DWP Under Pressure to Overhaul Popular Pension Perk: The Department for Work and Pensions (DWP) is facing growing scrutiny from MPs, charities, and policy experts over its handling of Pension Credit, a key welfare benefit used by around 1.3 million retirees across the United Kingdom. Designed to provide income support to pensioners on low incomes, this benefit is increasingly viewed as outdated, underclaimed, and too complex for many elderly citizens to access. Yet despite the support it offers, over 700,000 eligible retirees fail to claim it, resulting in more than £2.1 billion going unclaimed each year. With rising pensioner poverty, inflation, and the cost of living crisis continuing into 2025, calls for reform are growing louder and more urgent. Let’s dive into what Pension Credit is, why it matters, and what steps you (or a loved one) can take right now.

DWP Under Pressure to Overhaul Popular Pension Perk

Pension Credit is meant to ensure that no elderly person in the UK faces retirement in poverty. But with more than 700,000 retirees missing out, the system is clearly not fit for purpose. Between the “cliff-edge” rules, complex forms, and poor outreach, many pensioners are slipping through the cracks. With the pressure mounting on the DWP from MPs, charities, and watchdogs, reforms may finally be on the way. Until then, it’s crucial for families, communities, and advisors to help spread the word and ensure those who need help most can access it.

| Key Topic | Details |

|---|---|

| What is Pension Credit? | A benefit that tops up low retirement incomes to a minimum threshold |

| Value | Up to £4,000 per year per household |

| Number of Claimants | 1.3 million retirees currently claim |

| Estimated Missed Claims | Over 700,000 eligible pensioners are missing out |

| System Flaws | Complex application, lack of awareness, cliff-edge income rules |

| Who Is Pushing for Reform | MPs, DWP Committee, Age UK, Resolution Foundation |

| Official Source | gov.uk/pension-credit |

What Is Pension Credit and How Does It Work?

Pension Credit is a means-tested benefit for people over State Pension age (currently 66 in the UK). It’s meant to ensure that older citizens do not fall below a basic income level. There are two parts:

- Guarantee Credit – Topping up your weekly income to:

- £227.10 for single people

- £347.65 for couples

- Savings Credit – A reward for people who have modest savings or a small pension beyond the State Pension. This only applies if you reached State Pension age before April 6, 2016.

Pension Credit also acts as a “passport benefit.” If you qualify, you can receive a host of other free or discounted services, including:

- Free NHS dental treatment and glasses

- Council Tax Reduction

- Housing Benefit

- Warm Home Discount

- Free TV licence (for over-75s)

- Help with energy bills

Why DWP Under Pressure to Overhaul Popular Pension Perk?

