CRA Refuses $33,000 Tax Break on Spousal Support: When it comes to taxes, most of us hope we’re getting every dollar we’re entitled to. So when the Canada Revenue Agency (CRA) refused a taxpayer’s $33,000 spousal support deduction, it didn’t just create a problem for that person—it sent a wake-up call to thousands of Canadians. This case is a strong reminder that good intentions alone aren’t enough when it comes to taxes. If you’re divorced or separated and paying support to a former partner, understanding CRA’s requirements is absolutely essential. In this article, we’ll walk through what happened, the legal framework around spousal support, practical steps to ensure you’re compliant, and what professionals and individuals can learn from this taxpayer’s misstep.

CRA Refuses $33,000 Tax Break on Spousal Support

The CRA’s decision to deny a $33,000 tax deduction wasn’t just about paperwork—it was about compliance. This case proves that even well-intentioned actions can backfire if they don’t follow legal procedures. If you’re making spousal support payments, the message is simple: put it in writing, follow the terms, and keep records. Not doing so could cost you thousands—and no one wants to find that out during a tax audit. Whether you’re navigating a divorce, helping a client, or updating an agreement, understanding these rules ensures you’re protected and informed.

| Topic | Details |

|---|---|

| Taxpayer Issue | Claimed $33,000 in spousal support deductions |

| CRA Response | Deduction denied—no legal agreement in place |

| CRA Requirement | Payments must be made under a written agreement or court order |

| Legal Framework | Income Tax Act Sections 56.1 and 60 |

| Potential Penalties | Back taxes, interest, and penalties for misfiling |

| Key CRA Resource | CRA – Support Payments |

| Impacted Audience | Divorced or separated taxpayers, legal professionals, accountants |

What Happened?

In a recent real-world case highlighted by tax expert Jamie Golombek in the Financial Post, a taxpayer attempted to deduct over $33,000 in spousal support payments on their tax return. The problem? The payments were not made under a formal court order or a written separation agreement. CRA reviewed the claim and ultimately denied the deduction, stating that the payments didn’t meet the legal definition of “support payments.”

This situation isn’t uncommon. Many Canadians assume that just giving money to an ex-spouse counts as spousal support and is therefore deductible. But under Canadian tax law, it’s not that simple.

What Qualifies as Spousal Support (According to CRA)?

According to CRA’s guidelines and the Income Tax Act, for spousal support payments to be tax-deductible, they must meet the following criteria:

- Made under a written agreement or court order: You must have formal documentation dated and signed.

- Paid to a current or former spouse or common-law partner: No deductions for other family members.

- Support must be for the recipient: Payments intended for child support are not deductible.

- Payments must be periodic: Monthly or bi-weekly payments qualify, while lump-sum settlements do not.

- No advance lump sum or property transfer: One-time transfers or gifts of assets are not deductible.

The CRA is strict. If any of these conditions aren’t met, they’ll deny your claim—and that could result in thousands of dollars in unexpected taxes.

Real-World Example

Let’s say John and Mary separate. John, feeling generous and wanting to help Mary adjust, sends her $2,500 per month by e-transfer. However, they never signed a legal agreement or filed anything in court.

John later tries to claim $30,000 in spousal support deductions on his tax return. The CRA audits the return and asks for a copy of the legal agreement. John has none.

Result? Claim denied. Not only does John lose the deduction, but CRA could charge interest on the unpaid taxes and even penalties for misreporting.

Why Does the CRA Require Documentation?

There are several reasons for this:

- Preventing fraud: Without legal agreements, taxpayers could falsely claim deductions.

- Clarity for both parties: Legal agreements define who pays what, when, and for how long.

- Ensuring consistency: With documentation, CRA can apply tax rules uniformly.

Remember: informal, verbal, or undocumented payments are viewed by CRA as personal gifts, which are not deductible under Canadian tax law.

Step-by-Step Guide to Making $33,000 Tax Break on Spousal Support

To stay on the right side of the law and get your tax break, follow these steps:

1. Draft a Legal Agreement

This can be a:

- Court-issued divorce or separation judgment

- Mediated or lawyer-assisted separation agreement

- Mutual agreement drafted and signed by both parties

It should specify:

- Amount of spousal support

- Frequency of payments

- Effective start date

- Purpose of payments (i.e., spousal support)

2. Ensure It’s Signed and Dated

The agreement must clearly state the effective date and be signed by both parties.

3. Make Payments As Agreed

Stick to the terms. If the agreement says monthly payments, don’t pay bi-weekly. CRA expects strict compliance with the agreement.

4. Keep Accurate Records

Maintain records of:

