Millions Could See Their Credit Scores Drop After Major Medical Debt Rule Change: In a dramatic turn of events, millions of Americans could see their credit scores drop after a major medical debt rule change was blocked by a federal court. The rule, aimed at providing financial relief for millions of people struggling with medical debt, was designed to remove medical debt from credit reports and prevent it from impacting credit scores. However, after a recent court decision, this relief has been halted, leaving many at risk of facing lower credit scores and further financial struggles. This article explores the implications of this ruling, who is affected, and how you can protect your financial health amidst these changes. We’ll break down the situation, offer practical advice, and provide you with a guide to navigate this complicated issue.

Millions Could See Their Credit Scores Drop After Major Medical Debt Rule Change

The recent court ruling has brought uncertainty to millions of Americans struggling with medical debt. While the decision to block the Biden-era rule is disappointing, it’s essential to understand that there are still options available to protect your credit score and manage your medical debt effectively. By taking proactive steps like verifying your billing accuracy, negotiating with debt collectors, and seeking financial assistance, you can minimize the impact of this ruling on your financial health.

| Topic | Details |

|---|---|

| Court Ruling | A federal judge blocked a Biden-era rule to remove medical debt from credit reports. |

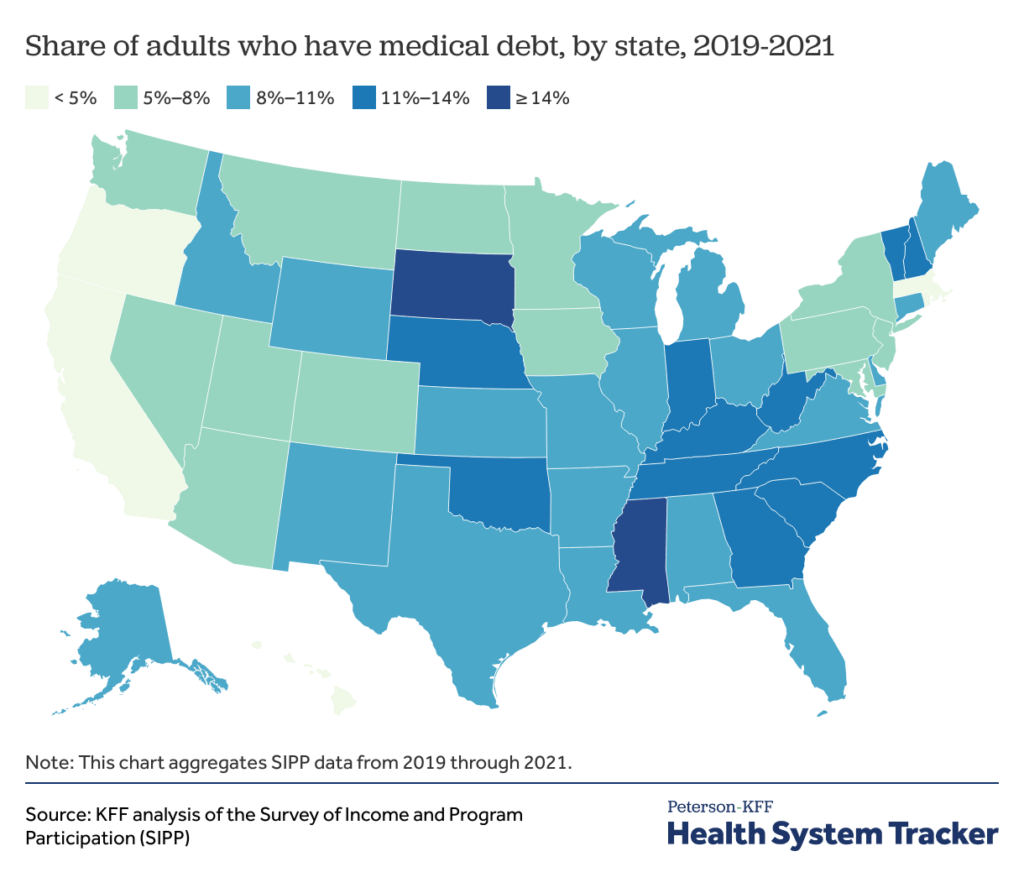

| Affected Population | Roughly 15 million Americans could be impacted by this ruling. |

