Congress’s Massive Megabill Slashes SNAP, Medicaid, and Taxes: The One Big Beautiful Bill Act—often called the “Megabill” or OBBBA—has become one of the most hotly debated laws of 2025. This sweeping legislation cuts billions in federal funding to social safety net programs like SNAP (Supplemental Nutrition Assistance Program) and Medicaid, while extending and expanding tax cuts for individuals and businesses.

For the state of Idaho, the implications are significant. From rural hospitals to working-class families, the effects of this bill will be felt for years to come. This article explains in simple, straightforward language how the bill works, why it matters, and what you can do about it—whether you’re a parent, healthcare provider, or policymaker. We’ll explore every angle of the Megabill in this comprehensive guide, including who wins, who loses, and how Idaho can prepare.

Congress’s Massive Megabill Slashes SNAP, Medicaid, and Taxes

The One Big Beautiful Bill delivers substantial tax relief to wealthier households while making it harder for low-income and working-class Americans to access food and healthcare. In Idaho, where rural access and economic resilience are already fragile, the Megabill’s consequences could be severe. Now is the time to get informed, stay organized, and protect your access to critical services. Whether you’re filing taxes or checking Medicaid eligibility, awareness is your best defense.

| Category | Key Changes & Impacts | Idaho Impact | More Info |

|---|---|---|---|

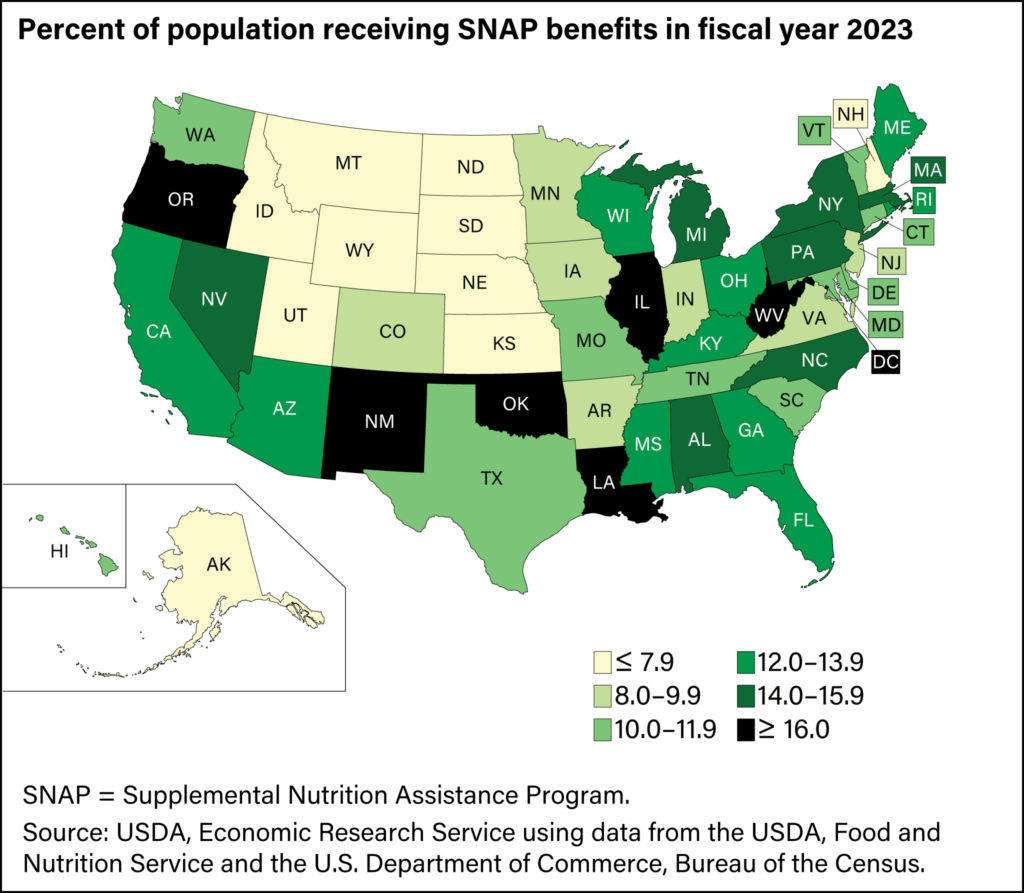

| SNAP | 20% nationwide cut ($186B); work requirement extended to adults aged 18–64; states must cover 75% of admin costs | Idaho faces ~$6M/year in new costs; over 150K residents could see reduced or lost benefits | fns.usda.gov |

| Medicaid | 80-hour monthly work requirement; $35 copays; semi-annual eligibility reviews; provider tax caps; tighter oversight | Idaho’s rural hospitals at risk; 140K+ enrollees may lose access or coverage | medicaid.gov |

| Taxes | Child Tax Credit increased to $2,500; SALT cap raised to $30K; new deductions for tips/overtime; MAGA savings accounts | Middle-class families may benefit; low-income families may lose more in benefits than they gain in tax cuts | irs.gov |

| Rural Health | Major cuts in Medicaid mean less revenue for small hospitals; $25B in rural relief fund added, but short of what’s needed | Up to 56% of rural hospitals in Idaho may face budget deficits | familiesusa.org |

