Most Americans Feel Financial Stress: Financial stress is a pervasive issue affecting millions of Americans, regardless of their income level. It might seem like earning more money would automatically ease these worries, but unfortunately, that’s not always the case. Many Americans who earn six figures still feel the strain of financial pressure, proving that higher income doesn’t always equate to less stress. In this article, we’ll explore the root causes of financial stress, why a bigger paycheck doesn’t always solve the problem, and provide practical advice that can help you take control of your finances and reduce stress. Whether you’re barely scraping by or earning a hefty salary but still feeling overwhelmed, this article will offer solutions that you can use to manage your financial situation more effectively.

Most Americans Feel Financial Stress

Financial stress affects people from all walks of life, regardless of income. But it’s important to understand that higher income alone doesn’t automatically solve the problem—it’s all about how you manage that income. Whether you’re just starting your financial journey or you’re an experienced earner, focusing on savings, investments, and creating a financial plan can help you reduce financial stress and increase your sense of security. Remember, financial peace doesn’t come from how much you earn but from how wisely you manage your money. With the right tools and strategies, you can achieve the financial stability and peace of mind you deserve.

| Key Fact | Data & Stats |

|---|---|

| Percentage of Americans feeling financial stress | 47% of Americans report money negatively affects their mental health. (Bankrate) |

| The myth of higher income = financial peace | Many high earners still live paycheck to paycheck, battling lifestyle inflation. |

| Net worth needed to feel financially comfortable | Americans believe they need an average net worth of $839,000 to feel financially comfortable. |

| Lifestyle inflation | Higher income often leads to increased spending, rather than increased savings. |

| Effective ways to manage financial stress | Experts recommend creating a written plan, building emergency savings, and seeking professional advice. |

The Reality of Financial Stress in America

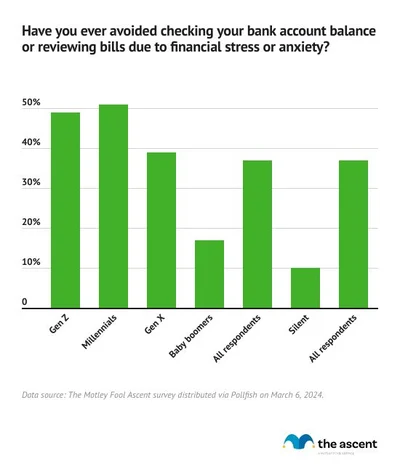

In recent years, financial stress has skyrocketed in the United States. According to a 2024 Bankrate survey, nearly 47% of U.S. adults said that money negatively affects their mental health. This isn’t just an issue for lower-income individuals—millennials and Gen Xers, in particular, report the highest levels of financial stress, with 50% and 54%, respectively, saying money is a major source of anxiety.

So why is this happening? Isn’t more money supposed to lead to less financial stress? Well, it turns out that the relationship between income and financial peace is far more complex than it appears.

The Hidden Trap: Lifestyle Inflation

You may think that a higher income would automatically make things easier, but lifestyle inflation often undermines financial stability. This occurs when a person’s spending rises along with their income. In simple terms: as you make more money, you start to spend more money. It could be on a new car, an upgraded apartment, or even fancier dinners out. While upgrading your lifestyle may feel good in the moment, it often means you have less money saved for the future or invested in growing wealth.

In fact, many people who earn six figures still find themselves living paycheck to paycheck. According to Verywell Mind, this is especially common for people who experience “lifestyle creep,” where they start spending more as they earn more. This vicious cycle of constantly upgrading your lifestyle, rather than saving, can lead to even more stress down the road.

A 2025 survey from Charles Schwab found that Americans believe they need an average net worth of $839,000 to feel financially comfortable, and $2.3 million to feel wealthy. Yet, the median net worth for retirees in the U.S. is only around $409,900—illustrating a significant gap between people’s financial perceptions and reality.

How to Tackle Financial Stress: Practical Tips and Insights

While financial stress is common, it’s not insurmountable. With the right mindset and tools, you can take control of your financial future. Here’s a detailed guide to help you reduce financial stress, build a solid financial foundation, and feel more confident about your money management.

1. Create a Written Financial Plan

One of the best ways to reduce financial anxiety is by having a clear plan. The key to feeling in control is knowing where your money is going and having a strategy for future goals. Whether you’re saving for retirement, a down payment on a house, or your children’s education, having a written financial plan can give you peace of mind.

