~$846,000 |

These numbers are estimates, but they show how delaying can significantly increase your total retirement income.

How the Bridge Strategy Works – Step by Step

Step 1: Estimate Your Social Security Benefits

Go to the SSA’s Retirement Estimator and enter your information to see how your monthly benefit changes at:

- Age 62 (the earliest you can claim)

- Full Retirement Age (typically 66–67)

- Age 70 (the max payout)

Write those numbers down — they’ll help you plan your bridge.

Step 2: Calculate How Much You Need to Bridge

Once you know your expected retirement income needs (say $3,000/month), calculate how much you’ll need to withdraw from savings to cover those years before Social Security kicks in.

Example:

- Retire at 62

- Need $3,000/month for expenses

- Delay Social Security until 70

$3,000 x 12 months x 8 years = $288,000 needed from your own savings to bridge the gap.

You don’t need that entire amount in cash on day one, but you do need a solid plan to withdraw safely and not run out of money.

Step 3: Strategize Which Accounts to Use

Depending on your situation, withdrawals can come from:

- Traditional IRA or 401(k) (taxable)

- Roth IRA (tax-free)

- Brokerage or savings accounts

A balanced approach might include taking some money from your Roth (to keep taxes low) and some from taxable accounts. A financial advisor can help with this.

Step 4: Invest Your Bridge Money Conservatively

You’ll want to protect your bridge funds from big market swings. That means using:

- Money Market Funds

- Short-Term Bond Funds

- Treasury bills

- High-yield savings accounts or CDs

Avoid aggressive investments like high-growth stocks during this period — you need reliability, not volatility.

Step 5: Start Social Security at Age 70

Once you hit 70, your benefit has grown as much as it can. You stop drawing from your savings and start collecting Social Security — which is now up to 76% higher than it would’ve been at 62.

Real-Life Example: Paul and Maria

Paul and Maria both retire at 62. Paul was the higher earner and qualifies for $2,500/month at 62. Maria qualifies for $1,200/month.

They decide to:

- Have Maria claim her benefits at 62 to provide some income

- Use savings to cover the rest of their expenses

- Delay Paul’s benefits until 70, when his benefit will be about $4,400/month

If Paul passes away, Maria will switch to his larger survivor benefit. By delaying Paul’s benefits, they secure a higher guaranteed income for both of them, for life.

Spousal & Survivor Benefit Strategies

Delaying Social Security can also maximize spousal and survivor benefits:

- A surviving spouse can receive the higher of their benefit or their spouse’s

- Delaying the higher-earning spouse’s benefit boosts the survivor’s lifetime income

- Couples can “split” the strategy — one claims early, the other waits

This coordinated approach helps protect the surviving spouse from a significant drop in income.

Common Mistakes to Avoid

- Claiming benefits too early out of fear or misinformation

- Not understanding how taxes affect your withdrawals and benefits

- Underestimating how long you’ll live — especially if you’re healthy

- Using risky investments to fund the bridge

- Failing to plan for healthcare costs during the bridge years

Retirement is not the time to guess. A little planning goes a long way.

Who Should Consider the Bridge Strategy?

This strategy is a good fit if you:

- Have saved at least $250,000 or more in retirement accounts

- Are in good health and expect to live beyond 80

- Want a guaranteed, inflation-protected income stream

- Are married and want to protect your spouse

- Prefer to use your own assets now to secure higher government benefits later

It might not be right for those with:

- Minimal savings

- Serious health issues

- A strong preference for accessing government benefits early

Visual Timeline: Bridge Strategy in Action

| Year | Age | Action | Income Source | Amount |

|---|---|---|---|---|

| 2025 | 62 | Retire | IRA withdrawals | $3,000/mo |

| 2026–2032 | 63–69 | Continue withdrawals | CDs, savings | $3,000/mo |

| 2033 | 70 | Start Social Security | SSA | $4,400/mo |

This simple flow keeps your finances stable — and your future more secure.

Some Social Security Recipients Could See Payments Slashed in Half— Check Why!

Why Some Social Security Recipients Might See Their Payments Slashed by 50%

Social Security Payments Confirmed for July 16, 2025—Is Your Name on the List?