Centrelink Issues ATO Tax Alert: Centrelink and the Australian Taxation Office (ATO) are raising red flags this tax season. A serious cyber scam is making the rounds—and it only takes one wrong click to lose your entire tax refund or Centrelink payment. The government is urging Australians to be on high alert, warning that fraudsters are impersonating official agencies and tricking people into giving away their login details. If you’re thinking, “I’m too smart to fall for that,” think again. These aren’t your average scams. We’re talking about highly personalized messages, fake websites, and advanced tactics powered by artificial intelligence. Whether you’re 18 or 80, everyone is a potential target. This article breaks it all down: how these scams work, what warning signs to look for, how to stay protected, and what to do if you’ve been targeted. Whether you’re new to tax season or a seasoned pro, this guide is here to help you protect what you’ve worked hard for.

Centrelink Issues ATO Tax Alert

This year’s tax season comes with a new kind of threat—one that’s fast, sneaky, and harder to spot than ever before. The Centrelink and ATO scam alert is not just another news headline. It’s a real warning that even one misstep could cost you thousands of dollars and your digital identity. Remember: no government agency will ever ask you to click a link in a text or email. Always go directly to official websites, monitor your account activity, and educate those around you. Stay informed, stay alert—and don’t let scammers cash in on your hard-earned refund.

| Issue | Details |

|---|---|

| Scam Type | Fake texts/emails impersonating ATO, Centrelink, or myGov |

| Goal | Trick users into entering credentials and reroute refunds |

| Methods Used | Phishing, cloned websites, AI-generated language |

| Common Messaging | Claims about tax refund status or account access issues |

| Time of Contact | Often sent early morning to catch users off guard |

| Amount Lost | Over $2.7 million in reported tax scams (Scamwatch 2023) |

| Reporting | Scamwatch.gov.au, ATO Scam Line: 1800 008 540 |

| Official Portals | my.gov.au, ato.gov.au |

What’s Going On: A New Breed of Tax Scams

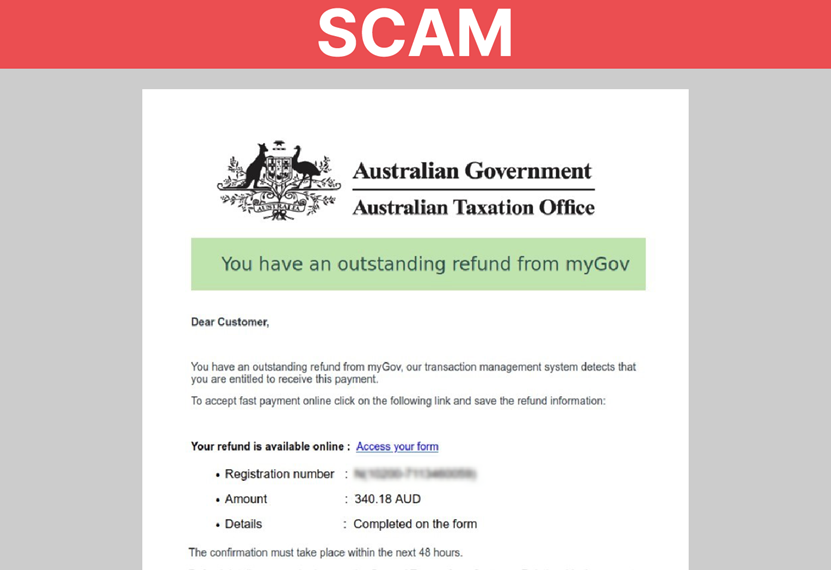

Let’s be clear—these scams aren’t new, but they’ve evolved. In the past, scam emails were full of typos and poor grammar. Today’s versions? They’re polished, professional-looking, and tailored to the individual. Many are written with the help of artificial intelligence and mimic the tone and format of real government communications.

The scam usually starts with a text or email. It might say something like:

- “You’re eligible for a refund—click here to verify.”

- “Important: Your myGov account has been suspended.”

- “Action required: Suspicious login detected on your ATO profile.”

The message includes a link that looks like it goes to an official government site, but it actually takes you to a fraudulent clone site. If you enter your login information, the scammer gains access to your myGov account—and from there, they can reroute your refund to their own bank account.

Real Case Study: One Click, $3,800 Gone

Take the case of Michelle, a 36-year-old nurse from Melbourne. She received what looked like a legitimate text from the ATO about an unclaimed refund. The link took her to a fake myGov login page. She entered her details and thought nothing of it.

Three days later, her $3,800 refund was deposited—not into her account, but into an account opened with stolen credentials. It was too late to reverse the transaction.

She filed a report with the ATO and Scamwatch, but the money was gone.

Why It’s So Dangerous: It’s Not Just About Money

These scams aren’t just about stealing a refund—they can lead to identity theft, Centrelink benefit redirection, and even Medicare fraud. Once inside your myGov profile, a scammer can:

- Change your personal details

- Update your bank account

- Link or unlink services (like Medicare or Centrelink)

- Access past tax returns and financial data

- Apply for benefits in your name

And all of this can happen without triggering an alert—unless you know what to look for.

How These Scams Work: Step-by-Step Breakdown

- Initial Contact: Scammer sends a fake ATO/Centrelink/myGov message via text or email.

- Phishing Link: The message contains a hyperlink to a fake website that mimics an official portal.