Start by assessing your current financial situation—this includes your income, expenses, savings, and debt. Then, set specific, measurable, achievable, relevant, and time-bound (SMART) goals that align with your long-term objectives. A financial plan doesn’t have to be complex, but it should give you a roadmap to follow. You can find resources from reputable sources like the Financial Planning Association to get started.

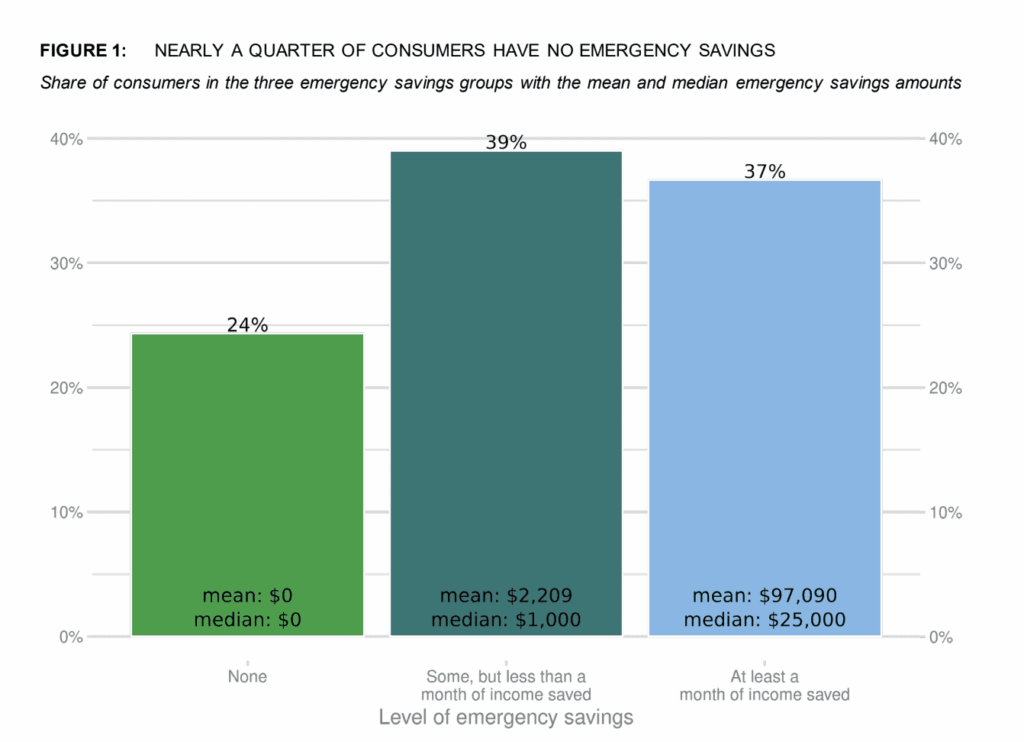

2. Build an Emergency Fund

Life is full of surprises, and many of those surprises come with a price tag. That’s why it’s essential to have an emergency fund to cover unexpected expenses like medical bills, home repairs, or job loss. Experts recommend saving at least three to six months’ worth of living expenses in a savings account that’s easy to access.

An emergency fund provides a cushion during tough times, so you don’t have to rely on credit cards or loans. For example, if you lose your job or face an unexpected car repair, having an emergency fund means you won’t have to stress about covering the cost and can focus on finding a solution.

3. Avoid Lifestyle Inflation

It’s tempting to spend more money when you get a raise, a bonus, or a new job with higher pay. But if you want to keep your financial stress at bay, it’s important to resist the urge to inflate your lifestyle. Instead, focus on saving and investing that extra income.

When you earn more, it’s a great opportunity to increase your retirement contributions, pay down debt, or put money into long-term investments. By controlling your spending and focusing on saving, you’ll be in a better position financially in the long run.

4. Seek Professional Advice

If you’re overwhelmed by managing your finances on your own, consulting with a financial advisor can be a game-changer. An advisor can help you assess your financial situation, create a customized plan, and offer strategies to improve your financial health. Don’t feel bad about asking for help—many people find that expert advice can make a huge difference in their financial lives.

5. Stay Consistent and Review Regularly

Financial management is a long-term commitment, not a one-time fix. Stay consistent with your budget, review your spending habits, and adjust your financial plan as needed. Regularly reviewing your finances allows you to stay on track and make necessary changes to keep your goals within reach.

4 Financial Mistakes Americans Keep Making That Wreck Their Budgets

Millions of Americans Could See Their Social Security Checks Cut by 50 Percent

Gen X Could See a Big Payday Soon With Upcoming Financial Changes- Check Detail!