Universal Credit and DWP Benefits Set for Major Overhaul: In 2026, the UK welfare system will undergo a major transformation, with significant changes to Universal Credit (UC) and other Department for Work and Pensions (DWP) benefits. These changes are aimed at simplifying the system, increasing support for individuals, and encouraging more people to return to work. As the government takes steps to modernize the benefits system, many people, especially those relying on Universal Credit, are left wondering: How will this affect them? Let’s break down the proposed changes, what they mean for you, and how you can prepare.

Universal Credit and DWP Benefits Set for Major Overhaul

The upcoming changes to Universal Credit and DWP benefits in 2026 represent a significant shift in the UK’s welfare system. These reforms are designed to better support people who need it most, while also encouraging more people to return to work. For claimants, this means a mix of increased allowances, tightened eligibility criteria, and new support measures. By staying informed and proactive, claimants can ensure they are ready for these changes and continue to receive the support they deserve.

| Key Change | Details |

|---|---|

| Increase in UC Standard Allowance | UC allowances for claimants will increase, with single persons aged 25+ seeing their weekly rate rise to £98. |

| Limited Capability for Work (LCWRA) | Existing claimants’ LCWRA payments frozen until 2029/30; new claimants will receive £50 per week. |

| New Severe Condition Premium | A new premium will be introduced for those with severe, lifelong conditions. |

| Jobcentre Support for LCWRA Claimants | More jobcentre assistance will be offered to those in the reduced LCWRA category. |

| PIP Eligibility Tightening | Eligibility for Personal Independence Payments (PIP) will become more stringent, with a focus on more severe conditions. |

| Transitional Protection | Legacy benefit claimants will transition to Universal Credit, with safeguards for those facing income reductions. |

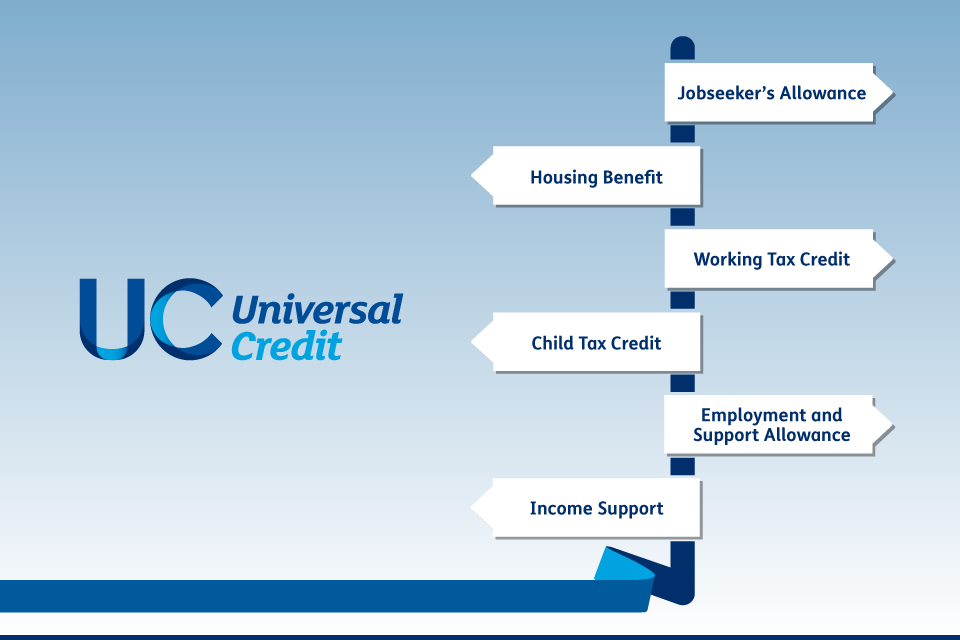

Introduction: What’s Changing in Universal Credit?

Universal Credit, the UK’s primary benefit system for people who are out of work or on a low income, has been through a lot of changes over the past decade. In 2026, even more significant reforms will be implemented as the government moves to overhaul the entire welfare system. While these changes are aimed at making the system easier to navigate and ensuring that benefits reach the people who need them most, they also raise important questions about how claimants will be affected.

This overhaul will impact millions of people who rely on Universal Credit and other DWP benefits, including those with disabilities, health conditions, and those facing long-term unemployment. So, what’s actually changing, and how do these reforms affect you, your family, or your clients?

What’s Happening to Universal Credit in 2026?

