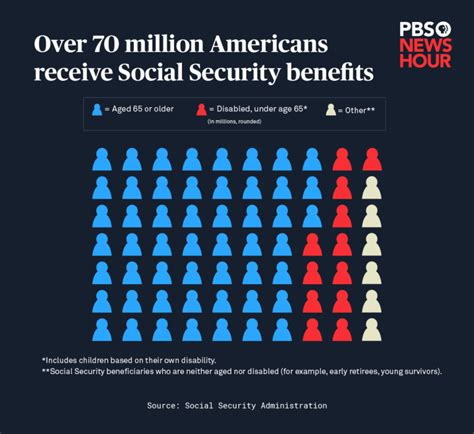

Social Security COLA 2026 Update: In 2026, your Social Security benefits could be bigger, but not by much—at least according to the most recent projections. If you’ve been following Social Security news and updates, you know how critical it is for retirees and people with disabilities to stay informed about the Cost-of-Living Adjustment (COLA). The COLA is the increase made to Social Security benefits to keep pace with inflation, and every year, millions of Americans rely on this bump to help offset the rising costs of living.

With inflation still affecting everyday expenses like food, gas, and healthcare, the COLA increase for 2026 is something worth paying attention to. The most recent projections, based on inflation data from earlier in 2025, suggest that Social Security recipients can expect an increase of between 2.6% and 2.7% in their benefits for the year. This means your monthly Social Security check could go up by just a few dollars. Let’s break it down further and see what that means for you.

Social Security COLA 2026 Update

The projected COLA increase for 2026 is a welcome boost for many, but it’s not going to be enough to counteract rising costs like Medicare premiums. Keep in mind that budgeting, staying informed, and planning ahead will help you better navigate the financial realities that come with Social Security and Medicare. Always stay on top of your benefits and explore available resources if you need assistance. In the meantime, it’s a good idea to track inflation and health insurance changes. After all, when it comes to Social Security, knowledge is power!

| Key Data/Insight | Explanation |

|---|---|

| Estimated COLA Increase | 2.6% to 2.7% (projected for 2026) |

| Average Monthly Benefit | Approx. $1,950 |

| Potential Increase in Benefits | About $53 per month for average beneficiaries |

| Medicare Part B Premium Increase | 11.6% rise, from $185 to $206.50 per month |

| Impact on Lower-Income Beneficiaries | COLA might be offset by higher Medicare premiums |

| Official Announcement Date | October 2025 |

| Official Social Security Website | SSA.gov |

What is Social Security COLA?

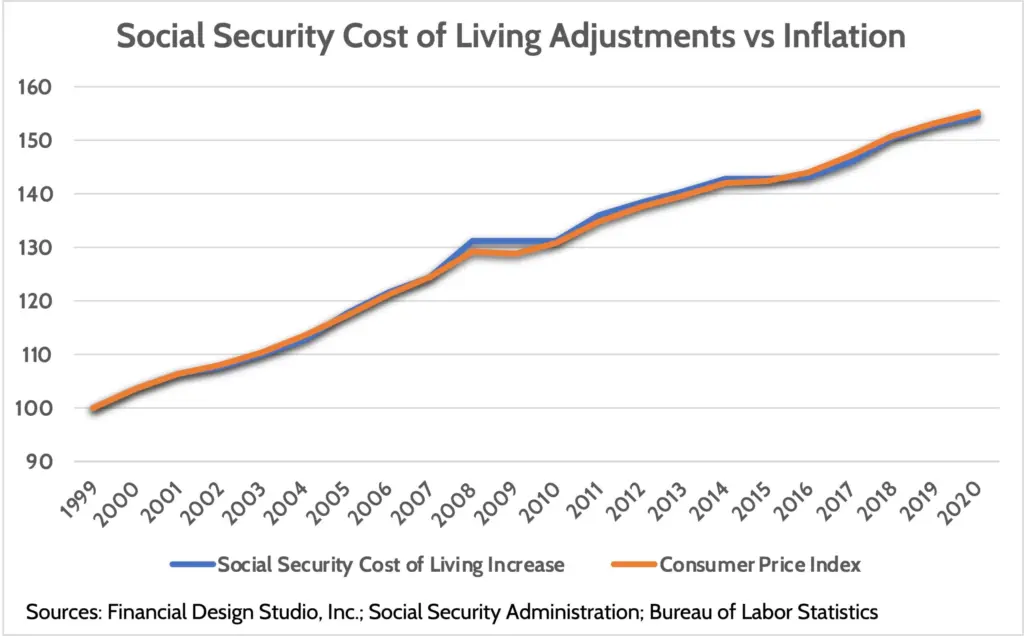

Before diving into what the 2026 COLA could mean for you, let’s first understand what it is. The Cost-of-Living Adjustment (COLA) is an annual adjustment made to Social Security and Supplemental Security Income (SSI) benefits. The goal of COLA is to help beneficiaries keep up with inflation, which can erode purchasing power over time.