- Credential Harvesting: Victim logs in, unknowingly giving away their username and password.

- Account Access: Scammer logs into the real myGov account, changes bank details or downloads private info.

- Money Stolen: Refunds or payments are redirected to an account the scammer controls.

Expert Commentary: What the Pros Say

According to the Australian Government’s Cyber Security Centre:

“Scammers are becoming highly sophisticated, using real data, AI-written messages, and mimicking legitimate platforms to manipulate victims. Even tech-savvy users are being fooled.”

The ATO itself warns that they will never include links in SMS or email messages.

How to Protect Yourself As Centrelink Issues ATO Tax Alert: 8 Steps That Actually Work

- Never click links in unsolicited texts or emails.

- Government agencies won’t send login links. Type the URL directly in your browser.

- Check the sender’s email address.

- Official government emails end in “.gov.au” and usually don’t come from free services like Gmail.

- Use two-factor authentication (2FA) on myGov.

- This adds a second layer of protection, even if your password is stolen.

- Monitor your account regularly.

- Log in weekly to check for changes in bank info or linked services.

- Use a password manager.

- Don’t reuse passwords. Tools like Bitwarden, Dashlane, or 1Password can help you create strong, unique passwords.

- Watch for early-morning messages.

- Scammers often send messages between 4–6 AM to catch people off guard.

- Educate your family.

- Elderly parents and young adults are common targets. Make sure they know the signs.

- Report suspicious activity immediately.

- Contact the ATO scam line at 1800 008 540 and lodge a report at scamwatch.gov.au.

Spot the Difference: Fake vs. Real Communications

Fake ATO Message Example:

“You are owed $3,280.70. Please verify your identity at [ato-taxclaim.com] to receive payment.”

Real ATO Message Example:

“You have a new message in your myGov inbox. Log in at my.gov.au to view it.”

Key differences:

- Real messages don’t include clickable links

- Scammers often use dollar amounts and urgency

- Domains are slightly altered (like “ato-taxrefund.net” instead of “ato.gov.au”)

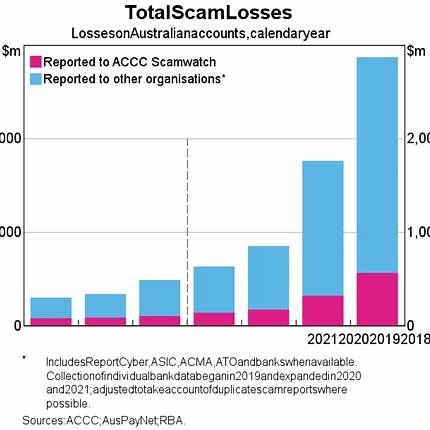

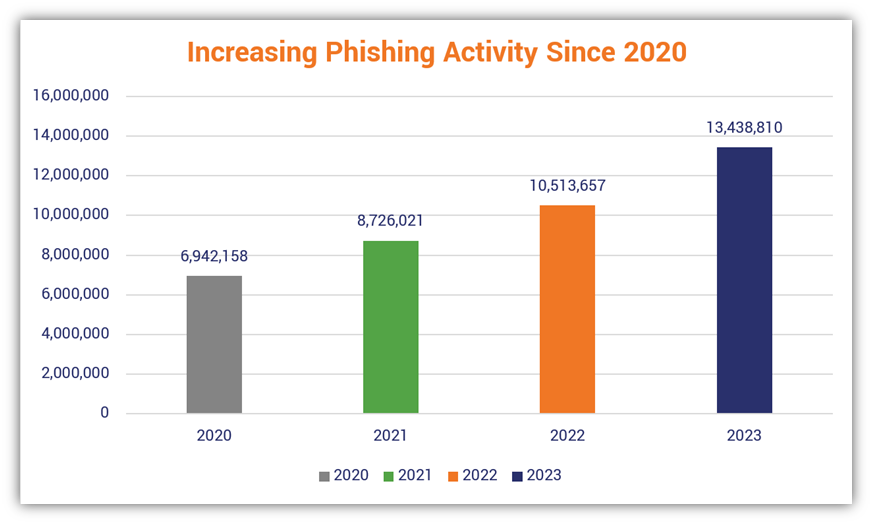

Historical Data: How Bad Is It Getting?

According to Scamwatch and the ACCC, tax-related scams are steadily rising:

- In 2023, over 14,500 tax scams were reported in Australia.

- Losses exceeded $2.7 million, a 22% increase from the previous year.

- In the past five years, tax and government impersonation scams have been among the top 5 scam categories in the country.

The use of AI-generated phishing, SMS spoofing, and data-leak exploitation is making these scams harder to detect—even by cybersecurity experts.

If You’ve Been Scammed: What to Do Right Now

- Change your myGov password immediately.

- Unlink services like ATO, Centrelink, and Medicare temporarily.

- Contact the ATO at 1800 008 540.

- Report the scam to Scamwatch at scamwatch.gov.au.

- Call IDCARE (Australia’s cyber support service) at 1800 595 160.

Timing matters. The sooner you act, the more likely it is that authorities can freeze accounts or block future damage.

Centrelink Warns ATO Tax Refund Recipients to Repay If Overpaid

WA Centrelink Customers Overcharged $2.3 Million by Synergy, Repayments Underway

Centrelink Payments Just Got a Boost – Here’s What the July 2025 Increase Means for You