Canada Is Sending Out Larger GST Cheques: If you’ve been hearing the buzz that Canada is sending out larger GST cheques in 2025, the good news is—it’s true. Starting in July 2025, the Government of Canada is boosting the GST/HST credit, meaning more money in the pockets of low- and moderate-income Canadians. The raise comes as part of the federal government’s effort to fight inflation and ease cost-of-living pressures. But hold on—despite what some viral social media posts might claim, there is no $3,000 GST cheque coming your way. What’s real is a 2.7% increase to the existing quarterly GST credit, and in some provinces, that’s topped up with additional provincial payments—automatically added to your account if you qualify.

Whether you’re a young adult just entering the workforce, a struggling single parent, a senior citizen, or a working-class family trying to stretch every dollar, this article walks you through exactly what’s happening, who qualifies, and how to make sure you get the full benefit.

Canada Is Sending Out Larger GST Cheques

The GST/HST credit increase in 2025 may not be life-changing for everyone, but it can be a critical source of relief for Canadians living on modest incomes. With an inflation-indexed bump, automatic provincial top-ups, and a simple qualification process tied to your taxes, it’s one of the easiest federal benefits to access.

Filing your taxes is the single most important thing you can do to ensure you receive every dollar you’re entitled to—and possibly more through other federal and provincial programs. No, there’s no magical $3,000 cheque. But for those who qualify, the real benefit is steady, tax-free cash flow that can help you stay afloat, stay fed, and stay ahead.

| Key Info | Details |

|---|---|

| New GST Credit Amount (2025–2026) | Up to $533/year for singles, $698/year for couples, plus $184 per child |

| Increase from 2024 | 2.7% adjustment for inflation |

| Eligibility | Must be 19+, live in Canada, have low-to-moderate income, and have filed a 2024 tax return |

| Payment Dates | July 5, October 4, January 3, and April 4 |

| Provincial Top-Ups | Newfoundland, Saskatchewan, New Brunswick, Nova Scotia, and PEI offer extra quarterly credits |

| Official Source | CRA GST Credit |

What Is the GST/HST Credit?

The Goods and Services Tax / Harmonized Sales Tax (GST/HST) Credit is a tax-free quarterly payment issued by the Canada Revenue Agency (CRA). Its purpose is to help lower-income Canadians recover some of the sales taxes they pay throughout the year.

Unlike other benefits, there’s no separate application needed. When you file your income tax return, CRA automatically calculates whether you’re eligible and how much you’ll get.

For the July 2025 to June 2026 benefit year, payments are increasing by 2.7%, reflecting adjustments for inflation. While it may not sound like a lot, when combined with provincial top-ups, it can make a noticeable difference—especially for families and seniors.

2024 vs 2025: GST Credit Comparison Table

| Category | 2024 GST Annual Max | 2025 GST Annual Max | Difference |

|---|---|---|---|

| Single adult | $519 | $533 | +$14 |

| Married/common-law couple | $680 | $698 | +$18 |

| Per child under 19 | $181 | $184 | +$3 |

These figures are maximum amounts, and the actual amount you receive will be based on your net income and family size.

Who Qualifies for the 2025 GST Credit?

You’re eligible to receive the GST credit in 2025–2026 if:

- You are 19 years of age or older

- You are a Canadian resident for tax purposes

- You have filed your 2024 income tax return

- Your adjusted family net income falls within the CRA’s eligibility limits

Here’s a breakdown of common scenarios:

Single adult earning $35,000/year

Likely eligible for the full $533/year (or $133.25/quarter)

Couple earning $45,000 + 2 children

May receive up to $698 + $184 × 2 = $1,066/year ($266.50/quarter)

Senior living alone with $25,000 income

Eligible for full GST credit and may also receive a provincial top-up

Student aged 20 with little to no income

Likely to receive the full GST credit if they’ve filed taxes

Even if you made little or no income, filing your taxes ensures the CRA can assess your eligibility.

Provinces Offering Extra Top-Up Payments

In addition to the federal GST/HST credit, several provinces offer additional quarterly benefits—automatically rolled into your CRA payment.

Newfoundland and Labrador

- Offers NL Income Supplement, Senior Benefit, and Disability Credit

- Combined, eligible recipients could get up to $575.50 extra per quarter

Saskatchewan

- Families may receive $299 per quarter in extra support based on income and dependents

New Brunswick

- Top-ups can be worth $200 or more per quarter

Nova Scotia

- Offers an additional $93.75 quarterly benefit

Prince Edward Island

- Provides a modest $55 quarterly payment

These are non-taxable and automatic—you don’t need to apply separately. All you have to do is file your taxes and ensure your address and marital status are current with CRA.

How to Maximize Your Benefit As Canada Is Sending Out Larger GST Cheques?

Here’s a checklist to make sure you receive the maximum GST credit you’re entitled to:

1. File your taxes every year, even if you have no income

Not filing means CRA can’t assess your eligibility.

2. Claim all eligible dependents

Each child under 19 adds $184/year to your credit.

3. Update your CRA account

If you move, get married, divorced, or have a child, update your personal info immediately to avoid overpayments or underpayments.

4. Use direct deposit

It’s faster and more reliable than waiting for a mailed cheque.

How the GST Credit Connects with Other Government Benefits?

