Social Security Claims Are Surging: If you’ve been thinking about when to claim your Social Security benefits, you’re not alone. In fact, millions of Americans are jumping the gun and claiming earlier than expected. Why? Because Social Security claims are surging at record levels, and there’s a mix of panic, fear, and practicality behind it. In 2025 alone, early claims have spiked by over 17%, with more than 1.8 million Americans filing before reaching full retirement age (FRA), according to CBS News. Whether you’re nearing retirement or still years away, it’s crucial to understand why this is happening and what it could mean for your future.

Social Security Claims Are Surging

Social Security isn’t vanishing, but it is evolving. You don’t need to rush into claiming based on fear or headlines. Instead, arm yourself with facts, run the numbers, and build a plan that’s right for you. Whether you’re 35 and just thinking ahead or 65 and ready to retire, understanding the Social Security system can help you make smarter financial decisions that last a lifetime. Plan wisely. Claim strategically. Live confidently.

| Key Point | Details |

|---|---|

| Surge in Claims | Over 1.8 million people filed early by May 2025, a 17% increase from 2024 |

| Trust Fund Depletion | Social Security trust fund may run dry between 2033-2035 (SSA.gov) |

| Media Fearmongering | Scary headlines push retirees to claim ~1 year earlier on average |

| Political & Policy Shifts | Legislative changes and agency staff cuts causing uncertainty |

| Boomer Effect | 10,000 Baby Boomers retire daily, putting strain on the system |

| Official Source | Visit SSA.gov for accurate Social Security information |

Why Social Security Claims Are Surging in 2025?

1. Fear Over Trust Fund Insolvency

Let’s face it—when people hear the words “bankrupt” or “insolvent,” they panic. According to the Social Security Administration (SSA), the trust fund reserves are expected to be depleted between 2033 and 2035, depending on economic factors and legislation. After that, benefits may only be covered at 77% through ongoing payroll taxes.

