Could Social Security Payments Go Higher? Social Security payments are an essential part of financial security for millions of Americans. However, many seniors are finding that their benefits aren’t keeping up with the rising costs of living, especially with inflation hitting hard in recent years. If you’ve ever wondered if there’s a way for your Social Security check to go higher, the answer may lie in the Consumer Price Index for the Elderly (CPI-E). But how does this work, and why does it matter?

In this article, we’ll dive into what CPI-E is, how it differs from the current formula used for Social Security cost-of-living adjustments (COLA), and what it could mean for your Social Security payments. Along the way, we’ll also discuss recent proposals, the pros and cons of this idea, and the likelihood of it becoming a reality. By the end, you’ll have a better understanding of how CPI-E might impact your future Social Security benefits and what steps you can take to prepare for any changes.

Could Social Security Payments Go Higher?

In the ongoing debate about the future of Social Security, CPI-E presents a promising opportunity to better align benefit increases with the real-life costs that seniors face. While it may offer higher payments in the future, it also comes with challenges, particularly related to Social Security’s solvency and the accuracy of the index. For now, staying informed and planning ahead are key steps in preparing for any potential changes. Whether or not CPI-E becomes the new standard, ensuring a robust retirement strategy will help secure your financial future, no matter what.

| Key Point | Details |

|---|---|

| What is CPI-E? | The Consumer Price Index for the Elderly (CPI-E) tracks the spending habits of people aged 62 and older, with a focus on housing and healthcare costs. |

| Difference Between CPI-E and CPI-W | CPI-W, the current index, focuses on the spending patterns of urban workers and clerical workers, not seniors. CPI-E gives greater weight to healthcare and housing. |

| Potential Impact on Social Security | CPI-E could lead to higher COLA increases, potentially boosting monthly Social Security payments. For example, it could have increased the 2024 COLA to 4%. |

| Recent Proposals | Senator Bob Casey introduced the “Boosting Benefits and COLAs for Seniors Act” in March 2024 to switch to the CPI-E formula. |

| Challenges | While CPI-E could benefit retirees, it faces challenges due to concerns over Social Security’s insolvency and the current political climate in Congress. |

| Sources | Kiplinger, PlanAdviser |

What is CPI-E and How Does it Work?

The Consumer Price Index for the Elderly (CPI-E) is a statistical measure that tracks inflation specifically for people aged 62 and older. It’s designed to reflect the spending habits and needs of seniors, who often face different expenses than younger workers. For example, seniors typically spend more on healthcare, which tends to rise faster than other expenses like food and transportation.

How Does CPI-E Compare to CPI-W?

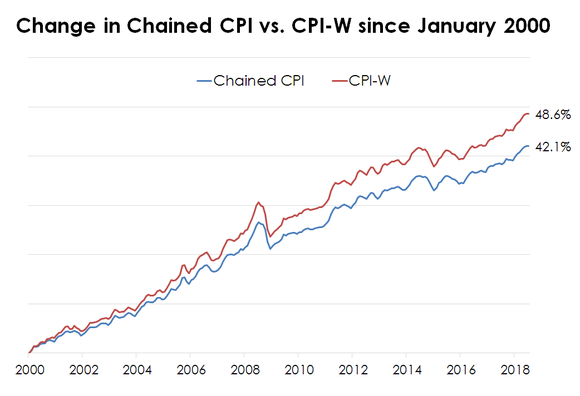

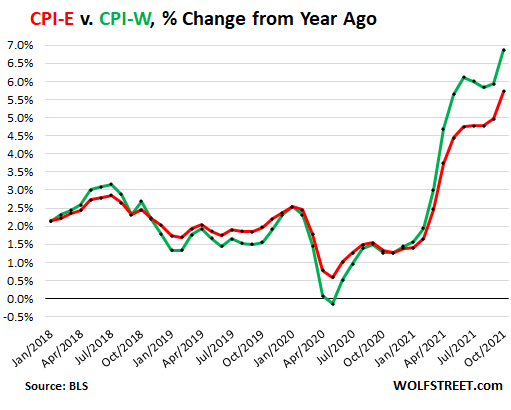

Currently, Social Security COLA adjustments are based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). This index tracks the cost of goods and services for urban wage earners, which includes things like food, housing, transportation, and medical costs. However, CPI-W doesn’t give as much weight to expenses that seniors incur more, like healthcare.

The CPI-E adjusts for this discrepancy by placing more emphasis on categories such as healthcare costs and housing expenses, both of which have risen significantly in recent years and take up a bigger chunk of a senior’s budget.

Why Might CPI-E Be Better for Social Security Recipients?

If the CPI-E were used to calculate Social Security COLA, it could result in higher benefit increases for seniors, helping them keep pace with inflation. This is especially important for older adults who may be living on fixed incomes and facing rising healthcare and housing costs.

