All Retirees Must Do This on October 15: If you’re collecting Social Security or planning to soon, then listen up, friend—October 15 isn’t just any ol’ day on the calendar. It’s the day that could make or break your retirement cash flow. Miss this, and you might be leaving thousands of dollars on the table. No kidding.

Every year on October 15, the Social Security Administration (SSA) announces the official Cost-of-Living Adjustment (COLA) for the upcoming year. For 2026, that day is once again front and center. This adjustment affects how much you’ll get in Social Security benefits starting in January. So yeah, it’s kind of a big deal. Understanding how COLA works, how it’s calculated, and what steps you should take to prepare can help you maximize your retirement benefits. Let’s dive into everything you need to know.

All Retirees Must Do This on October 15

October 15 isn’t just a date—it’s a financial checkpoint for retirees and anyone on Social Security. The COLA announcement affects everything from your monthly income to your Medicare premiums and tax bill. Don’t sleep on this. Mark the date, crunch your numbers, and make sure your budget’s on point. And hey, if this all feels overwhelming, talk to a financial advisor or tax pro who understands retirement planning. A little prep goes a long way.

| Item | Details |

|---|---|

| Event | Social Security COLA announcement |

| Date | October 15, 2025 |

| Impact | Directly affects monthly Social Security checks |

| 2025 COLA estimate | 2.6% (subject to change with final inflation data) |

| Source | SSA Official Site |

| Who it affects | Retirees, SSDI recipients, survivors, and SSI recipients |

| Why it matters | Missing updates could mess up budgeting, tax planning, and Medicare |

What Is COLA and Why Should You Care?

COLA stands for Cost-of-Living Adjustment. It’s a yearly tweak the SSA makes to Social Security benefits to keep up with inflation. Think of it like a raise to help cover rising grocery bills, gas prices, and doctor visits.

The Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) is the magic formula behind the COLA. The SSA compares average inflation data from July, August, and September. Then, boom—out comes the new COLA percentage.

Real Talk: How It Affects Your Wallet

If your monthly Social Security check is $2,000 and the COLA is 2.6%, you’d get an extra $52 per month—that’s $624 a year. Now imagine if you’re not aware of this, and you don’t adjust your budget, taxes, or Medicare plans. That can cause real headaches.

It’s also important to note that COLA doesn’t always keep up with the actual cost of living. Many seniors report that their real expenses—especially medical and housing—rise faster than the COLA increase. So, while it’s helpful, it’s not a golden ticket.

