Thousands in Forgotten 401(k)s Waiting for Michiganders: If you’ve ever worked in Michigan and switched jobs, chances are you may have left behind a retirement account, like a 401(k), that you’ve forgotten about. According to reports, billions of dollars in unclaimed 401(k)s are sitting out there, just waiting for people like you to claim them. The good news is, it’s not too late. Thousands of Michiganders are potentially owed money from these forgotten accounts, and you could be one of them.

In today’s fast-paced world, it’s easy to lose track of these types of financial accounts, especially after a job change or a move. But unclaimed 401(k)s can still grow with interest, and the funds might be more valuable than you think. Whether it’s a few hundred dollars or thousands, your forgotten retirement account could be sitting there, accumulating more wealth. In this article, we’re going to break down everything you need to know about forgotten 401(k)s in Michigan, how you can find yours, and what you can do with the money once you locate it.

Thousands in Forgotten 401(k)s Waiting for Michiganders

Finding and claiming your forgotten 401(k) is a great way to ensure you’re saving for your future. By following the steps outlined above, you can easily track down any unclaimed funds and take the necessary steps to secure them. Whether you decide to roll the funds into a new account or cash out, the choice is yours — but just remember, that money is still yours to claim. Taking the time to check for forgotten 401(k)s could lead to a financial windfall, helping you save more for retirement. Don’t let your hard-earned money sit in limbo any longer!

| Key Information | Details |

|---|---|

| What is a Forgotten 401(k)? | A 401(k) retirement account that has been left behind by former employees after switching jobs. |

| Amount of Unclaimed Funds Nationwide | Over $1.7 trillion in unclaimed 401(k) funds across the U.S. (source: The Sun) |

| How to Find Your Lost 401(k) | Use Michigan’s Unclaimed Property Database, National Registry, or PBGC. |

| Steps to Claim | Visit official databases, verify your identity, and claim your funds. |

| Useful Links | Michigan Unclaimed Property Database |

| Important Reminder | Unclaimed retirement funds can grow, potentially adding significant value over time. |

| Typical Account Size | Average unclaimed 401(k) balance is approximately $56,616 (source: The Sun) |

What is a Forgotten 401(k)?

A forgotten 401(k) is a retirement account that you might have set up through a previous job but lost track of when you left that company. It’s a common issue many people face, especially those who’ve worked for several employers over the years. After leaving a job, it’s easy to forget about that old 401(k) — but those funds may still be waiting for you.

Why Does This Happen?

When you leave a job, you might be offered the option to move your 401(k) funds to a new employer’s retirement plan or to roll them over into an individual retirement account (IRA). However, many workers fail to take action, leaving the funds behind. Sometimes, people simply forget or don’t realize they can take action, especially if they’ve switched jobs multiple times or had gaps in employment.

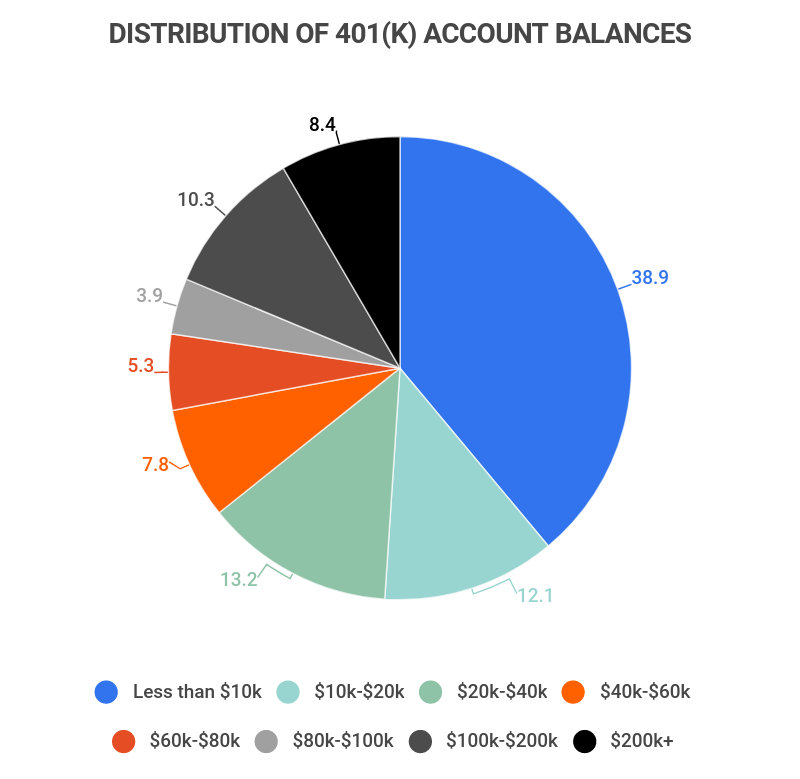

How Big Is the Problem?

The problem is quite significant, and it affects millions of Americans. According to The Sun, over $1.7 trillion in unclaimed retirement funds is sitting across the country in forgotten 401(k)s. The average balance for each of these forgotten accounts is approximately $56,616. Imagine that amount just sitting there, growing with interest over time! These funds might not be as large as they once were, but even small amounts can still have a noticeable impact on your future retirement.

How to Find Thousands in Forgotten 401(k)s Waiting for Michiganders?

Now that you understand the scope of the issue, let’s talk about how you can find your lost 401(k). There are several ways to go about it, from using official government databases to reaching out directly to past employers. Let’s break it down into steps:

Step 1: Use Michigan’s Unclaimed Property Database

The Michigan Department of Treasury maintains a database of unclaimed property, which includes lost retirement funds. They’ve made it easy for residents to check whether they’re owed money. Here’s how to use it:

- Go to the Michigan Unclaimed Property Search Page: Michigan Unclaimed Property

- Search by Name: Simply enter your full name to see if any unclaimed funds are associated with you.

