Do You Really Need $1 Million to Feel Financially Comfortable? Let’s talk about the money myth we’ve all heard at some point: “If I had a million bucks, I’d be set for life.” That $1 million goal sounds like the holy grail of financial freedom. But is it really enough in today’s economy? Whether you’re planning your retirement, paying off debt, or just starting to save, the idea of needing $1 million can feel either like a comfort blanket or a mountain too steep to climb. But the real truth? Financial comfort has less to do with hitting a specific number and more to do with how you manage your money and your lifestyle. In this article, we’ll break down exactly what it means to feel financially comfortable in 2025, if $1 million still cuts it, and how you can find your number — not someone else’s. Let’s dive in.

Do You Really Need $1 Million to Feel Financially Comfortable?

So, do you really need $1 million to feel financially comfortable? Not necessarily. For some, that number may be more than enough. For others, it might not even scratch the surface. The key is to understand your needs, budget your expenses, and build your plan. Focus less on chasing round numbers and more on building sustainable habits and multiple income streams. Financial comfort doesn’t come from hitting a million — it comes from knowing you’re prepared.

| Topic | Details |

|---|---|

| Target Keyword | Do you need $1 million to feel financially comfortable |

| Average ‘comfortable’ net worth (U.S.) | $839,000 – Charles Schwab Modern Wealth Survey |

| Average ‘wealthy’ net worth (U.S.) | $2.3 million |

| Generational expectations | Gen Z: $329K, Millennials: $847K, Gen X: $783K, Boomers: $943K |

| Common retirement rule | 4% Rule – $1M gives $40K/year |

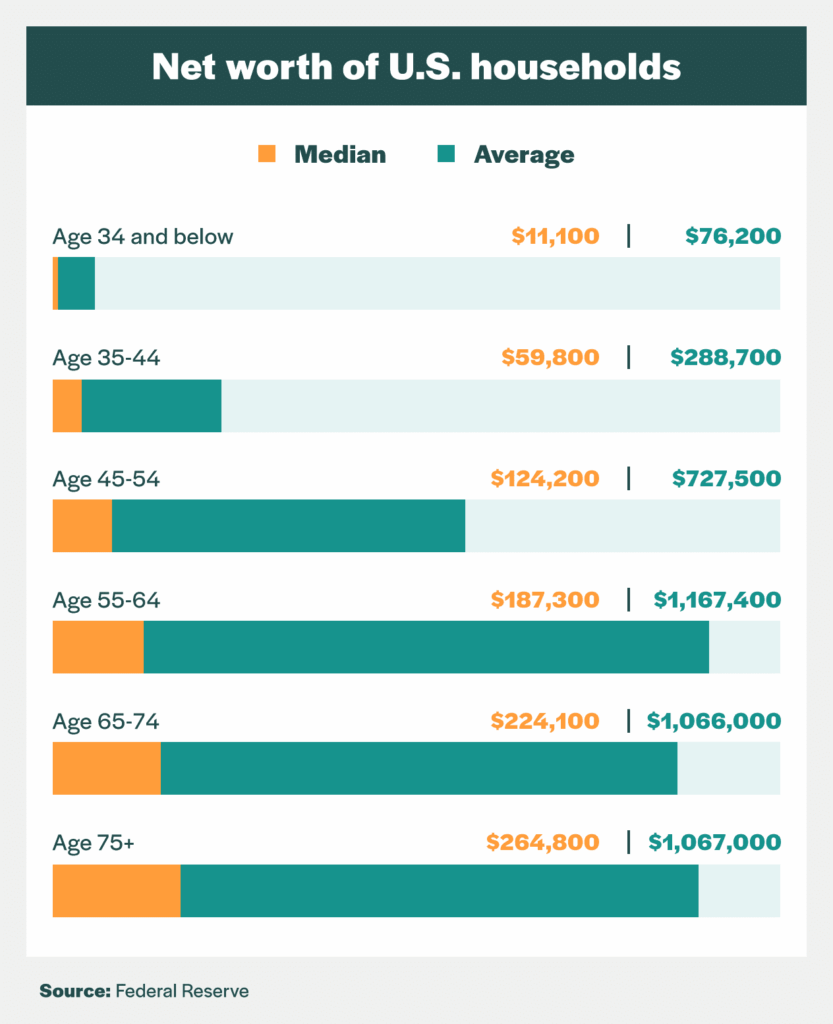

| Retirement savings average (age 55-64) | $408,000 – Federal Reserve SCF |

What Does “Financially Comfortable” Really Mean?

