Retired Couples Could Lose $18,100 a Year in 2033: Retired couples could lose $18,100 a year in 2033 if Congress doesn’t fix the looming Social Security shortfall. This article explains the crisis in plain terms, provides practical advice for families and professionals, and offers expert-backed insights to protect your financial future. Let’s cut through the noise: Social Security is in serious trouble. In less than a decade, benefit cuts of up to 24% could hit retired couples—unless lawmakers step up. For a middle-income, dual-earning couple retiring in early 2033, that could mean losing about $1,500 a month, or roughly $18,100 a year, according to the Committee for a Responsible Federal Budget (CRFB).

Retired Couples Could Lose $18,100 a Year in 2033

The takeaway is urgent but not hopeless. If Congress does nothing, retired couples in 2033 could lose up to $18,100 per year in Social Security benefits due to a 24% cut caused by trust fund depletion. Social Security won’t vanish, but the cuts would hurt—and they’re getting closer by the day. The solution is action: from policymakers, advisors, and individuals alike. Whether you’re near retirement or still building your nest egg, now’s the time to plan, save, and push for change.

| Topic | Detail |

|---|---|

| Trust Fund Insolvency Date | Late 2032 to early 2033 |

| Estimated Benefit Cut | 24% reduction |

| Dual-Income Couple Loss | ≈ $18,100 per year |

| Single-Income Couple Loss | ≈ $13,600 per year |

| Low-Income Couple Loss | ≈ $11,000 per year |

| High-Income Couple Loss | ≈ $24,000 per year |

| Post-2033 Payout Level | ~77% of scheduled benefits |

| Workers per Beneficiary (2035) | 2.3 to 1 |

| Reform Options | Raise tax cap, increase retirement age, create investment fund, cut COLAs |

What’s Behind the Social Security Crisis?

The basic issue is simple: more people are taking money out, and fewer are putting money in.

Here’s why:

- The Baby Boomer generation is retiring en masse.

- Americans are living longer, so they draw benefits longer.

- Birth rates are falling, so fewer workers are paying into the system.

