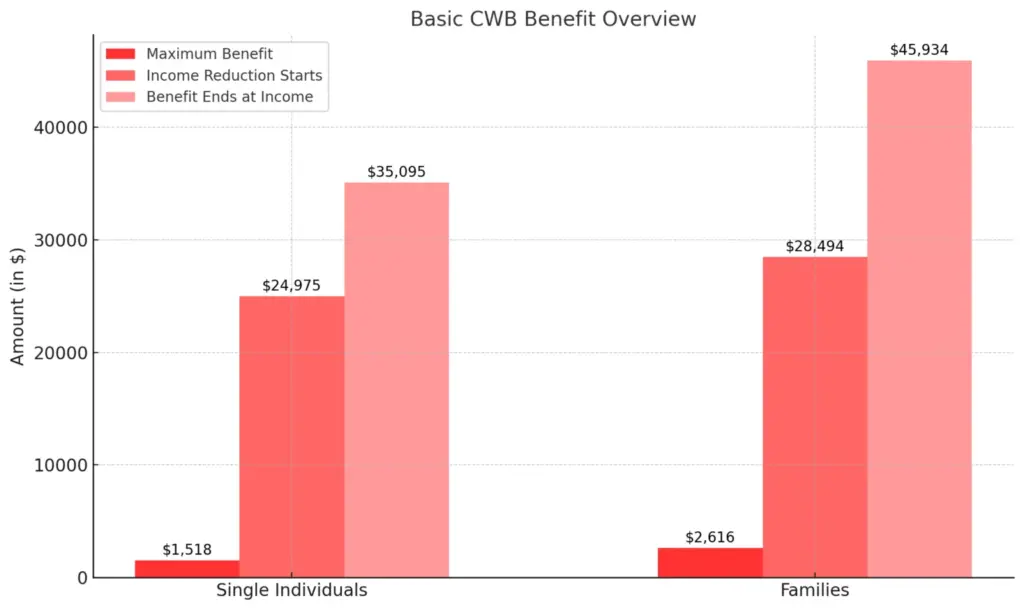

Boosted CRA Benefit in Quebec Could Bring Over $1,200: In the bustling world of taxes, social benefits, and financial relief, Quebec residents are in for a good surprise this week! The Canada Workers Benefit (CWB), a crucial support mechanism for low-income workers, is offering some much-needed relief in the form of boosted payments. If you’re living in Quebec and wondering how much you’ll be receiving, you’re not alone. This year, the Canada Revenue Agency (CRA) is stepping up to deliver increased CWB benefits of up to $1,200 to eligible residents. It’s a game-changer for many, and in this article, we’ll break down everything you need to know about these payments – from eligibility criteria to how to make the most of this financial boost.

Boosted CRA Benefit in Quebec Could Bring Over $1,200

The boosted CWB benefit in Quebec is a huge opportunity for those who need a bit of financial relief. With eligible residents potentially receiving up to $1,200 in the coming week, it’s a chance to get ahead on bills, save for the future, or just relieve some of that financial stress. Remember, this benefit is automatic for those who qualify, so all you need to do is make sure your taxes are filed and your income is within the acceptable range.

| Key Data | Details |

|---|---|

| Max Payment for Individuals | Up to $617.56 for singles |

| Max Payment for Couples | Up to $963.09 |

| Disability Supplement | Additional $137.95 per eligible adult |

| Next Installments | October 10, 2025, January 12, 2026 |

| Payment Method | Direct deposit or cheque |

| Eligibility Requirements | Tax return filed, income from employment, and Quebec-specific income thresholds |

For those who qualify, this enhanced benefit can provide critical support, especially with the rising cost of living. But who exactly qualifies, and how does the process work? Let’s dig deeper.

What is the Canada Workers Benefit (CWB)?

The Canada Workers Benefit (CWB) is a government program designed to provide financial assistance to low-income working Canadians. Think of it as a financial cushion for those who are struggling but still working hard. It’s essentially a refundable tax credit, which means if you qualify, you can receive payments even if you don’t owe taxes.

In 2025, the CWB has been ramped up to provide more generous payments for eligible workers. And in Quebec, there’s a special boost to help with local economic challenges.

CWB Boost for Quebec: A New Level of Financial Support

Quebec is set to receive one of the highest CWB payouts in the country, thanks to an adjustment made to account for regional living costs. The monthly payments you’ll be receiving are based on your income, household situation, and whether you qualify for the disability supplement. Here’s what you need to know about these payments:

- Singles without children could get as much as $617.56 per advance payment.

- Couples without children can receive up to $963.09.

- Single parents can expect $331.13.

- Couples with children are looking at $617.10.

