Canada Updates CRA Benefit Schedules for July 2025: If you rely on CRA benefits, July 2025 is a big month. The Canada Revenue Agency (CRA) has released an updated schedule, and it includes several critical payments—plus the launch of a brand-new benefit for Canadians living with disabilities.

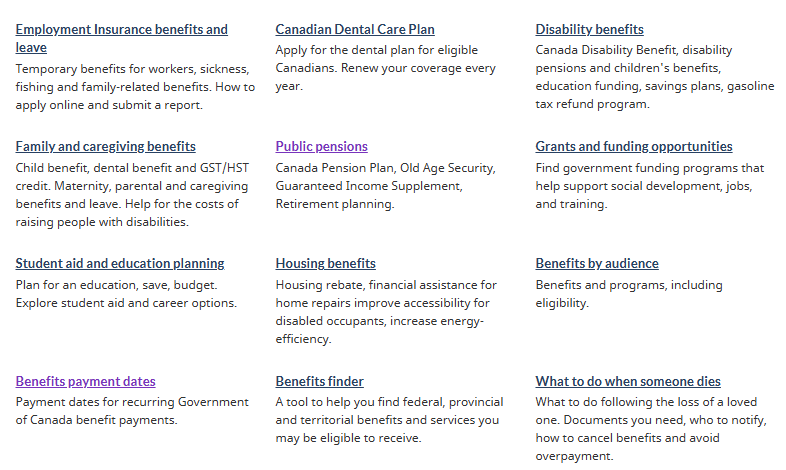

From the Canada Child Benefit (CCB) and GST/HST Credit to the Advanced Canada Workers Benefit (ACWB) and the all-new Canada Disability Benefit (CDB), this guide explains what you’re getting, when to expect it, and how to ensure you don’t miss a single dollar. Whether you’re a working parent, retired senior, or newcomer to Canada, these tax-free government supports can play a vital role in your monthly budget. So let’s get you up to speed—fast.

Canada Updates CRA Benefit Schedules for July 2025

The CRA’s July 2025 benefit schedule delivers meaningful financial help across Canada—especially for parents, workers, seniors, and people with disabilities. With the introduction of the Canada Disability Benefit, this month could be a turning point for many. By staying informed and proactive, Canadians can maximize the benefits available to them and ensure their financial well-being. Whether it’s by tracking payments, updating information, or applying for new benefits, every step counts.

Remember, the key is to stay up-to-date and file your taxes on time to ensure you don’t miss out. If you’re unsure about eligibility, use CRA’s tools or get professional advice to ensure you’re receiving the full support you deserve. These payments can help you manage daily expenses, reduce financial stress, and improve quality of life, so don’t leave money on the table.

Take action now, mark your calendar for important dates, and get ready to receive your much-needed benefits. It’s your right to be supported, and it’s easier than ever to access those resources.

| Benefit Name | Payment Date (July 2025) | Max Monthly Amount | Description | Official Info |

|---|---|---|---|---|

| Canada Child Benefit (CCB) | July 18 | Up to $666.41 per child under 6 | Monthly support for families with children | CRA – CCB |

| GST/HST Credit | July 4 | Varies (average $496/year per adult) | Quarterly payment to offset sales taxes for low/mid-income Canadians | CRA – GST |

| Ontario Trillium Benefit (OTB) | July 10 | Varies by income, rent, family size | Provincial benefit for Ontario residents; combines 3 credit programs | CRA – OTB |

| Advanced Canada Workers Benefit (ACWB) | July 11 | Up to $456.50/family; $136.83 disability top-up | Advance payment to working low-income individuals/families | CRA – ACWB |

| Canada Disability Benefit (CDB) | July 17 | Up to $200/month | New benefit for adults aged 18–64 with Disability Tax Credit | CRA – CDB |

| Canada Pension Plan (CPP) | July 29 | Avg $831.92; max $1,364.60 | Monthly payment for retirees/contributors aged 60+ | Service Canada – CPP |

| Old Age Security (OAS) | July 29 | Up to $713.34/month | Monthly pension for those aged 65 and older | Service Canada – OAS |

| Veterans Disability Pension | July 30 | Depends on disability % | Tax-free monthly support for injured veterans | Veterans Affairs |

Why CRA Benefits Matter—Especially in 2025

The cost of living in Canada has been rising steadily. Food, rent, childcare, and utilities are more expensive than ever, and for many Canadians, monthly CRA deposits help close the gap between income and expenses.

