CRA Denies Break on $33,000 Spousal Support: In a ruling that sent shockwaves through the Canadian tax community, the Canada Revenue Agency (CRA) recently denied a taxpayer’s claim to deduct $33,000 in spousal support payments from their taxable income. While it might sound like a routine tax disagreement, this decision shines a spotlight on a surprisingly common mistake made by separated and divorced Canadians. Support payments are emotionally loaded, financially significant, and—if you’re not careful—taxable in all the wrong ways. This case proves that good intentions don’t always translate into good tax outcomes. Let’s break down exactly what happened, why the CRA said no, and what every Canadian needs to know to avoid the same fate.

CRA Denies Break on $33,000 Spousal Support

The CRA’s denial of a $33,000 spousal support deduction offers a critical reminder: Tax law doesn’t care about your intentions—it only cares about what’s on paper. No matter how well-meaning or timely your support payments are, without proper documentation and structure, they may not qualify for the deduction. The good news? With the right planning and legal guidance, you can ensure your support payments are both compliant and tax-efficient. Don’t leave it up to chance. Be proactive, get it in writing, and keep those receipts.

| Key Point | Details |

|---|---|

| CRA Decision | Denied $33,000 spousal support deduction |

| Reason for Denial | No written court order or agreement; payments didn’t meet tax rules |

| Child Support Priority | CRA assumes child support must be paid first before any spousal support becomes deductible |

| Who It Affects | Divorced or separated individuals paying support |

| Documentation Needed | Formal agreement, proper language, clear proof of payment |

| CRA Reference | CRA: Support Payments |

What Actually Happened?

The taxpayer in question had been making regular support payments totaling $33,000 annually to a former spouse. These payments were made voluntarily and in good faith, but they weren’t backed by a proper court order or written agreement that clearly labeled them as spousal support.

To make matters worse, the agreement also included child support obligations, which CRA considers first in line. Unless child support is fully satisfied, no deduction can be claimed for any other type of support—even if additional money was sent.

The CRA reviewed the documents and payment records and ruled the taxpayer ineligible for a deduction. Despite the payments being real, the law was clear: they didn’t meet the criteria under the Income Tax Act.

Why This Case Is a Big Deal?

Most Canadians are surprised to learn that spousal support is deductible, but only under strict conditions:

- There must be a written separation agreement or court order that specifically mentions spousal support.

- The payments must be periodic and consistent—not lump-sum or informal.

- Child support payments must be fulfilled first before any spousal support can be deducted.

- The payments must be made directly to the recipient and clearly documented.

Failing to meet any of these conditions can result in CRA disallowing your deduction—even if you paid the money, and even if your ex agrees it was meant as support.

Real-World Financial Impact

Let’s look at the potential financial consequences. Suppose you earn $90,000 per year and pay $33,000 in support. If deductible, this reduces your taxable income to $57,000, which may move you to a lower tax bracket and save you thousands of dollars.

But if the CRA denies the deduction?

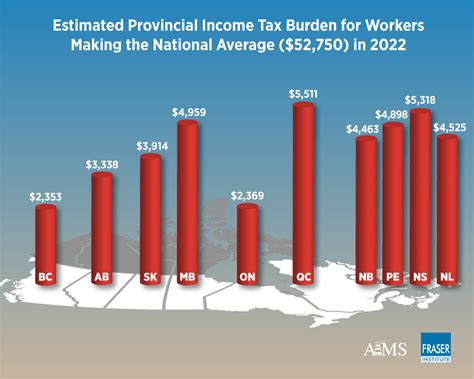

You pay taxes on the full $90,000 income, resulting in:

- Higher federal and provincial taxes

- No tax break for money already paid

- Possibly a reassessment or penalties

This is why proper structure and documentation is crucial. A simple misstep could cost you $5,000 to $10,000+ in additional taxes and lost deductions.

Step-by-Step Guide to Ensure You Get $33,000 Spousal Support

Step 1: Get a Written Agreement or Court Order

This is non-negotiable. CRA requires a formal, dated legal document—either a court-issued support order or a written separation agreement signed by both parties.

Verbal agreements or casual text messages will not be accepted.

Step 2: Specify the Type of Support

The document must clearly state that the payments are for spousal support, including:

- The amount to be paid

- The frequency (monthly, biweekly)

- The duration (e.g., for 5 years or until remarriage)

If your agreement simply says “support,” CRA may assume it’s child support or non-deductible.

Step 3: Separate Child and Spousal Support

Never combine the amounts into a single payment without clarification. CRA follows the “child support first” rule: any payments are presumed to satisfy child support until that amount is fully paid.

To protect your deduction, your agreement should include phrases like:

“The payer shall pay $1,500 per month in child support and $1,000 per month in spousal support.”

Only the $1,000 would then be deductible, assuming it meets the other conditions.

Step 4: Pay Through Traceable Means

Avoid cash. Instead, use:

- E-transfers

- Cheques with clear memos

- Direct deposits with documentation

Maintain detailed records including bank statements, e-transfer confirmations, and receipts signed by the recipient. CRA may ask for proof years after the payments are made.

Step 5: Report the Payments Properly

On your tax return:

- Payers claim the deduction on Line 22000.

- Recipients report it as income on Line 12800.

Use Form T1158 if requested, which details the support agreement, payment structure, and amounts paid.

Stats and Trends

According to Statistics Canada and CRA data:

- About 2.7 million Canadians are divorced or separated.

- Over 40% of those pay or receive some form of financial support.

- In 2023, CRA reviewed nearly 12,000 support deduction claims.

- Roughly 20% were denied, mostly due to poor documentation or ambiguous agreements.

With tax agencies using more automated tools and AI audits, compliance is no longer optional—it’s mandatory.

Common Mistakes That Lead to CRA Denials

- Lump-sum settlements: These are typically not deductible unless structured as periodic payments.

- Late or missed payments: CRA expects consistency and adherence to the agreement.

- Paying in cash: Hard to prove and unlikely to hold up during a review.

- No signature or date on agreement: Without proper execution, CRA won’t recognize it.

- Ambiguous language: Calling it “support” or “maintenance” without detail leaves room for misinterpretation.

U.S. Comparison: Alimony After 2019

For those with cross-border tax obligations, the rules are quite different:

- In the United States, the Tax Cuts and Jobs Act (2017) eliminated the alimony deduction for payers and the income requirement for recipients, starting January 1, 2019.

- In Canada, spousal support remains deductible for the payer and taxable income for the recipient—as long as the rules are followed.

Dual filers should consult a cross-border tax expert to avoid mistakes on both sides.

Expert Tips for Avoiding CRA Trouble

As a tax consultant with 15+ years of experience, here’s what I recommend to every client:

- Review your separation agreement annually to ensure it still reflects current obligations.

- Keep all correspondence with your ex that relates to support—especially if any changes occur.

- If your situation changes, file to amend the court order rather than making informal changes.

- Get CRA to pre-approve your deduction by submitting Form T1158 early in the year.

Canada Child Benefit Gets Surprise July Boost — Are You Getting More?

Boosted CRA Benefit in Quebec Could Bring Over $1,200 This Week for Eligible Residents

Canada Updates CRA Benefit Schedules for July 2025—Here’s What’s Coming Your Way