The most notable changes to Universal Credit include:

1. Increased Standard Allowance

Starting in April 2026, Universal Credit claimants will see an increase in the standard monthly allowance. For single people aged 25 and over, the weekly rate will rise to £98, providing a little extra cushion for those trying to make ends meet. This increase is part of the government’s plan to tackle the rising cost of living, and it aims to support those who rely on Universal Credit to cover their living expenses.

For families, the increase in the standard allowance is designed to help with daily costs like rent, utilities, and food. This adjustment will come as a welcome relief for many people across the UK, especially those struggling with inflation and soaring living costs.

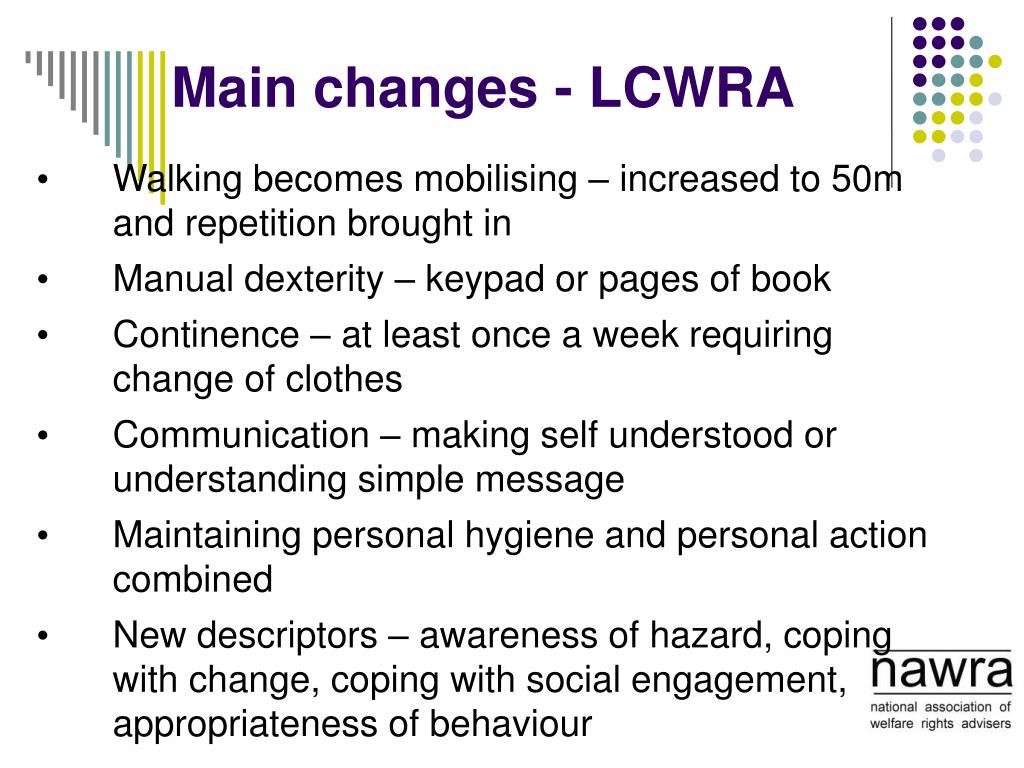

2. Changes to Limited Capability for Work and Work-Related Activity (LCWRA) Element

The LCWRA element of Universal Credit is for individuals who are unable to work due to long-term health conditions or disabilities. Currently, people in this category receive a weekly amount of £97. However, under the new reforms, this payment will be frozen at this rate until 2029/30.

For new claimants starting in April 2026, those who qualify for LCWRA will receive £50 per week. Additionally, individuals under 22 years old will no longer be eligible for the LCWRA element. This change is a part of a broader effort to focus resources on those with the most severe health conditions, while encouraging younger people to explore other support options.

3. Introduction of a New Additional Premium for Severe Conditions

Another key change is the introduction of a new premium for individuals with severe, lifelong conditions that significantly limit their ability to work or live independently. This premium will provide additional financial support to those who are unlikely to recover or improve, ensuring they receive a fair amount of assistance.

4. Enhanced Jobcentre Engagement and Work Allowance Support

Under the new system, claimants receiving the reduced LCWRA rate will receive more support from job coaches and other professionals at their local jobcentres. This is a move towards increasing the chances of returning to work, even for people who face significant health challenges.

In addition, the work allowance, which determines how much a claimant can earn before their Universal Credit payments are reduced, will continue to be a key part of the system, allowing claimants to keep more of their earnings.

What’s Changing with Personal Independence Payment (PIP)?