When inflation rises, so do the prices of goods and services—food, gas, rent, and even healthcare. The COLA increase ensures that your Social Security benefit stays in line with these rising costs. The COLA formula is based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), a measurement of inflation that reflects the average cost of living for most people in the U.S.

Pro Tip: Inflation can be tricky, and it doesn’t always affect everyone equally. While some things (like food or gas) may rise in price, others may not. The CPI-W helps give a balanced measure to calculate the increase that is most fair to all retirees.

What’s the Social Security COLA 2026 Update?

As of mid-2025, inflation numbers indicate that Social Security recipients could see a COLA increase of between 2.6% and 2.7% in 2026. While that’s not a huge jump, it still makes a difference, especially when we consider how inflation has been creeping up over the last few years.

Let’s break this down:

- For the average Social Security recipient, who currently receives around $1,950 per month, a 2.7% increase would mean an additional $53 per month. Not bad, right? But remember, the COLA is designed to keep up with inflation, so the money you get won’t necessarily go as far as it did the previous year.

- A higher COLA increase is usually a good thing because it means your Social Security benefits are more in line with the cost of living. However, as you’ll see below, Medicare premiums may impact how much you actually get to keep.

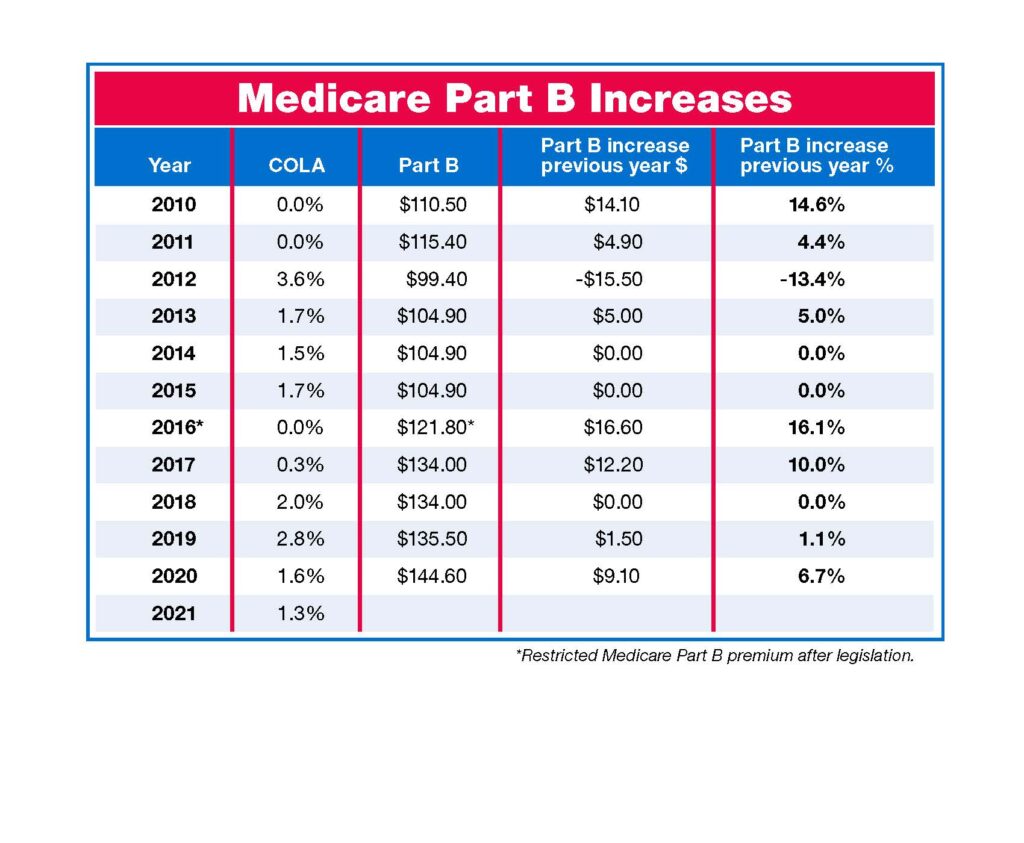

Medicare Premiums Could Eat Into Your COLA Increase

One of the major factors that might take a bite out of your COLA increase is the rise in Medicare Part B premiums. Medicare is the federal health insurance program for people age 65 and older, and most Social Security recipients are enrolled in Part B, which covers outpatient services.