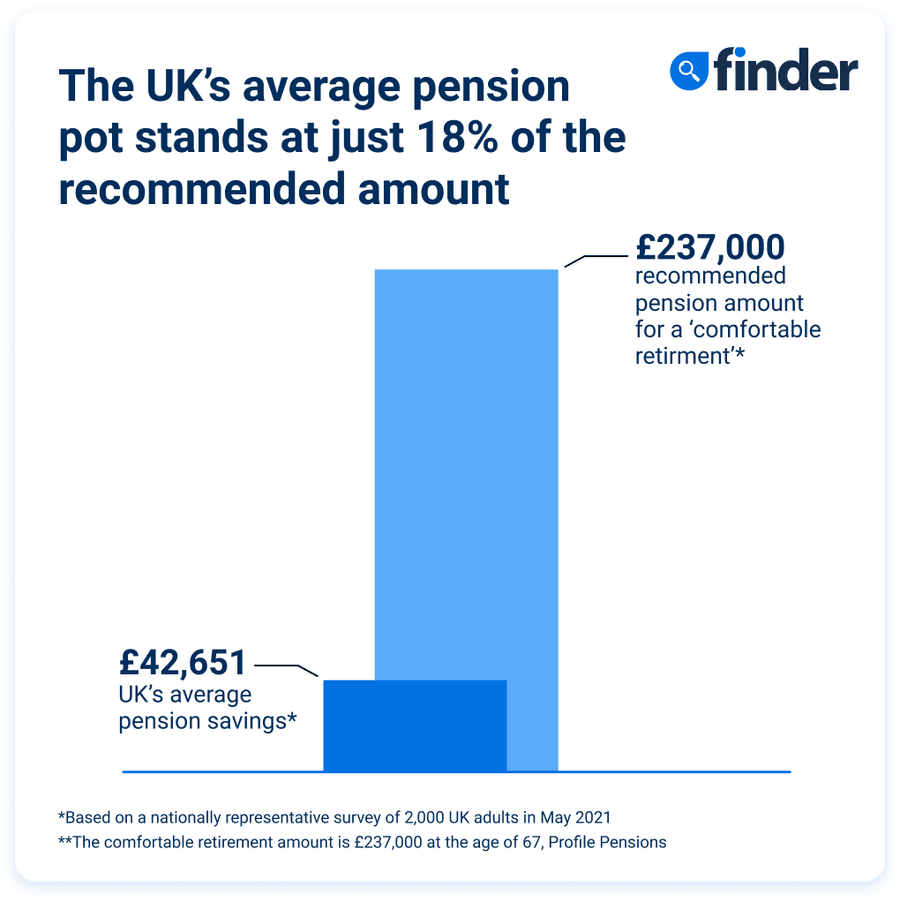

Despite the benefit’s value, over a third of eligible retirees never claim it. The reasons are varied and troubling:

- Lack of awareness – Many older people simply don’t know they qualify.

- Stigma – Some retirees don’t want to be seen as “on benefits.”

- Application complexity – The process can be overwhelming, especially for older people without internet access or digital skills.

- “Cliff-edge” disqualification – If your income is just a few pounds over the threshold, you may lose all benefits—making the system feel unfair.

A Real Case Study: Frank and Lorna

Frank and Lorna, a retired couple from Birmingham, were struggling to make ends meet on a joint weekly income of just £320. After speaking to a neighbor, they learned about Pension Credit and called the DWP helpline. Within six weeks, they were receiving an additional £27 per week, plus a rebate on their council tax.

“Before, we were choosing between heating and groceries,” Lorna says. “Now, we can manage both. It’s not luxury, but it’s peace of mind.”

Yet they almost missed out—until a casual chat prompted action. That story is far too common.

The System’s Biggest Flaw: The “Cliff-Edge”

One of the harshest criticisms of Pension Credit is its “cliff-edge” nature. That means if a retiree earns just £1 over the threshold, they lose access to the entire benefit—and all the extra services it unlocks.