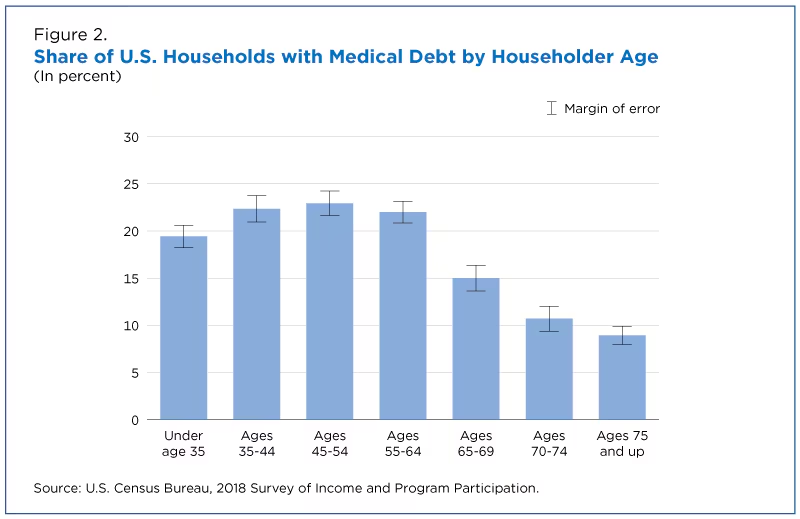

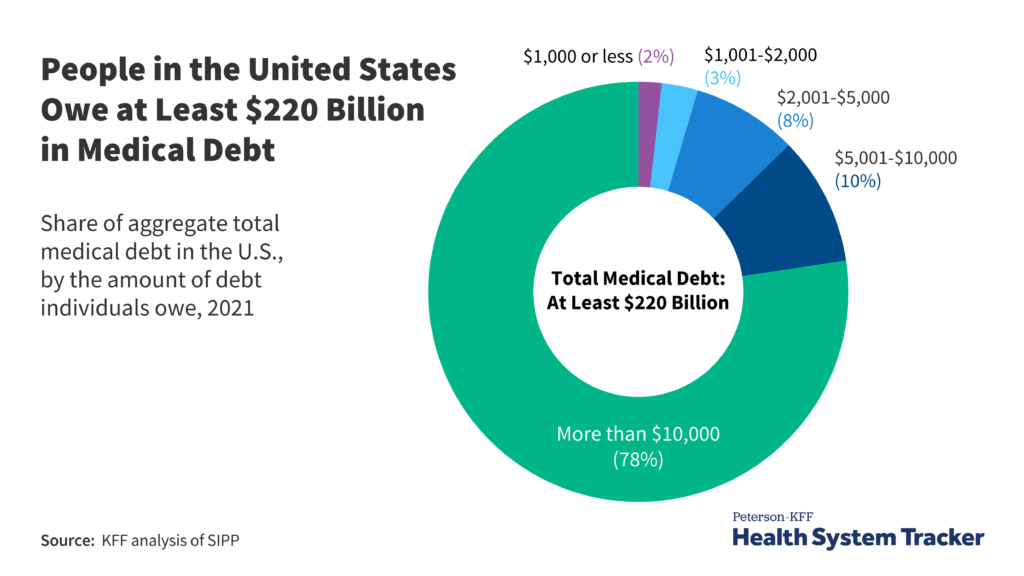

| Medical Debt Impact | Approximately 1 in 12 adults in the U.S. have medical debt. |

| Potential Credit Score Drop | People with medical debt on their reports may see a drop in credit scores. |

| Practical Advice | Verify billing accuracy, negotiate with collectors, and explore financial assistance programs. |

| Official Resources | Consumer Financial Protection Bureau |

Understanding the Medical Debt Rule and Its Impact

Medical debt has been a major issue for many Americans, affecting roughly 1 in 12 adults. The financial burden is overwhelming, and in some cases, medical debt can cause significant harm to credit scores. This, in turn, can lead to difficulties in securing loans, renting homes, or even getting a job, as many employers use credit scores as part of their hiring process.

