What If Social Security Runs Out in 2034? As we look ahead to 2034, a looming question weighs on many minds: What happens if Social Security runs out? The idea of Social Security’s funding drying up in just a little over a decade seems far-fetched to some, but it’s a reality that we need to prepare for. Social Security has been a safety net for millions of Americans, and if the projected shortfall happens, it could affect how much you receive in benefits. But don’t worry—there are practical ways to grow your wealth before it’s too late. In this article, we’ll break it down, showing you exactly how to prepare for a potential future without the full backing of Social Security.

What If Social Security Runs Out in 2034?

Social Security’s future is uncertain, but you don’t have to sit back and wait for the worst to happen. By taking proactive steps to maximize your retirement contributions, invest wisely, and diversify your portfolio, you can build a stronger financial future for yourself. Don’t wait until it’s too late—start growing your wealth now, and prepare for the future with confidence.

| Key Topic | Details |

|---|---|

| When will Social Security run out? | Social Security reserves expected to be depleted by 2034 |

| Projected reduction in benefits | By 2034, benefits may be cut by up to 19% |

| How to prepare | Maximize retirement accounts, diversify investments, delay Social Security |

| Investments to consider | Stocks, bonds, real estate, Roth IRAs, annuities |

| Additional Resources | Social Security Administration |

The Reality of Social Security’s Future

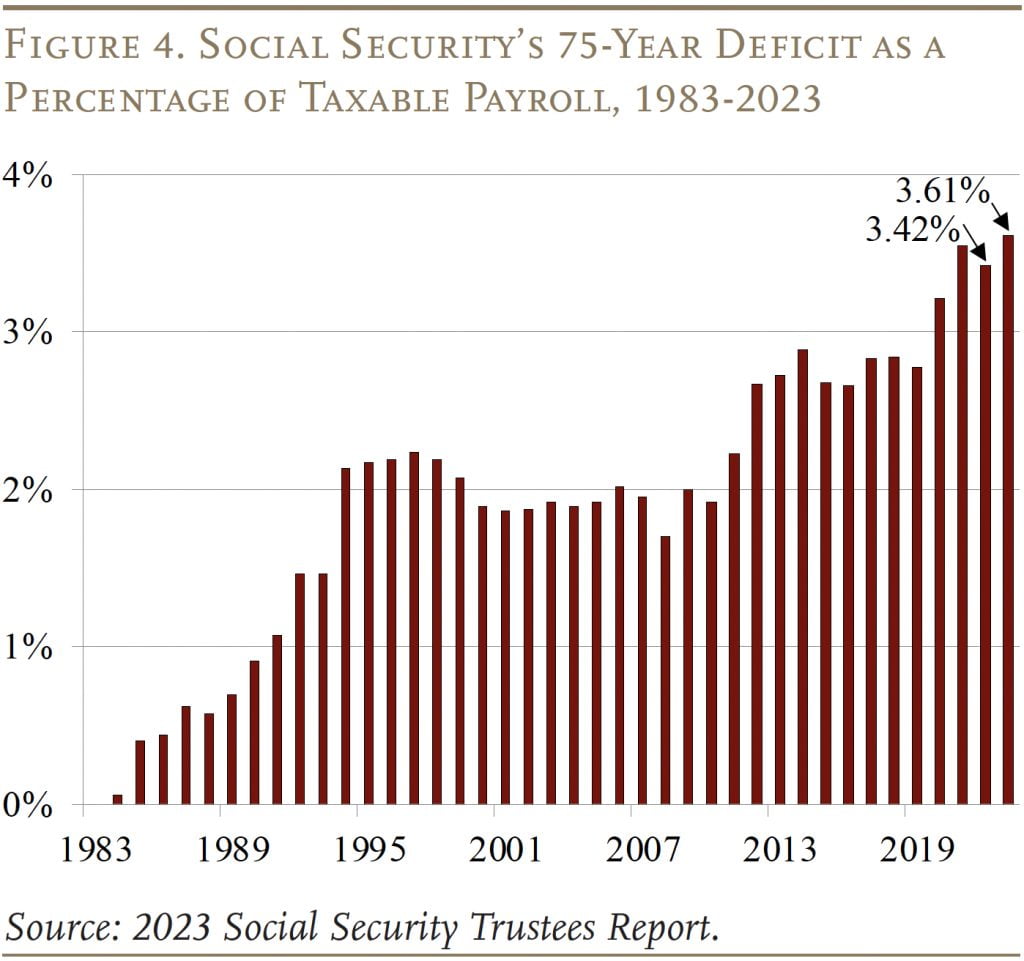

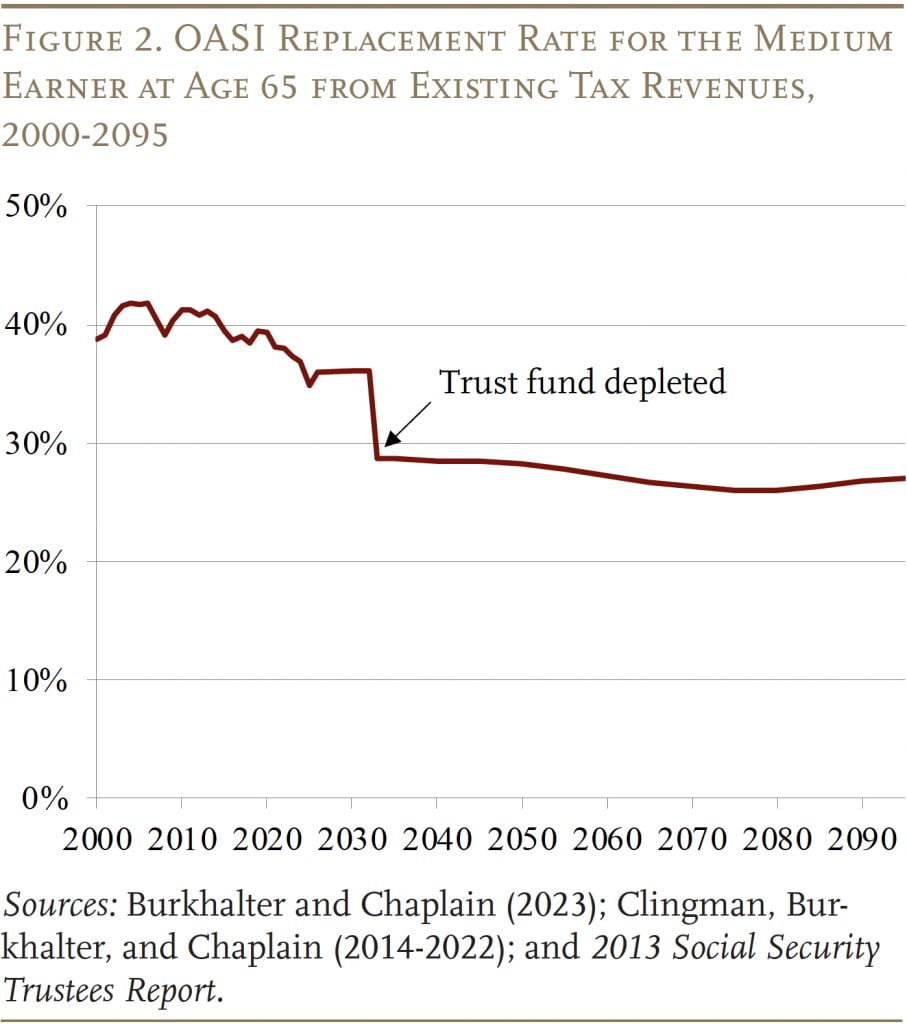

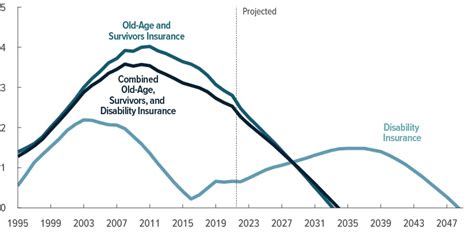

Social Security is like the rock that millions of Americans lean on when it comes to retirement income. The program has been around for decades, helping people secure their golden years with a monthly benefit check. But here’s the kicker: Social Security’s trust fund is projected to be depleted by 2034 if nothing changes. According to the 2023 Social Security Trustees Report, at that point, the program’s income will only be able to cover about 77% of the promised benefits. That means if you’re depending on Social Security to cover most of your expenses in retirement, you might face a significant reduction in the amount you receive.

