The Shocking Link Between Deportation and Social Security’s Collapse: In recent years, discussions around Social Security’s future sustainability have become more urgent than ever. Amidst debates over eligibility, funding, and benefits, one critical but often overlooked factor has surfaced: deportation policies and their potential impact on the Social Security system. While many focus on the aging population and financial shortfalls, the role of undocumented immigrants in the system is rarely discussed. So, what’s the connection between deportation and Social Security’s collapse, and why does it matter?

The Shocking Link Between Deportation and Social Security’s Collapse

The link between deportation and Social Security’s collapse is a critical issue that deserves more attention. Deportation policies can reduce the number of workers contributing to the system, which puts pressure on an already strained Social Security Trust Fund. At the same time, immigrants—both documented and undocumented—are vital to the U.S. economy, and their contributions help keep the system running. By addressing these issues through comprehensive immigration reform and fraud prevention, we can ensure a sustainable future for Social Security.

| Topic | Details |

|---|---|

| Immigrant Contributions to Social Security | Undocumented workers contributed about $24 billion to Social Security in 2024. |

| Deportation Impact | Large-scale deportations could increase Social Security deficits by $133 billion over 10 years. |

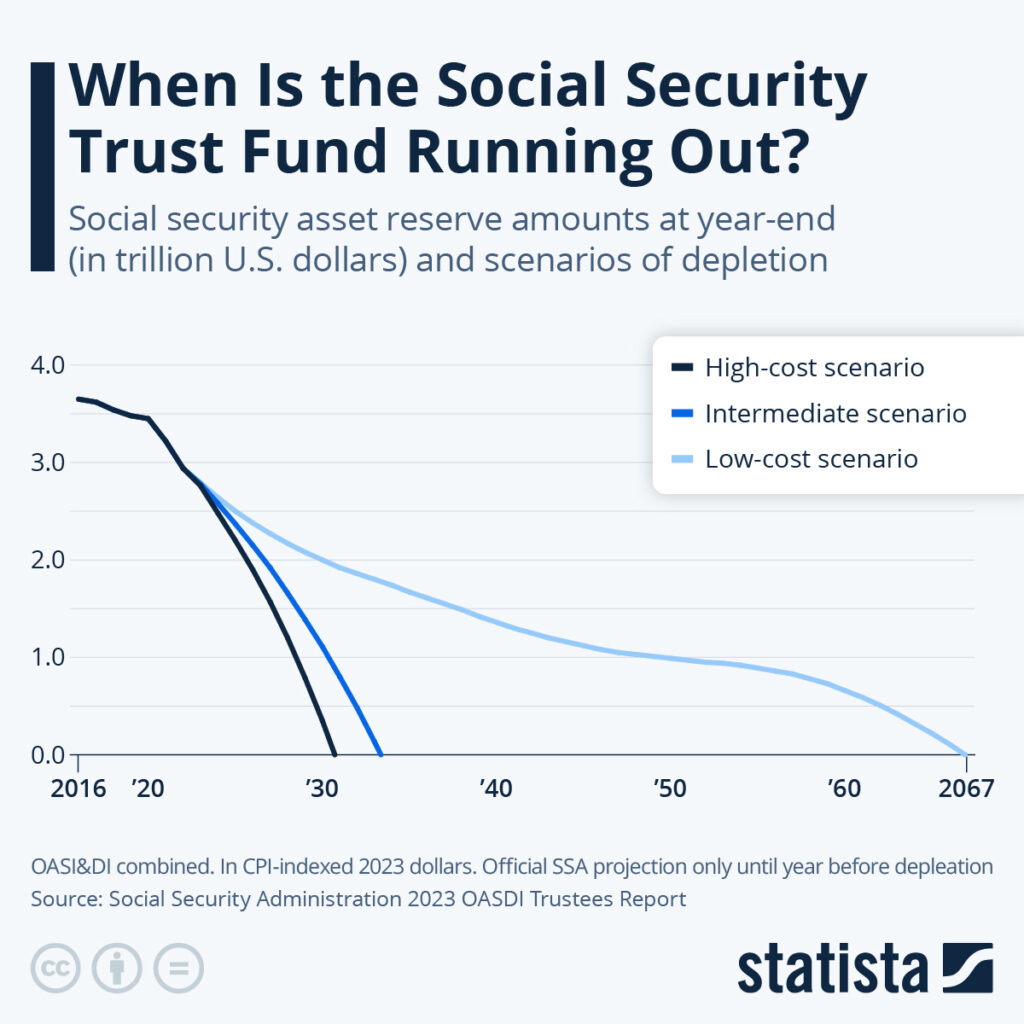

| Social Security Deficit Timeline | The Social Security Trust Fund could deplete in 2034 without reform. |

| Fraud and ITINs | Fraudulent use of SSNs and ITINs is a concern, but undocumented workers do not collect Social Security benefits. |

| Long-Term Effects | Deporting workers may slow economic recovery and put additional pressure on Social Security funding. |

| Official Resources | Learn more on the official SSA website: Social Security Administration |

The Impact of Deportation Policies on Social Security

Deportation policies, especially those involving the removal of undocumented workers, have the potential to cause significant disruptions in the U.S. economy—and by extension, Social Security. While some people might assume that undocumented immigrants do not contribute to Social Security, the reality is quite different. Many pay into the system without ever being eligible to collect benefits. This happens because, despite not having valid Social Security numbers (SSNs), some undocumented workers use Individual Taxpayer Identification Numbers (ITINs) to file taxes, or employers use fraudulent SSNs on their behalf.

