Free £300 DWP Payment Coming Soon: If you’re living in the UK and feeling the pinch from higher bills, fuel prices, and food costs, there’s some solid news coming your way. A £300 DWP payment is officially on the horizon—and it’s not just talk. The Department for Work and Pensions (DWP) has laid out the details, timelines, and who’s going to get it. Let’s be honest. Things have been tough lately. Whether you’re raising kids on Universal Credit, a pensioner managing winter heating costs, or just trying to stay afloat, this payment could be a real game-changer.

Free £300 DWP Payment Coming Soon

| Topic | Details |

|---|---|

| Payment Amount | £300 (non-taxable, one-off payment) |

| Payment Name | Cost of Living Payment |

| Authority | Department for Work and Pensions (DWP) |

| Disbursement Period | 8 July 2025 – 31 July 2025 |

| Eligibility Criteria | Must be receiving certain income-based benefits during 3–30 June 2025 |

| Automatic Payment? | Yes — no application needed |

| Where to Check Status | Official GOV.UK page |

What Is the £300 DWP Cost of Living Payment?

Let’s break it down plain and simple.

The Cost of Living Payment is a part of the UK government’s support program designed to help folks dealing with rising everyday expenses. It’s not a loan, not a benefit that you apply for — just a one-time, tax-free payment directly from the DWP or HMRC, depending on what benefits you receive.

This payment has already started hitting bank accounts for those who qualify. If you haven’t gotten it yet but believe you’re eligible, read on — we’ll guide you step-by-step.

Why This Payment Is Being Made?

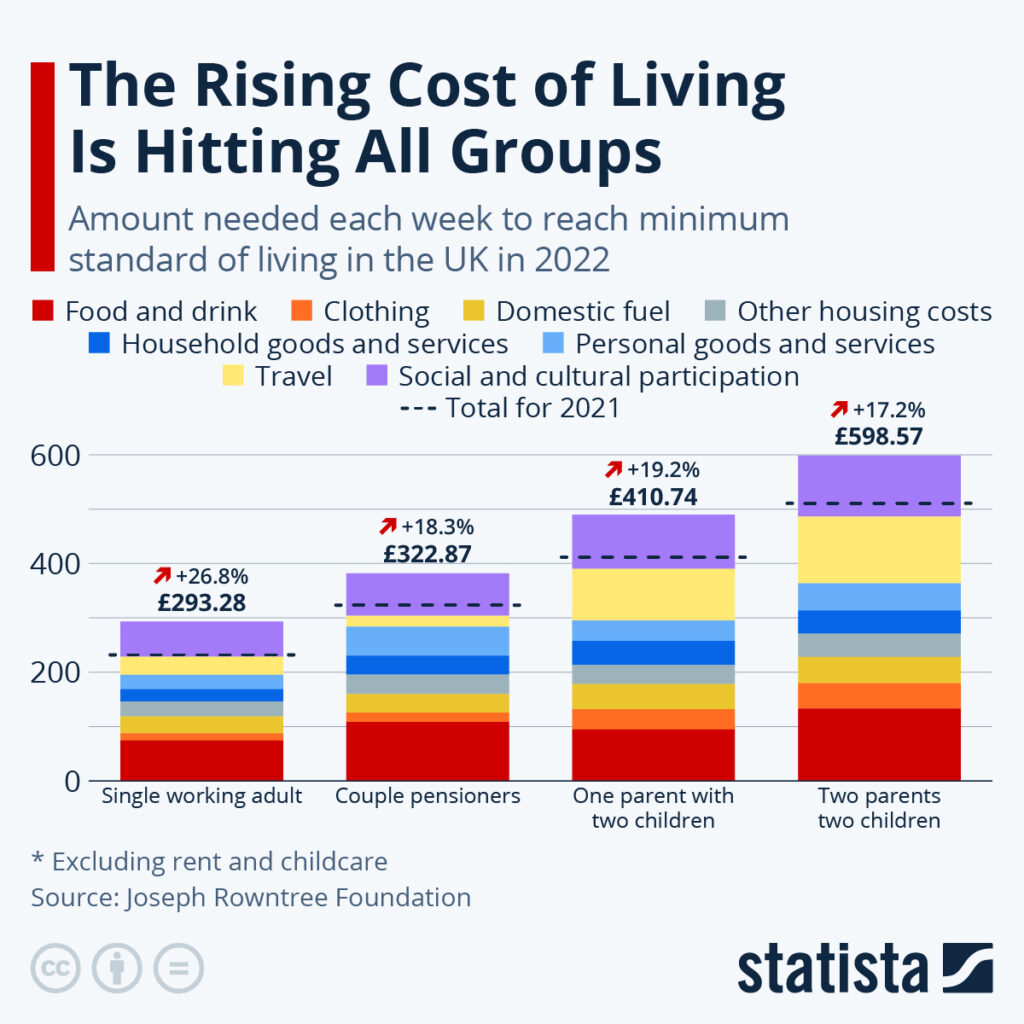

This isn’t just a nice gesture. The UK is still recovering from a cost-of-living crisis that started in 2022 and escalated with inflation, energy prices, and supply chain issues. Here’s what’s been happening, according to the Office for National Statistics (ONS) and Joseph Rowntree Foundation:

- 1 in 5 households reported skipping meals due to unaffordable food costs.