If you’re in your 40s or 50s, the idea of Social Security running dry may sound pretty scary, but here’s the thing: it’s not the end of the world. Social Security won’t completely disappear, but you might need to adjust your retirement plans. So, how can you make sure you’re still living your best life when you retire—even if Social Security isn’t enough to cover your needs? Let’s break it down.

How to Grow Your Money Before Social Security Runs Out in 2034??

While there’s no magic bullet to fix this problem, there are several ways to build a solid financial foundation that doesn’t rely solely on Social Security. It’s time to take control and make sure you’re on track for a comfortable retirement, no matter what happens with the government’s program.

1. Maximize Retirement Contributions

The first step to growing your money is to pay yourself first. If you’re not already maxing out your 401(k) or IRA, it’s time to step up your game. The earlier you start contributing, the better. You’re essentially giving yourself a tax break now, and your money grows tax-deferred until you retire.

- 401(k) Plan: This is one of the best ways to save for retirement. Many employers will match your contributions, which is essentially free money. Aim to contribute at least 15% of your pre-tax income, or more if you can. If your employer offers a match, don’t leave any of that money on the table!

- IRA (Individual Retirement Account): If you don’t have access to a 401(k), or you just want to save more, a Roth IRA is a great choice. You can contribute up to $6,500 a year ($7,500 if you’re 50 or older), and it grows tax-free. When you retire, the money you withdraw is also tax-free.

2. Invest Wisely and Diversify Your Portfolio

The best way to ensure your money grows is to invest it. But investing isn’t about picking the next hot stock or jumping on trends. You need a solid strategy, and the key to long-term growth is diversification.

- Stocks: Equities (stocks) are a great way to build wealth over time. The stock market has historically outperformed other investment vehicles over the long term. However, stocks can be volatile in the short term, so you need to be prepared for some bumps along the way.

- Bonds: Bonds provide more stability, offering regular interest payments. While they may not grow as quickly as stocks, they are a safer bet during periods of market turbulence. Balancing stocks with bonds in your portfolio can give you both growth potential and security.

- Real Estate: Real estate is another great investment opportunity. Owning property can provide rental income and appreciate over time, especially in high-demand areas. Plus, real estate has tax benefits, making it an excellent option for wealth building.

3. Consider Delaying Social Security Benefits

Did you know you can increase your Social Security monthly benefits by delaying your claim? The longer you wait to start taking Social Security (up to age 70), the more money you’ll get every month. For each year you wait past your full retirement age (which is usually around 66 or 67), your monthly benefit increases by about 8%.

For example, if your full benefit at age 66 is $2,000, but you wait until age 70 to start claiming, your monthly benefit will increase to about $2,640. That’s a significant bump!

4. Look Into Annuities for Guaranteed Income

Annuities are another way to guarantee income in retirement. Annuities are financial products that you purchase now and, in exchange, receive regular payments for a set period or for the rest of your life. This can provide peace of mind, especially if you’re worried about outliving your savings.

However, be sure to do your research before committing. Annuities can have high fees and may not be the best fit for everyone. But they can be a great option if you want to create a predictable income stream.

5. Embrace the FIRE Movement

The FIRE (Financial Independence, Retire Early) movement has gained a lot of traction in recent years. Essentially, it’s about saving aggressively and investing early so that you can retire well before the traditional retirement age. Many FIRE enthusiasts live frugally, save 50% or more of their income, and invest in low-cost index funds to maximize returns.

While this approach isn’t for everyone, it’s worth exploring if you want to build wealth faster and retire early. Even if you don’t want to fully retire at 40 or 50, the principles of FIRE can help you save more and become financially independent.

Recent Adjustment to Social Security Benefits Raises Questions- Check Details!

How Social Security May Evolve Under President Trump’s Proposed Changes

2026 Social Security COLA Forecast Updated — Here’s the Estimated Benefit Increase