The term financially comfortable isn’t about being rich or never working again. It means you can afford to:

- Cover your bills and necessities without stress

- Handle unexpected expenses without going into debt

- Save for the future consistently

- Spend a little on fun and personal goals without guilt

It’s more about peace of mind than luxury. For many, comfort means living debt-free, being able to help family, and not worrying about every bump in the road.

Why $1 Million Isn’t Always Enough Anymore?

Back in the 80s or 90s, $1 million could stretch a long way. You could buy a house, raise kids, and retire comfortably with some change left. But in 2025? That money doesn’t have the same buying power.

Here are the main reasons why $1 million may not be the “you made it” moment anymore:

1. Inflation Is Reducing Purchasing Power

The cost of living has increased sharply in recent years. Just in the last decade, prices for housing, food, healthcare, and services have surged, especially in urban areas. A dollar saved in 2010 buys less today.

2. Healthcare Costs Are Climbing

A retired couple may need over $300,000 just to cover medical expenses during retirement. That’s a huge chunk out of your million before you even get to enjoy it.

3. Longevity Means Your Money Needs to Last Longer

People are living longer. If you retire at 65 and live to 95, that’s 30 years of covering expenses. Even with conservative estimates, $1 million may not stretch that far unless you’re living extremely lean.

4. Real Estate and Rent Costs Are Soaring

In places like California, New York, and even many mid-sized cities, housing eats up a large portion of income. Owning a modest home in these areas can cost upwards of $800,000.

What the Data Says – How Much Do People Really Think They Need?

According to the 2025 Charles Schwab Modern Wealth Survey, Americans say they need $839,000 to feel financially comfortable — not quite a million. But to feel “wealthy,” they peg the number at $2.3 million.

Breakdown by Generation:

