Americans Set to Lose $110,000 in Earnings to Support Social Security: Social Security, one of the cornerstones of retirement planning for millions of Americans, is facing a significant challenge. The program, designed to support individuals in their retirement years, may soon be a lot less reliable, and workers across the U.S. could find themselves paying the price. According to new reports, young Americans, particularly those entering the workforce in 2025, could lose up to $110,000 in lifetime earnings as a result of rising payroll taxes and potential Social Security reforms. But what exactly does this mean for your financial future, and how can you better prepare for it? In this article, we’ll break down what’s happening with Social Security, why it’s important to pay attention now, and how you can safeguard your financial future in light of these changes.

Americans Set to Lose $110,000 in Earnings to Support Social Security

| Topic | Details |

|---|---|

| Estimated Loss per Worker | Up to $110,000 in lifetime earnings. |

| Proposed Payroll Tax Increase | Potential increase to 16.05% from 12.4%. |

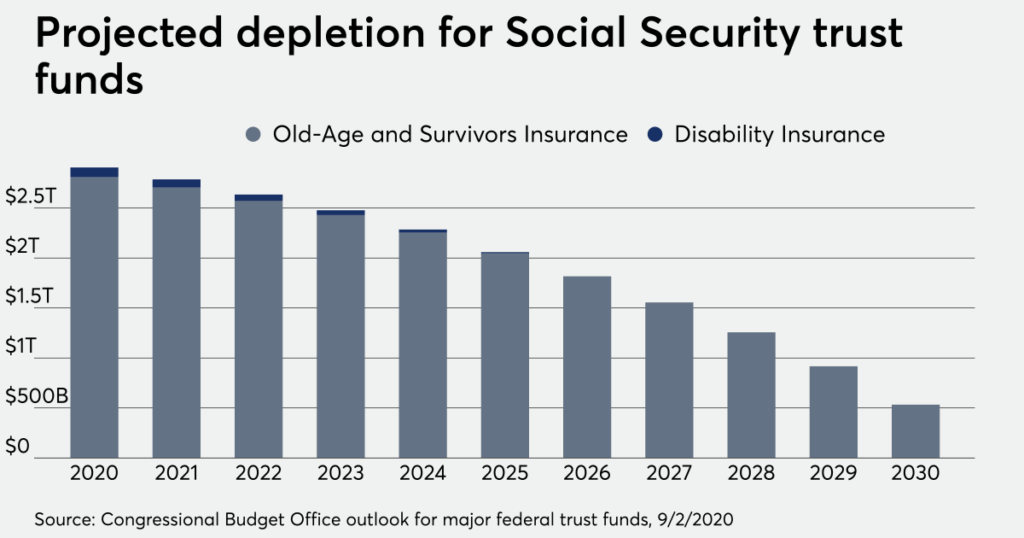

| Social Security Trust Fund Depletion | Projected to run out by 2033 unless reforms are made. |

| Recommended Action | Plan early: Consider alternative retirement savings options. |

| Important Resources | Social Security Administration, Cato Institute |

What’s Happening with Social Security?

The Issue with Social Security’s Future

Social Security has long been seen as a safety net for older Americans, a system that ensures income during retirement, or in the case of disability or death. But here’s the catch: the Social Security trust fund is running out of money. The latest projections show that the trust fund will be depleted by 2033, leading to a reduction in benefits for everyone who relies on it. In simpler terms, if the government doesn’t act soon, Americans may only receive about 79% of the benefits they’re currently promised.

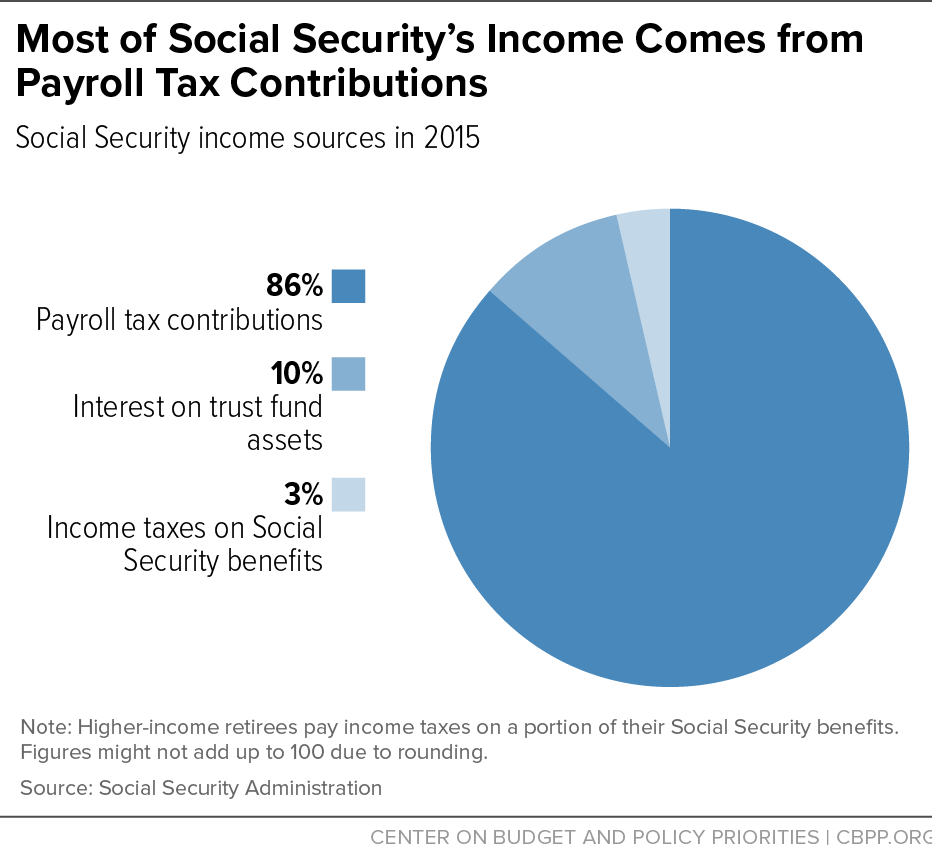

That’s where the $110,000 comes in. In order to keep Social Security running, the government may have to raise the payroll tax, which is what workers pay into the system with each paycheck. This increase will hurt younger generations the most because they will be paying more into the system without seeing the same benefits in return. If taxes rise from 12.4% to 16.05%, as some proposals suggest, young workers could lose up to $110,000 in earnings over their lifetime. So, let’s break down what that means for you.

