Centrelink Issues Urgent ATO Warning: Tax season is often a time of stress, confusion, and—let’s be real—lots of paperwork. But for Australians receiving government payments through Centrelink, there’s an additional layer of complication this year. Centrelink and the Australian Taxation Office (ATO) have issued a serious warning about tax mistakes that could affect your refund. And, in some cases, it could even cost you money if you’re not careful. This article is here to break down the problem and offer you practical, easy-to-follow advice on how to avoid making the tax mistake that could leave your refund in jeopardy. Whether you’re a first-time filer or a tax expert, this guide will help you navigate the confusion and keep your tax return on track. Let’s dive in.

Centrelink Issues Urgent ATO Warning

Tax season doesn’t have to be stressful if you stay informed and proactive. With Centrelink’s recent warning about potential tax errors and the rise in tax-related scams, it’s more important than ever to double-check your return, safeguard your personal information, and stay alert. By following the steps outlined in this article, you can avoid common mistakes, protect your tax refund, and ensure a smooth filing process. Remember, taxes don’t have to be a headache—just take your time, stay organized, and when in doubt, reach out to the professionals. Your refund and your personal information are worth the extra effort.

| Key Points | Details |

|---|---|

| Urgent Warning from Centrelink & ATO | Centrelink recipients might need to amend tax returns due to payment changes. |

| Risk of Tax Refund Theft | Scammers are targeting tax refunds with fake ATO communications. |

| Who Is Affected? | Those receiving Centrelink payments or expecting a tax refund. |

| How to Protect Yourself | Be cautious of unsolicited messages, and always use official channels. |

| Official Resources | ATO Scam Alerts |

Understanding the Issue

What’s Going on with Centrelink and ATO?

The Australian Taxation Office and Centrelink have sent out an urgent warning this tax season. Centrelink recipients may have received payment summaries that don’t reflect recent changes in government payments, and this could lead to incorrect tax filings. As a result, if you’ve already lodged your tax return, you might need to amend it in order to reflect the correct payment information.

This all boils down to a simple, but potentially costly, error. Payments were made before adjustments were finalized, and this could affect the accuracy of your payment summaries—meaning that your tax return might not match the updated figures.

How Does This Affect You?

If you’re someone receiving Centrelink payments, you’re probably wondering what this all means for your tax refund. Essentially, if you’ve filed your return already, there’s a good chance that your figures are outdated, and this could affect the amount of tax you owe or the refund you’re due to receive.

If you don’t fix the mistake, you could end up with the wrong refund amount. Worse, if the wrong details were used, it could even delay your refund or result in an unexpected tax bill.

How to Know If You’re Affected?

Centrelink has made it clear that anyone who receives government payments should review their payment summaries and ensure that they reflect any adjustments that have been made. Affected individuals will receive a notification through myGov or by mail, explaining what changes need to be made.

How to Fix the Mistake As Centrelink Issues Urgent ATO Warning?

Step-by-Step Guide for Centrelink Recipients

If you’ve already lodged your tax return, don’t panic! Here’s a simple guide to follow:

- Wait for Notification: Centrelink will notify you through your myGov inbox or by mail if there are any issues with your payment summary.

- Look for Changes in Your Payments: If you’ve received an update, it’s likely that you’ll need to amend your tax return to include the corrected figures.

- Amend Your Tax Return: If needed, log in to myGov and follow the steps to amend your return. You’ll be asked to enter the correct payment figures, which should match the latest updates you received from Centrelink.

- Confirmation from ATO: Once you’ve made the necessary changes, keep an eye out for confirmation from the ATO that your amended return has been accepted.

- Check for Refund Adjustments: After amendments, your refund may change. Be prepared for a longer waiting period, as amended returns can take time to process.