The GST credit is one of several income-tested federal programs. Filing your taxes ensures you’re also considered for:

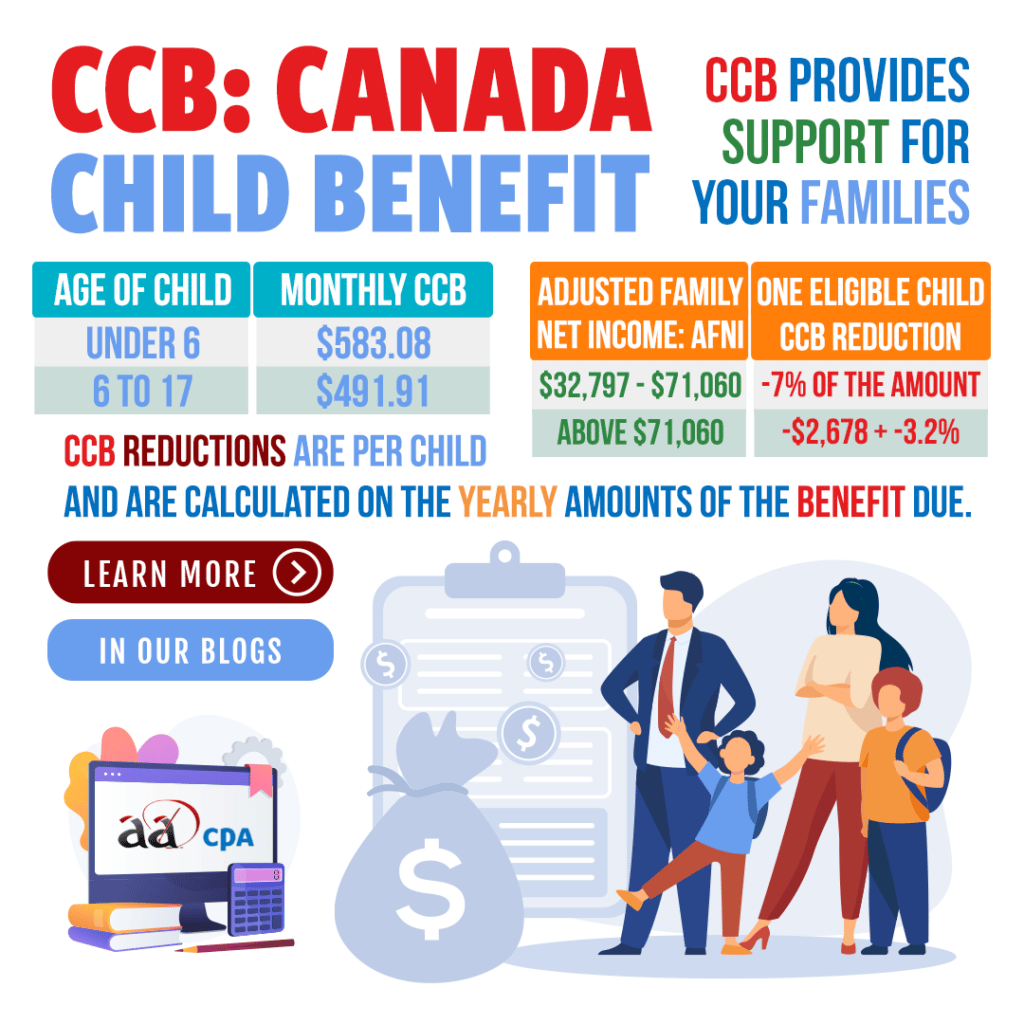

- Canada Child Benefit (CCB)

- Canada Workers Benefit (CWB)

- Climate Action Incentive Payment (CAIP)

- Guaranteed Income Supplement (GIS)

- Old Age Security (OAS)

If you’re low-income, these programs work together to boost your financial security. The government uses the same income information from your tax return to determine eligibility for all of them.

Common Mistakes That Could Cost You

Even though the process is simple, there are a few common mistakes people make that result in missed or reduced payments:

Not filing taxes: Even if you had zero income, you still need to file to get the credit.

Incorrect marital status: If you don’t update your status after a divorce or marriage, it could affect your benefits.

Outdated banking or mailing information: CRA can’t pay you if they can’t find you.

Unclaimed dependents: Not listing children or eligible family members could result in a lower payment.

Real-Life Example

Consider this example:

Jared, 42, lives in Saint John, New Brunswick. He’s a single father with two children and earns about $32,000 annually.

- GST Credit (federal): $133.25

- Children: $184 × 2 = $368

- NB Top-Up: $200

Total Quarterly Payment: $701.25

Total Annual Benefit: $2,805

That’s nearly $3,000 tax-free every year just from filing taxes and keeping his info up to date.

Is the $3,000 GST Cheque Real?

Let’s clear this up once and for all: No, there is no $3,000 GST cheque coming from the CRA.

This rumor likely stemmed from a one-time top-up issued in 2022 and 2024, which added roughly $250–$300 to GST credit payments. But those were temporary measures, not ongoing programs.

Multiple fact-checking sources, including ACTIA and Pioneer Worldwide, have confirmed that the $3,000 payout is false.

Payment Schedule for 2025–2026

GST/HST credit payments are made quarterly:

- July 5, 2025

- October 4, 2025

- January 3, 2026

- April 4, 2026

If the payment date falls on a weekend or holiday, the deposit usually arrives one business day early.

Canada Updates CRA Benefit Schedules for July 2025—Here’s What’s Coming Your Way