Lloyds Bank Update: If you’re a mortgage holder with Lloyds Bank, especially among the 33,000 first-time buyers, there’s important news that could impact your financial journey. Whether you’re considering your next steps in homeownership, wondering how recent changes could affect your loan, or simply staying informed about the latest banking trends, this update will cover everything you need to know. From mortgage options and affordability criteria to special offers and customer support, this article will break it down for you in a way that’s easy to understand and packed with actionable insights.

Lloyds Bank Update

In a world where mortgage lending is continuously evolving, staying informed about the latest updates from Lloyds Bank is essential. With its new lending criteria, £4 billion in extra lending, and cashback incentives like the Eco Home Reward, there has never been a better time to reconsider your options. Whether you’re a first-time buyer, a homeowner, or looking to make improvements, Lloyds Bank is making it easier for you to achieve your homeownership goals.In the end, your financial future depends on making the right choices today. Take advantage of these updates, check your eligibility, and make sure you’re getting the most out of your mortgage with Lloyds Bank.

| Topic | Details |

|---|---|

| 33,000 First-Time Buyers | Lloyds Bank has helped 33,000 first-time buyers in 2025. |

| Mortgage Lending Increase | Total lending increased by 3%, reaching £11.9 billion. |

| Affordability Changes | Borrowers can now qualify for higher loans under new affordability rules. |

| £4 Billion in Extra Lending | Lloyds has allocated £4 billion to high Loan-to-Income (LTI) borrowers. |

| Eco Home Reward | Up to £2,000 cashbacks for qualifying home improvements. |

| Customer Support | Multiple ways to get help with your mortgage online. |

Introduction: Understanding Lloyds Bank’s Mortgage Update

Lloyds Bank has been one of the UK’s major lenders for years, but recent updates could make a huge difference to current and future mortgage holders. With a focus on first-time buyers, affordability improvements, and support for existing customers, Lloyds Bank is positioning itself as an attractive choice for homeowners in 2025 and beyond.

Whether you’re looking to borrow more, switch mortgage plans, or benefit from Lloyds’ support programs, there’s something here for everyone. Understanding how these updates impact your mortgage, especially if you are among the 33,000 first-time buyers in the mix, will empower you to make informed financial decisions.

In this article, we’ll walk through everything you need to know about these changes in a simple, clear manner. You’ll find easy-to-follow steps and tips, supported by data and real-world examples, to guide your decisions.

What’s Changed at Lloyds Bank Update?

1. Mortgage Lending Boost

In recent months, Lloyds Bank reported a 3% increase in total lending, totaling £11.9 billion. This marks a significant change from previous years, where lending had plateaued. The majority of this increase was driven by mortgages, including those offered to first-time buyers.

In addition, Lloyds Bank has made it easier for borrowers to access higher amounts, thanks to updated affordability criteria. If you’re a first-time buyer, these changes could mean more borrowing potential for your dream home.

2. Better Affordability for First-Time Buyers

Lloyds has introduced a new set of affordability assessments for first-time buyers, making it easier for individuals and families to purchase homes. By relaxing stress tests and increasing loan-to-income ratios, the bank has made it possible for borrowers to secure up to £38,000 more than before.

For instance, if you have a £75,000 household income, your maximum borrowing capacity could increase from £286,005 to £324,520. These changes are especially beneficial for individuals in higher-income brackets, but even those on moderate incomes could benefit from these updates.

3. £4 Billion Boost for High LTI Borrowers

One of the standout features of Lloyds’ update is its £4 billion boost dedicated to high Loan-to-Income (LTI) borrowers. With this new initiative, Lloyds has created a pool of funds to help those who need to borrow at the higher end of the income-to-loan spectrum.

This initiative will help many first-time buyers who might have previously been denied for having higher LTI ratios. It’s a game-changer for those looking to purchase their first home but who may have had limited options due to stricter borrowing rules.

4. The Eco Home Reward

If you’re a current mortgage holder with Lloyds Bank, you might be eligible for the Eco Home Reward. This incentive gives cashback for home improvements aimed at increasing your home’s energy efficiency. You can receive up to £2,000 for things like installing insulation, adding solar panels, or installing a heat pump.

This is a great way for homeowners to not only improve the value and sustainability of their property but also to reduce their long-term energy costs. Additionally, it’s a step toward helping the environment and supporting green building practices.