The Cost to the American Worker

Americans are already facing a difficult economic environment with rising costs and inflation, and the thought of higher taxes can be a bitter pill to swallow. A median worker starting their career in 2025 could face this significant reduction in their lifetime earnings. For most workers, the extra tax burden means less money for things like saving for retirement, buying a home, or even just enjoying life. The increased payroll tax is particularly damaging for younger generations who are still building their careers and financial futures.

What Will This Look Like in Practice?

Imagine you’re in your early 20s, just starting your career. You’re excited to get your first paycheck, but then you notice a larger chunk being taken out for Social Security. While this feels like just another tax, it’s actually a sign of bigger problems ahead.

Let’s say you’re making $50,000 per year. Under the current system, you’d pay approximately $6,200 into Social Security. If the tax rate increases by just a few percentage points, that number jumps to nearly $8,000. Over the course of your career, that extra $1,800 per year could add up to thousands of dollars that could have been saved, invested, or spent on other things that benefit your long-term financial health.

How Americans Set to Lose $110,000 in Earnings to Support Social Security Affects Your Retirement?

Social Security and Retirement

At first glance, the idea of paying more taxes to secure future Social Security benefits might seem like a good thing. After all, it ensures that the system will be around for future retirees. But here’s the problem: Social Security was never meant to be your primary source of retirement income. It was designed to supplement your personal savings and investments. Relying solely on Social Security, especially with the potential reductions in benefits, is a risky strategy.

This is why it’s crucial to have a multi-faceted approach to your retirement planning. It’s not enough to assume Social Security will be enough to get you through your golden years.

The Role of Personal Savings and Investment

To combat the potential reduction in Social Security benefits, it’s a good idea to increase your focus on personal savings and investment. Here’s a guide to getting started:

Step 1: Maximize Your 401(k) Contributions

If your employer offers a 401(k) plan, contribute as much as possible, especially if they offer a match. This is essentially “free money,” and it can grow significantly over time with compound interest.

Step 2: Start an IRA (Individual Retirement Account)

Beyond your 401(k), consider starting an IRA. IRAs have tax advantages and can help you build wealth for retirement. A Roth IRA allows for tax-free growth, making it a great option for younger workers who are still in lower tax brackets.

Step 3: Invest in Stocks, Bonds, and Mutual Funds

The stock market can offer higher returns over the long term compared to other types of investments. Educate yourself on different types of investments and consider speaking with a financial advisor to build a well-diversified portfolio.

Step 4: Live Below Your Means

This one might sound basic, but it’s essential. The more money you can save and invest now, the better prepared you’ll be for whatever comes your way in the future.

Other Potential Solutions

While Social Security reforms are a hot topic, there are several potential solutions that Congress is considering. These include raising the retirement age, changing how cost-of-living adjustments are calculated, and increasing the payroll tax. Each of these options comes with its own set of challenges and would likely affect different groups of people in various ways.

Social Security Reform – What Could Happen?

Reforms could take several forms, including:

- Raising the retirement age: If the age at which you can begin claiming Social Security benefits increases, you may have to work longer before receiving benefits.

- Reducing cost-of-living adjustments (COLAs): This would mean that your Social Security benefits would not increase as much over time, potentially reducing your purchasing power.

- Payroll tax increase: As mentioned, raising payroll taxes would reduce your lifetime earnings, but it could also keep Social Security solvent longer.

Taking Action: What You Can Do Now

If you’re reading this, it’s not too late to start planning for the future. Whether you’re just beginning your career or nearing retirement, there are several steps you can take now to protect your financial security.

- Start saving and investing as early as possible.

- Diversify your retirement accounts to include both tax-deferred and tax-free options.

- Keep an eye on Social Security news and adjust your plans accordingly.

- Work with a financial advisor to ensure your retirement plan accounts for potential reductions in Social Security.

How Young Workers Can Adapt?

For young workers, the key is to start early. The sooner you begin to invest and save, the less you will rely on Social Security. Here’s an example: If you start investing $200 a month at the age of 25 and earn an average return of 7% per year, you could accumulate $500,000 by the time you turn 65. That’s a hefty chunk of retirement savings that could help make up for the potential shortfall in Social Security benefits.

How Older Workers Can Adapt?

Older workers, particularly those approaching retirement, need to make sure their Social Security strategy is in line with future changes. If you’re nearing retirement, it might be a good idea to delay claiming Social Security benefits. By waiting until age 70 to claim, you can get a 76% higher benefit compared to claiming at age 62.

For those who are close to claiming benefits, it’s crucial to consider if working longer might be beneficial to your financial well-being, especially if Congress increases the retirement age.

4 Financial Mistakes Americans Keep Making That Wreck Their Budgets

Trump’s ‘Big Beautiful Bill’ Could Reshape Social Security for Millions of Americans

Social Security Claims Are Surging — 5 Alarming Reasons You Should Act Fast