Average July Social Security Payments by Age Group: When most Americans think about retirement, Social Security is one of the first things that comes to mind. It’s not just a government program—it’s a safety net, a financial lifeline, and for many, a major part of their monthly income after they stop working. So if you’re asking yourself, “How much will I receive if I retire between ages 62 and 67?”, you’re not alone. The latest July 2025 Social Security data shows just how much those monthly payments can vary depending on when you claim your benefits. This article dives into the average July Social Security payments by age group from 62 to 67 across the U.S. We’ll break down the numbers, explain why they change so much by age, and offer tips to help you make the smartest decision for your future.

Average July Social Security Payments by Age Group

The average July Social Security payments by age group from 62 to 67 show just how much the timing of your claim can impact your retirement income. While it might be tempting to claim early, especially if you’re eager to stop working, waiting just a few more years could significantly boost your lifetime benefits. From understanding COLA increases and spousal benefits to maximizing your work history and knowing how taxes play a role, there are many moving parts. But with the right information and planning, you can make Social Security work smarter for you—not just harder.

| Age at Claiming | Average Monthly Benefit | Men | Women |

|---|---|---|---|

| 62 | $1,341 | $1,485 | $1,207 |

| 63 | $1,364 | $1,504 | $1,233 |

| 64 | $1,425 | $1,574 | $1,289 |

| 65 | $1,611 | $1,784 | $1,452 |

| 66 | $1,763 | $1,958 | $1,580 |

| 67 | $1,929 | $2,142 | $1,719 |

Why Benefits Increase the Longer You Wait?

Social Security benefits are calculated based on your average earnings over your 35 highest-paid working years. The age at which you choose to claim those benefits plays a major role in how much you’ll receive every month.

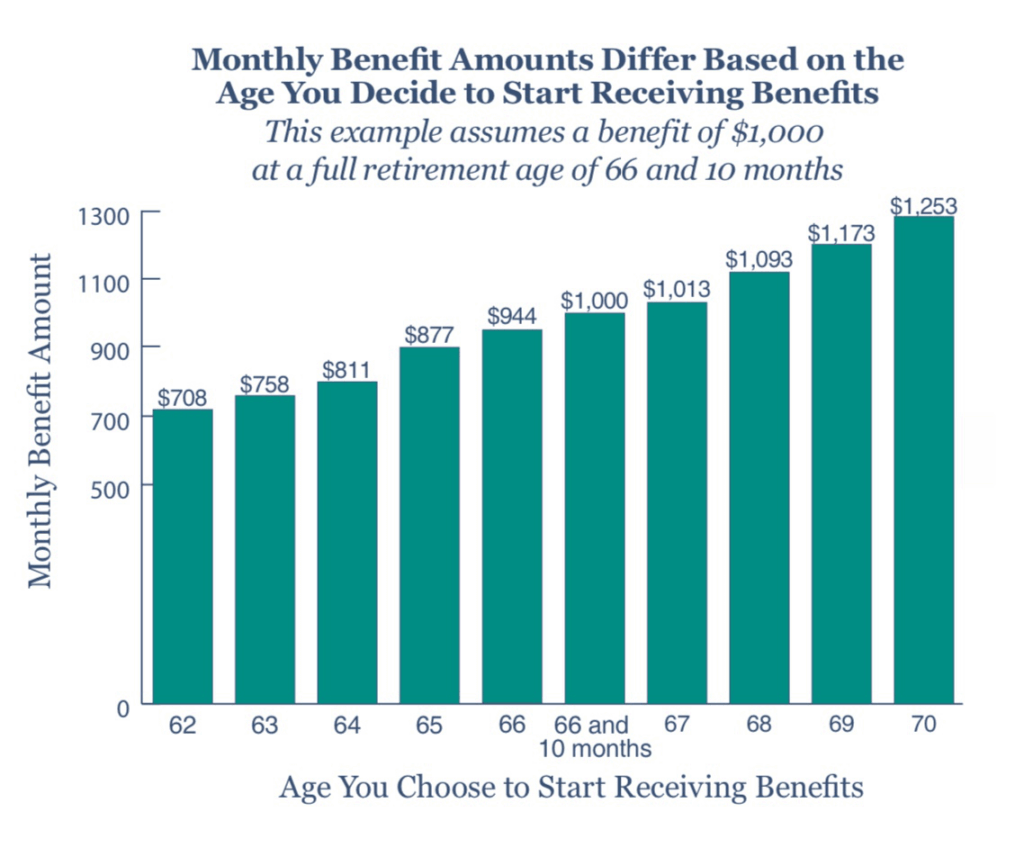

If you claim your Social Security at:

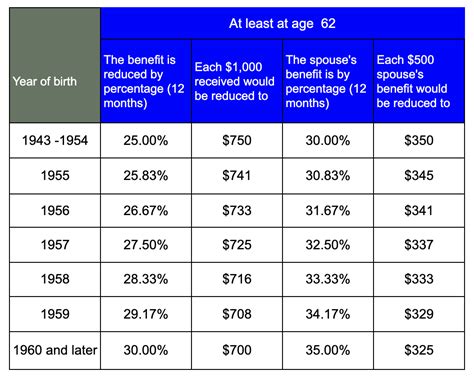

- Age 62 (the earliest possible age): You’ll receive about 70–75% of your full benefit.

- Age 67 (full retirement age for those born in 1960 or later): You’ll receive 100% of your benefit.