For example, in 2024, if the CPI-E had been used instead of CPI-W, the COLA adjustment would have been 4%, compared to the 3.2% increase that was actually given based on CPI-W. While this may not sound like much, it would have meant an extra $15 per month for a person receiving an average monthly benefit of $1,907. Over time, these smaller increases can make a big difference in seniors’ quality of life.

The Legislation Behind CPI-E and Social Security

In March 2024, Senator Bob Casey introduced a bill called the Boosting Benefits and COLAs for Seniors Act, which proposes switching from the CPI-W to the CPI-E for calculating Social Security COLA. This bill has received strong support from retiree advocacy groups and other organizations, who believe that the current method of calculating COLA doesn’t accurately reflect the economic realities seniors face.

However, the proposal has also raised some concerns. One key issue is the solvency of the Social Security Trust Fund. Currently, Social Security is projected to run out of money by 2033, and switching to CPI-E could increase the program’s financial strain, as it would result in higher payments to beneficiaries.

Despite these concerns, the idea of using CPI-E for COLA adjustments has gained traction, especially among those who argue that seniors should receive benefits that more accurately reflect their expenses. But for now, this remains a proposal, not a certainty.

Challenges and Criticisms of CPI-E

While CPI-E could result in higher Social Security payments for seniors, there are several challenges and criticisms to consider.

1. Higher Costs for Social Security

As mentioned earlier, the switch to CPI-E could put additional financial strain on Social Security, which is already facing projected insolvency by 2033. If CPI-E were adopted, it would likely increase benefits over time, which could lead to greater financial burdens for the program.

2. Sampling Issues with CPI-E

Another criticism of CPI-E is that it is not as widely used or tested as CPI-W. The CPI-W is based on a larger sample of people, making it a more reliable indicator of general price trends. However, the CPI-E uses a smaller sample size, which can lead to potential errors in tracking the true cost of living for seniors. This has raised concerns among economists and policymakers about the reliability of CPI-E as the basis for Social Security adjustments.

3. Political Obstacles

Even if the benefits of CPI-E are clear, getting it passed into law is a different matter. Social Security reform is a politically charged issue, and the switch to CPI-E faces stiff opposition from some lawmakers who are concerned about the program’s future. Moreover, some lawmakers believe that increasing benefits may not be the most effective way to address the financial needs of retirees.

Practical Tips for Maximizing Your Social Security Benefits

While waiting for changes in the COLA system, there are some proactive steps you can take to get the most out of your Social Security benefits:

1. Maximize Your Social Security Payments

If you’re planning for retirement, the timing of when you start claiming Social Security can significantly affect the size of your monthly check. The longer you wait, up until age 70, the higher your monthly payment will be. Here’s a breakdown:

- Start at age 62: This is the earliest age you can begin receiving Social Security, but it comes with a reduced monthly benefit.

- Wait until age 66-67 (Full Retirement Age): If you wait until your full retirement age (FRA), you’ll receive your full benefit.

- Wait until age 70: If you wait until age 70, you’ll receive a delayed retirement credit, meaning you’ll get a higher monthly payment.

2. Diversify Your Retirement Income

Social Security should be just one part of your retirement plan. Diversifying your retirement income sources can help you build a more reliable financial cushion. Consider contributing to retirement savings accounts like a 401(k) or IRA to provide additional income when you retire.

3. Review Your Benefits Regularly

It’s essential to review your Social Security benefits regularly, especially if you’re still working in your later years. Factors such as inflation, changing life circumstances, and future COLA increases can all affect your benefits. The Social Security Administration (SSA) website is an excellent resource to track your benefits and ensure you’re on track for retirement.

What Can You Do to Prepare If Social Security Payments Go Higher??

While the adoption of CPI-E for Social Security COLA is not guaranteed, there are steps you can take to ensure you’re prepared for potential changes:

1. Stay Informed About Legislation

Keep an eye on the latest legislation regarding Social Security and COLA adjustments. If CPI-E gains traction, you’ll want to know how it might affect your benefits.

2. Plan for Retirement

Regardless of what happens with Social Security, it’s important to have a comprehensive retirement plan. Social Security should be just one part of your retirement income. Consider contributing to 401(k)s, IRAs, or other retirement accounts to ensure a steady income in retirement.

3. Budget for Healthcare Costs

Because healthcare tends to be a major expense for retirees, it’s important to budget for rising medical costs. Consider exploring Medicare Advantage Plans or other supplemental insurance to help cover healthcare expenses that aren’t fully paid by Medicare.

Social Security Is Running Out of Cash — Here’s the Shocking Timeline

Social Security Claims Are Surging — 5 Alarming Reasons You Should Act Fast

Retired Couples Could Lose $18,100 a Year in 2033 — Social Security Crisis Deepens