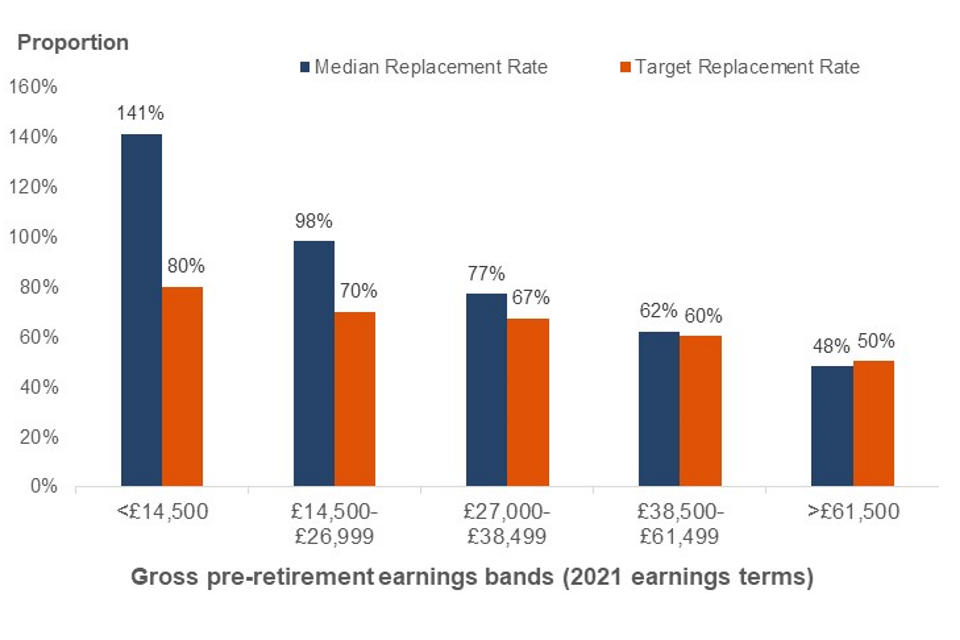

This discourages retirees from saving, working part-time, or taking on small pensions. A more balanced approach would involve a taper system, where the benefit gradually reduces as income rises.

According to the Resolution Foundation, such a system would help incentivize savings and support financial independence in retirement.

How the UK Compares Globally?

Across the world, most developed countries provide some form of senior income protection:

- Canada offers the Guaranteed Income Supplement, which is automatically added based on tax returns.

- Sweden has a guaranteed pension plus housing allowance, adjusted annually and fully digital.

- In the United States, low-income seniors receive Supplemental Security Income, and there are state-run pension top-ups with simpler enrollment.

By comparison, the UK requires pensioners to know about, apply for, and navigate a complex benefit to receive what many see as a basic human right.

Who’s Calling for Reform?

The calls for change are widespread and growing:

- The Work and Pensions Select Committee has recommended simplifying the application process and introducing a taper.

- Age UK has called the current system “inaccessible and outdated.”

- Labour MPs and some Conservative backbenchers agree that more aggressive outreach and automation are needed.

- Citizens Advice reports a 25% increase in over-65s needing help with benefit forms since 2022.

Why It Matters to You (Even If You’re Not Retired)

Whether you’re in your 30s, 40s, or 50s, this issue still affects you. Here’s why:

- Your parents or grandparents may be eligible.

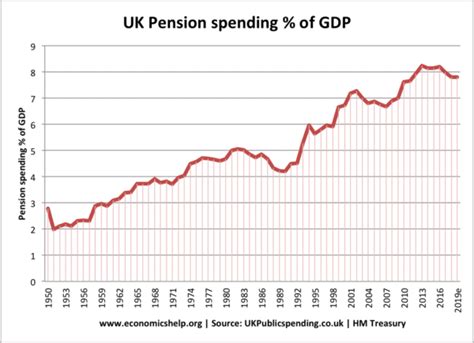

- You’re paying taxes into the system now—you’ll want it to work later.

- A fairer system reduces strain on healthcare, social housing, and community services.

Early access to help reduces health issues, debt, and even homelessness in older populations. That’s not just compassionate—it’s cost-effective public policy.

How to Check If You or Someone You Know Qualifies

Step 1: Check Eligibility

- Must be over State Pension age (66)

- Savings under £10,000 won’t affect the claim. Over that? There’s a small deduction.

- Income below £227.10/week (single) or £347.65/week (couple)

Step 2: Gather Documents

Have these ready:

- National Insurance number

- Bank account details

- Details of income and savings

- Housing costs, rent, or service charges

Step 3: Apply

- Online: www.gov.uk/pension-credit

- Phone: Call 0800 99 1234 (free from UK landlines and mobiles)

- Post: Request a form if you prefer paper-based applications

If you’re helping someone else, you can act on their behalf with their permission.

£150 DWP Payment Extended — See If Your Household Now Qualifies

Free £300 DWP Payment Coming Soon — Opening Date Just Announced for UK Households

£150 DWP Payment Confirmed for Millions — Find Out If Your Household Qualifies