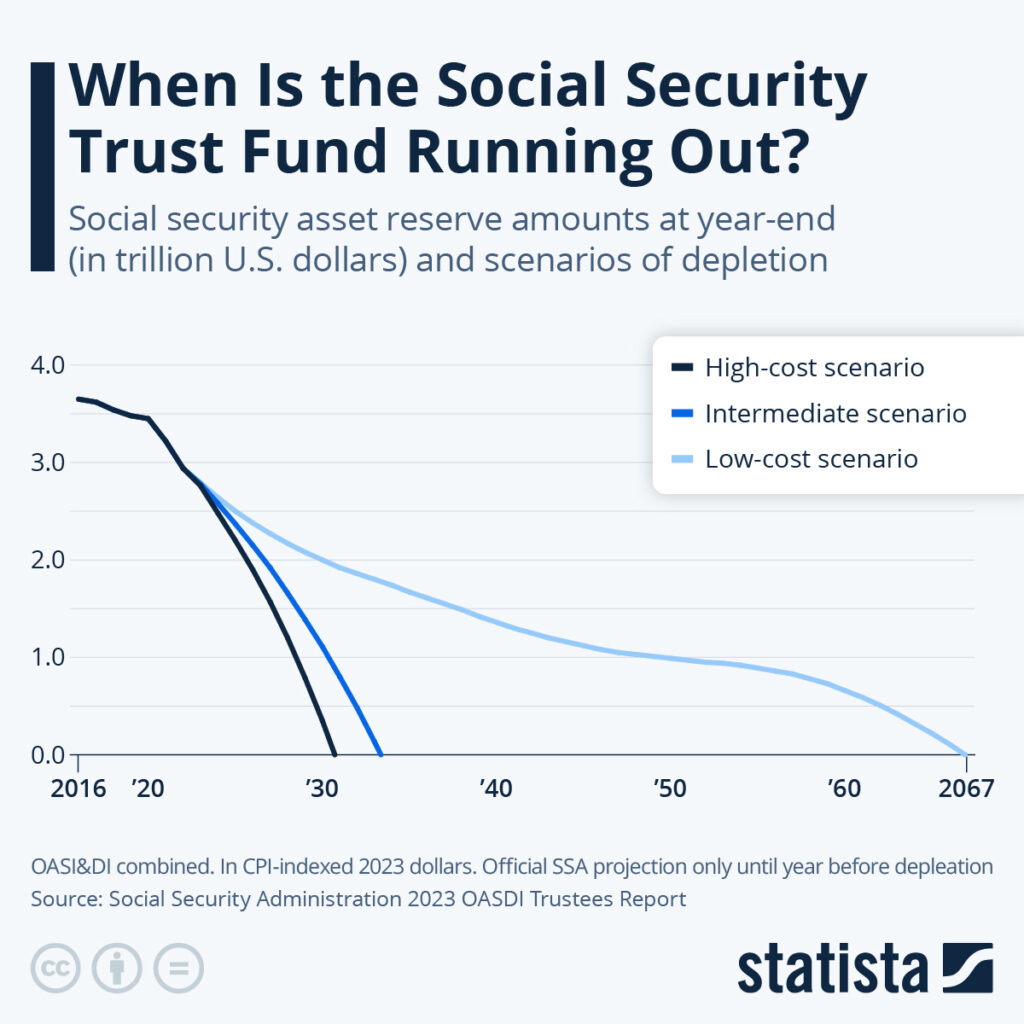

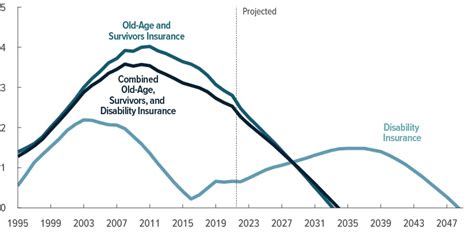

- By 2033, the Old-Age and Survivors Insurance (OASI) Trust Fund is projected to be depleted.

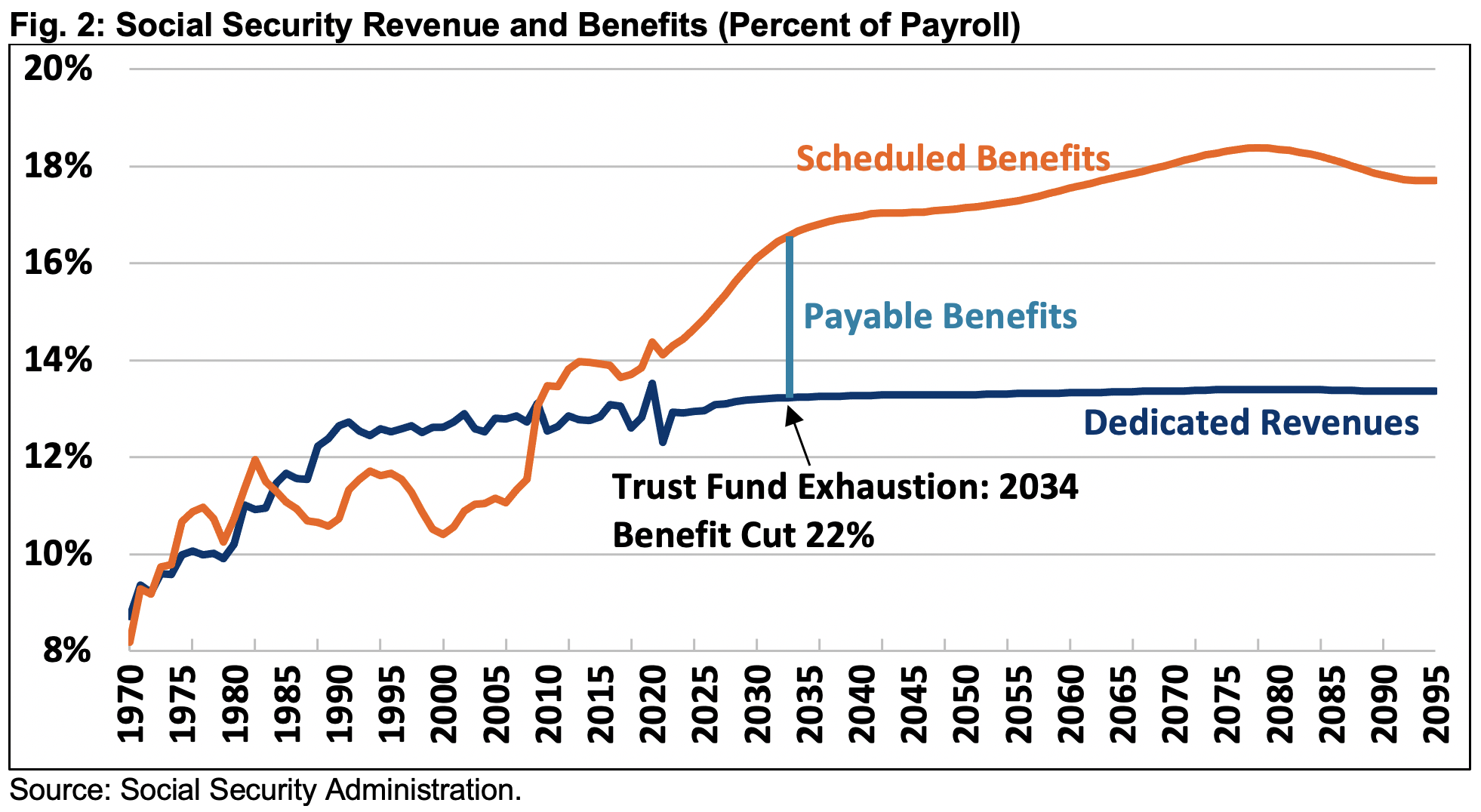

When that happens, Social Security can only pay out what it collects in taxes, which covers about 77% of scheduled benefits. The law doesn’t allow borrowing to make up the difference unless Congress changes it.

This would trigger a 24% benefit cut across the board—a drastic reduction, especially for those living on fixed incomes.

