Canada Child Benefit Gets Surprise July Boost: The Canada Child Benefit (CCB) has been a crucial support program for families across Canada for years, helping millions of parents manage the costs associated with raising children. But in 2025, there’s a surprising twist that families weren’t expecting. The Canadian government has given the CCB a boost, offering higher payments to families. This increase comes just in time to help parents cope with the rising cost of living. But what does this mean for you? Are you eligible for more money, and how can you get it? Let’s dive in and break it all down.

Canada Child Benefit Gets Surprise July Boost

The Canada Child Benefit (CCB) has always been a vital financial lifeline for families across the country. With the July 2025 boost, families can expect higher payments and a $1,800 bonus, helping them navigate the economic challenges of today. If you’re a parent or guardian, make sure your CRA account is up to date and that you file your taxes on time to maximize your benefits.

| Key Details | Information |

|---|---|

| Increased CCB Payment | Maximum annual CCB increases by $200 per child, effective July 2025. |

| New Monthly Payments | Families can now receive up to $666.41/month for children under 6 and $562.33/month for children aged 6-17. |

| One-Time $1,800 Bonus | Eligible families will receive up to $1,800 per child as a one-time bonus in July 2025. |

| Eligibility | Based on 2024 tax returns; update CRA account with current family details. |

| Next Payment Date | July 18, 2025 (followed by monthly payments around the 20th of each month). |

| Official Source | Canada Revenue Agency |

Introduction to the Canada Child Benefit (CCB)

The Canada Child Benefit (CCB) is a program designed by the federal government to provide financial assistance to families with children under the age of 18. This payment helps families cover expenses like food, clothing, healthcare, and more. It’s a monthly benefit that is adjusted each year to keep pace with inflation. The good news? This July 2025 boost means more money for parents across Canada, offering them a bit more breathing room when it comes to managing everyday expenses.

This increase is especially welcome during a time when the cost of living has surged. With prices for food, gas, and other essentials climbing, the government has taken steps to provide additional relief, giving parents a little more financial support in an unpredictable world.

