Dave Ramsey Advises Caution and Planning on 401(k) Contributions: When it comes to securing a comfortable retirement, the 401(k) is often the first thing that comes to mind. It’s the go-to retirement plan for millions of workers across the U.S. But is it really the best choice for everyone, especially given today’s uncertain economy? Financial expert Dave Ramsey, who has spent decades helping Americans take control of their financial futures, says that while 401(k) plans can be a key tool for retirement savings, they should be approached with caution and careful planning. He urges individuals to think beyond just contributing to their 401(k), and instead, focus on a balanced, strategic approach to retirement planning. This article will break down Ramsey’s advice, provide practical steps for building a solid retirement strategy, and explain how you can set yourself up for financial success in a world of economic uncertainty.

Dave Ramsey Advises Caution and Planning on 401(k) Contributions

Dave Ramsey’s approach to 401(k) contributions and retirement planning emphasizes the importance of being strategic and thoughtful about your financial future. By taking full advantage of your employer’s 401(k) match, prioritizing a Roth IRA, saving 15% of your income, and diversifying your investments, you can build a secure financial future, even in the face of economic uncertainty. The key is to avoid overreliance on a single tool—like the 401(k)—and instead create a well-rounded retirement strategy that includes various types of savings and investments.

| Key Point | Details |

|---|---|

| Maximize Employer Match | Contribute enough to your 401(k) to get the full employer match. This is essentially “free money” for your retirement savings. |

| Roth IRA Priority | After the employer match, prioritize contributing to a Roth IRA, which offers tax-free growth and more investment options. |

| Maintain a 15% Savings Rate | Aim to save 15% of your income for retirement once all non-mortgage debt is paid off and your emergency fund is fully established. |

| Be Careful with Target Date Funds | These funds might be too conservative as you approach retirement, potentially hindering the growth needed for a long retirement. |

| Avoid Overexposure to Company Stock | Don’t bet all your retirement savings on your employer’s stock. Diversify your portfolio to reduce risk and maximize returns. |

| Financial Behavior Matters | Ramsey emphasizes that 80% of financial success is about behavior—being consistent with saving and spending wisely, not just understanding the numbers. |

| Employer-Sponsored 401(k) Plans | These plans often offer tax benefits, but they’re not a one-size-fits-all solution for everyone. It’s important to have a well-rounded strategy. |

| Diversification Is Key | A good retirement plan includes various types of investments—stocks, bonds, real estate, and more—to balance growth and risk. |

For many of us, saving for retirement is a crucial part of planning for the future. But it can be tricky to figure out the best way to do it, especially when the economy feels like it’s always shifting beneath our feet. Let’s dive into what Dave Ramsey has to say about it all and break down the steps you can take to secure your financial future.

The Reality of 401(k) Plans: What You Need to Know

Why 401(k)s Aren’t the Holy Grail?

When you hear “retirement savings,” 401(k) is probably one of the first things that comes to mind. And for good reason—these employer-sponsored retirement accounts offer several advantages, like tax-deferred growth and the possibility of an employer match. But Ramsey warns that relying solely on a 401(k) may not be the best strategy for everyone, especially given the unpredictable nature of today’s economy.

A 401(k) can be a solid starting point for saving for retirement. However, Ramsey advises that you shouldn’t rely on it as your only retirement plan. The 401(k) is a tool, but it’s not a one-size-fits-all solution. Ramsey stresses that without a well-rounded retirement strategy that includes other types of investments and savings, you might not be setting yourself up for long-term financial security.

The Importance of Employer Match

Let’s start with the good news: If your employer offers a 401(k) match, you should take full advantage of it. This is essentially “free money” that can help grow your retirement savings. For example, if your employer matches your contributions dollar-for-dollar up to a certain percentage of your salary, that’s a benefit you definitely don’t want to leave on the table.

Ramsey recommends contributing at least enough to your 401(k) to take advantage of the employer match. This is a must-do step in your retirement planning strategy. You’re essentially doubling your savings with no extra effort on your part, so why wouldn’t you? But once you’ve met the employer match, Ramsey suggests turning your attention to other retirement accounts for even better growth potential.

Step 1: Maximize Your 401(k) Match

Actionable Tip: If your employer offers a 100% match up to 5% of your salary, contribute at least 5% of your salary to your 401(k). That way, you’re getting the full match—and doubling your savings in the process.

