Revenge Saving Is the Viral Trend Everyone’s Copying: In a world where we’re constantly looking for new ways to manage our money, a fresh trend has emerged that’s getting a lot of buzz — Revenge Saving. You might be asking, “What is Revenge Saving?” and more importantly, “Should I be doing it?” Let’s dive deep into what this trend is all about, why it’s so popular, and how you can use it to your advantage. Revenge Saving is a financial strategy that’s rising in popularity, especially among younger generations. After the COVID-19 pandemic caused disruptions to people’s spending habits, many turned to revenge spending to make up for lost time and opportunities. This trend was all about splurging on luxuries like dining out, vacations, and shopping sprees to enjoy life again. But as inflation soared and the economy became less predictable, people began to shift their focus — from spending to saving. And just like that, Revenge Saving was born.

Revenge Saving Is the Viral Trend Everyone’s Copying

Revenge Saving isn’t just a trend; it’s a smart financial move that’s helping many people regain control over their money and prepare for an uncertain future. By cutting back on unnecessary spending, setting clear savings goals, and finding accountability partners, you can take charge of your financial future in the same way others are. Whether you’re just getting started or you’re already on the path to financial freedom, Revenge Saving can offer you the tools and mindset to make the most of what you’ve got.

| Key Topic | Details |

|---|---|

| What is Revenge Saving? | A financial trend where people aggressively save to counter the effects of post-pandemic financial stress. |

| Why It’s Gaining Popularity | Fueled by economic anxiety, rising inflation, and job insecurity, especially in younger generations. |

| Target Audience | Primarily Gen Z and Millennials but relevant for anyone facing economic uncertainty. |

| Practical Tips | Cancel unnecessary subscriptions, track spending, set savings goals, and find accountability partners. |

| Impact on Global Economy | Revenge Saving is popular in countries like China, the U.S., and even India, with statistics showing significant rises in savings habits. |

What Exactly is Revenge Saving?

A New Approach to Personal Finance

After the pandemic, people were feeling frustrated. They had spent months stuck at home, unable to travel or spend money freely. So, when restrictions lifted, they went all in. They treated themselves to new clothes, trendy gadgets, and vacations to make up for lost time. This was called revenge spending. But then came the harsh reality check: the economy didn’t bounce back the way everyone expected. Inflation hit hard, job security became a concern, and housing prices climbed to ridiculous levels. So, in response to all these financial pressures, the Revenge Saving trend was born.

Revenge Saving is essentially the opposite of revenge spending. It’s about cutting back and saving aggressively to regain control of your finances. Instead of splurging on a night out or the latest tech gadget, you’re focused on putting that money into a savings account or investment portfolio.

Why Is It So Popular?

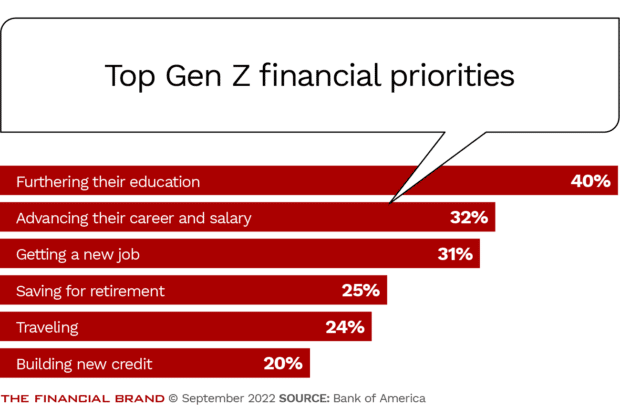

It’s no secret that times are tough financially. Inflation is high, making everyday expenses more expensive. Interest rates are rising, which means loans (like mortgages or car loans) are getting more expensive. And on top of that, the job market is unpredictable for many young adults, especially Gen Z and Millennials.

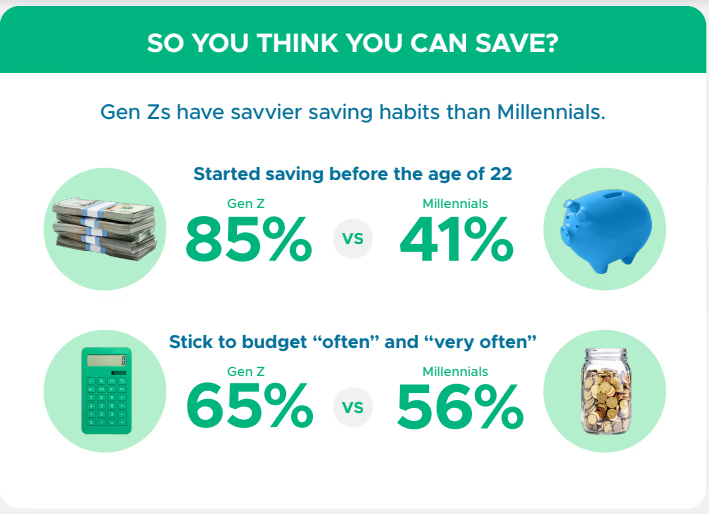

But what if I told you that this shift could be a golden opportunity? By embracing Revenge Saving, you’re taking control of your financial future. Research shows that 60% of Gen Z has started saving more aggressively in the past year【source: Reuters】. This trend isn’t just a knee-jerk reaction; it’s becoming a sustainable way to weather economic storms.

