Before the Great and Beautiful Act Takes Effect: Student loans. They’re a big deal, right? The kind of deal that weighs heavy on you, your future, and your bank account. The U.S. government recently passed the Great and Beautiful Act (OBBB), and it’s set to reshape the world of student loan repayment. For millions of borrowers, this could mean big changes to how much you pay, when you pay, and what options you have moving forward. If you’re a student loan borrower or know someone who is, now is the time to start making moves. It’s crucial to understand what’s about to happen, and what you can do right now to prepare for it. In this guide, we’ll walk through five essential actions that every student loan borrower should take before the big changes roll out.

Before the Great and Beautiful Act Takes Effect

The Great and Beautiful Act is a game-changer for student loan borrowers, but it’s also a lot to take in. Interest is coming back, new repayment plans like RAP will be available soon, and there are strategic moves you can make now to avoid paying more in the long run. By understanding these changes and taking proactive steps, you can navigate the upcoming changes without the stress. Stay ahead of the game, and keep your options open. Be proactive, stay informed, and ensure you’re ready for what’s coming. Student loans don’t have to control your future—your decisions today will set the stage for a brighter tomorrow.

| Key Point | Details |

|---|---|

| Interest Resumption | Interest on federal loans will resume on August 1, 2025, after a pause. |

| Saving on a Valuable Education (SAVE) Plan | Affected borrowers should transition to other plans as SAVE ends due to legal challenges. |

| New Repayment Assistance Plan (RAP) | Set to launch in 2026, RAP offers an alternative to current income-driven repayment plans. |

| Loan Consolidation | Avoid consolidating loans before 2026 to keep repayment options flexible. |

| Keep Information Updated | Regularly check your contact details with your loan servicer and stay updated. |

1. Transition from the SAVE Plan Before Interest Resumes

Let’s start with the big one—interest. You’ve probably gotten used to not paying interest on your federal student loans during the pandemic’s payment pause. Well, get ready—interest is coming back on August 1, 2025. This will affect around 7.8 million borrowers enrolled in the Saving on a Valuable Education (SAVE) plan.

If you’re enrolled in SAVE, you’ve been enjoying low or even zero interest on your loans for a while. But the SAVE plan will no longer be available due to legal challenges, and interest will start accumulating again. This could result in a serious spike in what you owe.

What Should You Do?

If you’re in SAVE, it’s time to act before the deadline. You’ll need to transition to an alternative repayment plan to keep your payments manageable. One option to consider is the Income-Based Repayment (IBR) plan, which will be available until July 1, 2028. Another option is the new Repayment Assistance Plan (RAP), which is expected to launch in July 2026.

It’s important to weigh your options carefully and act sooner rather than later. Talk to your loan servicer about the next steps, and get familiar with the alternative plans.