- Bank transfers or cheques

- Dates of payments

- Correspondence or confirmation from the recipient

5. Report Payments Properly

- Payer: Report on Line 22000 of the tax return

- Recipient: Report as income on Line 12800

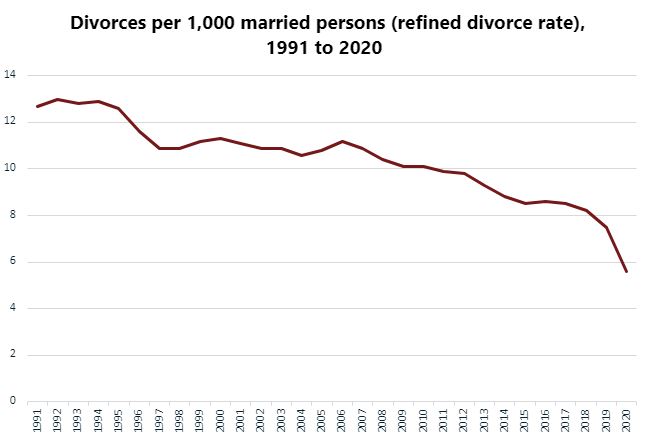

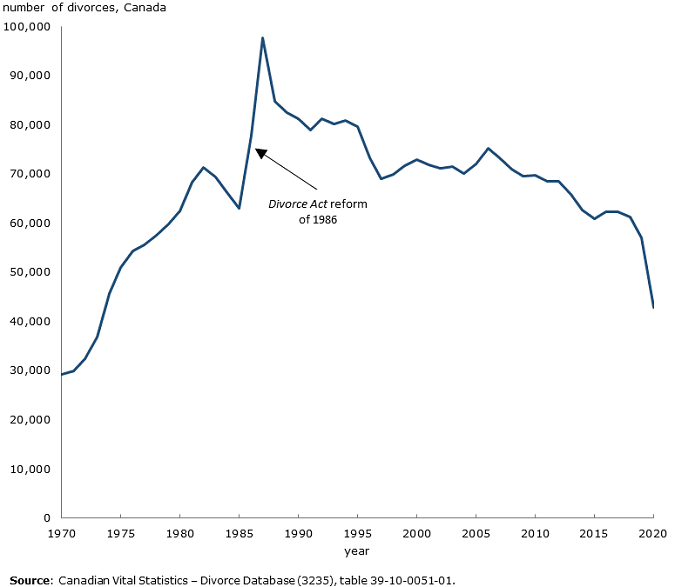

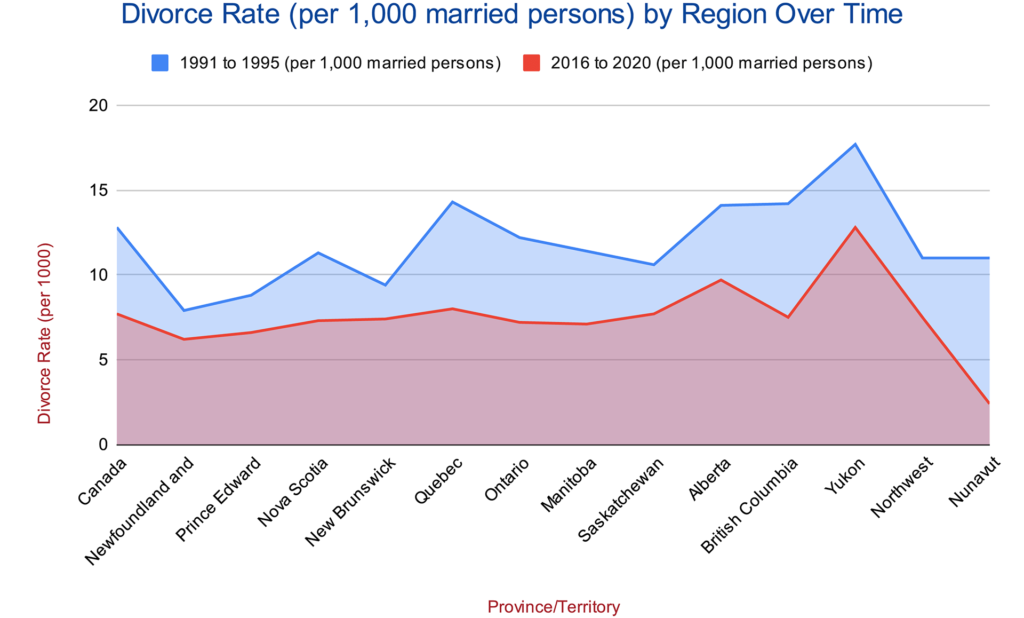

Statistics: Divorce and Tax Implications in Canada

- 38% of marriages in Canada end in divorce, according to Statistics Canada.

- Over 2.2 million Canadians reported some form of spousal or child support on their tax returns in 2023.

- CRA conducted over 5,000 audits related to support payments last year alone.

- The average denied claim was for over $10,000 in deductions.

Common Pitfalls to Avoid

No Legal Agreement

Without a written document, the CRA will deny your deduction—even if the payment amount is accurate.

Mixing Child and Spousal Support

You must clearly separate the amounts designated for child vs. spousal support. Child support is not deductible if the agreement was signed after May 1, 1997.

Lump Sum Payments

Only periodic payments count. If you give a one-time payment of $25,000, CRA won’t allow a deduction unless it’s part of a structured agreement.

No Proof of Payment

Even with a legal agreement, if you can’t show proof (e.g., bank statements), CRA can still deny your deduction.

What If Your Agreement Changes?

If the terms of support change (e.g., amount, duration), update the legal agreement or get a court amendment. Submit this new version to CRA if they request it. Do not simply change your payment pattern—CRA will flag it.

Taxpayer and Professional Tips

For Taxpayers:

- Always involve a lawyer or mediator when creating a separation agreement.

- Never assume a casual payment arrangement will fly with CRA.

- Keep everything in writing and backed by receipts.

For Accountants and Financial Advisors:

- Ask for the written agreement before filing the client’s return.

- Advise clients to keep all proof of payment, especially for large sums.

- Educate clients on the difference between spousal and child support.

For Legal Professionals:

- Ensure clients understand the tax implications of separation agreements.

- Draft clear, unambiguous clauses about support.

- Inform clients that failure to adhere to CRA rules can cost them thousands.

Earning This Much Could Trigger CRA Scrutiny of Your CPP Payments — Are You at Risk?

Boosted CRA Benefit in Quebec Could Bring Over $1,200 This Week for Eligible Residents