The rule that was blocked aimed to provide relief by removing medical debt from credit reports. Under this rule, medical debt would no longer impact credit scores, allowing individuals with medical debt to have a better chance of improving their financial standing. The rule was expected to help 15 million Americans, and it could have led to higher credit scores and more access to financial opportunities, such as home loans and credit cards.

What Changed and Why Does It Matter?

In a twist that shocked many, the federal court ruled that the Consumer Financial Protection Bureau (CFPB) had overstepped its authority. The judge found that the CFPB’s decision to implement this rule was outside the scope of their powers under the Fair Credit Reporting Act (FCRA), which is a law that governs credit reporting practices in the U.S.

Key Takeaways from the Court Ruling:

- Impact on Millions: The court’s decision means that medical debt will continue to appear on credit reports, potentially causing lower credit scores for millions of Americans.

- Delayed Relief: The relief that could have improved financial outcomes for many people is now delayed, at least temporarily.

- Financial Implications: People who were hoping to see their credit scores improve by 20 points on average due to this rule may now face a setback. This could affect their ability to get mortgages and other financial products.

The impact of this ruling is significant. If you’re one of the millions of Americans with medical debt, you could see your credit score take a hit, which may prevent you from qualifying for loans or other financial products.

How Millions Could See Their Credit Scores Drop After Major Medical Debt Rule Change?

To understand the significance of this ruling, it’s important to first grasp how medical debt impacts credit scores. A credit score is a three-digit number that reflects your creditworthiness. It’s used by lenders, landlords, and even some employers to assess your financial reliability.

What Makes Up Your Credit Score?

Your credit score is determined by several factors, including:

- Payment History (35%) – Your track record of paying bills on time.

- Amounts Owed (30%) – The total amount of debt you owe, including credit cards and loans.

- Length of Credit History (15%) – How long you’ve had credit accounts open.

- Credit Mix (10%) – The variety of credit types you have, such as credit cards, mortgages, and installment loans.

- New Credit (10%) – The number of recent credit inquiries you’ve made.

Medical Debt and Credit Scores

Medical debt, though a major factor in many Americans’ financial struggles, had a more lenient approach when it came to its effect on credit scores. However, even before this rule change, medical debt could significantly impact credit scores if not handled properly. Here’s how:

- Late Payments: If you miss a medical bill payment, it can be reported to the credit bureaus, causing your score to drop.

- Debt Collection: If you don’t pay your medical bills, they may be sent to collections, which can have a severe negative impact on your credit score.

This court ruling has reversed a policy that would have helped millions, potentially allowing them to recover from medical debt and move forward financially.

Steps You Can Take to Protect Your Credit Score

While this ruling is disappointing for many, there are still steps you can take to protect and improve your credit score if you have medical debt. Let’s break it down:

1. Verify Billing Accuracy

Medical bills are often confusing and filled with errors. If you receive a medical bill that you believe is incorrect, don’t ignore it! Verify the charges, check with your insurance company to ensure the services are covered, and challenge any mistakes.

2. Contact Your Health Provider

If you’re having trouble paying your medical bills, many hospitals and health providers offer financial assistance programs. These programs can help reduce your balance or set up a payment plan that works for you.

3. Negotiate with Debt Collectors

If your medical debt has already gone to collections, you can still negotiate with debt collectors. Many collectors are willing to work with you to set up a payment plan or even reduce the total amount owed. Be polite, but firm, and don’t hesitate to ask for assistance.

4. Consider Credit Counseling

Credit counseling agencies can help you create a budget, negotiate with creditors, and offer debt management solutions. Many agencies offer free consultations, so this is an option to consider if you’re struggling to manage medical debt.

5. Pay Down High-Interest Debts First

If you have multiple forms of debt, prioritize paying off high-interest debts first. Once these are paid down, you can use the extra funds to address your medical bills.

4 Financial Mistakes Americans Keep Making That Wreck Their Budgets

Fed’s Goolsbee Says Confidence Must Rebuild Before Outlook Feels Stable Again

What Financial Independence Really Means in 2025—and Why FIRE Isn’t Just a Trend