- Age 70: You’ll receive up to 132% of your full benefit, thanks to delayed retirement credits.

This tiered structure was designed to balance the system—those who retire early get more years of payments, but each check is smaller. Those who delay get fewer checks, but each one is significantly larger.

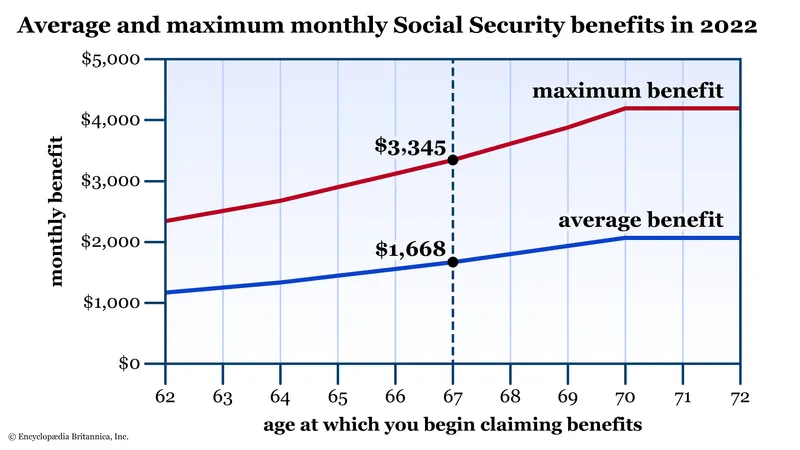

How Much More Do You Get by Waiting?

Let’s break this down with some real-world numbers.

Imagine someone eligible for $1,929 per month at age 67. If they claim early:

- At 62, they receive just $1,341/month—a $588 reduction.

- That’s a 30%+ loss every single month for the rest of their life.

Over the course of 20 years, that can add up to over $100,000 in lost income.

Real-Life Example: Dave vs. Linda

Let’s take two people, both eligible for a full benefit of $1,929/month at age 67.

- Dave retires early at 62, receiving $1,341/month.

- Linda waits until 67, receiving the full $1,929/month.

Over a 20-year retirement:

| Person | Monthly | Annual | 20-Year Total |

|---|---|---|---|

| Dave | $1,341 | $16,092 | $321,840 |

| Linda | $1,929 | $23,148 | $462,960 |

Linda ends up with $141,120 more just by waiting five more years to claim. That’s the power of understanding how Social Security works.

State-by-State Considerations

While Social Security is a federal benefit—meaning your monthly check doesn’t change based on where you live—the cost of living varies wildly.

In high-cost states like California, New York, or Hawaii, even $2,000 a month might not be enough to cover basic expenses. But in states like Mississippi, Arkansas, or West Virginia, your Social Security check might stretch much further.

What About COLA (Cost-of-Living Adjustment)?

Every year, Social Security benefits are adjusted based on inflation through what’s called the COLA.

In the past few years, COLA increases have looked like this:

- 2023: 8.7% (largest in over 40 years)

- 2024: 3.2%

- 2025 estimate: Expected around 2.6–3.0% (final number announced in October)

Even if you start at a lower benefit, your payment will go up each year with COLA. But the larger your base benefit, the more you gain from each percentage increase.

Example:

- Dave’s $1,341 benefit increased by 3.2% = +$42.91

- Linda’s $1,929 benefit increased by 3.2% = +$61.73

Gender Gap in Social Security

Let’s talk about something important: Men typically receive higher Social Security checks than women.

That’s due to several factors:

- Men tend to earn more over their lifetimes.

- Women often take career breaks for caregiving or work part-time.

- Women live longer on average, so their benefits need to last longer.

In July 2025:

- Men age 67 receive $2,142/month

- Women age 67 receive $1,719/month

That’s a $423 monthly gap, or over $5,000 per year. This makes retirement planning even more important for women, especially when deciding when to claim benefits.

How to Check Your Average July Social Security Payments by Age Group Amount?

Want to know what your benefit will look like? It’s easy.

Just create or log in to your mySocialSecurity account

From there, you can:

- View your estimated benefits at different ages

- Check your earnings record

- See how working longer affects your payments

Retirement Planning Checklist

Before you pull the trigger on claiming benefits, run through this list:

- Check your Full Retirement Age (FRA)

- Review your Social Security statement online

- Compare benefit amounts for claiming at 62, 67, and 70

- Evaluate other retirement income (pensions, 401(k), IRA)

- Consider your health and family longevity

- Speak with a financial advisor

- Review Medicare eligibility and timing

- Understand tax implications for your Social Security benefits

Tips for Maximizing Your Average July Social Security Payments by Age Group

- Work at least 35 years: The SSA uses your top 35 earning years to calculate benefits. Fewer years = lower average.

- Delay if you can: Every year you wait after 62 boosts your benefit, up until age 70.

- Avoid the earnings penalty: If you work while collecting benefits before your FRA, excess earnings may reduce your check temporarily.

- Use spousal or survivor benefits: You might qualify for up to 50% of your spouse’s or ex-spouse’s benefit, or 100% if they’ve passed away.

- Don’t forget taxes: Depending on your income, up to 85% of your Social Security could be taxable

Recent Adjustment to Social Security Benefits Raises Questions- Check Details!

Social Security Projected to Cut Benefits by 2033, Affecting Retired Workers

Trump’s ‘Big Beautiful Bill’ Sparks Debate Over Social Security and Benefits