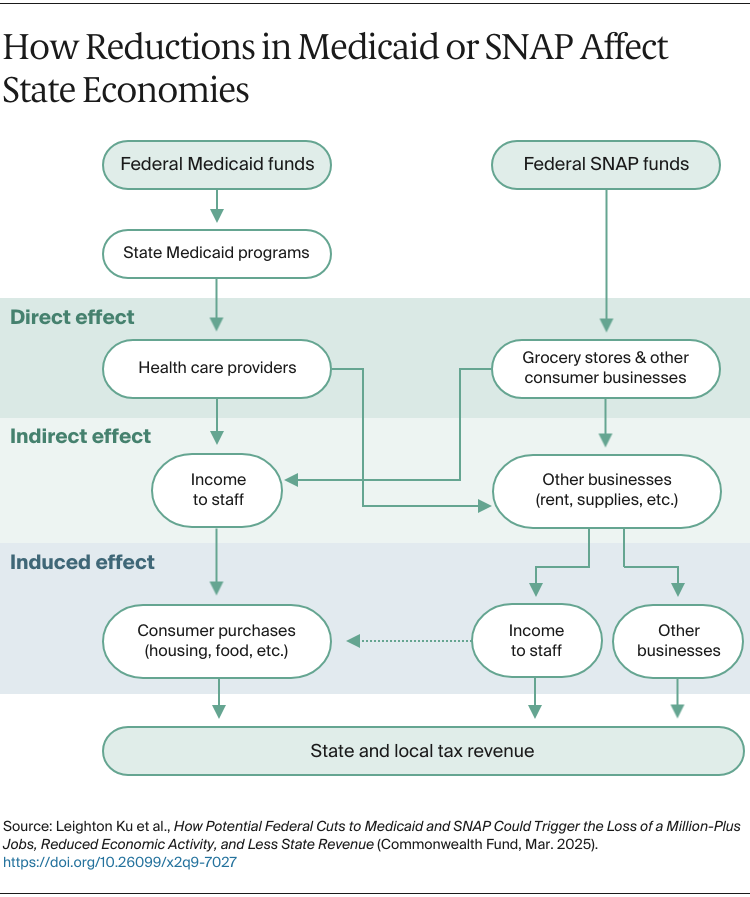

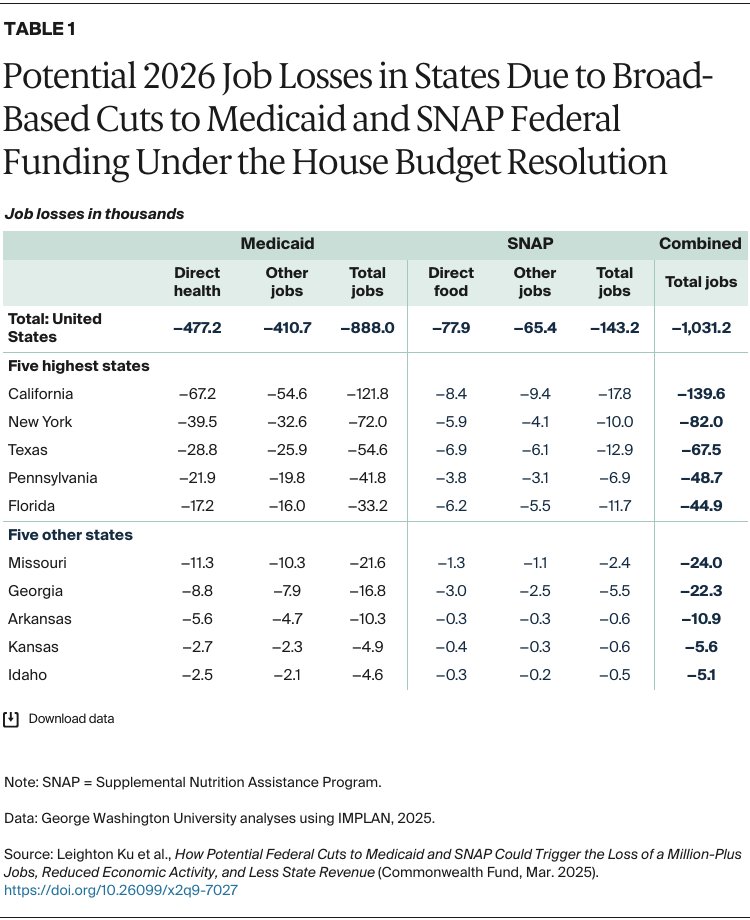

| Job Market | SNAP and Medicaid cuts may trigger job losses in healthcare and retail sectors, especially in rural areas | Idaho could see hundreds of lost jobs in hospitals, clinics, and service centers tied to federal programs | commonwealthfund.org |

What Is the Megabill?

The One Big Beautiful Bill Act (OBBBA) is a federal law designed to slash government spending and promote economic growth through tax reforms. It was signed into law in mid-2025 and affects nearly every American household through changes in healthcare, food assistance, and income tax rules.