What’s New for 2025: The CCB Boost

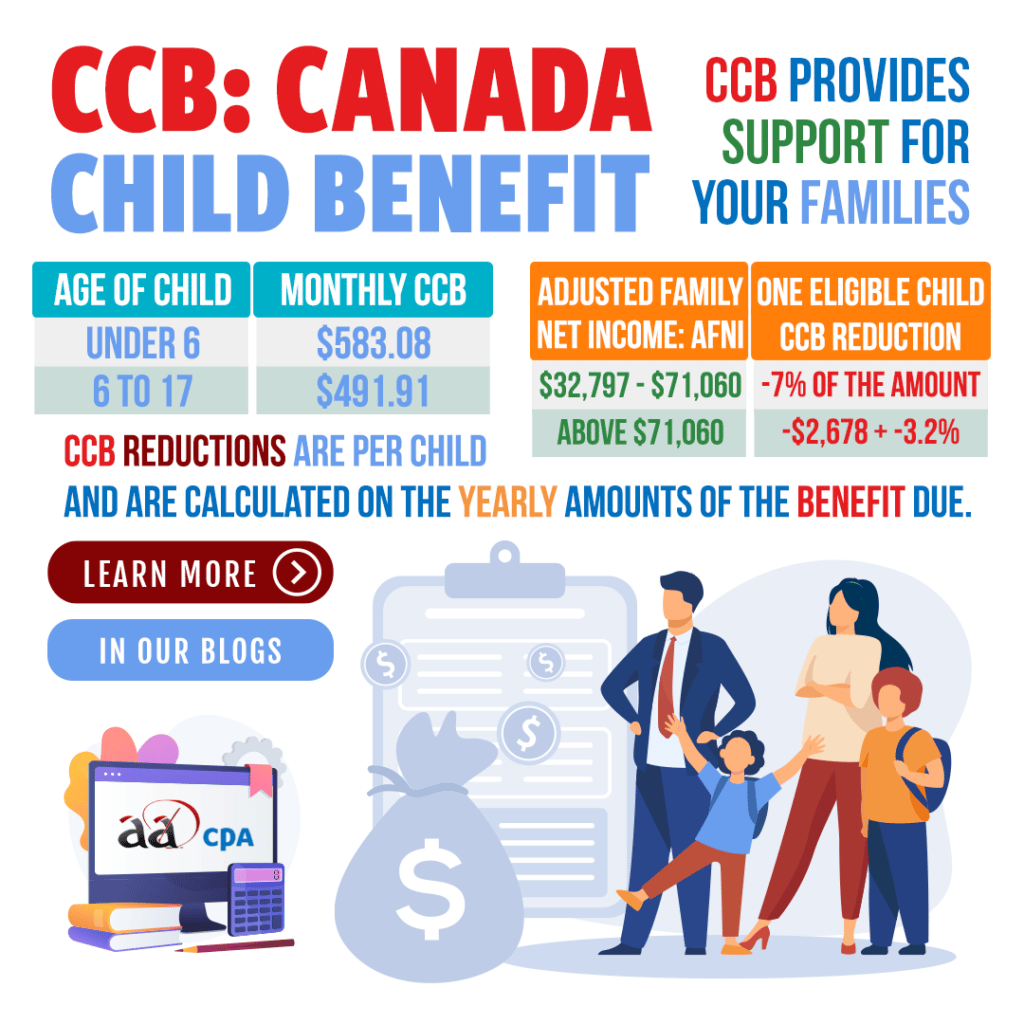

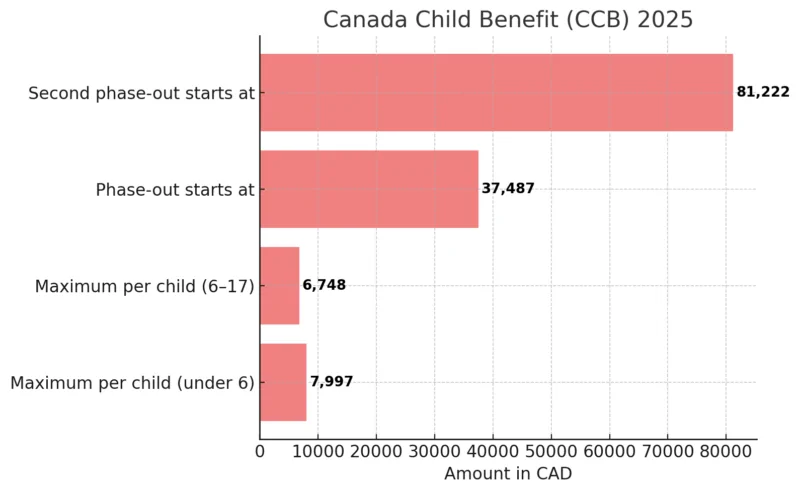

For the 2025 benefit year, which begins in July, the government has increased the maximum annual CCB payments for eligible families. This increase is part of an ongoing effort to adjust the CCB to keep pace with inflation. Families with children under 6 can receive up to $7,997 per year, which breaks down to $666.41 per month. For children between the ages of 6 and 17, families can get up to $6,748 per year (about $562.33 per month).

But there’s more. On top of the monthly payments, families will receive a one-time, tax-free bonus of up to $1,800 per child in July 2025. This lump sum is designed to provide a significant financial cushion to help cover the costs of raising children during these times of economic uncertainty.

Who Qualifies for the CCB Boost?

To qualify for the Canada Child Benefit, you need to meet certain criteria. Here are the key points:

- Eligibility is based on your tax return: You must file your 2024 tax return by April 30, 2025, to be considered for the July 2025 CCB payments. The Canada Revenue Agency (CRA) will determine your eligibility and calculate the amount based on your Adjusted Family Net Income (AFNI).

- Residency Requirements: You must be a Canadian resident. That means your primary home must be in Canada, and you should be living here with your children for at least 50% of the time.

- Children’s Ages: The child or children must be under the age of 18, and different payment rates apply based on the child’s age. As mentioned earlier, children under 6 will bring in a higher amount.

- Custody and Residency: Ensure that your CRA account reflects any changes in custody arrangements or if you’ve moved provinces. This will help avoid delays or issues with your payments.

If you’re unsure about your eligibility or want to check how much you could be receiving, the Canada Revenue Agency offers a helpful online tool called the Child and Family Benefits Calculator. This can give you a rough idea of your potential payments based on your income and family size.

The One-Time $1,800 Bonus

In addition to the regular monthly payments, families will receive a one-time bonus of up to $1,800 per child in July 2025. This is a special boost that the government is offering to help families through a period of higher-than-usual living expenses. The bonus will be paid automatically to eligible families based on their 2024 tax returns, so you don’t need to apply for it separately.

For those who have direct deposit set up with the CRA, payments will be processed quickly, meaning you could see that bonus hitting your bank account sooner rather than later.

Key Dates to Remember

The Canada Child Benefit is distributed on a monthly basis, but there are specific dates you need to keep track of. The payment schedule for the 2025 benefit year looks like this:

- July 18, 2025

- August 20, 2025

- September 19, 2025

- October 20, 2025

- November 20, 2025

- December 12, 2025

Subsequent payments will continue to arrive on or around the 20th of each month.

How Much Will You Get?

Here’s a simple guide to calculating your potential Canada Child Benefit for the 2025 benefit year:

- Number of Children: The more children you have, the higher your total benefit will be.

- Child’s Age: The benefit is different for children under 6 and those between 6 and 17.

- Adjusted Family Net Income (AFNI): The amount you receive will gradually decrease as your AFNI increases. This means higher-income families will receive less. For example, a family earning $45,000 annually with one child under 6 could receive approximately $7,471.09 annually, or about $622.59 per month.

This breakdown can help you better understand how the CCB works for your specific situation. And again, you can use the CRA’s Child and Family Benefits Calculator to estimate your exact payments.

How to Ensure You Receive the Canada Child Benefit Gets Surprise July Boost?

To qualify for the CCB and the July 2025 bonus:

- File your 2024 tax return by the April 30, 2025 deadline.

- Update your CRA My Account with your accurate banking and address details.

- Confirm custody and residency information for all children listed.

If you’ve recently moved provinces or changed custody arrangements, ensure your CRA account reflects these changes to avoid delays.

Tips for Maximizing Your CCB

While the Canada Child Benefit is based on your income and family size, there are a few things you can do to make sure you’re getting the full benefit you’re eligible for:

- File your taxes on time: This is essential. If you miss the April 30 deadline, you could delay your payments or risk not receiving the full benefit.

- Double-check your information: Ensure that your CRA account reflects accurate banking, address, and family information to avoid any delays in receiving payments.

- Understand how the CCB is calculated: The more you know about the CCB’s calculations (like how Adjusted Family Net Income impacts your payments), the better you can plan financially.

- Use the CRA’s Child and Family Benefits Calculator: This tool helps you estimate how much you can expect to receive, based on your specific circumstances.

What Expenses Can Be Claimed as Tax Deductions in Canada for 2025? Check Details

Canada Is Sending Out Larger GST Cheques—Here’s Who Gets the Bigger Payout

Canada Updates CRA Benefit Schedules for July 2025—Here’s What’s Coming Your Way