Alongside Universal Credit, the Personal Independence Payment (PIP), which supports people with disabilities or long-term health conditions, will also see changes. Starting in November 2026, the eligibility criteria for PIP will tighten, making it harder for some people to qualify for the daily living component of the benefit.

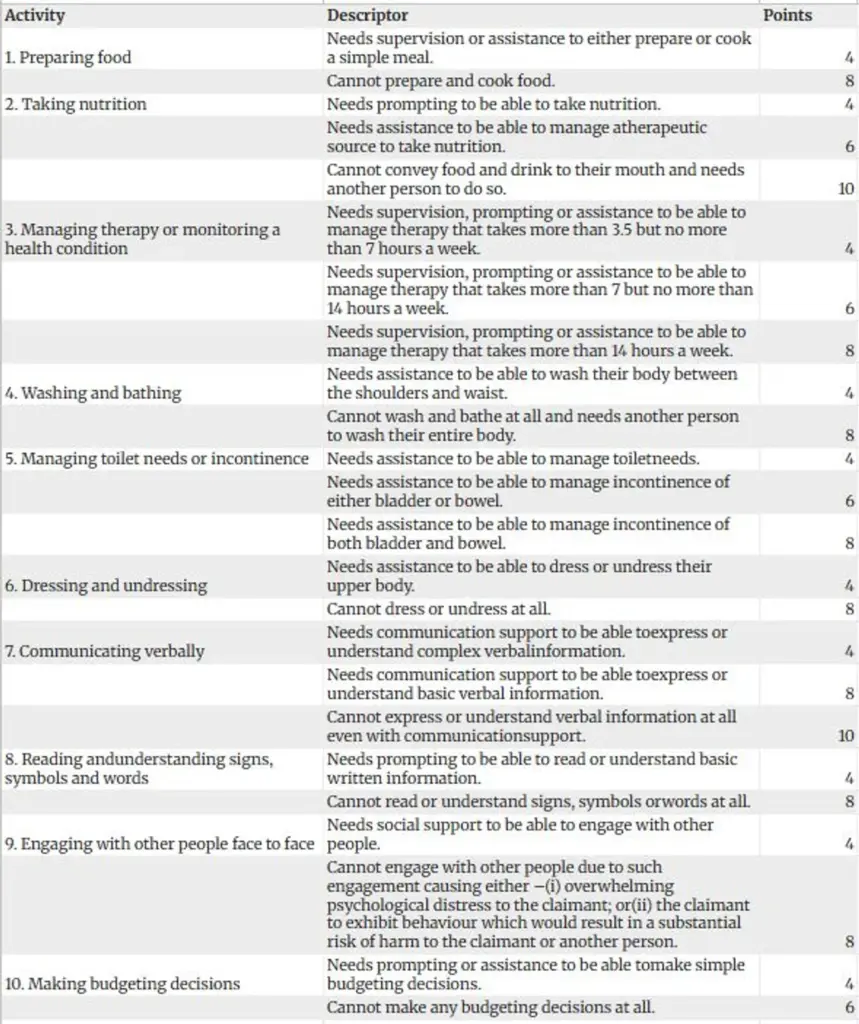

Tighter Eligibility for PIP

To qualify for the daily living component of PIP, applicants will need to score at least 4 points in at least one of the daily living activity descriptors. This change is aimed at ensuring that only those with more severe and debilitating conditions receive the support they need. For those who are currently receiving PIP, these changes will apply when their award is next reviewed.

How Universal Credit and DWP Benefits Set for Major Overhaul Changes Impact Claimants?

The reform to the welfare system will have several important implications for existing claimants and new applicants. Let’s break it down:

1. For Existing Claimants:

If you’re already on Universal Credit or PIP, don’t panic just yet. The DWP is rolling out these changes in stages, with full implementation set for 2026. However, existing claimants need to stay on top of any communications from the DWP, especially if you’re on legacy benefits like Employment and Support Allowance (ESA) or Jobseeker’s Allowance (JSA), as these will close in March 2026.

If you’re eligible for transitional protection, your current benefit level will be safeguarded, but it’s important to be aware that if you miss the transition deadline, you might lose out on this protection.

2. For New Claimants:

If you’re a new applicant, these reforms could mean a slightly different experience when you apply for benefits. The eligibility criteria for LCWRA and PIP will be stricter, so you’ll need to ensure that you meet the new requirements. Additionally, understanding the increased allowances and premiums will be important for calculating the level of support you might receive.

UK’s Retirement System Faces Pressure—Why the Government May Need to Raise the Pension Age Again?

DWP Lowers Estimated Reimbursements for Unpaid UK State Pensions in New Forecast