While proponents argue that it restores fiscal discipline and rewards work, critics warn that it strips vital safety net protections, especially for low-income Americans, seniors, rural populations, and people with disabilities.

Why Idaho Should Pay Attention?

Idaho is a largely rural state with a growing but vulnerable population. Many Idahoans rely on SNAP and Medicaid to survive. The state’s healthcare system, already strained, will now carry a larger burden due to federal funding cuts and new eligibility rules. If you’re not affected directly, someone in your community almost certainly is.

SNAP Changes: Less Food on the Table

Key Provisions

- $186 billion in federal SNAP cuts over the next 10 years

- Work requirement expanded to all non-disabled adults aged 18–64

- Idaho’s SNAP administration costs jump from 50% to 75%

- SNAP benefit increases will now only track inflation—not changes in actual food costs

Real-World Example

A 62-year-old woman in rural Idaho who relies on SNAP may now be ineligible unless she can prove 80 hours of work a month. Previously, she was exempt due to her age. Now, she may lose benefits entirely.

Implications for Idaho

More than 150,000 Idahoans rely on SNAP. Many of them are seniors, disabled individuals, or working families with unstable job hours. The new work requirements and funding cuts may lead to:

- Higher food insecurity rates

- More pressure on food banks

- Greater administrative burdens for local agencies

Medicaid Changes: Coverage at Risk

What’s New?

- Adults aged 19–64 must work at least 80 hours per month to remain eligible

- Medicaid enrollees may be charged up to $35 per medical visit

- Semi-annual re-evaluation of eligibility (vs. once per year)

- Provider tax limit reductions, affecting state hospitals’ ability to fund care

- Restrictions on coverage for gender-affirming care and abortion-related services

- Immigration-related delays for green card holders accessing Medicaid

Impact on Idaho’s Healthcare System

Idaho’s Medicaid expansion in 2020 extended coverage to over 140,000 low-income residents. Many of them now face increased risk of losing coverage. Rural hospitals may no longer be reimbursed for services to newly ineligible patients, leading to:

- Clinic and hospital closures in underserved areas

- Increased emergency room visits

- Rising premiums for privately insured Idahoans

According to Families USA, up to 56% of rural hospitals nationwide may face net income losses—putting over 1,000 facilities at financial risk.

Tax Cuts: A Mixed Bag

Who Benefits Most?

- Wealthier families and businesses benefit most from:

- SALT cap increase to $30,000

- Extension of Trump-era income tax cuts

- Deductions on overtime, tips, and car loan interest

- MAGA savings accounts—up to $1,000 per child in tax-free savings

Child Tax Credit

- Raised to $2,500 per child through 2028

- Phases back to $2,000 after 2028

- Only partially refundable depending on income

For Idaho Families

- A two-child household earning $75,000 might save up to $2,500 annually

- A single-parent household relying on SNAP and Medicaid could lose $1,600+ annually due to lost benefits—even with tax savings

A Washington Post analysis found that low-income families may suffer net losses, even as middle-income earners gain modest relief.

How Congress’s Massive Megabill Slashes SNAP, Medicaid, and Taxes?

Economic Ripple Effects

Idaho’s economy relies heavily on agriculture, service industries, and small businesses. Cuts to SNAP and Medicaid mean:

- Fewer dollars spent in local grocery stores and clinics

- Rising unpaid medical bills

- Job losses in healthcare, social work, and food distribution

Tribal and Rural Communities

Idaho’s five federally recognized tribes often rely on federally funded health and food services. Under the Megabill:

- Tribal health centers may face budget deficits

- SNAP and Medicaid enrollment may decline due to work rules and red tape

- Food insecurity may spike on reservations, especially among elders

Administrative Load on the State

Idaho’s Department of Health and Welfare must now:

- Track and enforce work hour compliance for both SNAP and Medicaid

- Handle twice-yearly re-enrollment procedures

- Support outreach and appeals for those unfairly removed from coverage

These changes mean more work, less funding, and greater risk of procedural errors that can kick eligible people off programs.

What Can You Do?

For Individuals

- Update your contact information with state benefit agencies.

- Track your work hours carefully if you receive SNAP or Medicaid.

- Explore other resources, including:

- Local food banks

- Community clinics

- Faith-based services

- Appeal decisions quickly if you lose coverage unfairly.

For Employers

- Help employees understand their work hour documentation needs

- Offer healthcare support or flexible scheduling if possible

- Encourage staff to file for new tax credits

For Healthcare Providers

- Prepare for reduced reimbursements

- Apply for rural health transformation grants

- Coordinate with nonprofits to offer bridge services

Georgia SNAP Benefits Slashed Under Trump’s Big Beautiful Bill Explained

Thousands in South Carolina Could Lose SNAP Benefits Under GOP Medicaid Cuts

A Look Ahead

This bill is now law—but political and legal challenges are likely. Advocates are already suing to overturn parts of the Medicaid changes, particularly those affecting work requirements and care access. Idaho lawmakers may also push back with state-level emergency funds, especially if closures begin to affect rural hospitals.

Elections in 2026 could shape how much of this bill stays intact. Public pressure and legal action could alter how some provisions are implemented or enforced.