Go Beyond the 401(k): Why You Should Consider a Roth IRA

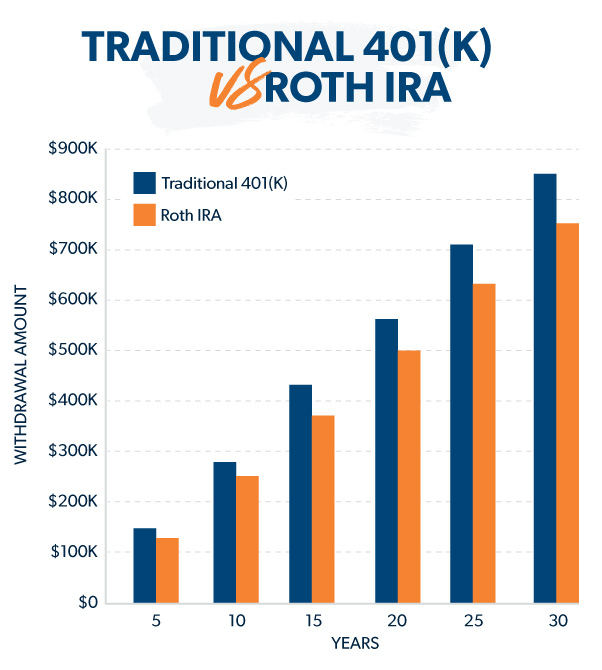

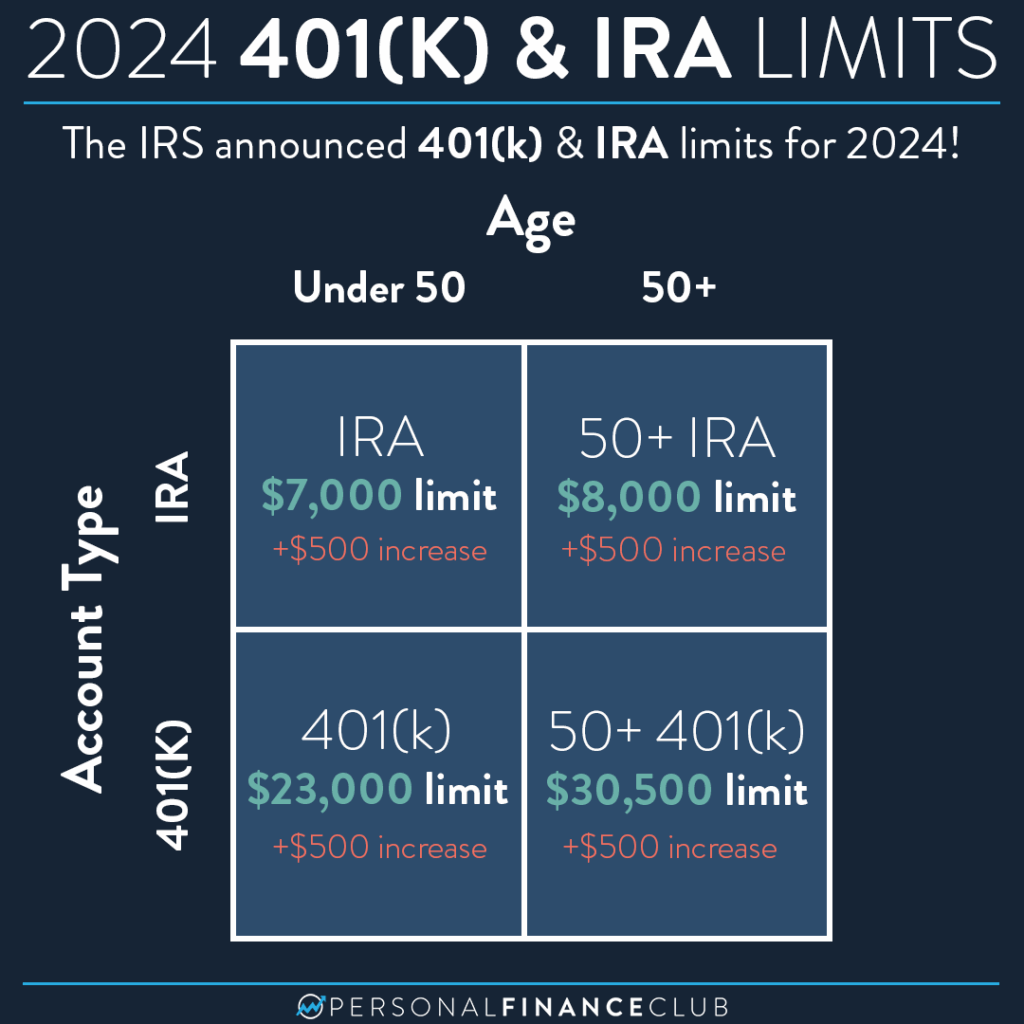

Once you’ve maximized your employer match, Ramsey suggests focusing on other types of retirement savings, like a Roth IRA. Unlike a 401(k), a Roth IRA allows you to contribute after-tax dollars, meaning your investments grow tax-free. When you retire and start withdrawing from your Roth IRA, the money is tax-free, too. This is a big advantage, especially if you expect to be in a higher tax bracket when you retire.