Understanding Loan-to-Value (LTV) and Loan-to-Income (LTI) Ratios

When applying for a mortgage, you’ll often hear the terms Loan-to-Value (LTV) and Loan-to-Income (LTI). But what do they mean?

- LTV Ratio: This is the percentage of the property’s value that you borrow from the bank. If you have a home worth £300,000 and borrow £240,000, your LTV is 80%.

- LTI Ratio: This is the ratio of your income to the loan amount. If you earn £50,000 and want to borrow £250,000, your LTI is 5. An LTI of 4-5 is typically acceptable for most lenders, though high LTI loans can carry additional risks for both the borrower and lender.

Lloyds Bank is now allowing higher LTI ratios, which means more borrowing power for many buyers, especially first-timers. It’s important to fully understand these ratios and how they affect your borrowing capacity.

How to Improve Your Chances of Getting a Better Mortgage Deal?

If you’re wondering how you can improve your chances of qualifying for a mortgage or getting a better deal, here are some tips:

1. Improve Your Credit Score

Your credit score is one of the biggest factors affecting your mortgage eligibility. To improve your score:

- Pay bills on time.

- Keep your credit card balances low.

- Check your credit report for errors and fix them.

2. Save for a Larger Deposit

The larger your deposit, the lower your LTV ratio. A smaller LTV can help you secure better interest rates.

3. Pay Off Debt

If you have high debt-to-income ratios, it may be harder to qualify for a loan. Try to pay down existing debts like credit cards or loans to improve your chances.

4. Seek Financial Advice

Mortgage brokers and financial advisors can offer insights into how to improve your financial situation and help you get a better mortgage deal.

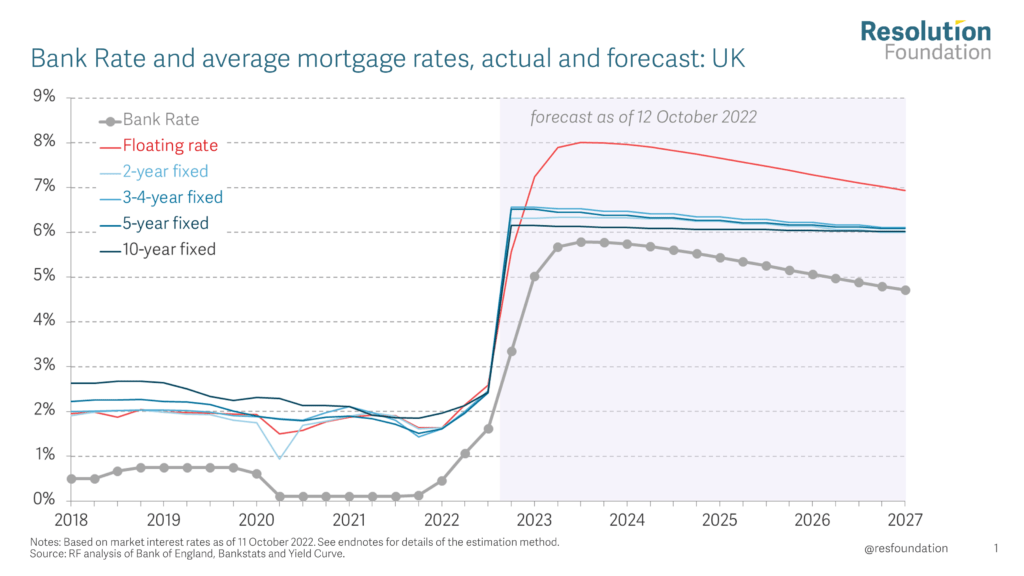

The Role of Interest Rates in Mortgage Lending

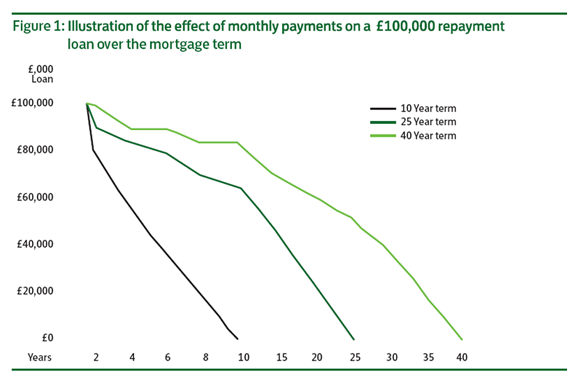

The interest rate on your mortgage plays a critical role in how much you’ll pay over time. A higher rate means higher monthly payments and more money paid over the life of the loan.