| Generation | Comfortable | Wealthy |

|---|---|---|

| Gen Z (18–27) | $329,000 | $1.7 million |

| Millennials (28–43) | $847,000 | $2.1 million |

| Gen X (44–59) | $783,000 | $2.1 million |

| Boomers (60–78) | $943,000 | $2.8 million |

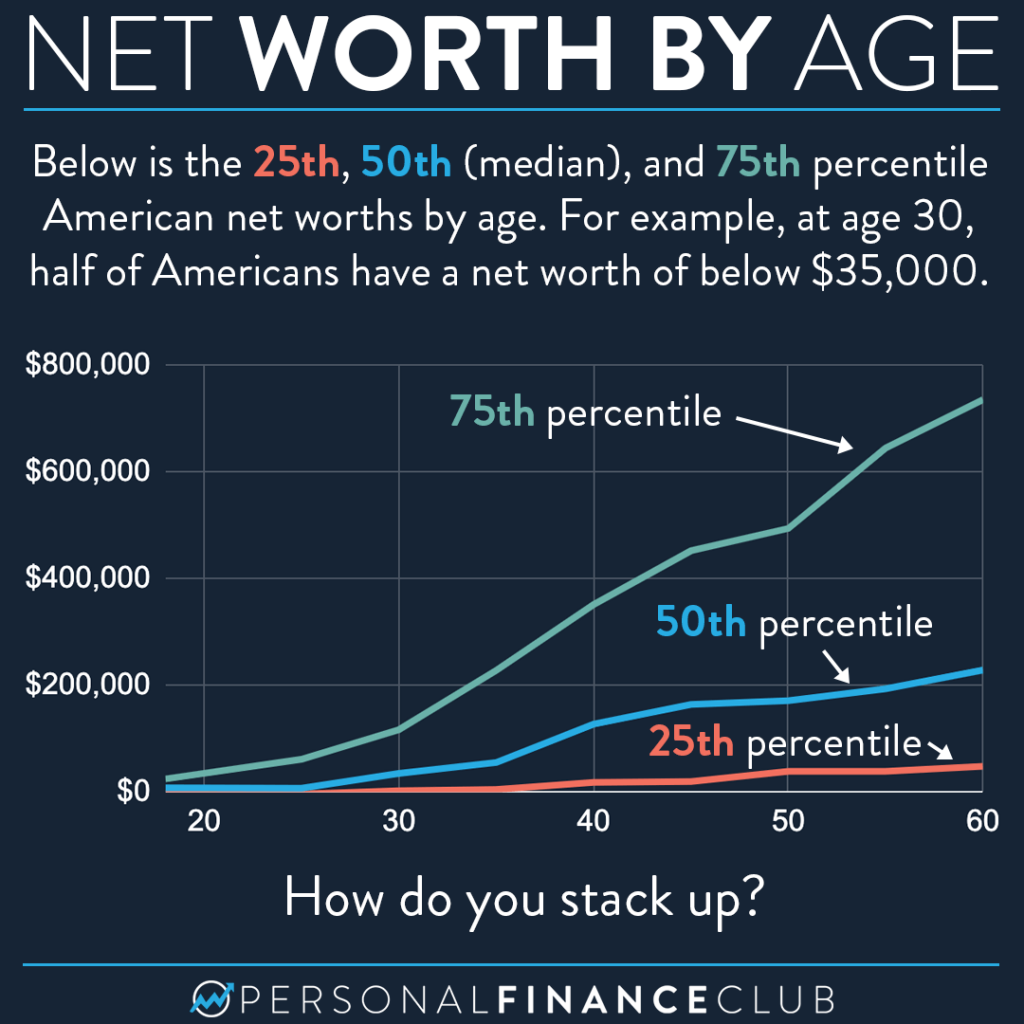

These numbers reflect more than just savings — they include investments, real estate equity, business value, and other assets.

How Far Does $1 Million Really Go?

If you follow the widely used 4% Rule, which says you can safely withdraw 4% of your retirement savings annually, $1 million gives you:

$40,000 per year

That’s before taxes and assumes no major emergencies. For someone living in a low-cost area, this might be enough. But if you’re paying rent in a big city, it might barely cover housing.

How to Reach Financial Comfort Without $1 Million?

Let’s be honest: not everyone will save $1 million. And that’s okay. Many people retire or live comfortably with less, depending on their lifestyle and income sources. Here’s how:

1. Figure Out Your Personal “Comfort Number”

Instead of chasing a big round number, calculate what you need. Use this simple formula:

Annual expenses × 25 = Retirement target

If you need $50,000 per year → $1.25 million

If you need $30,000 per year → $750,000

This is called the FIRE (Financial Independence, Retire Early) number. It’s not just for early retirees — it’s a great planning tool for everyone.

2. Diversify Your Income Sources

Savings alone won’t cut it. Aim to build multiple streams:

- 401(k) and IRAs

- Social Security

- Rental income

- Dividends or annuities

- Freelance or part-time work in retirement

3. Downsize Your Expenses

Living in a lower-cost city, sharing housing, or moving abroad can drastically cut expenses and stretch your savings.

4. Invest for Growth

Don’t stash your money in a savings account where inflation eats it up. Consider:

- Low-cost index funds (like S&P 500 ETFs)

- Target-date retirement funds

- Real estate or REITs

Real-Life Case Studies

Sarah – School Teacher, Oregon

Net worth: $520,000

Sarah owns her home, lives modestly, and has a pension. She retired early and says she doesn’t miss the hustle at all.

John & Nina – Suburban Florida

Combined net worth: $890,000

They live off Social Security and rental income from two properties. They travel, help their grandkids, and feel “richer than ever.”

Mark – Tech Professional, San Francisco

Net worth: $1.2 million

Despite hitting seven figures, he still works part-time due to high living costs. He’s considering moving to a lower-cost city to fully retire.

5 Common Myths About Do You Really Need $1 Million to Feel Financially Comfortable?

Myth 1: You need $1M to retire.

False. You can retire with less — or more — depending on your expenses and location.

Myth 2: Hitting $1M means you’re rich.

Not necessarily. A million might not go far if your cost of living is high.

Myth 3: If I save late, I’ll never get there.

Not true. People catch up in their 40s and 50s all the time through smart investing.

Myth 4: It’s all about savings.

Nope. Income from Social Security, pensions, or real estate often plays a big role.

Myth 5: It’s too late for me.

It’s never too late to start saving, investing, or reducing expenses.

Revealed: The Top 20 U.S. Companies You’ll Want to Work for in 2025—Are You On the List?

Lack of Succession Planning Among Financial Advisers May Pose Unexpected Risks to Clients

4 Financial Mistakes Americans Keep Making That Wreck Their Budgets