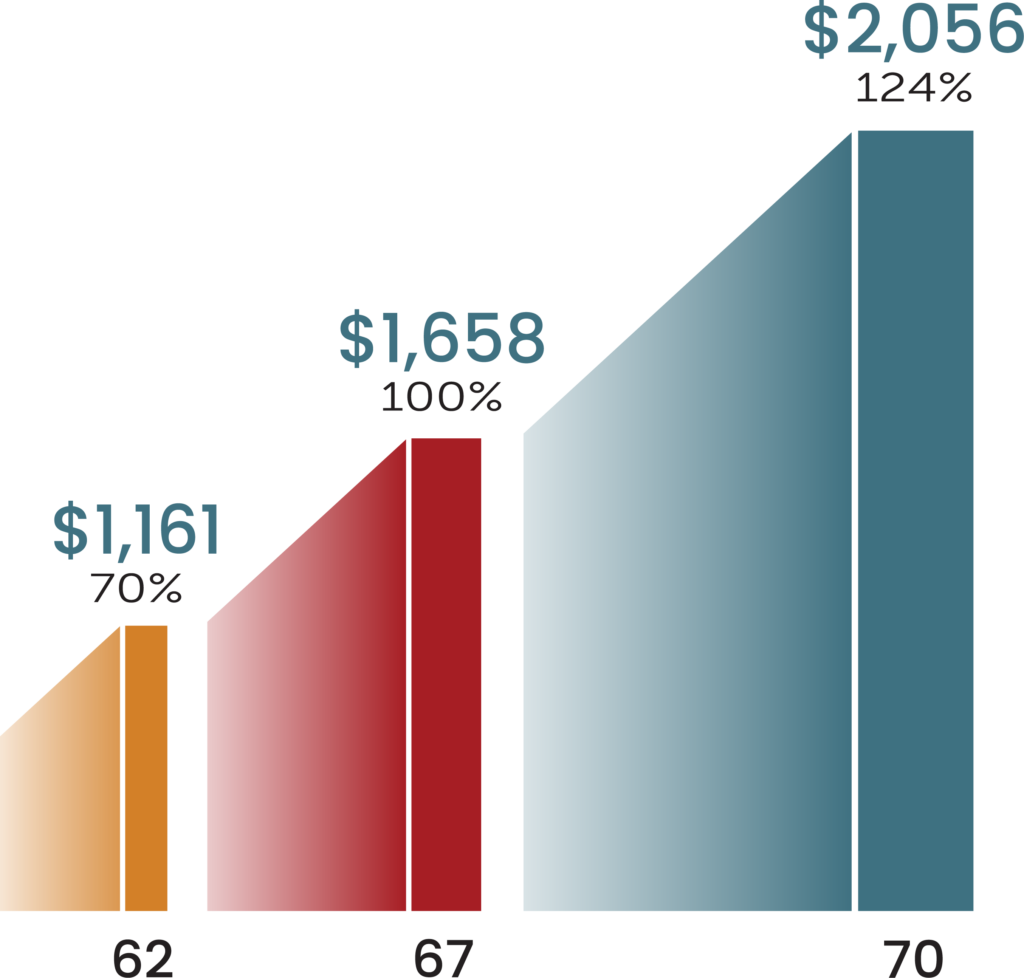

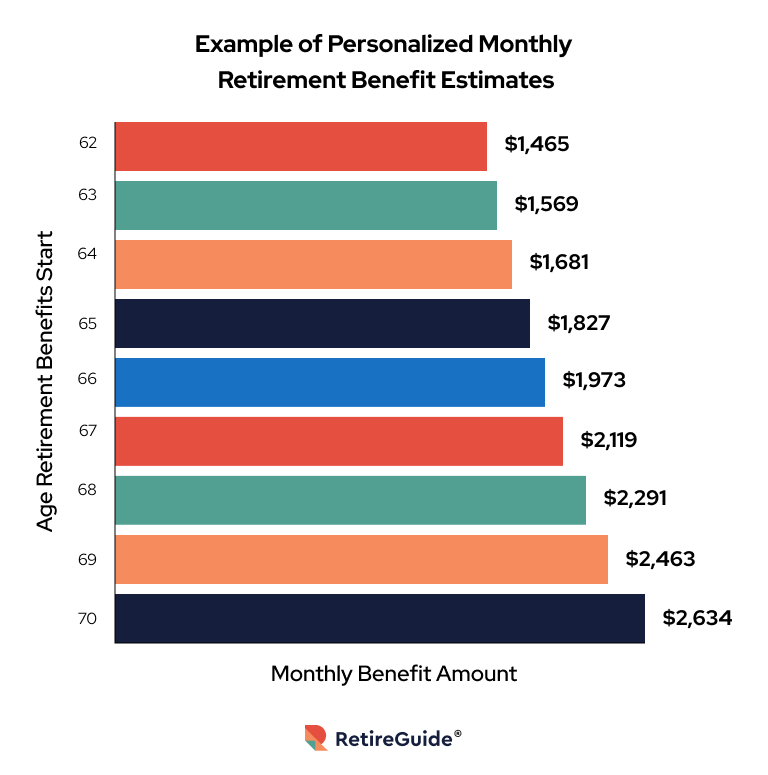

To many, that sounds like a ticking time bomb. So instead of risking a potential cut, people are claiming early—often at 62, the earliest eligible age. But this move comes at a cost: a 25% to 30% reduction in monthly benefits for life.

2. Scary Headlines Influence Decisions

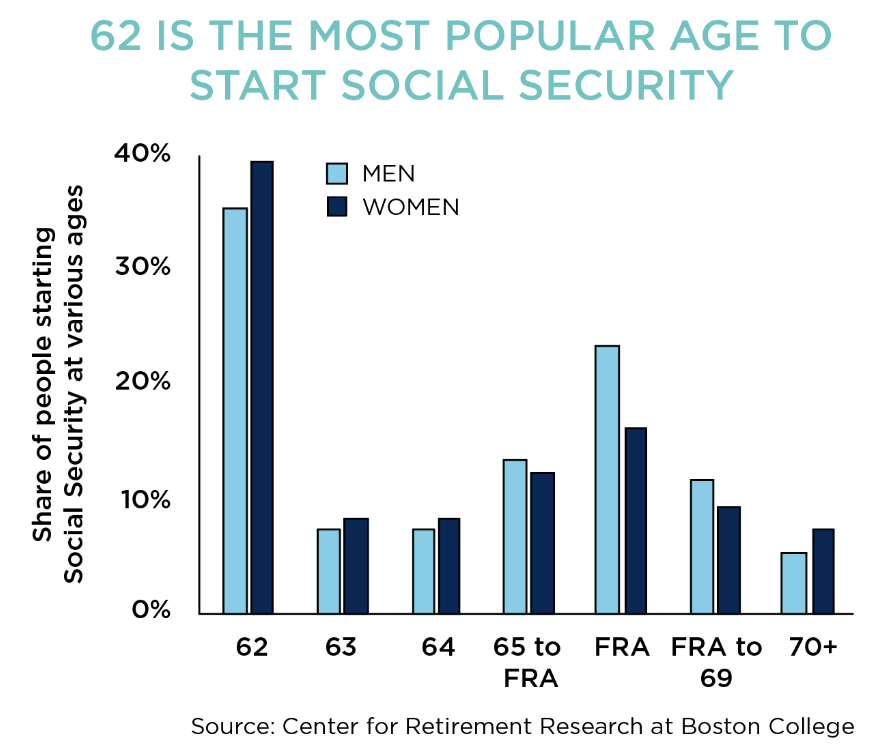

The media loves a crisis. Headlines like “Social Security Will Be Gone by 2033!” can seriously influence behavior. In fact, a study by Boston College’s Center for Retirement Research found that people exposed to alarming headlines filed nearly a year earlier than those who weren’t.