The Role of Undocumented Immigrants in Funding Social Security

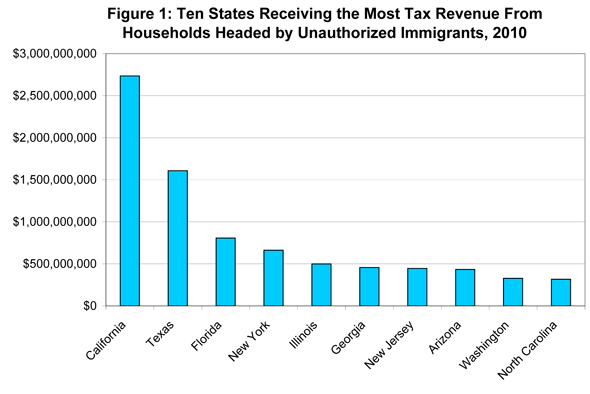

When it comes to the U.S. Social Security system, the reality is that undocumented immigrants contribute significantly to its funding. According to the Social Security Administration (SSA), unauthorized workers in the U.S. contribute billions each year through payroll taxes. In fact, these workers are responsible for paying into the system but are not eligible to receive benefits.

A 2024 report estimated that unauthorized immigrants paid approximately $24 billion into Social Security taxes—money that goes directly to support beneficiaries like retirees, the disabled, and survivors of workers who have passed away.

This large contribution is made possible through various means. Many immigrants use Individual Taxpayer Identification Numbers (ITINs) to file tax returns and pay into the system. This helps to ensure that the Social Security system remains robust, even though these workers are not eligible to collect benefits themselves.

The Shocking Link Between Deportation and Social Security’s Collapse Financial Impact on Social Security