A Roth IRA also offers more flexibility and variety in terms of investment options compared to a 401(k). For example, you can invest in individual stocks, bonds, mutual funds, or even real estate. With a 401(k), you’re generally limited to a selection of funds that your employer offers, which may not always align with your personal investment goals.

Step 2: Prioritize a Roth IRA After the Employer Match

Actionable Tip: Once you’ve contributed enough to your 401(k) to get the full employer match, start contributing to a Roth IRA (if eligible). It’s a great way to benefit from tax-free growth and expand your retirement portfolio.

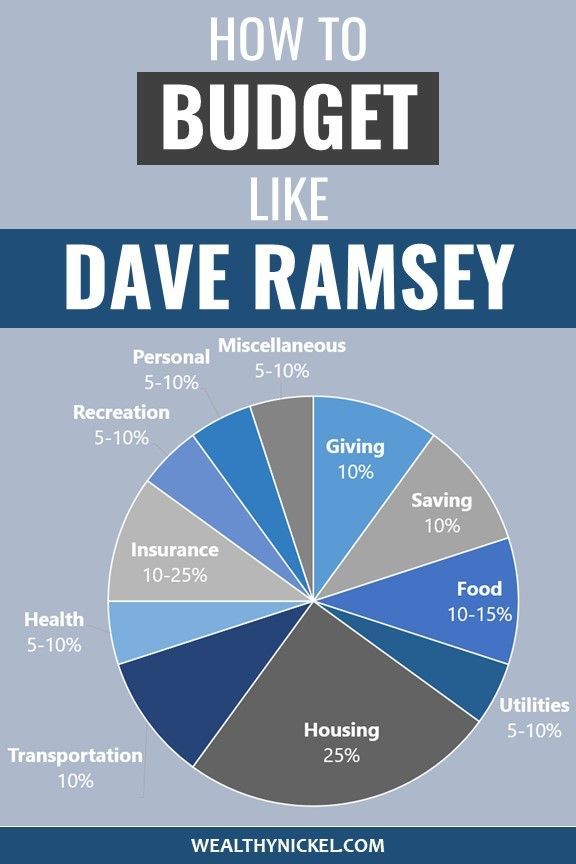

How Much Should You Save? The 15% Rule

One of the most common questions people have about retirement planning is, “How much should I be saving?” Dave Ramsey has a simple, yet effective answer: 15% of your gross income. This might sound like a lot, but if you stick to this rule, you’ll be setting yourself up for financial success in the long run.

Keep in mind that this 15% should come after you’ve paid off all non-mortgage debt and built an emergency fund. The goal is to save enough for retirement without compromising your current financial stability. It’s not about living paycheck to paycheck while trying to max out your retirement contributions—it’s about finding the right balance between short-term and long-term financial goals.

Step 3: Save 15% of Your Income for Retirement

Actionable Tip: Once your debts are paid off and you have a fully funded emergency fund (3-6 months of living expenses), aim to contribute 15% of your income toward retirement. This will set you up for a comfortable retirement, no matter what happens in the economy.

Dave Ramsey Advises Caution and Planning on 401(k) Contributions with Target Date Funds and Company Stock

While a 401(k) is a great tool, Ramsey cautions against blindly investing in target date funds or putting too much of your retirement savings in company stock. Target date funds are often included in 401(k) plans as a default option, and while they automatically adjust their asset allocation based on your retirement age, they may not always provide the best growth potential. Ramsey warns that target date funds can become too conservative as you approach retirement, which might limit your returns.

Likewise, relying heavily on your employer’s stock within your retirement portfolio is a risky move. If your company’s stock takes a downturn, so will your retirement savings. Diversifying your investments across different assets (stocks, bonds, real estate, etc.) helps to reduce risk and increase the likelihood of a successful retirement.

Step 4: Diversify Your Investments and Be Cautious with Target Date Funds and Company Stock

Actionable Tip: Don’t put all your eggs in one basket—diversify your portfolio. Avoid overexposure to your employer’s stock, and be mindful of relying too heavily on target date funds. Make sure your retirement investments are well-rounded and aligned with your long-term goals.

4 Financial Mistakes Americans Keep Making That Wreck Their Budgets

Gen Z Is Saving for Retirement Early, But Employers May Be Falling Behind

Expert Offers Guidance for Couples Planning Retirement With Limited Savings