Key Steps to Implement Revenge Saving Is the Viral Trend Everyone’s Copying

Now that we know what it is and why it’s important, let’s break it down into actionable steps that you can use right away. Whether you’re someone just starting to save or a seasoned saver looking to adjust your habits, these tips will help you take advantage of Revenge Saving.

1. Audit Your Expenses

Before you start saving aggressively, take a hard look at your spending. Make a list of all your regular expenses and see where you can cut back. Do you really need that monthly subscription to a streaming service you rarely use? Can you cancel some of those fancy food deliveries and cook at home instead?

2. Set Realistic Savings Goals

Revenge Saving doesn’t mean you need to go to extremes, like living off ramen noodles for a month. The key is to set achievable goals. Maybe you can commit to saving an extra 20% of your income each month, or putting aside $100 per week. The important thing is consistency and tracking your progress.

3. Cancel Unnecessary Subscriptions

We all have those little charges that add up over time. Streaming services, fitness apps, magazines, and online shopping memberships can all be canceled or downgraded to free versions. By cutting out the non-essentials, you’ll be surprised at how much extra cash you can free up every month.

4. Create an Emergency Fund

Revenge Saving isn’t just about saving for big purchases or vacations. A key component of this strategy is building an emergency fund that can help you survive unexpected financial setbacks. Aim to save 3 to 6 months of living expenses in a high-yield savings account.

5. Find an Accountability Partner

It’s easy to say you’re going to save money, but it’s a whole different story to stick with it. Accountability partners—friends or family members who are also into saving—can help you stay on track. You can even join online communities focused on frugal living and revenge saving, where you can share tips, motivation, and savings challenges.

6. Invest Wisely

Once you’ve built up some savings, consider putting that money to work through investments. Look into stocks, bonds, or real estate—whatever fits your financial goals and risk tolerance. If you’re not sure where to start, consulting with a financial advisor could give you the guidance you need.

Real-Life Examples of Revenge Saving

Emma’s Story

Emma, a 28-year-old marketing professional from Chicago, started practicing Revenge Saving after realizing how much money she was wasting on take-out, impulse buys, and unnecessary subscriptions. She decided to cut back on eating out, limit her shopping to only essentials, and put every extra dollar into a high-yield savings account. In just six months, Emma saved $8,000—more than enough for her emergency fund and a down payment on a small apartment. Emma credits the practice for giving her the financial freedom to make better life choices.

Jake’s Journey

Jake, a 32-year-old software engineer from San Francisco, started tracking his spending after realizing that his daily Starbucks habit and weekly dinner with friends were eating into his savings. By opting for homemade coffee and limiting his outings, Jake managed to save over $12,000 in one year. He used that savings to start investing in a diversified portfolio, setting him up for future financial stability.

Psychological Benefits of Revenge Saving

Apart from the obvious financial benefits, Revenge Saving can have a positive impact on your mental well-being. By taking control of your finances and actively saving, you feel empowered and less anxious about your financial future. The act of saving money—no matter how small—creates a sense of achievement and reduces stress. It’s like a mental weight is lifted, knowing that you have a financial cushion to rely on during tough times.

Long-Term Benefits of Revenge Saving

Revenge Saving isn’t just about surviving today—it’s about setting yourself up for long-term financial security. By adopting this mindset early, you’re building habits that will lead to financial independence and a more stable life. Here are some long-term benefits:

- Retirement Savings: By starting to save early, you can build a strong foundation for retirement, even if it feels far away.

- Debt Reduction: With Revenge Saving, you’ll be better equipped to pay off high-interest debts, such as credit card balances or student loans.

- Homeownership: Saving aggressively can help you achieve significant milestones like buying a house or investing in property.

Challenges to Revenge Saving

While Revenge Saving can be highly effective, it’s not without challenges. Here are some common obstacles people face and how to overcome them:

- Impulse Spending: It’s easy to get caught up in the moment and make unnecessary purchases. Combat this by practicing mindfulness and waiting 24 hours before making non-essential purchases.

- Lifestyle Creep: As your income increases, you might be tempted to upgrade your lifestyle. Stay grounded by sticking to your savings goals and remembering your long-term objectives.

- Overextending Savings: Saving is important, but don’t forget to enjoy life. Find a balance that allows you to save for the future while still having fun in the present.

Personal Finance Tools to Help You Save

To make your Revenge Saving journey easier, consider using personal finance tools. These apps and websites can help you track spending, set goals, and stay motivated:

- Mint: A free app that helps you track your spending and create budgets.

- YNAB (You Need A Budget): Helps you prioritize saving by giving every dollar a job.

- Acorns: Automates investing by rounding up your purchases and investing the change.

Gen Z Is Saving for Retirement Early, But Employers May Be Falling Behind

US Online Spending Jumps by $24.1 Billion as Deep Discounts Drive Summer Sales

How to Finally Stop Overspending—Practical Tips That Actually Work