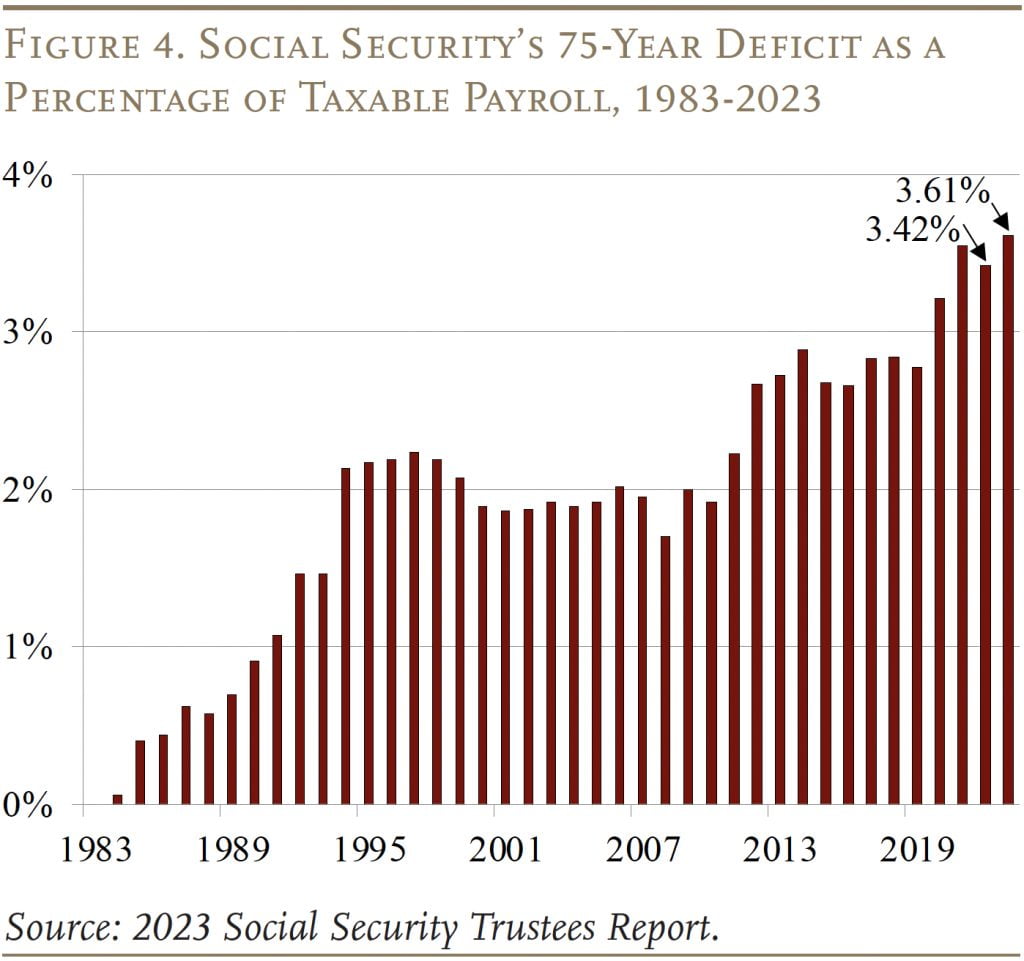

Deportation policies, especially those that lead to mass removals of unauthorized workers, could put a strain on Social Security’s finances. Studies have shown that widespread deportations could lead to a $133 billion increase in Social Security’s deficit over the next decade. This happens because Social Security’s trust fund relies on the contributions of workers who are currently paying taxes. Removing large numbers of workers from the system means fewer people paying into Social Security, which makes it harder for the system to meet future obligations.

Furthermore, deporting workers could accelerate the depletion of the Social Security Trust Fund, pushing up the timeline for its potential collapse. While the Social Security Trust Fund is currently projected to run out of money by 2034, policies that reduce the workforce or limit contributions could speed up this timeline.

What Happens if the Trust Fund Depletes?

When Social Security’s Trust Fund is exhausted, the program will still collect payroll taxes. However, it will only be able to pay out a portion of the benefits it currently provides. Projections show that Social Security will only be able to pay about 79% of benefits after 2034 without additional revenue or reforms.

While Congress could choose to increase funding through higher taxes or other means, many Americans worry that Social Security will not be able to provide for future generations. This concern is especially valid as the U.S. population ages and the birth rate declines, leading to fewer workers supporting a growing number of retirees.

Addressing Fraud in the System

Another critical aspect of deportation policies and Social Security is the issue of fraud. Some undocumented workers use fraudulent Social Security numbers to gain employment, which can lead to concerns about fraud and abuse in the system. While this is a valid concern, it’s important to note that these workers do not receive Social Security benefits. They are merely contributing to the system through payroll taxes.

It is estimated that up to $1 billion in Social Security benefits are paid out each year to fraudulent claims, although this is a small percentage of the overall program. The Social Security Administration (SSA) has been working to improve its fraud detection systems, but the issue remains a challenge.

The Economic Consequences of Deportation

Deporting a large number of workers could have serious consequences for the broader U.S. economy. Immigrants, both documented and undocumented, play essential roles in many sectors of the economy, particularly in industries like agriculture, construction, and hospitality.

If deportation policies were to remove a significant portion of this workforce, it could result in labor shortages, increased production costs, and lower economic growth. This would make it harder for the economy to recover from setbacks, such as the COVID-19 pandemic, and could ultimately impact Social Security by reducing the number of taxpayers contributing to the system.

The Broader Societal Impact of Deportation

Deportation does not only have economic consequences—it can also have significant social implications. Families torn apart, communities disrupted, and social services stretched thin are just a few of the challenges that deportation can bring. The costs associated with deportation are not just financial; they also touch on human rights, public health, and social welfare.

When workers are deported, their families often experience emotional and financial hardship. This can result in a cycle of poverty and social instability, which, in turn, places more pressure on state and federal programs designed to support those who are most vulnerable.

Practical Steps for Addressing Social Security’s Financial Issues

1. Comprehensive Immigration Reform

One way to address the issue of deportation and Social Security’s sustainability is through comprehensive immigration reform. By offering a pathway to citizenship for undocumented workers who have been contributing to Social Security, we can ensure that these workers can continue to contribute to the system legally. This would help stabilize Social Security’s funding while also allowing workers to access benefits when they reach retirement age.

2. Strengthening Fraud Prevention

The SSA needs to continue strengthening its fraud prevention efforts to ensure that individuals who are not entitled to benefits do not receive them. This includes improving its ability to detect fraudulent SSN use and cracking down on illegal activities.

3. Raising the Social Security Payroll Tax Cap

One potential solution to help fund Social Security is raising the payroll tax cap. Currently, Social Security taxes are only collected on income up to a certain threshold (around $160,000). By increasing or eliminating this cap, the program could receive more funding from higher-income earners.

4. Expanding Social Security to Include Immigrants

Expanding Social Security benefits to include more workers—particularly immigrants who have been contributing for many years—would be a sustainable way to increase the funding base of the system. This could come in the form of providing work permits or citizenship pathways for long-term contributors who have been paying taxes for decades.

How Social Security May Evolve Under President Trump’s Proposed Changes

Social Security Shake-Up Incoming — What Every Recipient Needs to Know Now

The Social Security Bridge Strategy That May Help You Delay Retirement Withdrawals