Historical Background: We’ve Been Here Before

Social Security faced a similar crisis back in the early 1980s. At that time, the system was within months of running out of money. Congress and President Ronald Reagan passed a bipartisan reform in 1983, which included:

- Gradual increases to the full retirement age (from 65 to 67).

- Taxing Social Security benefits for higher-income retirees.

- Phased-in payroll tax hikes.

Those changes stabilized the program for decades. But now, we’re in the same boat again—with even more retirees and fewer workers.

What the Numbers Really Mean

According to CRFB, here’s how much various couples could lose annually if no changes are made by 2033:

| Retiree Type | Annual Benefit Cut |

|---|---|

| Dual-income, middle earners | ~$18,100 |

| Single-income household | ~$13,600 |

| Low-income, dual earners | ~$11,000 |

| High-income, dual earners | ~$24,000 |

These estimates are based on typical earnings and retirement dates. The cuts will vary depending on your personal work history, age at retirement, and income level.

Who’s Most Affected?

While everyone receiving Social Security will feel the pinch, the pain won’t be equal.

Lower-income retirees: They rely heavily on Social Security, sometimes for 90% or more of their retirement income. Even a 10% cut would hurt, but 24% could mean skipping meals, missing prescriptions, or losing housing.

Women and minority retirees: Women live longer and often earn less over their lifetimes. Racial income and wealth disparities mean minority retirees are also more dependent on benefits.

Younger generations: If nothing is done, Millennials and Gen Z may contribute more and receive less than any previous generation.

The Workforce Problem: Why It’s Structural

Back in 1955, there were 8.6 workers for every retiree. Today, that number has fallen to around 2.7. By 2035, it’s projected to drop to 2.3 workers per retiree. Fewer workers mean less money coming into Social Security through payroll taxes, even though the number of retirees keeps climbing.

This math doesn’t work unless something changes.

What You Can Do to Prepare If Retired Couples Could Lose $18,100 a Year in 2033?

1. Review Your Social Security Statement

Go to ssa.gov/myaccount and create or log in to your account. You’ll see your earnings history and projected benefits at different retirement ages (62, full retirement age, 70).

2. Consider Delaying Retirement

Every year you delay Social Security past full retirement age increases your benefit by about 8% per year, up to age 70. This can add thousands to your annual benefits and help offset future cuts.

Example: If your FRA is 67 and you wait until 70, your monthly check could be about 24% higher.

3. Increase Personal Savings

Relying only on Social Security is risky. Use retirement accounts like:

- 401(k) or 403(b)

- Roth IRA or Traditional IRA

- Health Savings Account (HSA)

Even saving an extra $50–$100 a month now can compound into a valuable cushion.

4. Adjust Your Lifestyle Projections

Use conservative estimates when planning your retirement income. Instead of assuming you’ll receive full Social Security, base your plan on receiving 75–80% of projected benefits.

For Professionals: How to Advise Clients

Financial advisors, HR leaders, and retirement planners must prepare clients for potential cuts. Here’s how:

- Model benefit scenarios: Run projections assuming both full benefits and 24% cuts.

- Incorporate inflation and tax changes: Consider how COLAs and benefit taxation might evolve.

- Advocate for diversified income: Push clients to build multiple streams (Social Security, pensions, retirement accounts, rental income).

- Stay current on legislation: Follow trusted sites like CRFB, SSA, and CBPP for updates.

What Can Congress Do?

Several proposals are on the table:

1. Lift the Payroll Tax Cap: Currently, income above $168,600 isn’t taxed for Social Security. Taxing higher earnings could close a large portion of the funding gap.

2. Raise the Retirement Age: Gradually increasing the full retirement age to 69 or 70 would reduce outlays. But this hits workers in physically demanding jobs harder.

3. Modify Cost-of-Living Adjustments (COLAs): Adjusting the inflation formula to reduce annual COLA increases could slow benefit growth.

4. Create a Sovereign Investment Fund: A bipartisan proposal from Senators Cassidy and Kaine would invest $1.5 trillion to generate returns and support the trust fund.

5. Means Testing: Reducing or phasing out benefits for higher-income retirees could reduce the system’s burden but may be politically difficult.

Delays in acting only make the problem worse. The sooner reforms happen, the less severe they need to be.

Policy Deadlines and Political Reality

The 2025 election cycle is a key inflection point. While both parties acknowledge the problem, neither wants to take the political risk of proposing benefit cuts or tax hikes before an election. That means 2026–2027 could be the next serious reform window.

In the meantime, the system’s deficit continues to grow. The longer we wait, the deeper the cuts or higher the taxes will have to be.

How You Can Advocate for Change?

- Call your representatives: Urge bipartisan action on Social Security solvency.

- Join advocacy groups: Organizations like the AARP and National Committee to Preserve Social Security and Medicare provide updates and lobbying support.

- Support credible reforms: Educate yourself on solutions and share facts—not fear—with others.

Recent Adjustment to Social Security Benefits Raises Questions- Check Details!

Social Security Projected to Cut Benefits by 2033, Affecting Retired Workers

Republican Senator Lays Out Social Security Changes That Could Reshape Future Benefits