2. Understand the New Repayment Assistance Plan (RAP)

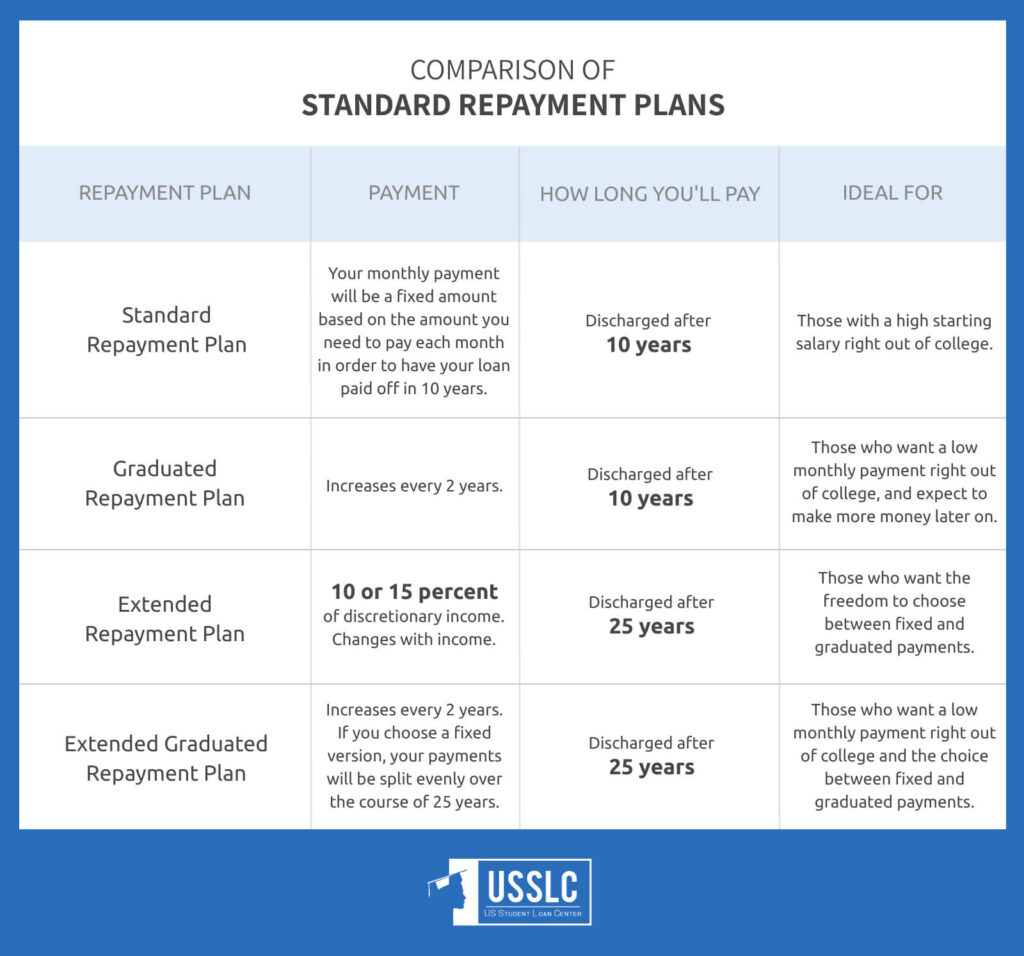

The Repayment Assistance Plan (RAP) is one of the major changes under the Great and Beautiful Act. This new plan will replace older income-driven repayment plans like PAYE and ICR. The RAP plan will offer lower monthly payments, ranging from 1% to 10% of your adjusted gross income (AGI), depending on your income and family size.

Key Features of RAP

- Payments will be spread out over 30 years, and any remaining loan balance will be forgiven after that period.

- Borrowers with families may see higher payments compared to older plans.

- Parent PLUS loan borrowers won’t be eligible for RAP.

While RAP offers some relief, it’s important to understand how it will affect your budget long term. For example, if your family size is large, your payments could be higher than what you’d expect under the current system.

What Should You Do?

Make sure you’re aware of the RAP plan details and compare them to your current repayment options. If RAP seems like a better fit for you, reach out to your loan servicer to discuss how to enroll. Keep an eye on the official Department of Education website for updates about the launch in 2026.

3. Avoid Consolidation Before July 1, 2026

Here’s a pro tip: Hold off on consolidating your loans until July 1, 2026. Why? Because consolidating federal loans too early could limit your repayment options to the new standard repayment plan or RAP. That means you might miss out on more flexible income-driven plans like IBR.

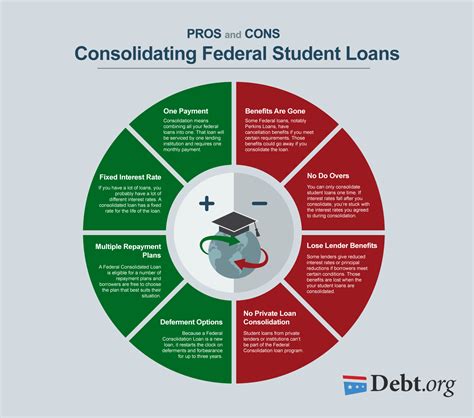

Consolidation is a strategy that some borrowers use to simplify their loan payments by combining multiple loans into one. However, it’s crucial to wait until you have the full range of repayment options available. Consolidating too soon could lock you out of better plans down the road.

