US Government Suspends Student Loan Forgiveness Under IBR: In a recent shift that has left many borrowers uncertain about their financial futures, the U.S. government has suspended student loan forgiveness under the Income-Based Repayment (IBR) plan. This pause has sparked concerns and confusion for over two million borrowers who were relying on this program for eventual debt cancellation. If you’re one of these borrowers, it’s important to understand what’s going on and how it could affect your plans for student loan forgiveness. In this article, we will break down exactly what this suspension means for you and what steps you can take next.

US Government Suspends Student Loan Forgiveness Under IBR

The suspension of student loan forgiveness under the IBR plan has undoubtedly created confusion and frustration for millions of borrowers. However, understanding the situation and staying informed will help you navigate this challenging period. Stay enrolled in IBR, monitor updates from the Department of Education, and be mindful of your payment and forbearance options. This pause is temporary, and while it may seem like a significant hurdle, it’s important to remember that the long-term goal of student loan forgiveness remains in place. By staying proactive and well-informed, you can continue working toward your financial freedom.

| Key Points | Details |

|---|---|

| Government Action | The U.S. Department of Education temporarily suspended student loan forgiveness under the IBR plan. |

| Impact on Borrowers | The suspension affects over 2 million borrowers who were expecting loan forgiveness after 20 or 25 years of payments. |

| Refunds for Extra Payments | Borrowers who made extra payments after reaching the forgiveness threshold may be eligible for refunds. |

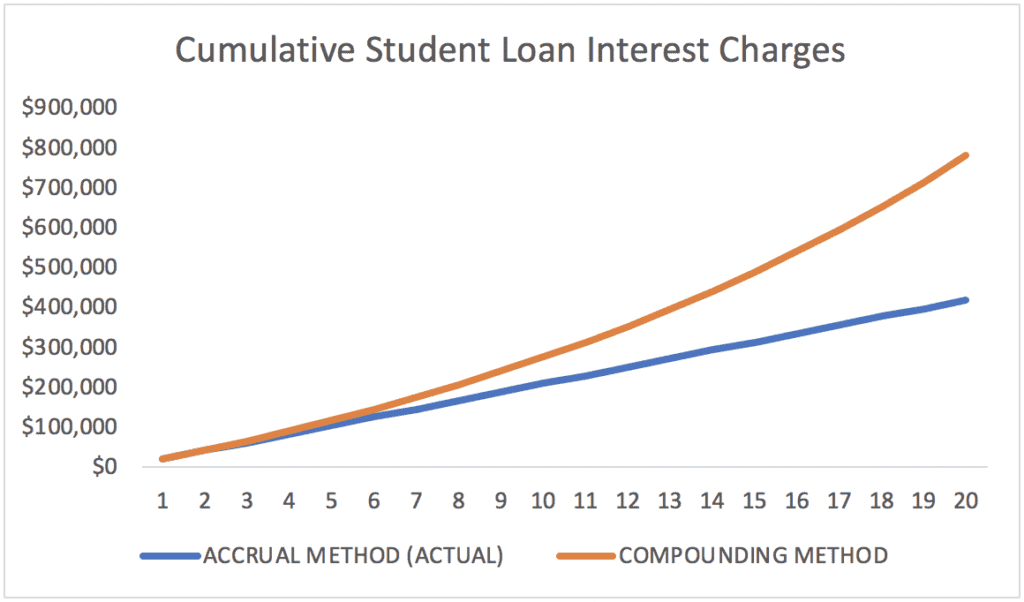

| Interest Accrual | Borrowers requesting forbearance during the suspension will see interest continue to accumulate on their loans. |

| Forbearance Risks | Forbearance could delay forgiveness and result in additional interest charges, making it crucial to weigh your options. |

| Next Steps for Borrowers | Stay enrolled in IBR, track updates from the Department of Education, and consider your forbearance options carefully. |

For many borrowers, the Income-Based Repayment (IBR) plan has been the pathway to student loan forgiveness. This plan is designed to help borrowers manage their monthly payments based on their income and family size. Once borrowers make their required payments for 20 or 25 years (depending on when they first took out their loan), their remaining loan balance is forgiven.