- Claim the Property: If you find your 401(k), follow the instructions to submit a claim. It’s free to claim any unclaimed property, and the state does not charge for this service.

Step 2: Use the National Registry of Unclaimed Retirement Benefits

This is a nationwide, secure database listing retirement plan accounts that have been left unclaimed. It’s especially useful for individuals who have changed jobs multiple times. To use this tool:

- Visit the National Registry Website: Unclaimed Retirement Benefits

- Search Using Your Social Security Number: You’ll need your Social Security number to check for any unclaimed retirement benefits.

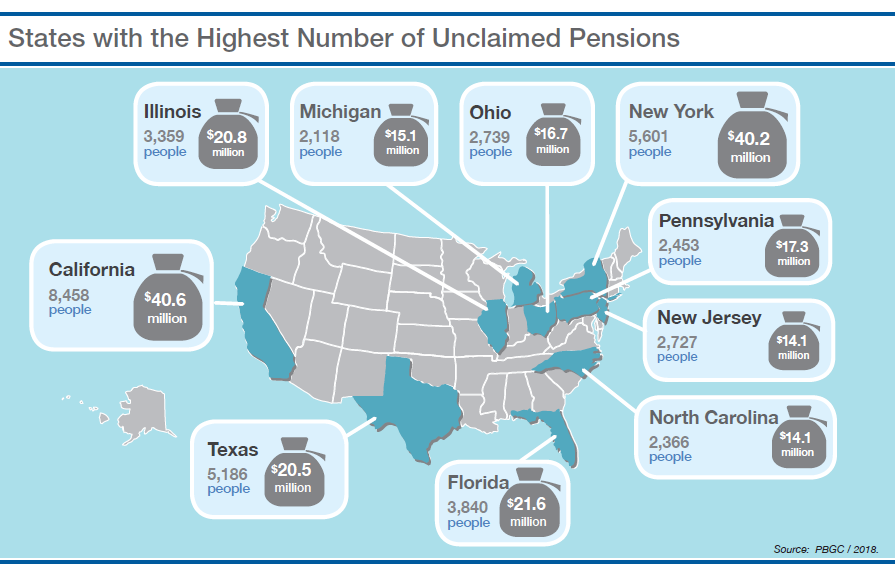

Step 3: Check with the Pension Benefit Guaranty Corporation (PBGC)

If you were part of a pension plan at a previous employer and the company went out of business, your pension may be held by the Pension Benefit Guaranty Corporation (PBGC). To search for any unclaimed pension benefits, you can:

- Visit the PBGC’s Website: PBGC Unclaimed Retirement Benefits

- Enter Your Details: Use your last name and the last four digits of your Social Security number to search.

What Can You Do with Your Found 401(k)?

Once you find your lost 401(k), you’ll have a few options for what to do with the money. Here’s what you need to know about each option:

1. Roll It Over to a New Employer’s Plan

If you’re currently employed and your employer offers a 401(k) plan, you may want to roll your old 401(k) into your current employer’s plan. This can help you consolidate your retirement funds, making it easier to manage. Plus, your employer might offer a matching contribution, which can help grow your savings.

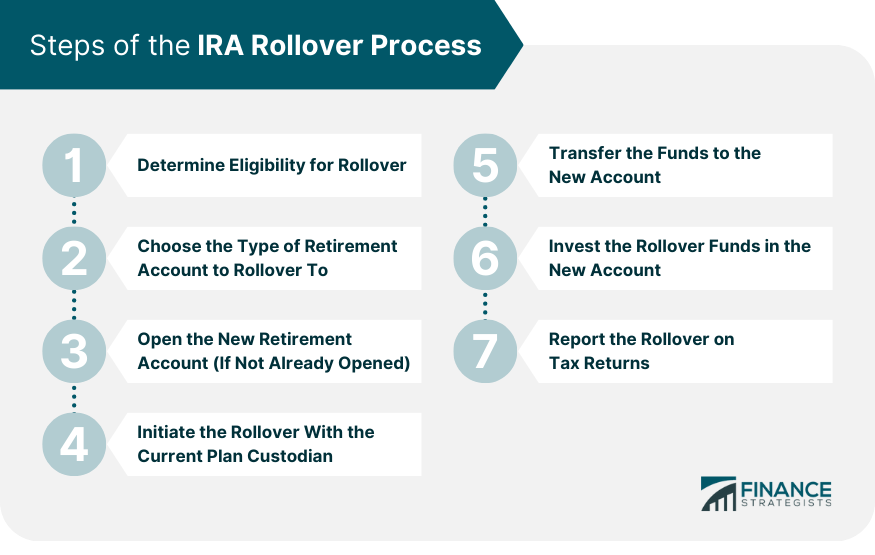

2. Roll It Over into an IRA

Another option is to roll your old 401(k) into an Individual Retirement Account (IRA). An IRA offers more investment options and potentially lower fees compared to a 401(k). This option can give you more control over your retirement savings.

3. Cash Out (But Be Cautious)

While it’s tempting to just cash out your 401(k), it’s generally not recommended. If you cash out before age 59½, you could face heavy tax penalties. You’d also be missing out on the opportunity for those funds to continue growing over time.

Dave Ramsey Advises Caution and Planning on 401(k) Contributions Amid Economic Shifts

Paper Checks to Be Phased Out — Social Security Pushes for Electronic Payment Transition

US Online Spending Jumps by $24.1 Billion as Deep Discounts Drive Summer Sales