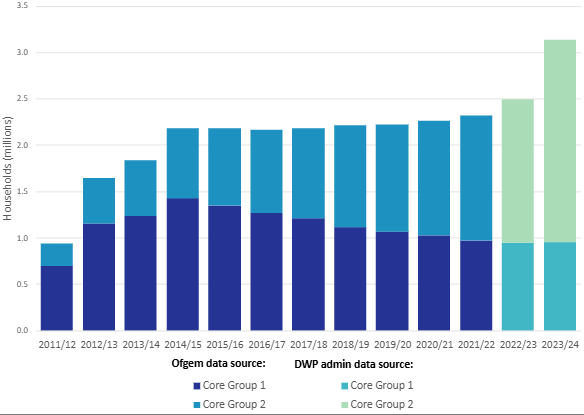

- Energy bills rose by more than 60% between 2021 and 2023.

- In 2024, over 7.2 million households were reported as being in fuel poverty.

These payments are the government’s way of cushioning the blow—especially for the most vulnerable groups like low-income earners, retirees, and disabled people.

Who’s Eligible for the £300 DWP Payment?

The list of qualifying benefits hasn’t changed much from previous rounds of support. You’re eligible if you were receiving any of the following between 3 June and 30 June 2025:

Qualifying Benefits:

- Universal Credit

- Income-Based Jobseeker’s Allowance (JSA)

- Income-Related Employment and Support Allowance (ESA)

- Income Support

- Pension Credit

- Working Tax Credit

- Child Tax Credit

It’s important to note that you won’t qualify if you only receive:

- New Style JSA

- New Style ESA

- Contribution-Based ESA or JSA

…unless you also receive one of the qualifying income-based benefits.

How Will the £300 Payment Be Sent?

No extra forms, no phone calls, no online claims. This payment is automatically issued to eligible recipients.

It will show up in your bank account with the reference “DWP COL” or “HMRC COLS” if you’re on tax credits. The key here is making sure your benefit payments were active during the qualifying period in June.

When Will You Get the Payment?

If you’re on a DWP benefit (like Universal Credit or Pension Credit), your payment will arrive between 8 July and 31 July 2025.

If you’re on Tax Credits only, the HMRC will send your payment later in July, usually after the DWP has completed its payment cycle.

How to Check If You Got Free £300 DWP Payment Coming Soon?

Here’s what to look for:

- Check your bank account or building society account.

- Look for a payment of exactly £300.

- The reference should look something like: “DWP COL” followed by your National Insurance number.

- If you get tax credits, it will appear as “HMRC COLS”.

What If You Didn’t Get the Payment?

This is where things can get tricky, but don’t stress.

Here’s what to do:

- Step 1: Wait until 15 August 2025.

- Step 2: Go to the official GOV.UK portal to report a missing payment: gov.uk/guidance/cost-of-living-payment

- Step 3: Fill out the form and submit it. Be ready to provide your National Insurance number and benefit details.

How This Payment Compares to Previous Years?

The £300 Cost of Living Payment is part of a larger series of government support rolled out since 2022. Here’s how it stacks up:

| Year | Amount | Target Group | Delivery Time |

|---|---|---|---|

| 2022 | £650 | Universal Credit & others | July & Autumn |

| 2023 | £900 (in 3 parts) | Same as above | Spring–Autumn |

| 2024 | £299 | Universal Credit, Pension Credit | February |

| 2025 | £300 | Same group | July |

While the amount may vary, the principle remains: help low-income households handle everyday costs.

Additional Government Support You May Be Missing

This £300 is helpful, no doubt—but it’s not the only support available. You may also be eligible for:

Winter Fuel Payment:

- For pensioners born before 24 September 1958.

- Worth up to £600, depending on age and household circumstances.

- Payments typically made between November and December.

Warm Home Discount:

- Worth £150 off your electricity bill.

- Automatically applied for most pensioners.

Local Council Assistance:

- Local authorities offer emergency help, food vouchers, and rent support under the Household Support Fund.

- Check with your local council’s website.

Real-Life Scenarios: Who Benefits?

Let’s make this practical. Here’s how real people might experience the benefit.

Case 1: Peter, 70, London

- Peter gets Pension Credit and lives alone. He qualifies for the £300 payment, Winter Fuel Payment, and Warm Home Discount. Altogether, he’s looking at about £1,050 in support this year.

Case 2: Aisha, 29, Bradford

- Aisha is a single mum on Universal Credit with 2 kids. She’ll get £300 in July, and may also qualify for school meal vouchers and energy help from her local council.

How to Prepare Financially?

Getting support is great—but it’s also key to plan smart. Here’s a simple strategy:

- Budget in advance — treat the £300 as emergency funds or seasonal expense coverage.

- Pay off high-interest debts first, like credit cards or rent arrears.

- Use local services — food banks, libraries, and community grants can stretch your funds.

- Visit MoneyHelper UK for free budgeting tools.

UK’s Retirement System Faces Pressure—Why the Government May Need to Raise the Pension Age Again?

UK Set to Raise State Pension Age Beyond 67 as Life Expectancy Grows

DWP Lowers Estimated Reimbursements for Unpaid UK State Pensions in New Forecast