But, as of July 2025, things have changed. The U.S. Department of Education suspended student loan forgiveness under the IBR program, throwing a wrench in the plans of many who were counting on having their loans forgiven after decades of on-time payments. If you’re currently on an IBR plan or planning to enter one, here’s what you need to know about the suspension, how it affects you, and what steps you should take next.

Why the Suspension Happened?

The suspension stems from legal and administrative issues related to the U.S. government’s broader student loan forgiveness programs. Specifically, the system updates required to comply with the new Saving on a Valuable Education (SAVE) plan impacted IBR as well. This plan, which is designed to offer broader relief to borrowers, includes some restrictions on the types of forbearances and deferments that will count toward forgiveness.

What Does This US Government Suspends Student Loan Forgiveness Under IBR for Borrowers?

For borrowers who were expecting forgiveness soon, this suspension is a major setback. If you’ve been on the IBR plan for a long time, you may have been planning to have your loans discharged after 20 or 25 years of payments. Unfortunately, this new development means those milestones won’t be processed as quickly as expected. Here’s a rundown of the key impacts:

1. Delays in Loan Forgiveness

The most significant consequence of this suspension is the delay in student loan forgiveness. Borrowers who were expecting forgiveness under IBR after completing 20 or 25 years of payments will need to wait longer than expected. The Department of Education has not yet provided a clear timeline for when these forgiveness applications will be processed again.

2. Refunds for Extra Payments

If you’ve already reached your forgiveness threshold and continued to make payments, you could be eligible for a refund for those extra payments once the suspension ends. While the suspension is frustrating, this potential refund offers a silver lining for borrowers who’ve been diligent in paying off their loans.

3. Interest Will Continue to Accumulate

If you request forbearance during this period of uncertainty, it’s important to note that interest will continue to accrue on your loans. This means that, while you may not be making payments, the balance of your loan could continue to grow. This is particularly important if you’re relying on forgiveness after a certain number of years of payments.

4. Possible Risks of Forbearance

Forbearance can offer temporary relief by allowing you to skip payments. However, it’s essential to understand that not all forbearance types will count toward forgiveness under the IBR plan. Additionally, during periods of forbearance, interest continues to accumulate, which can result in a larger loan balance in the long run.

5. The Department of Education’s Role

The Department of Education has stated that they are working to process forgiveness applications but has not provided an exact timeline for when forgiveness will resume. This uncertainty makes it more important than ever to stay informed and monitor updates from the official channels.

What Should Borrowers Do Now?

While this suspension may feel like a setback, there are still steps you can take to protect yourself and minimize any negative impacts on your loan situation. Here’s a breakdown of what you can do next:

1. Stay Enrolled in IBR

Even though forgiveness is paused, it’s still a good idea to remain enrolled in the IBR program. This will allow you to continue making income-based payments and eventually get back on track when the suspension is lifted. The IBR plan still offers more favorable terms compared to other repayment plans.

2. Monitor Updates from the Department of Education

The Department of Education is the official source for updates regarding the resumption of forgiveness processing. Be sure to check your loan servicer’s website and email notifications for any important announcements.

3. Consider Requesting Forbearance Carefully

If you’re facing financial difficulty and need some breathing room, you may want to request a forbearance. However, be cautious. Remember that interest will continue to accrue, which can lead to a larger loan balance down the line. If you do go this route, make sure you understand how it will affect your loan and forgiveness status.

4. Keep Track of Extra Payments

If you’ve continued to make payments after reaching the forgiveness threshold, keep detailed records of those payments. This will be helpful when the suspension is lifted and you’re able to request a refund for any excess payments.

5. Explore Other Repayment Plans

If the suspension of the IBR plan leaves you uncertain about your financial future, consider exploring other repayment plans, such as the Pay As You Earn (PAYE) or Revised Pay As You Earn (REPAYE) plans. These may offer more immediate relief, though they come with different terms and conditions.

6. Seek Financial Counseling or Legal Help

If you’re unsure how this suspension impacts your individual situation, you may want to seek advice from a financial counselor or a student loan attorney. They can offer personalized guidance based on your circumstances and help you understand your options.

Social Security Introduces New Rules in July That Will Impact Monthly Payments Across the US

4 Financial Mistakes Americans Keep Making That Wreck Their Budgets

CNBC Uncovers the Devastating Financial Impact of Supporting Adult Children on U.S. Families