According to Statistics Canada, nearly 40% of Canadians under 35 say they would not be able to handle a $500 emergency. CRA benefits like CCB and GST credits offer a safety net—especially if you’re in a lower tax bracket or have dependents.

These payments are non-taxable and delivered directly to your bank account, usually without needing to reapply every year (as long as you file your taxes).

What’s New in Canada Updates CRA Benefit Schedules for July 2025? Major Updates to Know

Canada Disability Benefit (CDB) – Brand-New Support

For the first time, Canadians aged 18 to 64 who are approved for the Disability Tax Credit (DTC) will receive a monthly Canada Disability Benefit.

Here’s how it works:

- Monthly amount: Up to $200/month

- If you qualify for less than $240/year, CRA may issue a lump sum instead

- Payments start July 17, 2025

This benefit is non-taxable, and it’s designed to close the income gap for disabled Canadians who often face higher living costs and lower employment rates.

To apply for the DTC (a requirement for the CDB), your doctor must complete Form T2201.

Advance Canada Workers Benefit – Boost for Working Canadians

If you’re working full-time or part-time and still struggling, the Canada Workers Benefit can make a big difference. Starting in 2023, CRA began paying a portion of this benefit in advance, three times a year.

For July 11, 2025, the advance payment will include:

- Singles: Up to $265

- Families: Up to $456.50

- People with disabilities: An extra $136.83

You don’t need to apply separately—the CRA issues this automatically based on your last tax return.