What Should You Do?

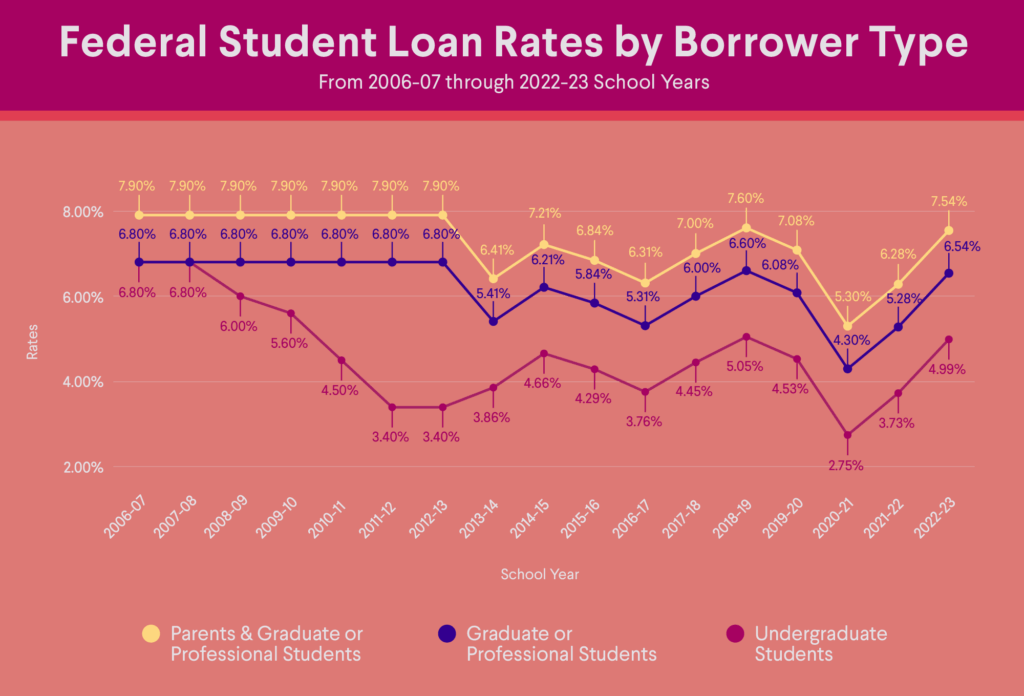

If you’re considering consolidating, check with your loan servicer to see if it’s worth waiting until 2026 to ensure maximum flexibility. Keep in mind that consolidating loans will not only affect your repayment plan options but also how interest rates are calculated.

4. Update Your Contact Information and Monitor Loan Status Before the Great and Beautiful Act Takes Effect

Now is the perfect time to double-check that your contact information is up-to-date with your loan servicer. The Department of Education and your loan servicer will be sending out important updates about your loan, especially regarding changes due to the Great and Beautiful Act. You don’t want to miss out on these updates.

What Should You Do?

Log into your account at StudentAid.gov and verify that your contact info is correct. Keep an eye out for emails and official notifications about your loans. The more proactive you are in monitoring your loan status, the better you’ll be prepared when the new changes come into play.

Bonus Tip:

You can also regularly check your loan balance, interest rates, and repayment due dates via your servicer’s portal to stay on top of your payments.

5. Explore Alternative Repayment Plans if Necessary

If you’re struggling with your current payment plan, don’t wait for the new changes to take effect before seeking help. Income-driven repayment plans can help make your payments more affordable. These plans adjust your monthly payment based on your income, and if your financial situation changes, your payment will adjust as well.

You may also want to explore options like deferment or forbearance, which allow you to pause payments temporarily. However, keep in mind that interest may still accrue during these periods, increasing the amount you owe.

What Should You Do?

Contact your loan servicer to explore your options if you’re having trouble making payments. The key is to act early—delaying could lead to default, which can seriously damage your credit and make future loans harder to get.

US Online Spending Jumps by $24.1 Billion as Deep Discounts Drive Summer Sales

Trump’s ‘Big Beautiful Bill’ Sparks Debate Over Social Security and Benefits