What gets lost in the noise? The reality that Social Security won’t disappear—it will just pay less if changes aren’t made. But even a partial cut sounds scary enough to cause rash decisions.

3. Political Uncertainty & System Cuts

Politics plays a huge role in Social Security. With rising partisan divides and no long-term fixes in place, uncertainty fuels fear. Budget cuts to the SSA—reducing staff from 57,000 to around 50,000—have led to longer wait times, delayed phone support, and slower claims processing.

There’s also talk of reform: proposals like raising the full retirement age (FRA), adjusting the payroll tax cap, or changing how benefits are calculated. And with tech billionaires like Elon Musk tweeting about overhauling entitlement programs, many Americans feel pressured to claim before the rules change.

4. Boomer Retirement Surge

More than 10,000 Baby Boomers turn 65 every day. That’s not just a fun fact—it’s a real strain on the system. The sheer volume of new retirees filing for benefits adds stress to SSA operations and creates a domino effect of anxiety across younger generations.

Even those in their early 60s feel the pressure: “If I don’t get mine now, there might not be anything left when I do.” It’s not necessarily true, but perception drives action.

5. Economic Pressures: Inflation & Debt

Let’s talk real life: groceries, rent, utilities—all more expensive than ever. Add in rising medical costs and credit card debt, and many Americans simply can’t afford to wait for their benefits.

Social Security often becomes the lifeline instead of a supplemental income source. But here’s the problem: claiming early reduces monthly benefits for life. It also limits what your spouse could receive in survivor benefits.

Should You Claim Social Security Early? Pros & Cons

Pros of Claiming Early:

- Immediate access to income

- Helps during health issues or job loss

- May offer peace of mind during uncertain times

Cons of Claiming Early:

- Up to 30% lower benefits for life

- Reduces potential spousal and survivor benefits

- Could increase tax burden if still working

Unless you’re in a tight spot financially or facing poor health, most experts recommend waiting until FRA (66-67) or even age 70. The delayed retirement credits can increase your monthly benefit by up to 8% per year beyond FRA.

How to Make a Smart Social Security Decision?

Step 1: Create a My Social Security Account

Visit SSA.gov/myaccount to access your personalized benefits statement. It shows what you’d earn at 62, 67, and 70.

Step 2: Evaluate Your Health & Longevity

If your family has a history of long life—and you’re in good health—delaying may be in your best interest. The longer you live, the more you gain from higher monthly benefits.

Step 3: Assess Financial Resources

Review your:\n

- Savings and investments

- 401(k) or IRA balances

- Housing situation (mortgage paid off?)

- Healthcare needs

Step 4: Use Retirement Calculators

Sites like Fidelity, NerdWallet, and the SSA’s Quick Calculator provide break-even analysis and long-term projections.

Step 5: Talk to a Fiduciary Financial Advisor

Don’t DIY your retirement strategy. A fee-only fiduciary can help you balance taxes, income needs, and longevity planning.

Spousal and Survivor Benefits: Don’t Overlook These

Social Security isn’t just for you—it can impact your spouse, too.

- Spousal benefits allow your spouse to claim up to 50% of your benefit at their full retirement age.

- Survivor benefits can be as high as 100% of your monthly amount if you pass away and your spouse is eligible.

But here’s the catch: If you claim early and reduce your benefit, their potential payout shrinks, too. Delaying your claim helps both of you in the long run.

Claiming Strategies That Can Help

There’s no one-size-fits-all rule. But here are some popular strategies professionals use:

File and Suspend (for higher earners): Allows one spouse to delay their benefit while the other claims spousal benefits.

Claim Now, Delay Later: If you need money now, claim early but plan to pause later and repay to restart at a higher rate (within 12 months).

Bridge Strategy: Use savings or part-time work to “bridge the gap” until age 70 so you can maximize your Social Security payout.

How Social Security Fits Into a Broader Retirement Plan?

Social Security is only one leg of your retirement stool. Don’t rely on it as your sole source of income unless you have no other options. Consider combining it with:

- Pensions (if available)

- Personal savings or brokerage accounts

- Annuities or passive income

- Part-time work during retirement

Diversifying your income sources gives you more flexibility and security.

Real-World Example

Case Study: Anna, Age 62

Anna works part-time and is thinking of claiming early due to fears about Social Security’s future. But a financial planner helps her run the numbers. If she waits until 70, her monthly benefit would jump from $1,400 to $2,400—a difference of $12,000 per year, every year.

Because Anna has some savings and can downsize her home, she chooses to wait. At 85, she’ll have received over $130,000 more by delaying.

Trump’s Claim That His Bill Ends Social Security Taxes Debunked by Experts

How Social Security May Evolve Under President Trump’s Proposed Changes

How Social Security Taxes Could Be Impacting Your Retirement Income Today? Check Details!