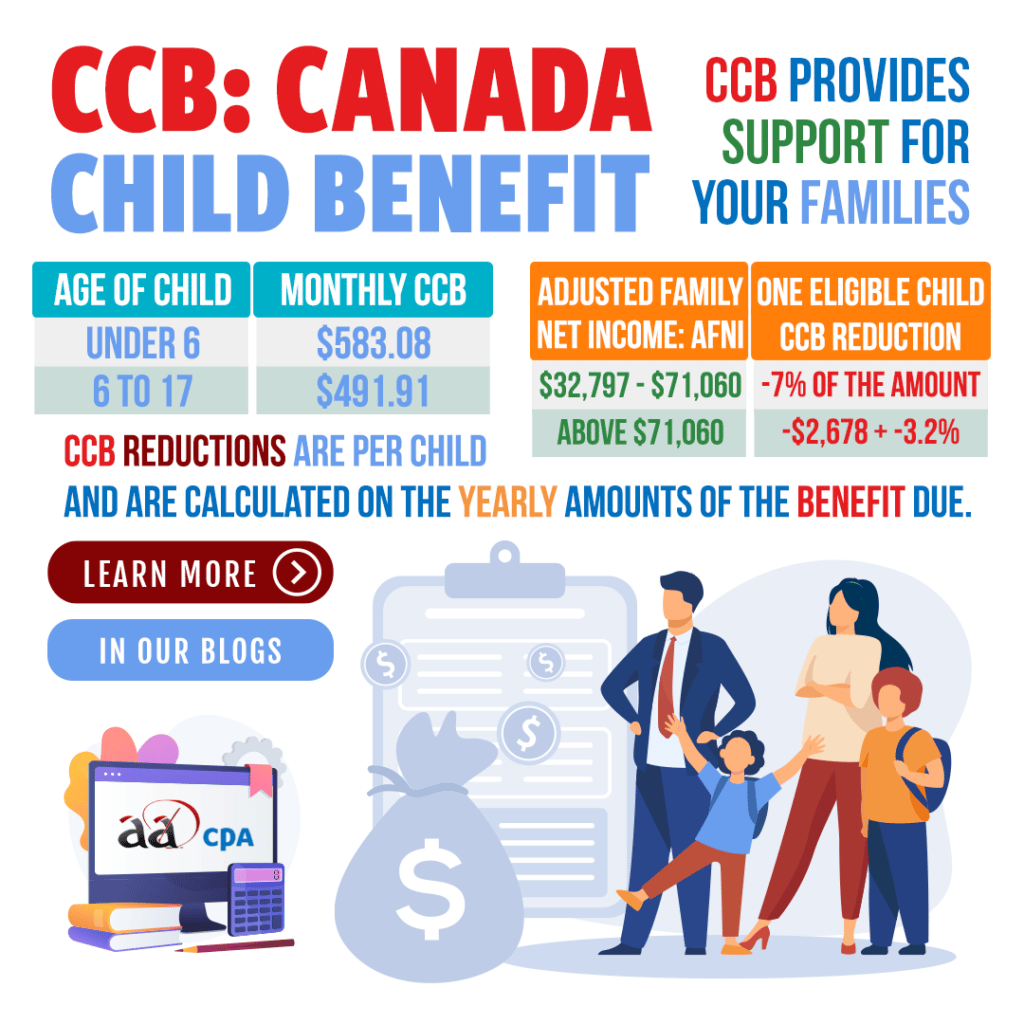

Canada Child Benefit (CCB) – July 18, 2025

The Canada Child Benefit is one of the most generous family benefits in the world. For July 2025 through June 2026, here’s how the monthly CCB is calculated:

- Children under 6: Up to $6,996 annually ($583/month)

- Children 6–17: Up to $6,748 annually ($562.33/month)

Actual payment amounts depend on your net family income. For example:

- A single parent earning $30,000 with one 4-year-old child will likely receive the full $666.41.

- A two-parent household earning $75,000 with two kids aged 7 and 10 might receive around $1,000/month.

CPP & OAS – July 29

For seniors, July continues the regular monthly schedule for:

- Canada Pension Plan (CPP): Retirement benefit for those who contributed during working years

- Old Age Security (OAS): Monthly benefit for Canadians aged 65 and up

Both are adjusted annually for inflation.

If you turned 65 in 2025, you can apply for OAS as long as you’ve lived in Canada for at least 10 years since age 18.

Veterans’ Disability Pension – July 30

If you or a loved one served in the Canadian Armed Forces and sustained a service-related injury or illness, the Veterans Disability Pension provides tax-free compensation.

Payouts vary based on:

- Type and severity of injury

- Whether it’s a single pension or combination

- Whether you’re receiving other benefits like the CAF Long-Term Disability (LTD)

Practical Examples – Who Gets What?

Let’s run through a few realistic scenarios.

Example 1: Single mom with 2 young children

- Monthly CCB: $1,332.82

- GST/HST credit (quarterly): ~$149

- ACWB: $456.50 (July installment)

Total July deposits: Over $1,800

Example 2: Disabled adult working part-time

- CDB: $200

- GST/HST: ~$124

- ACWB with disability supplement: $401.83

Total July deposits: Around $725

Example 3: Retired couple on OAS and CPP

- CPP (both average): $831.92 x 2 = $1,663.84

- OAS (both): $713.34 x 2 = $1,426.68

Total July pensions: $3,090.52

How to Make Sure You Receive Payments Accoridng to Canada Updates CRA Benefit Schedules for July 2025?

Follow this checklist to avoid delays and ensure you’re receiving the benefits you’re entitled to:

- File your 2024 taxes – Even if you had no income or are self-employed, filing your taxes is essential to qualify for benefits like CCB, GST/HST, and ACWB.

- Register for CRA My Account – This online service lets you track your payments, view notices, and update your personal information. It’s the fastest way to stay on top of your benefits.

- Set up direct deposit – It’s the quickest and most secure method to receive your benefits. You’ll get your money faster and avoid delays associated with paper checks.

- Update your marital and address status – Any change in your household can affect the amount of benefits you’re eligible for, so make sure your information is current.

- Apply for DTC if you haven’t yet – If you or a family member qualifies, apply for the Disability Tax Credit (DTC) to ensure you receive additional benefits like the Canada Disability Benefit (CDB) or disability supplements to other programs.