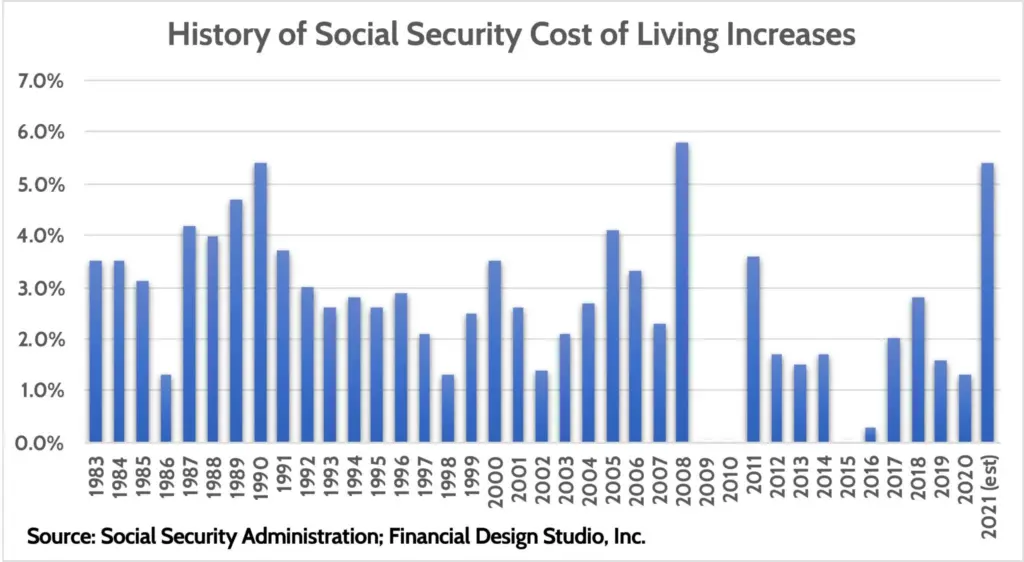

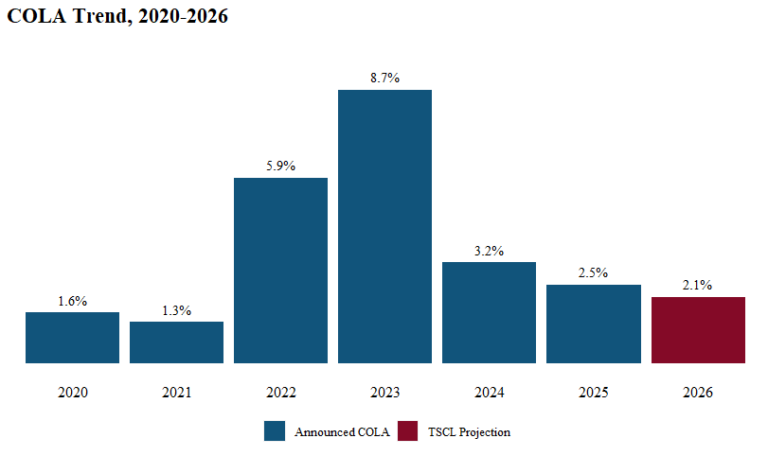

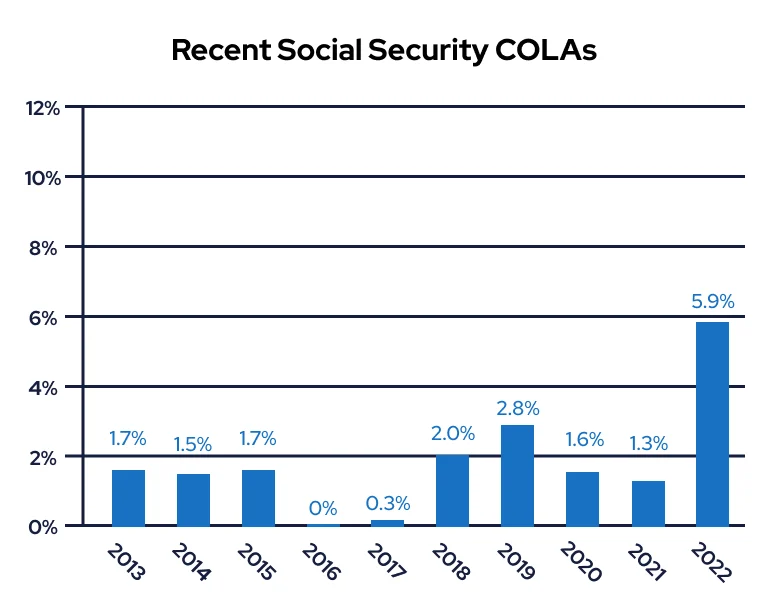

Historically, COLA has ranged from 0% (in flat years like 2016) to 8.7% (a record in 2023). This means the adjustment can significantly impact your quality of life if planned correctly—or erode your savings if ignored.

COLA vs. Real Inflation – The Hidden Gap

While COLA helps cushion retirees against inflation, it doesn’t always reflect the true increase in living expenses. The SSA bases its calculations on the CPI-W, which tracks inflation experienced by urban wage earners—not retirees.

But older adults typically spend more on healthcare, housing, and prescription drugs—costs that rise faster than average inflation. A 2024 report from the Senior Citizens League states that Social Security benefits have lost 36% of their buying power since 2000. Many experts argue for a shift to the CPI-E, a separate index designed for elderly spending habits, but for now, COLA is what retirees must work with.

Step-by-Step: What All Retirees Must Do This on October 15

Step 1: Mark the Date

Circle October 15 on your calendar. Set a phone reminder. Tattoo it on your memory. This is the day the SSA goes public with next year’s COLA.

Step 2: Visit the Official Source

Go to the SSA’s official website. This is the most accurate, up-to-date info.