Right now, interest rates are rising in many parts of the world, including the UK, as central banks try to curb inflation. While Lloyds Bank offers fixed-rate and variable-rate mortgages, it’s important to consider locking in a rate if you believe that interest rates will rise in the near future. A fixed-rate mortgage will give you stability, while a variable-rate mortgage could save you money if rates fall.

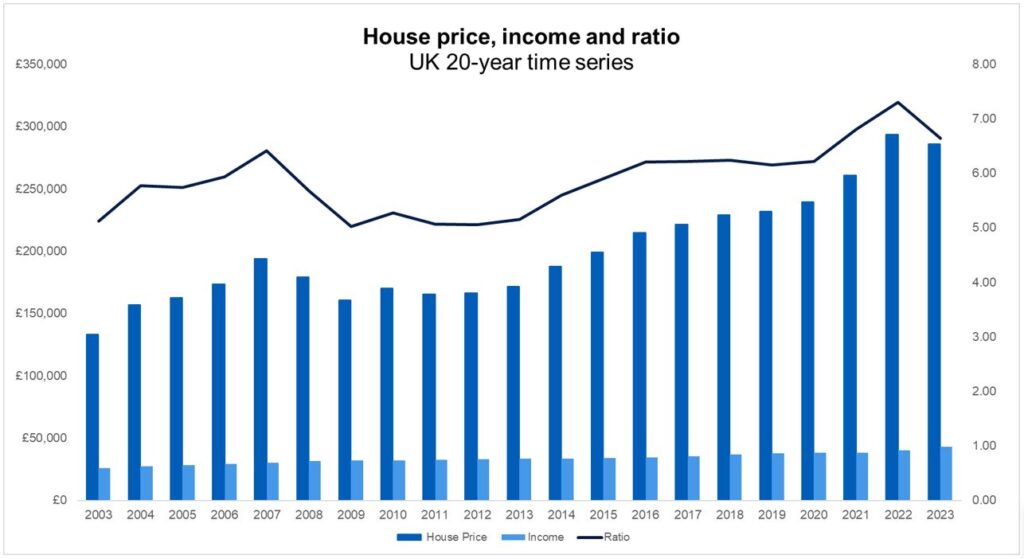

Navigating the Changing Economic Landscape

Macroeconomic factors such as inflation, government policy changes, and global events can impact interest rates and mortgage lending. For example, if inflation continues to rise, the Bank of England may increase rates to stabilize the economy, which can make borrowing more expensive.

Staying informed about these trends can help you decide whether it’s a good time to lock in a fixed rate or whether you should wait for better conditions.

Customer Testimonials and Success Stories

Let’s take a look at a real-world example. Tom and Sarah, a young couple from Manchester, recently secured a mortgage with Lloyds Bank after taking advantage of the updated affordability criteria. With a combined income of £60,000, they were able to borrow £310,000 for their first home, an increase of £35,000 compared to previous offers from other banks.

Tom says, “We were thrilled when we found out we could borrow more. It meant we could purchase a better home than we initially thought possible.”

Practical Advice: What You Should Do Next

1. Consider Re-financing or Switching Mortgage Plans

If you’ve been with Lloyds for a while and your mortgage is up for renewal, it’s a good idea to explore new mortgage deals. With changes in the lending criteria, now may be the perfect time to re-evaluate your options.

When you switch to a new deal, you might qualify for better interest rates or improved terms. Don’t hesitate to contact Lloyds Bank to see if there are deals that suit your current financial situation.

2. Look Into Borrowing More for Home Improvements

If you’ve owned your home for over six months and need extra funds for renovations or improvements, Lloyds offers additional borrowing options. This could be used for things like home extensions, kitchen upgrades, or other major projects.

Remember, loans for home improvements can sometimes come with better interest rates compared to general unsecured loans, making it a smart financial decision in many cases.

3. Explore the Eco Home Reward

If you’re eligible for the Eco Home Reward, don’t miss out. You could be leaving money on the table by not taking advantage of this scheme. Reach out to Lloyds Bank for more details on what improvements qualify and how to claim your cashback. It’s an easy way to improve your home’s energy efficiency and receive a bonus in return.

Lack of Succession Planning Among Financial Advisers May Pose Unexpected Risks to Clients

Gen X Could See a Big Payday Soon With Upcoming Financial Changes- Check Detail!