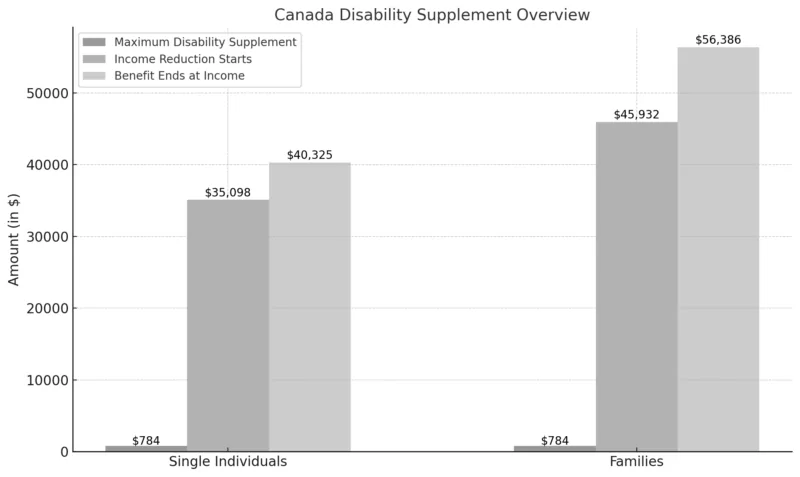

- If you’re eligible for the disability supplement, you could receive an extra $137.95 per adult.

For a couple without kids who both qualify for the disability supplement, their payout could total up to $1,238.99. That’s a significant amount of support that could help with everything from rent payments to unexpected bills.

How Does the CWB Benefit Help Quebec Residents?

Quebec’s cost of living has been steadily climbing, especially in major urban areas like Montreal and Quebec City. From housing prices to grocery bills, everyday essentials have become more expensive for residents. The boosted CWB benefit is designed to help offset these rising costs by providing extra financial assistance to low-income workers.

For many individuals and families, this could mean the difference between struggling to make ends meet and getting a little breathing room. Whether it’s paying for utilities, securing healthier food options, or covering transportation costs, this boost can make a noticeable impact on daily life.

How to Qualify for the Boosted CWB?

Eligibility for the CWB is pretty straightforward but still requires meeting specific criteria. You’ll need to meet the following conditions to receive the advance payment:

- Be a Canadian resident – This is non-negotiable. Only Canadian residents qualify.

- Be at least 19 years old (or younger if you live with a spouse, common-law partner, or child).

- File your 2024 income tax return – If you haven’t done so yet, now’s the time to get it done. Payments will be based on your most recent tax return.

- Earn income from employment or self-employment – This is a core requirement; you need to be actively working.

- Meet Quebec-specific income thresholds – Each province has its own income thresholds. Quebec’s thresholds are slightly higher due to the cost of living.

If you’re concerned about whether you’ll get the payment, the easiest way to find out is to visit your CRA My Account. Payments are automatic if you’ve filed your return and met the income requirements, but always keep an eye on your account for updates.

Boosted CRA Benefit in Quebec Could Bring Over $1,200 Payment Process: What You Need to Know

Payment Date: The first round of boosted CWB payments will be issued on July 11, 2025. Keep an eye on your bank account or mailbox (for those receiving checks) to see when the money hits.

Payment Method: The CRA generally sends payments through direct deposit or a cheque. Direct deposit is faster, but if you don’t have it set up yet, you can still receive a cheque.

Next Installments: If you miss out on the first payment, don’t worry. There will be additional installments on October 10, 2025, and January 12, 2026. So, you’ve got a chance to catch up if needed.

Protect Yourself From Scams

While the CWB is a blessing, it’s also important to stay alert for scams. Unfortunately, scammers often try to take advantage of people looking for financial relief. The Canada Revenue Agency (CRA) never sends unsolicited messages about payments. If you get an email, call, or text claiming to offer extra benefits, it’s likely a scam.

Always verify information through official channels, and if you’re in doubt, check out the CRA’s scam alert page for the latest updates and tips on how to protect yourself.

Practical Steps for Maximizing Your Benefit

Here’s a practical guide to make sure you’re getting the most out of this financial benefit:

- File Your Taxes Early – If you haven’t filed yet, get your tax return in as soon as possible. It’s essential for you to qualify for the benefit.

- Set Up Direct Deposit – This ensures you get your money quickly and directly into your bank account. Visit the CRA website to learn how to set it up.

- Check Your Eligibility – Use the CRA’s online tools to confirm your eligibility for the CWB and any other provincial benefits.

- Be Mindful of Income Limits – If your income is too high, you might not qualify for the full benefit. Double-check your income details to avoid surprises.

- Look Into Additional Support – If you’re still struggling, Quebec has other programs like housing relief and food assistance, so explore all your options.

Example: How a Single Parent Could Benefit

Let’s say you’re a single parent living in Quebec, and you qualify for the CWB boost. If your income is under the threshold, you could receive up to $331.13 in advance payments. This could help with paying for essential things like groceries, childcare, or a portion of your rent. If you’re eligible for the disability supplement, you could receive an additional $137.95, bringing your total benefit to $469.08. That extra money might just be the relief you need to ease your financial worries.

Canada Is Sending Out Larger GST Cheques—Here’s Who Gets the Bigger Payout

What Expenses Can Be Claimed as Tax Deductions in Canada for 2025? Check Details

GST/HST Payments in Canada Start This Week—Check If You Qualify for the July 2025 Deposit