Step 3: Calculate Your New Benefits

Take your current benefit and multiply it by the new COLA percentage. For example:

- Current benefit: $2,000

- COLA: 2.6%

- New benefit: $2,052 starting January 2026

You can also use calculators provided by AARP and other financial organizations to plug in your data and see personalized results.

Step 4: Review Medicare Premiums

The COLA might push you into a higher Medicare Income-Related Monthly Adjustment Amount (IRMAA) bracket. That means you could pay more for Medicare Part B or D.

Medicare premiums typically rise with income, and a modest COLA increase could mean a significant premium hike if you’re on the edge of an income threshold.

Step 5: Adjust Tax Withholding

Your new income may bump your tax bracket or withholding rate. Talk to a tax pro or use the IRS Tax Withholding Estimator

Failing to update your tax withholding can result in a surprise tax bill in April. Don’t wait—review your W-4V form and adjust accordingly.

The Bigger Picture: Budgeting for 2026

Inflation Ain’t Slowing Down

According to the U.S. Bureau of Labor Statistics, inflation was about 3.3% as of mid-2025. Even if the COLA lands at 2.6%, that’s below real-world cost increases for many folks.

So, don’t just rely on COLA. Revisit your:

- Grocery spending

- Health care costs

- Emergency fund

- Travel and fun money

- Long-term care needs

A thorough review of your monthly budget can help you identify waste, redirect funds, and stretch your benefits further.

Retirees with Side Gigs: Watch Out

If you earn over $25,000 (individual) or $32,000 (couples) from combined sources, a portion of your benefits could be taxable. The COLA could increase this amount, so plan ahead.

Don’t Forget About Estate Planning

An increase in your Social Security benefits may influence your overall financial picture, including your estate planning documents. Review:

- Wills and trusts

- Power of attorney

- Beneficiary designations

Make sure everything is updated to reflect your current situation.

State-Level Impacts of COLA

Your federal Social Security increase might also influence your state benefits. Many states adjust Medicaid, energy assistance, and supplemental income programs based on income thresholds. A higher COLA could unintentionally disqualify someone from benefits unless the state updates its income eligibility levels.

If you receive state-level assistance, contact your state Department of Human Services or local Area Agency on Aging after October 15 to learn how COLA might affect your eligibility.

When Will You See the New Payment?

The COLA takes effect in January, but your first increased payment will likely hit your account depending on your birthday:

- Born 1st–10th: Payment on the second Wednesday of the month

- Born 11th–20th: Payment on the third Wednesday

- Born 21st–31st: Payment on the fourth Wednesday

For those receiving SSI, the payment typically arrives on the first of the month.

Pro Tips from the Pros

Tip #1: Use SSA’s Online Tools

Create a my Social Security account to get real-time updates, view your benefit statements, and estimate future payouts.

Tip #2: Use a Retirement Calculator

Plug in your new COLA-adjusted benefits into a tool like the AARP Retirement Calculator to see how it affects your overall financial health.

Tip #3: Consider a Roth Conversion

If your COLA bump pushes you into a new tax bracket, consider converting some of your traditional IRA into a Roth IRA in 2025. That might help minimize your future tax load.

Tip #4: Revisit Long-Term Care Planning

If your COLA increase boosts your monthly income, think about allocating a portion toward long-term care insurance or savings. This could be critical down the line when medical costs soar.

Tip #5: Schedule a Year-End Financial Check-In

Meet with a financial advisor before the end of the year to reassess:

- Income projections

- Tax liabilities

- Health care expenses

- Estate plans

It’s always better to plan proactively than react to surprises.

Common Misconceptions—Busted

“COLA is a bonus.”

Nope. It’s not a gift. It’s an adjustment to maintain your buying power.

“Everyone gets the same COLA.”

True—but how much you receive depends on your base benefit.

“I don’t have to do anything.”

Technically true, but not acting means you could lose money through bad budgeting, incorrect Medicare planning, or tax issues.

“I’ll be notified automatically.”

Not necessarily. If you’ve opted out of paper mail or haven’t set up your my Social Security account, you might miss key updates. Always double-check.

Trump’s ‘Big Beautiful Bill’ Sparks Debate Over Social Security and Benefits

Republican Senator Lays Out Social Security Changes That Could Reshape Future Benefits

Paper Checks to Be Phased Out — Social Security Pushes for Electronic Payment Transition