In 2026, the Medicare Part B premium is projected to rise by 11.6%, from $185 in 2025 to $206.50 per month in 2026. That’s a pretty big increase and could eat into any COLA increase you might get.

For instance, if your Social Security check goes up by $53 per month, but your Medicare premium jumps by $21.50 per month, you’re only left with about $31.50 extra. This means that, for many recipients, Medicare could effectively cancel out a large portion of the COLA increase.

For low-income individuals, this could be a real problem. If your monthly Social Security payment is smaller and you rely heavily on Medicare, even a small increase in Part B premiums could leave you with less money for other needs.

How Can You Offset Rising Healthcare Costs?

If you’re worried about Medicare premiums eroding your COLA increase, you might want to explore additional options to help manage your healthcare expenses.

- Medicare Advantage Plans: Some Medicare recipients opt for Medicare Advantage plans (Part C), which bundle Part A, Part B, and sometimes prescription drug coverage. Depending on the plan, these may come with additional benefits like dental, vision, or wellness programs, which can provide cost savings in the long run.

- Supplemental Insurance: If you prefer to stay with original Medicare, you can consider Medigap policies, which help cover out-of-pocket expenses such as co-pays, deductibles, and coinsurance.

- Preventive Healthcare: Another important strategy is to take advantage of preventive services offered by Medicare. Preventive care can often reduce long-term medical costs and keep you healthier, reducing the risk of needing more expensive treatments down the line.

How COLA and Medicare Impact Low-Income Seniors?

The COLA increases are often essential for helping low-income retirees make ends meet. However, as discussed, if Medicare premiums keep rising, many seniors may find themselves in a difficult spot.

This is especially true for seniors who are eligible for Medicaid, which helps pay for Medicare premiums for low-income individuals. However, the One Big Beautiful Bill Act, passed recently, could result in Medicaid coverage for some seniors being reduced or eliminated, leading to even higher Medicare costs for those individuals.

This poses a risk of many seniors losing financial ground despite the COLA adjustment. So, while the 2026 COLA increase may provide some relief for most, it might not be enough for everyone.

Tips for Lower-Income Seniors to Stretch Their Dollars

- Access State and Local Programs: Many states offer assistance programs to help with healthcare and energy costs. For example, the Low-Income Energy Assistance Program (LIHEAP) helps pay heating and cooling bills. Check with your local Area Agency on Aging or state health department for resources.

- Food Assistance Programs: If rising food prices are a concern, consider applying for SNAP (Supplemental Nutrition Assistance Program), which helps low-income individuals and families afford groceries.

- Budgeting and Financial Planning: It’s essential to develop a strict budget and stick to it. When your income is limited, tracking every penny can ensure that your money goes as far as possible. Consider meeting with a financial advisor who specializes in working with retirees.

What Can You Do to Prepare for 2026?

As a Social Security recipient or someone planning for retirement, it’s important to be proactive about your finances and health insurance. Here are some things you can do to prepare for the 2026 COLA:

1. Monitor Your Medicare Premiums

Keep an eye on your Medicare Part B premiums as the new year approaches. Understanding how much your Medicare premiums are going to rise will help you plan ahead and adjust your budget accordingly.

2. Track Inflation Trends

Although inflation rates are unpredictable, you can still track the overall trends. Being aware of the economic conditions in your area (through resources like Bureau of Labor Statistics) can give you insight into how your COLA may compare to actual price increases.

3. Explore Supplemental Insurance

If Medicare premiums or out-of-pocket healthcare costs are getting out of hand, consider looking into supplemental insurance plans that can help cover these costs. Doing so could reduce the financial strain and make your COLA increase stretch further.

4. Budgeting Tips

When budgeting, remember that inflation is a factor. Some costs are going to rise faster than others, so adjust your spending habits. Make sure to set aside money for emergencies—like unexpected healthcare expenses.

5. Seek Help if You’re Struggling

If you’re struggling financially, there are federal and state programs designed to help seniors. For example, LIHEAP (Low-Income Energy Assistance Program) can help with heating and cooling costs, while Supplemental Nutrition Assistance Program (SNAP) provides food assistance.

2026 Social Security COLA Forecast Updated — Here’s the Estimated Benefit Increase

2026 COLA Estimate Is In—Here’s How Much Social Security Could Increase

Social Security Retirement Age Adjusted to 67 Under New Guidelines- Check Official Details!