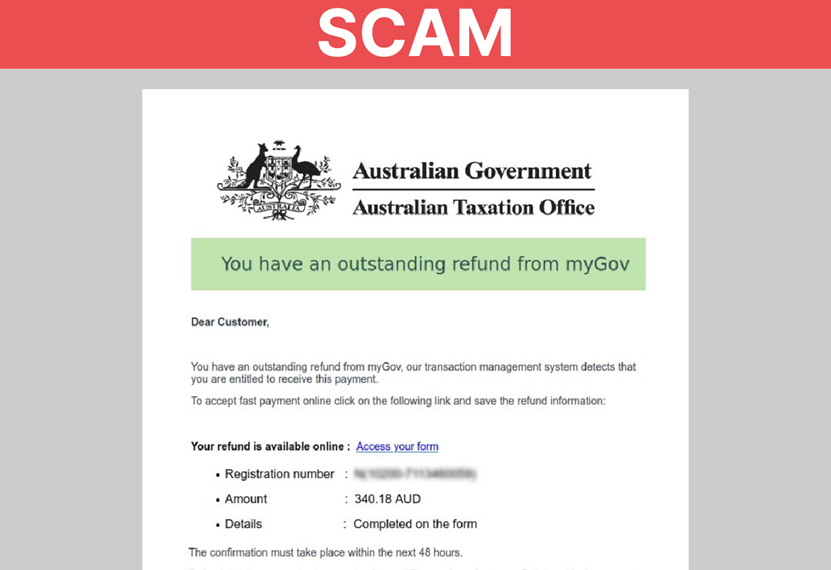

The Rise of Scams: A Dangerous Threat to Your Refund

While you’re trying to fix potential issues with your tax return, there’s another looming problem: scammers. As if tax season wasn’t stressful enough, fraudsters are taking advantage of the situation to target unsuspecting Australians.

How Do These Scams Work?

Scammers are getting increasingly clever with their tactics. They often impersonate Centrelink or the ATO, sending fake emails, SMS messages, or even making phone calls. These communications usually claim that there’s an urgent problem with your tax return or that your refund is ready to be processed—but only if you provide your personal information.

Once they have this data, they can steal your identity, access your accounts, or even redirect your tax refund into their own pockets.

How to Protect Yourself from Scams?

- Don’t Respond to Unsolicited Messages: The ATO or Centrelink will never contact you by email, SMS, or phone to ask for sensitive information. If you receive a message that seems suspicious, don’t respond, and don’t click on any links.

- Verify the Source: Always check the source of the message. Make sure that the contact is legitimate before you share any personal details.

- Use Secure Channels: If you need to contact the ATO or Centrelink, always do so through their official contact details. Never use a phone number or email address that appears in an unsolicited message.

- Enable Multi-Factor Authentication (MFA): To safeguard your myGov and ATO accounts, set up multi-factor authentication. This adds an extra layer of protection by requiring a second form of verification when logging in.

Additional Tax Tips for a Smooth Filing

Beyond fixing errors and protecting yourself from scams, here are a few more tax tips to ensure everything goes smoothly:

1. Check Your Payment Summaries Early

Don’t wait until the last minute to gather your documents. The earlier you check your payment summaries from Centrelink and any other sources, the sooner you can catch any discrepancies or errors.

2. Keep Track of All Deductions

If you’re eligible for any deductions, be sure to keep accurate records. This can include work-related expenses, donations to charity, and any other deductions you might be entitled to claim.

3. Consider Getting Professional Help

If you’re feeling overwhelmed by the changes or don’t know how to navigate amending your tax return, it might be worth consulting a tax professional. They can ensure that everything is filed correctly, helping you avoid errors that could delay your refund.

4. Check Pre-filled Information

If you’re filing online, be sure to double-check the pre-filled information in your tax return. While this data is typically accurate, it’s always wise to ensure nothing’s been missed or entered incorrectly.

Centrelink Cash Boost Hits Millions of Aussie Bank Accounts Starting Today

WA Centrelink Customers Overcharged $2.3 Million by Synergy, Repayments Underway

Centrelink Warns ATO Tax Refund Recipients to Repay If Overpaid